What Are Accounting Controls and Processes?

When you hear the phrase “internal control system required by Sarbanes-Oxley (SOX) Section 404?” do you automatically think of policies and procedures? Simply having accounting policies and procedures does not indicate an internal controls accounting system. Well-written accounting controls procedures that document well-defined accounting processes, however, are an important component of the control system you are building.

Accounting Procedures Should Document Important Processes

The decision to write accounting policies and procedures to document a process with controls should not be taken lightly. Once your accounting processes are documented in an accounting procedure there is a commitment by the organization, the accounting department, and its members to execute the process in a consistent manner each and every time to avoid unnecessary risk.

Accounting Control Defined

Accounting control is the configuration of processes and procedures to manage risks within an organization for the verification, validity, and correctness of financial statements.

Internal Control and Risk Avoidance

In many cases, however, this is exactly what the organization wants and needs – a high level of consistency in key financial processes, as well as a certain level of planning in how accounting processes should work. When written and implemented correctly, your accounting procedures should provide this level of internal control and risk avoidance.

While creating the accounting procedure each accounting process should be reviewed reflectively. Decisions can be made by accounting managers and process-owners about how key financial activities should be carried out, and what goals, checks, and risk measures should be part of the accounting process.

Objectives of Accounting Control

- To protect against asset losses

- To guarantee that a company’s documented financial performance and reported cash flows are accurately represented in its financial statements.

- To guarantee that business goals are fulfilled in a timely and effective way.

- to guarantee compliance with laws and regulations

Sarbanes-Oxley Controls

When it comes to internal controls required for Sarbanes-Oxley compliance, accounting procedures that meet these criteria (documenting key process steps, risks, and checks/metrics) are an important part of your accounting internal control system. Creating the accounting procedure, however, is only the beginning.

The accounting process and its associated procedure must be communicated to all affected parties through training, meetings or other types of communication or events. Then, regular internal audits are needed to ensure that personnel are aware of the accounting procedure, risks, and the process requirements that it documents. Writing accounting procedures without the necessary awareness and follow-up is counter productive.

This is why the decision to write an accounting procedure is an important one. Hastily cranking out accounting procedures without properly defining and understanding your accounting risks, processes or without the proper follow-up (training, audits) is actually a detriment to your accounting internal control system.

Using a casual approach to creating accounting process documents increases the chance of not capturing key aspects of the process, associated financial risks, or needed internal controls/metrics. That is the opposite of the control that SOX intended to encourage.

Your financial internal controls accounting processes are critical business processes that impact your financial compliance with commonly established GAAP or IFRS best practices, or legal requirements like Sarbanes Oxley (SOX).

How to Write Internal Controls Accounting Procedures

There are several important keys to writing useful internal controls accounting procedures for the Accounting Department or any department. We have already talked about one: take time to do the necessary research and gather the appropriate information to ensure that your accounting procedure properly captures the goals and key attributes of the accounting process.

Other important elements to keep in mind include:

Keep Accounting Controls Simple

Accounting internal control procedures should document the overall process being executed. It is not necessary to document every single detail of every single action.

That information belongs in accounting work instructions or training materials. Including minutia and too many details leads to an overly long and confusing accounting document, which ensures that your accounting procedure will be neither used nor followed providing questionable risk avoidance.

Accounting Internal Control Examples

-

- Process flows should be documented in Standard Operating Procedures.

- Separation of duties – the originator and the approver should be two separate persons.

- All staff should be given their own computer login and passwords.

- Inventory and assets should be physically verified.

Accounting Controls, More Than Text

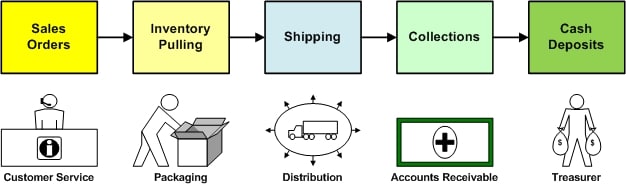

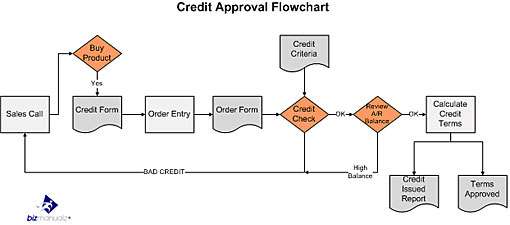

Why create accounting internal control procedures that rely solely on text? Graphics can illustrate accounting process flow, inputs/outputs, and important relationships or risks.

We all know that a picture can be worth a thousand words; using graphics can improve simplicity and usability, which can lead to better internal control. Take advantage of how easy it is to integrate graphics (including photos) into your accounting procedures.

Be Consistent with Internal Controls

Accounting internal control procedures should be consistent in format and design, and in the use of language and terms. They should be highly recognizable and familiar in an organization.

To a degree, they should even be similar in length. That is to say there is a consistency problem if one accounting procedure is four pages long and another procedure is 25 pages (refer to “Keep It Simple” above).

Maintaining Accounting Controls

Keeping accounting procedures up to date means you are properly maintaining the internal control system. A change in the process means a change in the accounting procedure. This aligns with the first point as well.

The more basic and simple you keep an accounting procedure then the easier it is to maintain. Checks and metrics should also be evaluated regularly and modified if they do not truly monitor the effectiveness of the accounting process or provide the needed internal controls.

What Accounting Controls are Needed for SOX Compliance?

Developing accounting procedures to document processes as part of an internal control system that meets the Sarbanes-Oxley Section 404 requirement should be done in iterations according to the risks that your accounting operations face. For the purpose of SOX compliance, the mission is financial statements without material errors.

Two Key Questions to Answer

- What are the most important accounting processes that need to execute properly to complete the mission?

- What business processes contain the most financial risks to the mission?

For each iteration of your SOX implementation, focus only on the number of accounting processes (selected by priority of importance and risk) that your organization has the resources to develop, deploy and maintain properly.

Don’t Bite Off More Than You Have Time to Complete

Don’t try to develop/integrate accounting procedures for 15 processes if your organization can only handle five at a time. Over reaching is a sure path to failure.

Generally, a system with five functioning, well-controlled processes provides more internal controls accounting than a system with 15 poorly controlled accounting processes. Once the organization has defined and created accounting documentation for five processes, then identify the next five accounting process.

Accounting Controls and Processes

Remember, useful accounting internal controls accounting procedures should be simple and clear, as well as known and maintained. Otherwise, they are a detriment to the required SOX internal controls. Check out all of our Financial Internal Control procedure template.

We would like to hear from you about accounting policies and procedures required by SOX. Our mission is to help companies improve through improved accounting processes and training and developing accounting policies and procedures in a way that enhances that goal. One way to be successful in that mission is to know what you think.

To learn more about Bizmanualz Internal Controls Accounting Procedures, check out our Accounting Procedures or download free sample accounting procedures right now.

Leave a Reply