What is the Importance of Accounting Procedures Manual?

Every company should document its accounting procedure process. A well-designed and properly maintained system of accounting policy and procedure documentation enhances your accountability and consistency, while at the same time producing long-term savings from reduced duplication, rework, training, and increased focus, consistency, and productivity. Writing accounting manuals of policies and procedures is an important task. What is the importance of accounting procedure manual?

The Importance of Accounting Procedures Manual

An accounting procedures manual is an important document that outlines the steps taken to complete financial tasks within an organization. It serves as a reference for employees who handle financial tasks and provides guidance on how to properly complete each task.

The manual helps ensure that financial processes are uniform and consistent, and the manual‘s accuracy helps to protect the organization from potential financial errors or legal consequences. The procedures manual also serves as a training tool for new staff members so they can quickly become familiar with the organization‘s financial processes.

Why Write an Accounting Manual of Policies & Procedures?

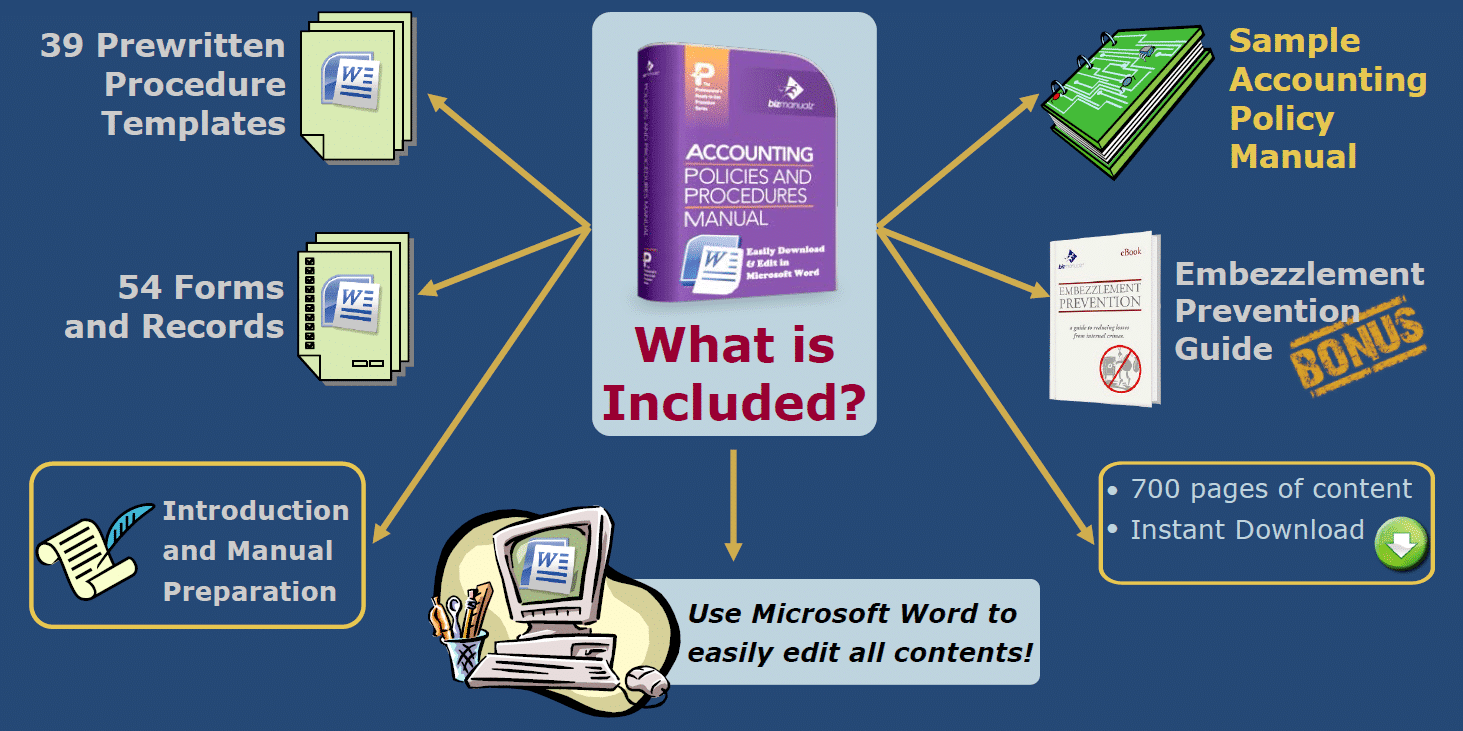

Both the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) recognize policies and procedures as key elements of internal controls. Templates from Bizmanualz help you quickly implement an effective system of financial controls to achieve compliance with Generally Accepted Accounting Principles (GAAP), Sarbanes-Oxley (SOX) Section 404 and similar EU directives (IFRS) using industry best practices. Our templates help you not have to write accounting policies and procedures manuals from scratch.

Accounting Best Practices are Key to Internal Controls

The resulting accounting policy and procedure documentation serves as a training tool for your accounting staff. Communication is essential to your internal control framework, and documented accounting policies and procedures are one of the best ways to communicate essential accounting information and make sure everyone in accounting is “on the same page”.

Well-Designed Accounting Policies and Procedures

Well-designed accounting policies and procedures documentation promotes understanding between accounting and other departments. Well-written accounting procedures enhance your accounting audit process, as well.

