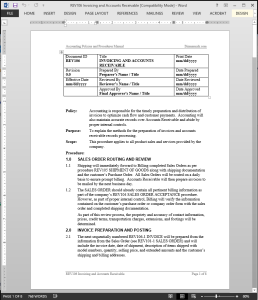

Accounts Receivable Policy Template

Accounts Receivable Policy Template

The Accounts Receivable Procedure / Policy Template explains the methods for preparing invoices and accounts receivable records.

The policy allows for the timely preparation and distribution of invoices to optimize cash flow and customer payments. This procedure applies to all product sales and services provided by the company. (8 pages, 743 words)

Shipping will immediately forward to Billing completed Sales Orders along with shipping documentation and the customer’s Purchase Order. All Sales Orders will be routed on a daily basis to ensure prompt billing. Accounts Receivable will then prepare invoices to be mailed by the next business day.

The next sequentially numbered invoice will be prepared from the information from the Sales Order and will include the invoice date, date of shipment, description of items shipped with model numbers, quantity, selling price, and extended amounts and the customer’s shipping and billing addresses.

On a monthly basis, Accounts Receivable will generate an aged trial balance of customers’ accounts with individual invoice information and days outstanding and will forward to Credit for timely collection activities.

Accounts Receivable Procedure / Policy Template Activities

Accounts Receivable Procedure / Policy Template Activities

- Sales Order Routing and Review

- Invoice Preparation and Posting

- Distribution

- Accounts Receivable

Accounts Receivable Procedure / Policy Template Forms

Reviews

There are no reviews yet.