What are the Benefits of Full Cycle Accounting?

Businesses today are looking for ways to maximize their profits while minimizing their operating costs. One way to do this is by implementing full cycle accounting. This approach ensures financial accuracy, enhances decision-making, streamlines operations, and ensures compliance with all business regulations. In this article, we’ll take a closer look at what are the benefits of full cycle accounting, its key components and advantages, and how it can be implemented in your business.

What is Full Cycle Accounting?

Full cycle accounting involves managing all aspects of a business’s financial transactions, from the initial recording of transactions to the ultimate reporting and analysis of financial data. In other words, it’s a comprehensive accounting process that covers everything from bookkeeping to financial statements.

Full cycle accounting is an essential process for any business that wants to keep track of its financial health. By maintaining accurate financial records, a business can make informed decisions about its operations, investments, and growth opportunities.

Definition and Overview

Full cycle accounting involves recording all financial transactions, including payments, receipts, bills, and invoices. This data is then organized into financial reports, such as balance sheets and income statements, and analyzed to determine the financial health of the business.

The process of full cycle accounting begins with the recording of financial transactions. This can be done manually or through automated systems, such as accounting software. Once the transactions are recorded, they are organized into financial reports, which provide a snapshot of the business’s financial position.

These financial reports are used to analyze the business’s financial health and make informed decisions about its operations. For example, if a business is experiencing a cash flow problem, it may use its financial reports to identify areas where it can cut costs or increase revenue.

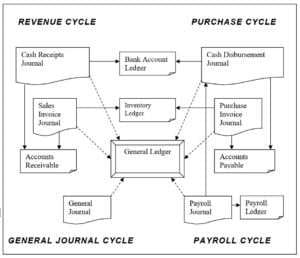

Key Components of Full Cycle Accounting

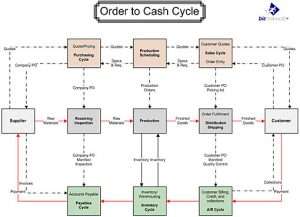

Full cycle accounting consists of different key components. These include accounts the revenue cycle, payable, accounts receivable, payroll processing, bookkeeping, and tax preparation. Each component plays a critical role in ensuring that the business’s finances are accurate and up-to-date.

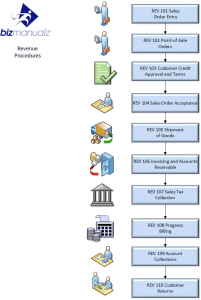

Revenue Cycle

The revenue cycle starts when orders are taken. It is not over until your business receives money AND has passed the point of no returns. Make sure your accounting department is effective and successful by using these sample revenue cycle accounting methods.

Accounts Payable

Accounts payable involves managing the business’s bills and ensuring that they are paid on time. This component is critical for maintaining good relationships with vendors and suppliers.

Accounts Receivable

Accounts receivable involves managing the business’s invoices and ensuring that customers pay their bills on time. This component is critical for maintaining a healthy cash flow.

Payroll Processing

Payroll processing involves managing the business’s payroll and ensuring that employees are paid accurately and on time. This component is critical for maintaining good relationships with employees.

Bookkeeping

Bookkeeping involves managing the business’s financial records and ensuring that they are accurate and up-to-date. This component is critical for maintaining compliance with tax laws and regulations.

Tax Preparation

Tax preparation involves managing the business’s tax returns and ensuring that they are accurate and filed on time. This component is critical for maintaining compliance with tax laws and regulations.

The Accounting Cycle Process

Full cycle accounting follows a systematic process known as the accounting cycle. The accounting process includes recording transactions, posting entries to the general ledger, adjusting accounts at the end of the accounting period, preparing financial statements, and closing the books for the period.

The accounting cycle is a critical process for ensuring that the business’s financial records are accurate and up-to-date. By following this process, businesses can ensure that they are in compliance with tax laws and regulations, and that they have a clear understanding of their financial position.

Full cycle accounting is an essential process for any business that wants to maintain accurate financial records and make informed decisions about its operations. By managing all aspects of its financial transactions, a business can ensure that it is in compliance with tax laws and regulations, maintain good relationships with vendors, suppliers, and employees, and make informed decisions about its growth and investment opportunities.

