How to Write Accounts Receivable Procedures

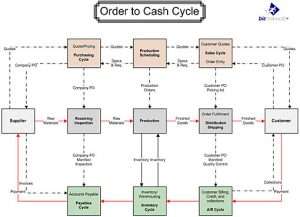

Cash is everything to a business and you certainly would not want to burn up your cash. Learning How to Write Accounts Receivable Procedures helps you to control your cash flow; Let’s look at an example of accounts receivable procedures that is a part of the revenue cycle process.

Accounts Receivable Process Procedure

Let’s continue that crucial theme of time with another major source on your balance sheet; specifically, accounts receivable, or “A/R”. If you have $500,000 or more in accounts receivable, then by compressing the accounts receivable cycle you will generate cash. It is all about time.

Reducing Average Days Collection

Why? Because if we focus on reducing your average days collection by 50%, your accounts receivable balance will fall to $250,000. The result? An extra $250,000 in your bank account!

Let’s see how this would work in a real-life business scenario.

Service Business A/R Metrics

A service organization with $700,000 in average A/R balances needed assistance, so we examined their A/R function to understand and quantify the workflow and workload issues. Next, we designed and implemented a process to improve A/R performance.

The metrics we developed reduced their “over 60” accounts receivable by 85% and their overall A/R balance by 50% within 90 days of implementing the new procedures. With these new accounts receivable processes and reports, the company now tracks Average Days Collection and past due rather than just Days Sales Outstanding (DSO) as the measure of their collection effectiveness.

The result: an extra $350,000 in cash! Again, it’s obvious what a crucial role time plays and how an increase in velocity and discipline directly lead to increases in efficiency and cash savings. So, how can you use time to your advantage?

Accounts Receivable Procedures and Collection Methods

Accounts Receivable is a part of the revenue process. The sale is not complete until you get paid for the sale and until you get paid you have loaned your money to your customers, interest free. The longer they have your money, the less chance there is for you to get your money back.

The money sitting in receivables is money that is not sitting in your bank account. Therefor, here are a few things to keep in mind when Writing Accounts Receivable Procedures.

Decrease Your Collection Cycle Time

Examine customer accounts that go beyond your terms. Do not wait until their late by as much as twice the net terms to take action. Time is your enemy, the likelihood of collecting your receivables decreases with time.

You have to catch collection problems early in the collection cycle. If you decrease your collection cycle time you will improve proper cash flow control.

Tighten Your Credit Policy

Examine credit process for slippage. Do you have a credit approval process? Do you perform credit checks? What standards are used to extend credit and how often do you review your credit policies to make sure they work as intended? These are a few of the Accounts Receivable question you should be asking.

Reduce Your Credit Terms

Change the credit terms you offer your customers. If you offer terms of net 45, reduce it to net 30. You might offer a discount of 1% if paid within 10 days else net due in 30 days. This is equivalent to 18 % annual interest and most businesses will take those terms.

Shorten Your Invoice Process

Bill your customers immediately. This is a big one. Many service organizations wait until the end of the month to tally billable hours and determine customer charges, but waiting until the end of the month costs you money.

This could reduce your day’s receivable by as much as 15 days right there. Email or fax your invoices right away to save another day or two (e.g. QuickBooks accounting software contains this feature).

Reduce Your Billing Errors

Most customers delay payments because of invoice errors. Customers won’t recognize the invoice until it is corrected and may not even notify you, the vendor, of the error until you call for collection. Again, avoiding this delay in error and time will amount to cash savings.

Train Your Accounts Receivable Personnel

Make sure that all personnel involved are training to understand the performance metrics for their jobs. For example, a company will manage $500,000 in monthly A/R balances (that’s $6,000,000 per year!) using an A/R clerk who makes $40,000. But then the supervisor uses nothing more than On-The-Job (OJT) training for the clerk.

Does your CFO think that he or she (the CFO) is really managing the cash? But, in reality, that’s not the case; the clerk is managing the money day-to-day. So shouldn’t the A/R clerk receive enough training to manage such a significant amount of $6,000,000 per year? After all, it only takes a 7% change in A/R in one month to equal the A/R clerk’s entire annual salary. Isn’t the A/R savings worth a little extra time in training?

Maximize Your Accounting Process

With the A/R department you should use each element of the accounts receivable procedures to gain the most benefit for your business. Automation improves business cash flow, and with time-saving accounting process procedures set in place, you will let your efficiency work for you

Write Accounts Receivable Procedures

With accounts receivable procedures in place, you will increase your efficiency by reducing your Average Days Collection. And of course a reduction in Average Days Collection means your A/R balance will also fall, creating more cash on hand. And already we’re halfway to our $1,000,000 goal!

Leave a Reply