What Is an Accounting Department Organization Chart?

The company’s Accounting Department Organization Chart provides the foundation for coordinating and administering your accounting management system. A description of the roles and responsibilities applicable to the accounting and operations staff are provided. Responsibilities specific to certain procedures or tasks are presented in the related procedures. What Is an accounting department organization chart?

Accounting Department Organization Chart

Accounting Department Organization Chart

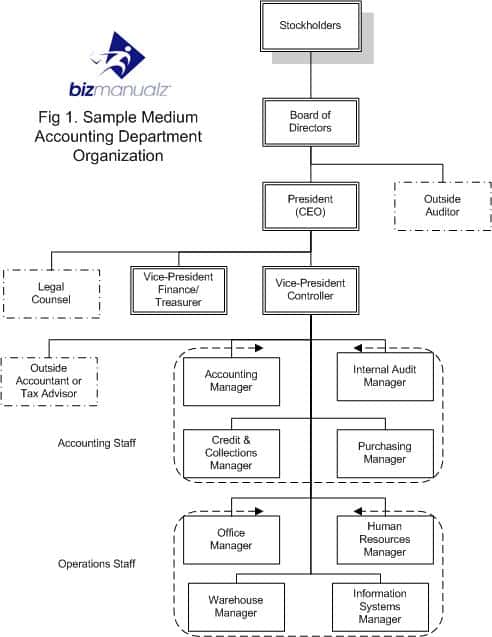

The Sample Medium Accounting Department Organization Chart to the right shows the general organization of the company’s accounting department. The actual Organization Chart may vary in detail based on the size of the department or organization involved and the type of activity performed. Your job descriptions describe accounting department roles and responsibilities.

Note: in a larger company the administrative or operations staff may report to the Vice-President of Finance and Administration in order to allow the Controller to focus on the accounting operations.

The accounting department is headed by the controller or Chief Financial Officer (CFO). The Chief Financial Officer controls the flow of cash through the organization and maintains the integrity of funds, securities and other valuable documents.

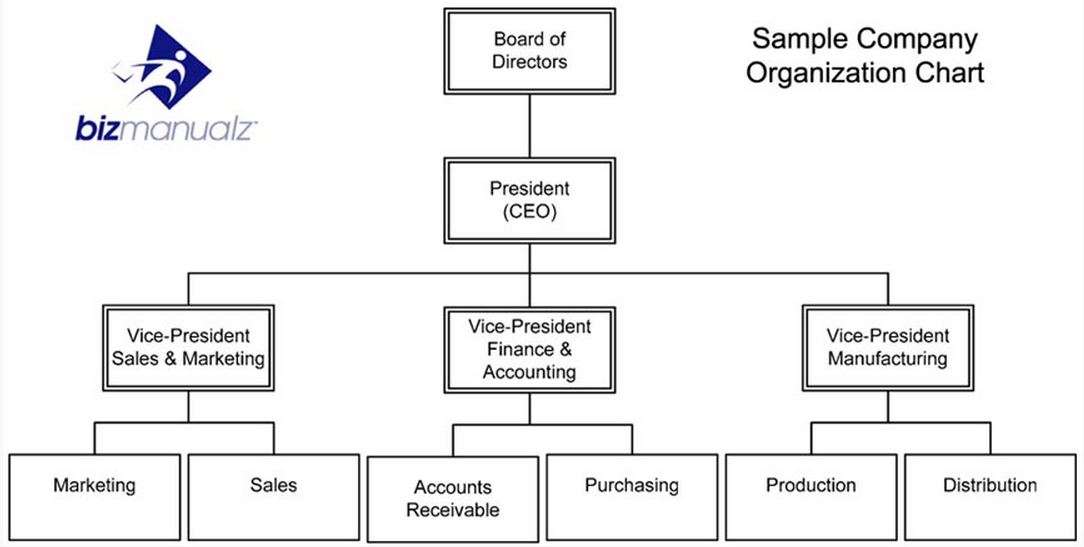

The Accounting Department Organization Chart is organized into three main responsibilities:

- Finance and Treasury

- Accounting, and

- the remaining Operations staff

Finance & Treasury Responsibilities

Finance & Treasury responsibilities are focused on raising capital, debt and or equity appropriations, cash management, Treasury investments, fund balances, and management activities.

The Finance/Treasurer/Controller is responsible to the President/CFO for all long-range financial matters and to establish company-wide financial and administrative objectives, policies, programs, and practices, which insure the company of a continuously sound financial structure. See Bizmanualz Finance Policies and Procedures Manual for a complete discussion of finance and treasury activities.

The Controller directs the accounting and control functions, reporting the results of operations and provides chronological systems. The Controller is accountable to the President and supervises the accounting and operations staff.

Controller Duties and Responsibilities

- Develops and implements the Accounting Manuals Template, accounting policies, coordinates systems and procedures, and prepares operating data and special reports as required, including interim and year-end financial statements. Maintains the company’s system of accounts and keeps books and records on all company transactions and assets.

- Establishes, coordinates and administers, as an integral part of management, an adequate plan for the control of operations including, profit planning, programs for capital investing and financing, sales forecasts, expense budgets and cost standards, together with necessary controls and procedures to effectuate the plan.