Benefits of Full Cycle Accounting

Implementing full cycle accounting offers many advantages that can significantly benefit your business. Here are some of the main advantages:

Improved Financial Accuracy

Full cycle accounting ensures accurate and up-to-date financial records by recording all transactions. This information can be used to produce financial statements, which are essential in making informed business decisions.

Moreover, with accurate financial records, businesses can easily identify areas where they can cut costs and improve their bottom line. They can also use the data to identify trends and patterns, which can help them forecast future financial performance.

Enhanced Decision-Making

With accurate financial data, businesses can make informed decisions based on real-time information. This data helps in forecasting and budgeting and supports informed decision-making that can improve the profitability and sustainability of the business.

Furthermore, full cycle accounting provides businesses with a better understanding of their cash flow situation. This information can help them make strategic decisions about investments, expansion plans, and other financial matters.

Streamlined Business Operations

Full cycle accounting automates financial processes, reducing the amount of time and resources required to maintain accurate financial records. This streamlined approach frees up staff members to focus on more pressing matters, like driving sales and growth.

Moreover, with automated financial processes, businesses can reduce the risk of errors and inaccuracies, which can have a significant impact on their financial performance.

Better Compliance and Risk Management

Full cycle accounting ensures that your business adheres to all relevant regulations, both internal and external. This helps in mitigating risks and avoiding any financial penalties or legal liabilities.

Furthermore, with full cycle accounting, businesses can easily track and monitor their financial performance, which can help them identify potential risks and take appropriate measures to mitigate them.

Increased Efficiency and Cost Savings

Full cycle accounting streamlines the financial process, reduces errors, and eliminates the need for manual tasks. This increases efficiency and saves on labor costs associated with traditional accounting processes.

Moreover, with full cycle accounting, businesses can easily identify areas where they can cut costs and improve their bottom line. They can also use the data to negotiate better deals with suppliers and vendors, which can lead to significant cost savings.

Implementing Full Cycle Accounting in Your Business

Now that we’ve covered the benefits of full cycle accounting let us look at how to implement it in your business:

Assessing Your Current Accounting System

Before adopting full cycle accounting, it is essential to understand your current financial systems’ strengths and weaknesses. This assessment will help you to identify the changes necessary to streamline financial processes and improve efficiency.

One of the key aspects of assessing your current accounting system is to identify the areas where you are spending too much time and resources. For instance, if you are manually entering data, it may be time to automate this process. By identifying these areas, you can make the necessary changes to improve efficiency.

Choosing the Right Accounting Software

Choosing the right accounting software is critical when implementing full cycle accounting. The software you choose should be able to automate various financial processes and provide real-time financial information.

When choosing the right software, it is essential to consider your business’s size and needs. For instance, if you have a small business, you may not need a complex accounting system. On the other hand, if you have a large business, you may need a system that can handle multiple users and transactions.

Developing an Implementation Plan

Once you have identified the necessary changes and the right software, the next step is to create an implementation plan. This plan should cover details, such as training of staff and a timeline for implementation.

When developing the implementation plan, it is essential to involve all stakeholders in the process. This will ensure that everyone is on the same page and that the implementation process runs smoothly. Additionally, the plan should be flexible enough to accommodate any unforeseen challenges.

Training Your Team on Full Cycle Accounting

Full cycle accounting requires training of your staff on the new software and processes. The training should cover all aspects of full cycle accounting and ensure that your team is comfortable using the new system.

The training should be comprehensive and cover all aspects of the new system. This includes how to input data, generate reports, and troubleshoot any issues that may arise. Additionally, the training should be ongoing to ensure that your team is up-to-date with any changes or updates to the system.

Implementing full cycle accounting in your business can significantly improve efficiency and streamline financial processes. By assessing your current accounting system, choosing the right software, developing an implementation plan, and training your team, you can successfully implement full cycle accounting in your business.

Full Cycle Accounting

Full cycle accounting offers many benefits to businesses, including improved financial accuracy, enhanced decision-making, streamlined operations, better compliance, increased efficiency, faster cash cycle, and cost savings. Implementing full cycle accounting requires an assessment of your current financial systems, choosing the right software, and a well-planned implementation process.

Train your staff on the new software and processes to ensure that they are capable of using the system optimally and provide the desired results. Upgrade your accounting system today and enjoy smoother accounting processes and greater financial accuracy.

Leave a Reply