How to Manage Working Capital

One important topic on finance processes is knowing how to manage working capital. Working capital is the money it takes to run your business on a daily, weekly, and monthly basis. It is the money used to pay your suppliers for materials and the money needed to pay for the goods and services (i.e. inventory and payroll) you have used while you wait for your customers to pay you.

How To Manage Working Capital

Working capital is comprised of three elements: accounts receivable, accounts payable, and inventory. Companies need to actively manage these three in order to get the most from their working capital, which can be expressed in the equation:

working capital = accounts receivable + inventory – accounts payable

First, Accounts Receivable

The cash flowing into your business as a result of customers paying invoices is crucial in managing your business’ working capital. This is the credit issued to your customers and it needs to be managed. Your organization should be actively measuring Days Sales Outstanding (DSO), which is the average number of days it takes to collect payment after the sale was made. Typically calculated as [(Accounts Receivable / Sales) X (Days)]. Days would be determined by the period for which you are calculating your DSO; for example 30 if you calculate it monthly and 90 if you calculate it quarterly.

One key to managing Account Receivable is to remove delay in invoicing customers after shipment of an order or delivery of a service. These delays consume cash available as working capital. Set a goal to invoice customers immediately after fulfillment. If it currently takes 10 days to invoice a customer, then the goal should be to do it in 5. If it currently takes 5 then the goal should be 2 days. Finding ways to reduce the DSO frees cash formally tied up in receivables so it can be used in ways that provides return and fuels growth.

Prompt invoicing is the most important method to reduce DSO. It is something you have direct control over, plus, why should customers be conscientious about paying your invoice in a timely way if your make little effort to send invoices promptly?

Second, Accounts Payable

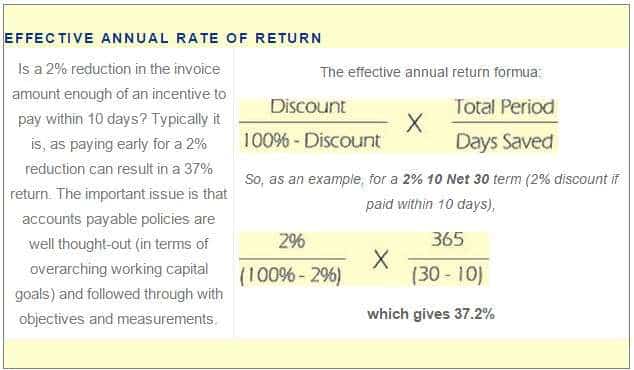

Accounts payable is perhaps the easiest process to control because it simply involves paying the bills. But paying bills shouldn’t just be left to chance; there should be clear policies and goals that direct these activities. But generally, when it comes to paying bills, The Golden Rule should apply. Treat others’ invoices as you wish others would treat your invoice. Basically, that means pay it on time according to the terms. There may be no advantage in paying early, but purposely paying late as a working capital management tool is unprofessional and can negatively impact your business.

You may think you are getting away with paying your bills late, but in reality, if the organization you’re paying late has their act together, then your delayed payment may eventually result in increased prices or reduced service levels. While you may be the customer, do you really want to run you business in a way that elicits frowns and curses when your name is mentioned? Building such a negative reputation can have long term detrimental repercussions.

Ensure your policy states that payment will be made according to terms, with a goal of mailing payment five business days prior to the due date or having funds transferred on the due date for electronic payments (and a supporting measurement that clearly indicates performance in relationship to the goal). The accounts payable policy should also clearly state when invoices should be paid early.

3. Inventory Management

Including inventory as a finance function sometimes causes confusion and skepticism. There is no doubt, however, that inventory consumes financial resources; whether in the form of purchased materials/parts, work-in-process, or finished goods, inventory is cash that should be in your bank account and not sitting on the factory floor. Those responsible for managing the company’s financial resources and performance should also have the ability to oversee and monitor all three types of inventory.

The purchasing representative might believe they are getting a good deal by buying one years worth of parts, and perhaps they are. But making such decisions impacts the overall financial resources consumed by inventory, especially when you include the cost of ownership.

The responsible financial authority should stay informed of inventory performance, and in response set clear policies and goals for reducing and managing inventory levels through metrics such as Inventory Turns (the number of times that a company’s inventory cycles or turns over per year), Days Inventory (the average number of days of inventory on hand per accounting period), Average Inventory (the starting inventory number at the start of a period minus the ending period inventory number divided by 2), and Cost of Ownership (the total cost of maintaining inventory such as warehouse space including utilities and maintenance, finance costs, personnel, equipment, shrinkage, obsolescence, and insurance).

The overarching goal should be to find ways to reduce all types of inventory while ensuring operational needs are being met. This, as with accounts receivable, releases cash tied up in non-productive means so it can be used to gain return or grow the business.

Managing the working capital processes is just as vital to business success as producing products and services that customers want and that fulfills their expectations. Businesses not actively managing their working capital may find an exorbitant amount of financial resources being consumed in unproductive ways such as growing accounts receivable amounts and hefty inventories.

Easily Customizable Financial Procedures

Why start from scratch when writing your financial procedures to implement internal controls? By researching best practices and key compliance activities, Bizmanualz has done most of the work for you. Besides providing the policies and procedures in a hard cover manual, all the materials are also provided on CD in Microsoft Word format so you can quickly and easily adapt and customize them to fit your organizational needs.

Although specifically designed to help small and medium sized businesses (which typically lack the resources to create the documentation frequently called for by internal control systems), the Bizmanualz Finance Policies and Procedures can help companies of all sizes with their compliance efforts, whether it is compliance with SOX, GAAP, or with SEC public company reporting. Plus, the Finance Manual covers important functional areas like Raising Capital, Treasury Management, Financial Reporting and Analysis, Auditing and Controls, and Financial Administration.

Prewritten Financial Procedures Templates for Compliance and Improvement

Since SOX became law, finance and accounting departments in business of all kinds and sizes have been scrambling to develop the required internal controls. Bizmanualz developed the Finance Procedures Manual as not just a not just a “how to” book, but financial processes in the form of customizable financial procedure templates so your documentation can be dynamic and changeable.

With SOX and other regulatory requirements, the main goal of internal control is compliance. However, companies taking the time and effort to create a control system with compliance as the only goal is doing the bare minimum and, as a result, they are missing an important opportunity. Control systems are an excellent way to manage by objectives and drive performance upward. A well-defined process not only documents activities, but can be continually improved through incorporating objective setting, reviewing results, and corrective actions right into the process.

Speed Your Finance Policies and Procedure Development

Strengthen compliance, enhance performance, or speed the development of your financial procedures. Are you still trying to build an internal control system to help you comply with Sarbanes-Oxley (SOX) and other financial regulations? Bizmanualz CFO Policies and Procedures Manual – can provide a big boost in meeting regulatory requirements. Policies and procedures are listed as key control activities in the COSO publication “Internal Control -Integrated Framework.” Both SEC and the PCAOB point to this COSO document as an example of internal controls that meets SOX requirements.

Whether your goal is compliance, enhancing performance, a boost in developing documented procedures, or all three, the Bizmanualz can help. You can order the new Finance Procedures Manual online at our website at: www.bizmanualz.com or by calling 800-466-9953 (international customers call 1-314-863-5079). Or, to view a complete table of contents and a sample finance procedure, visit the free policies and procedures page.

very useful document many thanks