Introducing the Revenue Policy and Procedures Manual Template Word

Are you tired of struggling to create a comprehensive revenue policy and procedures manual for your business? Look no further than our Revenue Policy and Procedures Manual Template Word.

This template is designed to provide you with a customizable and easy-to-use solution for creating a manual that outlines your company’s revenue policies and procedures. With this template, you can ensure that your team is on the same page when it comes to revenue management, and that your business is operating efficiently and effectively.

The Revenue Policy and Procedures Manual Template Word includes a variety of sections that cover everything from revenue recognition and billing to collections and refunds. Each section is fully customizable, allowing you to tailor the manual to your specific business needs.

In addition to the customizable sections, the template also includes helpful tips and best practices for revenue management. These tips are designed to help you optimize your revenue processes and ensure that your business is operating at its full potential.

With the Revenue Policy and Procedures Manual Template Word, you can save time and effort while creating a comprehensive manual that will benefit your business for years to come. Don’t wait any longer to streamline your revenue management processes – get started with our template today!

Revenue Policies and Procedures Manual

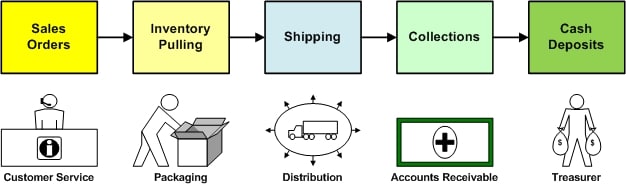

Develop your Revenue Policies and Procedures Manual easily using editable Word templates. It includes all steps from sales orders to collections using an effective accounts receivable procedures. This downloadable product is also included in the Accounting Policies and Procedures Manual. This accounting procedures manual includes prewritten MS-WORD procedures with forms templates for any purchasing department. DOWNLOAD yours now.

Make Your Accounts Receivables Procedure Easier

The proper identification and acceptance of all sales are an important element of collections using an accounts receivables procedure. It represents the primary source of most companies’ operational cash flow and therefore needs to be protected, managed and monitored using financial internal controls appropriate with accounts receivables. The included revenue cycle accounting procedures should be utilized to account for and recognize all sales income of the company. Use these accounting revenue cycle procedures to ensure efficiency and success in your accounting department.

This Revenue Policies and Procedures Manual was developed to assist organizations in preparing an Accounts Receivables Procedure Manual for any industry or business size. It can be custom tailored to fit one’s individual company concerns and operations.

Download Your Revenue Policies and Procedures Manual Now!

Improve all aspects of your revenue policy & procedures, including sales order, shipment of good, accounts receivable, customer returns, and more. Save time using prewritten accounting procedures manual Word Templates.

Your DOWNLOAD Includes 10 Revenue Policies and Procedures:

- Sales Order Entry Procedure

- Point-Of-Sale Orders Procedure

- Customer Credit Approval and Terms

- Sales Order Confirmation Procedure

- Order Fulfillment Procedure

- Accounts Receivable Procedure

- Sales Tax Collection Procedure

- Progress Billing Procedure

- Account Collections Procedure

- Customer Returns Procedure

13 Revenue Forms:

- Sales Order

- Order Form

- Credit Application

- Request for Credit Approval

- Credit Inquiry

- Phone Confirmation Checklist

- Shipping Log

- Commercial Invoice

- Invoice

- Accounts Receivable Write-Off Authorization

- Account Collection Control Form

- 30-Day Satisfaction Guarantee

- Return Goods Authorization

10 Example Job Descriptions:

- Accounting Manager

- Administrative Services Manager

- Chief Financial Officer

- Credit Manager

- Customer Service Representative

- Project Manager

- Sales Manager

- Sales Representative

- Service Manager

- Shipping Manager

As well as a “How To” Manual Preparation Guide that provides an introduction to producing your manual!

Order Your Revenue Policies and Procedures

The Revenue Policies and Procedures Manual comes with 11 easy-to-edit Microsoft Word document template files, available as a convenient downloadable file. Take advantage of this special package and start saving yourself the time and money to develop this material. Download yours now!

Reviews

There are no reviews yet.