How to Calculate Break Even Sales

Businesses must understand how much they need to sell to cover costs and avoid losses. This is called the break-even point. Calculating it is vital for financial planning. Here, we’ll look at the concept of break-even sales and learn how to calculate it. How to calculate break even sales

Calculating Break Even Sales

To calculate break-even sales, we need to know the different costs that contribute to a company’s expenses. These include fixed costs, which stay the same, like rent and salaries. Variable costs, on the other hand, change with sales and can be things like raw materials or commissions.

We can use a formula to calculate the break-even point. It is: Fixed Costs / (1 – (Variable Costs / Sales)). Plug in the values for fixed costs, variable costs, and sales to determine the amount of sales needed to reach the break-even point.

The concept of break-even sales was first mentioned by C.P.J. Braithwaite in his book “The Economic Theory of Firms”. Since then, it has been widely used by businesses for financial analysis and decision-making.

Understanding Break Even

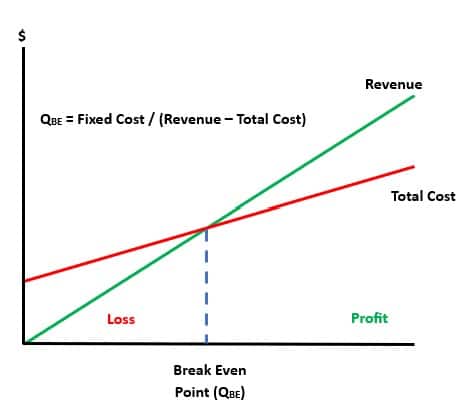

To understand break-even in calculating financial viability, dive into the definition of break-even sales and the importance of calculating them. Gain insight into how break-even sales help determine the point at which a business covers its costs and begins generating profit.

Definition of Break Even Sales

Break Even Sales is when you neither make a profit nor incur a loss. This is when your total revenue is equal to the total cost. To calculate Break-Even Point (BEP), divide fixed costs by contribution margin per unit. Units can be calculated by dividing fixed costs by contribution margin ratio.

Break-Even Analysis is important for businesses. It helps to see how changes in costs and sales affect profits. Variables such as price and costs can be adjusted to plan operations better.

Henry Ford’s accountant, Roy Lamson, was the first to popularize Break-Even Analysis in 1926. This revolutionized the automotive industry and set new standards for business financial management.

Importance of Calculating Break Even Sales

Breaking even sales is a key part of business management. It shows when total revenue equals total costs, meaning no profit or loss. By calculating break even sales, companies can decide on prices, cost control and revenue goals.

The Importance of Calculating Break Even Sales

| Aspect | Importance |

|---|---|

| Pricing Strategies | Setting prices to cover all costs |

| Cost Control Measures | Finding areas to reduce costs |

| Revenue Targets | Setting realistic sales goals |

Calculating break even sales can help find areas to cut back costs and be more efficient. This can lead to better profits.

Alfred Marshall introduced the concept of break even sales in the late 19th century. Since then, it has become an important tool for businesses to check their financial situation and plan for success.

Steps to Calculate Break Even Sales

To calculate break-even sales efficiently, gather relevant financial information and determine fixed costs, variable costs, contribution margin, and eventually break-even sales. By following these steps, you can better understand the financial aspects of your business and make informed decisions for optimal profitability.

Step 1: Gather Relevant Financial Information

Calculating break-even sales requires data. Get it by following four steps:

- Examine income statements to understand revenue and expenses. This reveals business profitability.

- Scrutinize expense categories, like production costs, operational costs, and overhead expenses.

- Assess product or service pricing strategies, related to demand elasticity, competition, and market trends.

- Check sales volume data for customer demand patterns and trends.

Gathering financial information thoroughly is key. Consider external economic factors that may have impacted past performance too. Many businesses fail due to an inadequate understanding of their finances before decisions are made. Therefore, research and gather accurate financial data first.

Step 2: Determine Fixed Costs

Figuring out fixed costs is a must for calculating break-even sales. These costs don’t change with the level of production or sales and must be tracked accurately. Here are 6 steps to determine fixed costs:

- Discover expenses that stay the same regardless of production or sales volume.

- Such as rent, salaries, insurance premiums, and utilities.

- Work out the total spent on each fixed expense category.

- Leave out any variable costs for accuracy.

- Add up all the individual fixed expense categories to get the total fixed costs.

- Regularly update the calculations, as fixed costs can change.

In addition to these steps, there are tips for determining fixed costs effectively:

- Be detailed: Look at your financial records and invoices carefully to identify fixed expenses accurately.

- Differentiate between variable and fixed costs: Clearly mark variable and fixed expenses when categorizing costs for precise calculations.

- Use history: Analyze previous financial statements and records to comprehend trends in your fixed expenses over time.

- Consult experts: Get help from accountants or financial advisors who can help you uncover any undiscovered or forgotten fixed costs.

By following these steps and tips, businesses can make sure they have a clear understanding of their fixed expenses and calculate break-even sales figures correctly without leaving out any important factors.

Step 3: Determine Variable Costs

To work out break-even sales, it’s vital to identify variable costs. This helps businesses figure out how much money they need to make to cover their expenses and become profitable.

- Step 1: Recognize Variable Costs

Variable costs vary with production or sales levels. These include raw materials, direct labor and shipping fees. - Step 2: Group Variable Costs

Divide variable costs into separate categories. This helps to see which costs directly affect products or services sold. For example, separate manufacturing from marketing costs. - Step 3: Give Each Category a Value

Put a value on each category of variable costs. Use precise financial data and analysis to do this accurately. - Step 4: Work Out Total Variable Costs

Total the values for all the categories of variable costs. This will show how much money was spent on variable expenses over a specific period.