- In conjunction with the President and Vice President of Finance, coordinates, reviews, and endorses budget proposals, discusses proposed changes and significant changes.

- Compares performance with operating plans and standards, and reports and interprets the results of operations to all levels of management.

- Provides for the control and editing of all company orders, to insure conformity to established policies and procedures, and to facilitate data control and retrieval of records generated by these orders.

- Establishes and administers tax policies and procedures.

- Supervises or coordinates the preparation of reports to government agencies.

- Coordinates all matters of business between the company and its stock transfer agents and registrars.

- Provides other managers and departments with information required by them to carry out their assigned responsibilities.

- Assures protection for the assets of the business through internal control, internal auditing and assuring proper insurance coverage.

- Assists Marketing in establishing and maintaining product pricing policies.

- Serves as a liaison between the company and legal counsel or outside accountant support. Recommends the appointment of independent public accountants overseeing their audit work.

- Provides advice on all matters to the Vice President of Finance and the President.

Accounting Staff

The popular Accounting Policies and Procedures Manual contains a policy manual to house your accounting organization chart, policies, procedures, and systems.

Accounting staff responsibilities are focused on accurately documenting the Company’s operations, collecting all money owed to the company, and responsibly disbursing money owed to vendors. The accounting staff consists of the following positions:

Accounting Manager Responsibilities

The accounting manager directs and organizes all general accounting activities and accounting staff. Prepares accounting and financial reports and ensures accurate accounting systems and record keeping. Reports directly to the Controller. Assists in supervision of Accounts Payable Clerk and Accounts Receivable Clerk.

Credit & Collections Manager Responsibilities

The Credit & Collections Manager is responsible for processing customer credit inquiries, approving credit/financing terms and collection of delinquent accounts. Reports directly to the Controller. Coordinates activities with Accounting and Sales.

Purchasing Manager Responsibilities

The purchasing manager is responsible for purchasing of all inventory, supplies and capital goods for the company including negotiating price, delivery and credit terms. Evaluates vendors and determines most cost-effective inventory and reorder levels. Reports to the Controller. Coordinates activities with all departments; works closely with Manufacturing, Accounts Payable, and Receiving.

Internal Audit Manager Responsibilities

The internal audit manager is responsible for establishing and implementing internal control mechanisms; performing audit functions on payroll, and billing; assist in developing new or refining existing accounting policies and procedures; assist in streamlining current business processes to improve the overall efficiency and effectiveness of the company.

Operations Staff

Operations staff responsibilities are focused on diligently supporting the operating transactions of the company with assistance, training, and other services, as needed. Note: in a larger company the administrative or operations staff may report to the Vice-President of Finance and Administration in order to allow the Controller to focus on the accounting operations.

The operations staff consists of the following positions:

Office Manager Responsibilities

The office manager is responsible for performing a variety of administrative, office and clerical functions. Reports directly to Controller and is key to boost office productivity. Assists and coordinates activities with the President and other managers in the company. Supervises Receptionist.

Human Resources Manager Responsibilities

The human resources manager develops and updates personnel policies, procedures and forms. Assists and supports department managers and employees regarding personnel issues. Maintains personnel records. Reports directly to the Controller. Coordinates activities and assists all department managers and employees.

Information Systems Manager Responsibilities

The information systems manager is responsible for overseeing network and Internet operations; determines technical goals in consultation with top management, produces detailed plans for the accomplishment of these goals; plans and coordinates the installation and upgrading of hardware and software; analyzes the computer and information needs of the organization and determines personnel and equipment requirements.

Warehouse Manager Responsibilities

The warehouse manager pulls orders and packs and prepares them for shipment. Supervises all shipping and receiving clerks and functions. Contracts with freight carriers for the most beneficial service of the company. Reports to Controller. Coordinates with Sales and Customer Service.

Accounting Department Organization Chart

Your Accounting Department Organization Chart is the basis for your accounting management system. It help to communicate and clarify accounting department roles and responsibilities with responsibilities specific to your accounting procedures or financial tasks.

Download Free Sample Accounting Procedures to see how easy it is to edit MS Word Templates to build your own policy and procedure accounting management system.

I think that accounting is very important for the business. I also believe organizing the accounting department is necessary. This article is really helpful. Thanks for sharing this article.

Thanks for sharing this article. This will definitely help me in managing my accounting department. I also think that by understanding every details about the accounting department will help to be able to have a good and organized accounting department.

Thanks for sharing this article. I think that this article is a big help for business owner to understand the tasks or job of the employee they hired. I think that by having a knowledge about tasks and responsibilities of the employee the business owner will definitely be able to have an organized business process.

Yes, I totally agree with what you said. Accounting staff are the ones who are incharge of the money of the company that’s is why business owner must choose the right and trustworthy person for it. Thanks for sharing this article.

[…] What Is an Accounting Department Organization Chart? – The company’s Accounting Department Organization Chart provides the foundation for coordinating and administrating your accounting management system. […]

Our web based org charting tool is another great way to quickly come up with professional org charts. Plus there are plenty of professionally designed templates to quickly get started as well.