What is the Difference Between Bookkeeping and Financial Accounting?

The two important terms “accounting” and “bookkeeping” are easily confused. What are they, how do they interrelate, and how do they interface with accounting methods, policies and procedures? What is the difference between bookkeeping and financial accounting?

The Difference Between Bookkeeping and Financial Accounting

First let’s define the terms bookkeeping, accounting

Bookkeeping

Bookkeeping

Bookkeeping refers to the actual transactional entering and recording of data. Examples are writing checks, processing payroll, making deposits, recording disbursements and recording receipts. Bookkeeping and accounting share two basic goals:

- To keep track of income and expenses, thereby improving the Company’s ability to achieve profitability

- To collect the necessary financial information about The Company’s business to file required reports and tax returns

Financial Accounting

Accounting encompasses the broader responsibilities over developing and maintaining the accounting system under which bookkeeping functions are performed and generally falls within the top ten job responsibilities of a CFO. Accounting is concerned with the timely and accurate recording of transactions, providing useful management information, and properly reporting such information for various user needs.

The Bizmanualz Accounting Policy and Procedure Manual Template set includes answers to basic accounting questions.

Developing and maintaining an accounting system involves setting up and maintaining an appropriate chart of accounts for the particular business. Accounting policies and procedures are then established to provide guidance and internal control for all possible financial transactions.

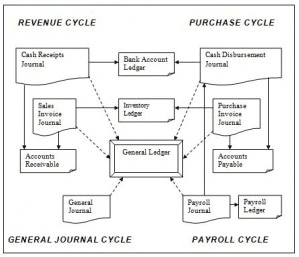

The financial transactions come from source documents (checks, sales orders, etc.), to journals (payroll journal, cash disbursement journal, invoice register, etc.), to the general ledger, (based on the chart of accounts), and ultimately to a variety of reports for all internal and external needs. Bookkeeping and reporting can be thought of as the input and output of a complete accounting system.

Accounting manuals template ensure:

- Integrity of the input data; and

- Accuracy and validity of the output report.

Reporting

Reporting, (the output of the data generated through various bookkeeping functions), is used for both internal and external purposes. Internal Reports are reports used within the company, by both management and other designated personnel. Internal reporting can be further divided into non-financial and financial data.

Non-financial data

Non-financial data includes a variety of measurement and productivity data, applicable to the specific business. These can be daily customer count, web page “hits”, production activity per employee hour, units and total weight of product shipped, or even daily weather conditions.

Financial data

Examples of financial data reports include:

-

- Financial statements – Profit and loss reports (income statement), balance sheets and cash flow statements

- Daily reports with critical balances, such as, sales, cash level, inventory, accounts receivable and accounts payable

- Segmented profit and loss reports (or P/L) on specific jobs, profit centers or departments

- Register reports, listing all transactions for specific areas such as, payroll, checks, receipts, invoices, etc.

- Listings of source data files such as customer, employee, vendor and inventory lists.

- Aging reports for both Customers (accounts receivable or A/R) and Vendors (accounts payables or A/P)

- Inventory reports for costing and valuation

- Exception reports – open purchase orders, back orders, inventory stock outs.

External reports generated for the use of people or organizations outside of the business. Generally, one of the more important users is the Internal Revenue Service (IRS) and various state and local taxing authorities.

Required income tax returns can be prepared more easily from financial reports that are classified in a comparable manner. A tax practitioner is usually retained to prepare and file these returns. The report most commonly requested of the company is the general ledger and related financial statements.

Financial report data and format will vary depending on user:

- Banks, lending institutions. To observe the financial viability of a business and to determine its ability to support additional amounts and types of debt financing

- Employees. To determine the stability of the business of their employer – this may be useful in wage negotiations

- Suppliers. To assess the suitability of granting credit terms to a business

- Existing and Potential Investors. To assess the potential risk of investing in a business and to monitor the status of existing investment in a business

- Public. To gain more insight into any business, which is legally required to make certain financial information available

- Government. To fulfill the requirements of all applicable local, state and federal reporting statutes, including income, sales, insurance, property, and payroll tax returns

- Media / Press. To use available business reports in specific trade and business publications

What Is the Difference Between Finance and Accounting?

Most people lump finance and accounting together. Although both finance and accounting revolve around the management of assets, they are actually both different.

The easiest way to remember the difference between these two is to remember that finance is the planning of distributing the business’ assets, and accounting is the recording and reporting of the financial transactions.

Accounting Software Program Structure

To navigate more easily in any accounting software it is important to understand the difference between accounting, bookkeeping, and reporting. It’s also important to understand the basic organizational structure that is common to all accounting systems.

In spite of all the ancillary menu options and all the different terms used by competing accounting software products, there are really only three major components of any accounting software package: Input, Output, and Maintenance.

Accounting Inputs

Accounting inputs refers to all of the “bookkeeping” tasks discussed above. This includes entering invoices, checks, bills, payments, payroll, accounts payable and adjusting entries.

Each accounting software may “disguise? this input function under different names: “tasks” or “activities”, or it may include specific input functions separately under each cycle area, or it may simply provide icon pictures of activities to be clicked on. Regardless of the specialized “look” of the program, the most important and most heavily used routine in any accounting software is data input.

Accounting Outputs

Accounting outputs refers to all of the reporting functions of the program. Once transactional data has been entered, the only usefulness in having it entered is the ability to retrieve it in a variety of report formats. Generally, these reporting options are found grouped together under one menu, not surprisingly labeled, “reports”! However, with some programs, they are scattered throughout the menus as appendages to each major cycle activity.

Accounting Maintenance

Accounting maintenance encompasses the accounting tasks and can be broken down into two sub-categories: utility maintenance and data file maintenance. Utility maintenance refers to overall utility features like backup, restore, import and export data, fiscal year close, purge, or condense and repair data. These are all usually found on one menu and are generally placed under administrative password control to prevent unauthorized use.

Data File Maintenance

Data file maintenance does require data input, but the input is not transactional. This refers to the creation and maintenance of the chart of accounts (in support of the general ledger), the customer list, vendor list, inventory list and employee list.

These are generally found in one area usually labeled “maintain” or “lists”. In other programs they may be separated and found within each module (i.e.: customer list in the accounts receivable module or revenue cycle).

Understanding how your own accounting system works, (where its input, output and maintenance functions are), is as important as understanding the actual double entry accounting that is occurring “behind the scenes”. As you will discover throughout the Accounting Policies and Procedures Manual, you need to know how the numbers developed and where they came from, in order to establish effective accounting policies and procedures to insure their integrity, accuracy and completeness for financial internal control.

Bookkeeping and Financial Accounting

Now that you know the difference between bookkeeping, and financial accounting reporting, Download Free Policies and Procedures to see how easy it is to edit MS Word Templates to build your own Accounting policy and procedure management system.

Very helpful and a wonderful research network

I obtain BBA in Accounting at university of Liberia, so let to be part of this group for learning purpose.

Interesting blog, good information is provided regarding Finance, Accounting and Bookkeeping. It was very useful, thanks for sharing the blog.

Great post and explanation on the differences of these important terms. These terms confuse many people on a regular basis. This detailed article will prove to be a valuable resource for those individuals in the future. Thanks for contributing!