What is an Example of a Credit Policy?

When you deliver goods or services and you extend a business customer credit by accepting a promise to pay (accounts receivable) later through an invoice, then in a sense you are loaning your customers cash. During the whole process of acquiring loans, the first question every person must think about is whether the loan is essential at that moment or not. What is an example of a credit policy?

Does Your Credit Policy Protect Your Business Cash?

As a lender it’s easy to give out money with an assurance it’ll come back, but as a person who is acquiring the loan, it is essential to keep to the loan agreement (Rate of interest and Timespan). So what steps can you take to make sure you get your cash back?

One can peruse a debt collectors directory if it is worth going through the trouble. One can easily go online and to find collection agencies. The key is to have a clear credit policy before you loan the money.

Good Cash Management Practices

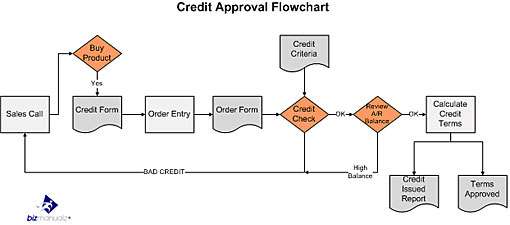

If you use good cash management practices to protect yourself from your employees and co-workers, then shouldn’t you be taking the same precautions with those outside your business? Of course, we are talking about a proper credit policy for clearly establishing the process of determining who can receive credit (can “promise?” to pay later) and how much credit they are allowed.

Credit Manual Strategy

Since determining credit may not always be a straightforward matter, a credit manual that includes credit policies and credit procedures, as well as clear explanations of the strategy or intent behind the policy, can be very useful. Communicating the purpose behind credit policies can be a great help to those making the credit decisions.

Credit Manual Communicates Credit Policy and Intent

Internally, the credit manual can be an instrument to get various departments on the same page when it comes to customer credit. For example, the accounts receivable department and the sales department are frequently at odds regarding what the credit policy should be.

Accounts receivable wants tight credit so they can collect within the proper period and not deal with delinquent accounts. Sales, obviously, wants to book sales and they are not prone to turning away customers. It is management’s job to establish clear credit policies and clear credit procedures, as well as explain the reasoning, in order to minimize the inherent conflict created by varied interests of these two departments.

Credit Policy is About Risk Reduction

Clearly communicating information about the how the company wants to extend credit as a licensed and authorized money lender is one important goal of your credit manual, credit policy and procedures. Another important goal is to create consistency in how you handle and extend your business customer credit, both internally and externally.

But most importantly, your credit policy is about risk reduction. It should be created in advance and take into account such things as its effect on sales, the impact on the company’s cash flow, and legal liability.

Using the Credit Policy Manual

Although it is frequently overlooked, part of the credit process should be regular communication between the various departments involved with using the credit policy manual. Imagine the synergy created when accounts receivable, collections, sales and marketing, and even design and production all agree and cooperate in managing business customer credit. The sales department knows and agrees not to waste its efforts on customers who don’t pay, and those making credit decisions know and agree when exceptions need to be made.

Clear Credit Policy Helps Extend Credit Wisely

Besides establishing consistency internally, the credit manual can also ensure consistent and fair treatment for external customers. The ability to extend short term credit is an important business tool, and if customers feel they are being treated unfairly or without a modicum of trust or respect – it can mean lost business.

When it comes to completing credit applications, references and credit checks, a certain level of consistency is expected, and this is especially true for making credit decisions. The name or size of the company should not be a major factor in deciding who gets credit.

For example, I recently worked with training at a large construction company, and one of their regular customers was somewhat of a celebrity businessman. Apparently, as a matter of practice, this well-known businessman delayed payment of owed invoices until they fell into collections, and then he would attempt to negotiate to a lesser settlement amount.

Eventually, however, the construction company had to tell their customer “you’re fired.” By the time they considered the delay, the collection efforts, and the reduced payment, they were lucky to break even.

Apparently, this person relied on people wanting to do business with him because of his celebrity status. You can’t, however, put a customer’s well-known name or brand in the bank to cover your payroll and your own accounts payable. Your company is better off finding lesser known customers who pay their bills. Consistent and fair company credit policies can help make sure that happens.

Example of a Credit Policy

Your credit manual and credit policies and procedures are directly related to protecting your cash, and you should understand those components as you develop and update them. But just as critical as development of the credit manual is how you communicate your policies and procedures clearly to all affected parties in your organization.

Poor credit practice is tantamount to leaving you cash drawer open? maybe no one will take advantage of your carelessness, but why take that chance?

Download Free Sample Financial Procedure Templates to see how easy it is to edit MS Word Templates to build your own accounting policy and procedure management system.

Thank for the great tips

i am impressed your blog.thanks for sharing with us