Understanding the Steps of the Accounting Process

Accounting and the rules of accounting are a crucial part of any business. It’s the process of recording, classifying, and summarizing financial transactions to provide information that helps decision-makers. Understanding the accounting process can help you make better financial decisions for your business. In this article, we’ll look at the various steps involved in the accounting process with a step-by-step accounting process guide.

The Importance of the Accounting Process

The accounting process is an essential aspect of any organization, small or large. It helps you keep track of your finances, make better financial decisions, ensure compliance with regulations, and maintain financial internal control. Let’s look at these benefits in detail:

Ensuring Financial Accuracy

One of the main benefits of the accounting process is that it helps you maintain financial accuracy. By keeping track of your financial transactions, you can monitor your cash flow, expenses, and profits. This information is crucial in making informed decisions that can help your business grow.

For example, if you notice that your expenses are increasing while your profits are decreasing, you can investigate the cause of this trend. Perhaps your business is overspending on unnecessary expenses, or maybe your sales have decreased due to changes in the market. By identifying the root cause of the problem, you can take action to rectify the situation and improve your financial performance.

Facilitating Decision Making

The financial information generated through the accounting process is essential in making informed decisions. Whether it’s deciding where to invest your money or identifying areas where you can cut costs, the accounting process can provide you with the insight you need to make sound decisions.

For instance, if you are considering investing in a new product line, you can use your financial records to determine whether this investment is feasible. You can analyze your sales data, production costs, and profit margins to determine whether the investment will generate a positive return on investment (ROI).

Compliance with Regulations

Compliance with regulations is essential in any business. It helps you avoid penalties, fines, and legal issues. The accounting process ensures that you maintain accurate records that are compliant with local and international regulations.

For example, if you are operating a business in the United States, you must comply with the Generally Accepted Accounting Principles (GAAP) and the Internal Revenue Service (IRS) regulations. Failure to comply with these regulations can result in penalties, fines, and legal issues that can harm your business’s reputation and financial stability.

In addition to complying with regulations, the accounting process can also help you prepare for audits. By maintaining accurate records and financial statements, you can provide auditors with the information they need to verify your business’s financial performance and compliance with regulations.

In conclusion, the accounting process is a critical aspect of any organization. It helps you maintain financial accuracy, make informed decisions, and ensure compliance with regulations. By investing in a robust accounting system, you can set your business up for success and growth.

The Accounting Cycle: An Overview

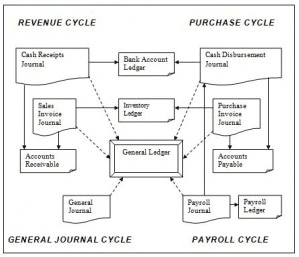

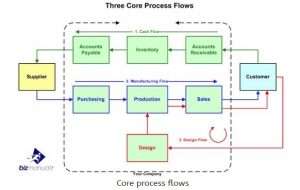

The accounting process is a vital part of any business. It involves several steps that are collectively known as the accounting cycle. The accounting cycle consists of identifying and recording financial transactions, preparing financial statements, and closing the books. The accounting process happens within and around the accounting system.

Proper bookkeeping and accounting are essential for every business. It helps businesses keep track of their financial transactions, understand their financial position, and make informed decisions. Let’s take a closer look at each step of the accounting cycle:

Identifying Transactions

The first step in the accounting cycle is to identify financial transactions. These transactions can include sales, purchases, salaries, loans, and other financial activities. It’s essential to record every transaction, no matter how small, to ensure accurate financial records.

For example, if a business sells a product or service, it needs to record the sale in its books. Similarly, if a business takes out a loan, it needs to record the loan in its books. Identifying and recording financial transactions is the foundation of the accounting process.

Recording Transactions

Once you’ve identified your financial transactions, the next step is to record them in a journal. The journal serves as a chronological record of all transactions. It’s important to record each transaction accurately, including the date, amount, and details of the transaction.

Recording transactions accurately is crucial because it helps businesses keep track of their financial position. It also helps businesses prepare financial statements and tax returns. Without accurate record-keeping, businesses may face legal and financial consequences.

Preparing Financial Statements

After recording all financial transactions in a journal, the next step is to prepare financial statements. Financial statements are reports that provide information on a company’s financial position, performance, and cash flow. The three primary financial statements are the balance sheet, income statement, and cash flow statement.

The balance sheet shows a company’s assets, liabilities, and equity. The income statement shows a company’s revenue, expenses, and net income. The cash flow statement shows a company’s cash inflows and outflows. These financial statements help businesses understand their financial position and make informed decisions.

Closing the Books

The final step of the accounting cycle is to close the books. Closing the books means preparing closing entries that transfer revenue, expenses, and dividends to the retained earnings account.

