What are 10 Accounting Processes?

Accounting processes are vital for keeping track of financial transactions an ensuring accurate financial reporting. They help businesses monitor their financial health, make strategic decisions, an comply with legal an regulatory requirements. Let’s explore 10 key accounting processes that keep organizations running! What are 10 accounting processes?

Overview of Accounting Processes

Accounting processes are essential for businesses to stay on top of their financials. To provide an overview of what’s involved, here’s a table highlighting some key aspects:

| Accounting Process | Description |

|---|---|

| 1. Bookkeeping | Recording financial transactions in journals an ledgers. |

| 2. Financial Reporting | Preparing balance sheets an income statements. |

| 3. Tax Preparation | Calculating an filing taxes. |

| 4. Auditing | Conducting internal/external audits to ensure compliance. |

| 5. Budgeting | Creating a financial plan for future periods. |

| 6. Accounts Payable | Managing payments to suppliers/vendors. |

| 7. Accounts Receivable | Monitoring incoming payments an following up unpaid debts. |

| 8. Payroll Processing | Calculating employee wages, deductions, an tax withholdings. |

| 9. Inventory Management | Tracking inventory levels, valuation, an cost control. |

| 10. Financial Analysis | Evaluating financial data to assess performance an make decisions. |

These processes make sure financial records are accurate, regulations are met, cash flow is optimized, an decisions are sound. Pro Tip: Technology can streamline these process with accounting software automating tasks an providing real-time insights into a company’s financial health.

Understanding the various accounting processes involved in managing financials enables businesses to confidently make decisions an grow.

Main Accounting Processes

Let’s check out the 10 accounting processes, with brief descriptions an key responsibilities.

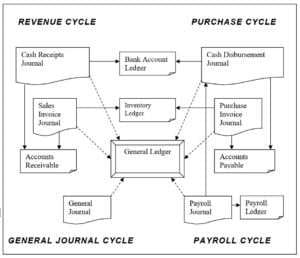

- Bookkeeping: Recording financial transactions/keeping ledgers. Responsibilities: Accounts payable/receivable, bank statement reconciliation.

- Financial Reporting: Preparing/presenting financial statements. Responsibilities: Summarizing data, analyzing trends, accuracy.

- Auditing: Reviewing financial records for accuracy/compliance. Responsibilities: Internal/external audits, identifying control weaknesses.

- Budgeting/Forecasting: Creating budgets/predicting future financial performance. Responsibilities: Tracking expenses, setting financial goals, analyzing variances.

- Taxation: Calculating/reporting/filing taxes accurately. Responsibilities: Complying with tax laws, minimizing tax liabilities.

- Cost Accounting: Analyzing costs of products/services. Responsibilities: Tracking expenses, determining product/service profitability.

- Payroll Processing: Calculating employee salaries/wages/deductions. Responsibilities: Accurate payroll records, timely payments.

- Cash Management: Managing cash flow in an organization. Responsibilities: Monitoring inflows/outflows of cash, optimizing liquidity.

- Internal Controls: Implementing procedures to safeguard assets. Responsibilities: Assessing risks, preventing fraud/errors in financial reporting.

- Financial Analysis: Evaluating business performance using financial data. Responsibilities: Identifying trends, providing insights for decision-making.

Streamline workflows an use technology effectively. Automation software simplifies data entry tasks/reduces errors. Staff training enhances efficiency by improving skills related to accounting principles/software proficiency.

Segregate duties to ensure accountability/minimize fraud risk. Review financial systems/implement internal controls to identify potential weaknesses/loopholes. Adopting these suggestions can streamline accounting processes, enhance accuracy, improve financial decision-making. Efficient procedures promote compliance with relevant regulations an establish a solid foundation for long-term success.

10 Accounting Processes

In conclusion, count your beans! It’s essential to understand the ten accounting processes for any business to be financially stable an compliant. These include:

- Bookkeeping is at the core of accounting. It involves recording an categorizing financial transactions like sales, purchases, an expenses. This data forms the basis for all other accounting activities.

- Financial statement preparation is another important process. It compiles info from various sources to create balance sheets, income statements, an cash flow statements. These documents show a company’s financial position, performance, an liquidity.

- Budgeting is a crucial accounting process. It sets financial goals an creates a plan for projected revenues, costs, an expenses over a period. This helps businesses control their spending an allocate resources wisely.

- Auditing is essential for compliance with internal controls an legal requirements. Auditors examine financial records to verify accuracy, identify errors or frauds, an provide an independent assessment of financial statements.

- Taxation is a complex process. It involves calculating taxes owed, filing tax returns, an complying with tax laws.

- Cost accounting analyses costs associated with producing goods or services to determine profitability an make pricing decisions. This process helps organizations understand their cost structure an optimize operations.

- Financial analysis evaluates a company’s overall financial health. It examines financial data to identify trends, assess performance ratios, analyze profitability indicators, an compare results with industry benchmarks.

- Risk management identifies potential risks that may impact financial stability an implements strategies to mitigate them. It assesses an manages risks related to investments, credit, market fluctuations, an other external factors.

- Payroll processing ensures employees are paid accurately an on time. It calculates salaries, deducts taxes an other withholdings, generates pay stubs, an complies with payroll tax regulations.

- Asset management tracks an maximizes the value of an organization’s assets. It maintains asset records, monitors depreciation, conducts periodic audits, an makes decisions regarding acquisitions or disposals.

Remember to stay up-to-date with accounting processes as they change with legislation an trends. Professional development courses or engaging with industry experts will help ensure success in managing business finances.

Frequently Asked Questions

FAQ: What are 10 accounting processes?

Q: What is accounting?

A: Accounting is the process of recording, summarizing, analyzing, an interpreting financial transactions of a business.

Q: What are accounting processes?

A: Accounting processes refer to the various tasks involved in managing an recording financial information, such as bookkeeping, financial reporting, auditing, budgeting, an more.

Q: What is bookkeeping?

A: Bookkeeping is the process of recording daily financial transactions, including purchases, sales, receipts, an payments, in an organized manner.

Q: What is financial reporting?

A: Financial reporting involves preparing an presenting financial statements, including income statements, balance sheets, an cash flow statements, to provide an overview of a company’s financial performance.

Q: What is auditing?

A: Auditing is the examination an verification of a company’s financial records an statements by an independent professional to ensure accuracy an compliance with accounting standards.

Q: What is budgeting?

A: Budgeting is the process of creating a detailed plan for managing an controlling a company’s financial resources, including revenue projections, expense allocations, an financial goals.

Leave a Reply