Save Months Developing Your Accounting Manual

You can spend hundreds of hours developing your Accounting Policies Procedures Manual and still not have the comprehensive accounting best practices you and your company need. Why reinvent the wheel when you can download and use easily editable Word templates that are thoroughly researched to greatly simplify the policy procedure writing process. Since you can download your order right now, you can get started right away!

Considerations to Writing Accounting Policy & Procedures Manuals

There are several things you have to consider when writing, documenting and maintaining your accounting policy and procedure manual:

1. Senior Management Support

First and foremost, management commitment is the key to getting procedures used. Your accounting policies and procedures program requires the backing and support of senior management.

Without top management’s express support, the proper control environment won’t exist and without that, compliance — with whatever regulation or standard (Sarbanes-Oxley, 8th EU Directive, ISO 9001, etc.) — will be extremely difficult to achieve.

2. Document the Actual Accounting Process

You have to start with the current state of the accounting process, not the ideal state. You’ll confuse your employees if you document a future state, an aspirational process, or an improvement that isn’t currently in use.

Document the current state of your processes and train new employees on those procedures. As you implement a given process, always look for ways to improve it. Make changes to processes as needed, update the accounting procedures accordingly, and hold a training event on the updated procedures.

3. Employee Process Owners

Are your accounting policies and procedures driving improvement and internal control? They will…IF you use your employees to drive the improvement process. Put your employees in charge of documenting “their” processes.

After all, they know their jobs and they’re naturally in the best position to improve them. Give your employees the necessary resources, focus them on the metrics for their job, then have them document their processes and train others.

4. Availability of Accounting Policies Procedures Manual

Your documented accounting policies procedures manual needs to be available at the point of use, where they’re an integral part of the process. If they’re in another room, or if they’re not readily accessible on the employee’s computer, they won’t be used. Out of sight is out of mind.