This step prepares your accounts for the next accounting period. It is the main difference between bookkeeping and financial accounting.

Closing the books is essential because it helps businesses start the next accounting period with accurate financial records. It also helps businesses prepare for audits and tax returns. Without closing the books, businesses may face legal and financial consequences.

In conclusion, the accounting cycle is a crucial process for every business. It helps businesses keep track of their financial transactions, understand their financial position, and make informed decisions. By following the accounting cycle, businesses can ensure accurate record-keeping and avoid legal and financial consequences.

Step-by-Step Guide to the Accounting Process

Now that you understand the accounting cycle, let’s dive deeper into the step-by-step guide to the accounting process. This guide will help you understand the intricacies involved in each step.

Step 1: Analyzing Financial Transactions

The first step in the accounting process is to analyze financial transactions. This step involves examining every financial activity your organization has engaged in and preparing a detailed list of every transaction.

It is important to analyze each transaction carefully to ensure that you have an accurate record of your financial activities. This step is critical in ensuring that the rest of the accounting process runs smoothly.

During this step, you will need to ensure that you have all the necessary information for each transaction. This includes the date, amount, and details of the transaction. You will also need to ensure that each transaction is properly classified based on the type of account it belongs to.

Step 2: Journalizing Transactions

The next step is to record all transactions in a journal. The journal serves as a chronological record of all transactions, including the date, amount, and details of the transaction. It is important to record each transaction accurately and in the correct account to ensure that your records are accurate.

During this step, you will need to ensure that each transaction is recorded in the correct journal. There are several types of journals, including the general journal, sales journal, and cash receipts journal. Each journal is used to record specific types of transactions.

Step 3: Posting to the General Ledger

After recording transactions in a journal, the next step is to post them to the general ledger. The general ledger is a master record of all accounts used by an organization. Posting to the general ledger helps you keep track of individual account balances.

During this step, you will need to ensure that each transaction is posted to the correct account in the general ledger. You will also need to ensure that each transaction is posted in the correct column, either the debit or credit column, depending on the type of account.

Step 4: Preparing a Trial Balance

Once you’ve posted to the general ledger, the next step is to prepare a trial balance. A trial balance is a report that lists all account balances in the general ledger. This report helps you ensure that debits and credits are in balance.

During this step, you will need to ensure that each account balance is properly calculated and recorded on the trial balance. This step is critical in ensuring that your records are accurate and that you can move on to the next steps in the accounting process.

Step 5: Adjusting Entries

The next step is to prepare adjusting entries. Adjusting entries are entries made at the end of an accounting period to account for transactions that haven’t been recorded yet. This step ensures that your financial statements are accurate.

During this step, you will need to ensure that each adjusting entry is properly recorded in the correct account. This step is critical in ensuring that your financial statements accurately reflect your organization’s financial activities.

Step 6: Preparing an Adjusted Trial Balance

After adjusting entries, prepare an adjusted trial balance. The adjusted trial balance lists all account balances, including adjustments made through adjusting entries, to ensure that the accounts are still in balance.

During this step, you will need to ensure that each account balance is properly adjusted and recorded on the adjusted trial balance. This step is critical in ensuring that your records are accurate and that your financial statements reflect your organization’s financial activities.

Step 7: Creating Financial Statements

The next step is to create financial statements. This involves preparing the balance sheet, income statement, and cash flow statement. Using the information from the trial balance, you can generate accurate financial statements.

During this step, you will need to ensure that each financial statement is properly prepared and reflects your organization’s financial activities. This step is critical in providing accurate financial information to stakeholders and investors.

Step 8: Closing Entries

The next step is to prepare closing entries. Closing entries transfer revenue, expenses, and dividends to the retained earnings account. This step ensures that your accounts are ready for the next accounting period.

During this step, you will need to ensure that each closing entry is properly recorded in the correct account. This step is critical in ensuring that your accounts are properly closed and ready for the next accounting period.

Step 9: Preparing a Post-Closing Trial Balance

The final step is to prepare a post-closing trial balance. This report lists all account balances after closing entries are made. This report ensures that all accounts are still in balance.

During this step, you will need to ensure that each account balance is properly recorded on the post-closing trial balance. This step is critical in ensuring that your accounts are properly closed and that your financial records are accurate.

Accounting Process Steps

The accounting process is essential in any organization. It helps you maintain financial accuracy, make informed decisions, and ensure compliance with regulations. Understanding the accounting process can help you make better financial decisions for your organization. Whether you’re managing your own finances or running a business, the accounting process is crucial. Use the step-by-step guide outlined in this article to help you through the accounting process.

Leave a Reply