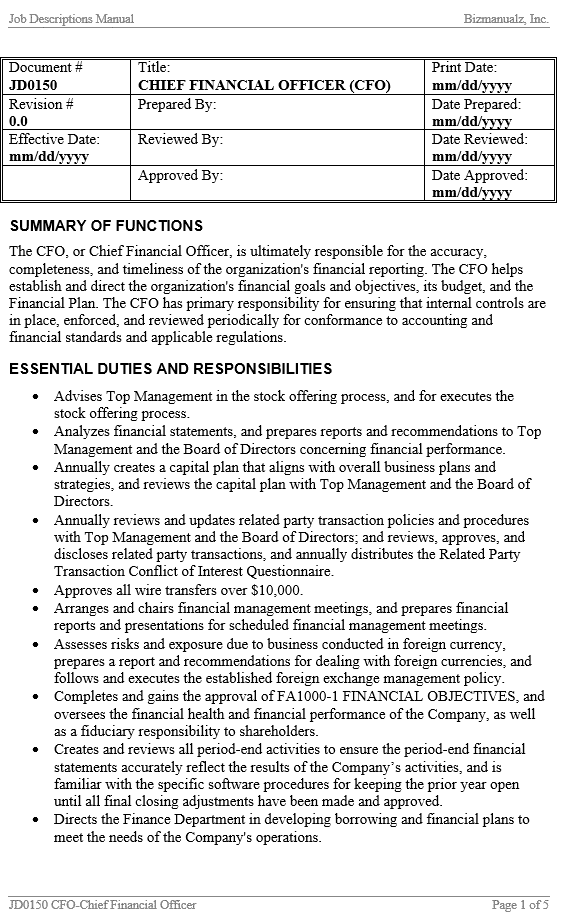

5. Define Employee Responsibilities

Even the CFO has defined responsibilities, authorities, and metrics, contained in a job description. Do all of your accounting employees have clearly defined metrics? Do they know what’s expected of them each and every day? Who has the authority to approve certain transactions? Who is responsible for safekeeping assets and controlling records?

Even the CFO has defined responsibilities, authorities, and metrics, contained in a job description. Do all of your accounting employees have clearly defined metrics? Do they know what’s expected of them each and every day? Who has the authority to approve certain transactions? Who is responsible for safekeeping assets and controlling records?

Your job descriptions should be more specific than “collects receivables”, for an example. They should indicate how many transactions processed per day, or how to prioritize receivables in order of collections importance. Job descriptions should also ensure that employees understand how their functions and responsibilities are integrated with other accounting processes.

6. Clearly Stated Purpose of Accounting Policy

What’s the difference between policies and procedures? An accounting policy is a guiding principle used to set the direction of your accounting organization, while an accounting procedure is a particular way of accomplishing something within your accounting department like counting inventory, collection receivables, or purchasing assets.

Your accounting procedures should explain the internal controls utilized, in order to increase employee understanding of, support for, and proper usage of those controls. You can address all accounting policies in the introduction of the accounting manual, or address specific account policies at the beginning of each accounting procedure.

7. Periodic Accounting Policies Procedures Reviews

Are your accounting procedures effective? Scheduled process-procedure reviews, integrated with your procedure writing standards (that include the “Seven Cs” to avoid procedure writing errors and your risk assessment framework), will help you identify deficiencies you need to address.

8. Utilize a Document Control Procedure to Approve Policies and Procedures

“Document Controls” are quality assurance policy statement and procedures, required by ISO 9001 because traceability and an improvement baseline for document changes are critical. What if your accounting policies and procedures aren’t changing?

The world is not static — your accounting procedures shouldn’t be, either. Remember, your competitors’ accounting procedures are changing.

9. Organize the Accounting Manual Structure

A sample accounting manual structure should cover exclusions, the organization of the accounting department, the applicable accounting standards (GAAP, IFRS, etc.), your accounting cycles or processes, accounting transactions and timing, documentation standards, cost accounting methodologies, and statements of ethics or company restrictions or related party-transactions.

10. Create a User-Friendly Procedure Format

Who are you writing procedures for? Accounting users, of course — but are they novices, occasional users, or frequent users? Different users have different needs, but all users require an easy way to navigate through your accounting policies and procedures manual, or else they will not use it.

Use a table of contents, color-coded tabs, and index numbers for departments or sections. Provide a detailed index in the back with cross references to related subjects, regulations, or standards. Make your accounting policies and procedures manual easy to use and your users will use it.

The Importance of Accounting Procedures Manual

The accounting procedures manual is a crucial manual that explains the procedures followed to fulfill financial activities inside a company is the accounting procedures manual. It offers direction on how to correctly do each work and acts as a reference for staff members who handle financial tasks.

The manual assists in ensuring that financial procedures are standardized and constant, and the accuracy of the manual aids in shielding the business from potential financial blunders or legal repercussions. The procedures document also works as a training resource for new employees, helping them get up to speed on the business’ financial procedures fast.

Get a Free Sample Accounting Procedure

Bizmanualz templates are the perfect solution to those tasked with writing accounting policies and procedures. View free sample accounting procedures from the accounting manual with no obligation. You will get the accounting manual table of contents and one complete policy and procedure Word file. After you place your order with our secure server you can download your accounting manual immediately. Your purchase is risk-free with our money-back guarantee.