As well as these steps, it’s important to keep reviewing and updating variable cost calculations as business conditions change. Knowing how to work out variable costs is great for helping businesses optimize their operations and make informed decisions about pricing and profitability goals.

Step 4: Calculate Contribution Margin

Calculating the contribution margin is key for knowing your break-even point and making smart business choices. Here’s a 4-step guide to help you out:

- Find sales revenue – Work out the money made from selling products/services. This includes physical and intangible goods.

- Deduct variable costs – These are expenses directly related to production/delivery, such as materials, labor, and shipping fees. Subtract these from sales revenue to get gross margin.

- Calculate contribution margin ratio – To see how much each sale covers fixed costs, divide gross margin by sales revenue. Multiply this number by 100 to get a percentage.

- Analyze and interpret – This ratio reveals how efficient each sale is for covering fixed expenses and generating profits. Compare it with industry benchmarks + previous data to evaluate your business’s financial health.

Accurately calculating the contribution margin can provide insightful information on your business’s financial performance. Use this to perfect operations and maximize profits. Don’t forget this essential step!

Step 5: Calculate Break Even Sales

Calculating break-even sales can be done in three steps:

- First, identify fixed costs, such as rent, salaries, and insurance.

- Second, work out the contribution margin – the difference between the selling price per unit and variable costs per unit. This shows how much each sale contributes to covering fixed costs.

- Lastly, divide total fixed costs by the contribution margin. This will give you the break-even point in units or dollars.

Understanding the significance of break-even sales is also important. It helps decision-makers analyze profitability levels and make strategic decisions to increase efficiency and profits.

Take a restaurant owner wanting to open a second location. They needed to calculate their break-even sales to see if it was financially feasible. By following these steps, they discovered the minimum number of customers they would need to serve each day at the new location to cover their fixed costs. This helped them make an informed decision about expanding their business.

Examples and Calculation Demonstrations

To calculate break even sales for your business, refer to the examples and calculation demonstrations in this section. Discover how to determine break even sales for a service-based business and a product-based business. By examining these examples, you will gain an understanding of the necessary calculations and strategies needed for your own business.

Example 1: Calculating Break Even Sales for a Service-Based Business

Calculating break-even sales for a service-based business is essential for understanding profitability. We can analyze costs and revenue to discover the point when expenses are covered and profits start being made. Let’s take a look at an example. We’ll use a made-up service-based business.

Consider a marketing consulting firm that charges $100 an hour. The fixed costs for this business are $5,000 monthly, for expenses such as office rent, utilities, and insurance. Plus, there are also variable costs per project, like employee salaries and marketing costs. To figure out the break-even sales, we need to know how many billable hours are needed to cover the fixed and variable costs. Let’s say the variable cost per hour is $50. We can make a table to understand better:

| Amount ($) | |

|---|---|

| Fixed Costs | $5,000 |

| Variable Costs per Hour | $50 |

| Service Price per Hour | $100 |

By dividing the total fixed costs by the difference between the service price and variable cost per hour, we can find out how many billable hours are needed to break even: $5,000 / ($100 – $50) = 100. This means that the marketing consulting firm needs to book 100 billable hours each month to cover all expenses and reach the break-even point. It’s important to note that this calculation is based on a constant selling price and variable cost per hour. In reality, these values may vary due to market conditions or other factors specific to each business.

Example 2: Calculating Break Even Sales for a Product-Based Business

Let’s work out the break-even sales for a product-based business! We need to figure out when total revenue equals total costs. This helps us know the minimum sales needed for covering expenses and earning a profit.

Say the sales price of a product is $20, variable cost per unit is $10, and fixed costs are $5,000.

We can work out the break-even quantity using this formula:

Break-Even Quantity = Fixed Costs / (Sales Price – Variable Cost per Unit)

Using our example values:

Break-Even Quantity = $5,000 / ($20 – $10) = 500 units

Therefore, this product-based business needs to sell 500 units to break even. Keep in mind that this calculation assumes constant sales price and variable cost per unit. Any changes in these factors will alter the break-even quantity.

Understanding our break-even point assists with making decisions about pricing strategies and production volumes. Knowing this crucial threshold allows us to plan and aim for profitability. So don’t skip out on calculating your break-even sales quantity and gain valuable insights into your product-based business!

Limitations and Considerations

To accurately calculate break even sales, it is important to be aware of the limitations and considerations involved. Understanding the limitations of break even analysis and considering various factors during the calculation process will ensure a more robust and reliable result. This section explores the limitations of break even analysis and factors to consider in break even sales calculation.

Limitations of Break Even Analysis

Break Even Analysis may have some drawbacks to consider. These could reduce the precision and dependability of the analysis in decision-making.

- 1. Assumptions: Break Even Analysis largely relies on assumptions like fixed costs and variable costs. Any divergence from these assumptions can cause erroneous results.

- 2. Simplistic: This analysis presumes a linear relationship between expenses and revenues, overlooking complexities that could exist in real-world situations.

- 3. Ignoring Competition: Break Even Analysis disregards competitive elements, like pricing tactics or market conditions, which could heavily influence profitability.

- 4. Limited Scope: It just concentrates on covering costs instead of maximizing profits. Thus, it might not be suitable for businesses wishing to reach significant progress.

- 5. Time Sensitivity: The analysis assumes unchanged cost structures over time, ignoring potential changes that might occur in the future.

- 6. Lack of Contextual Insights: Break Even Analysis overlooks qualitative elements of business decisions, such as customer preferences or market trends.

In spite of these limitations, Break Even Analysis is still a valuable tool for preliminary assessments in decision-making processes.

It is important, though, to recognize these restrictions while using Break Even Analysis for making informed decisions. By looking at these limitations with other analytical tools and including qualitative insights into the decision-making process, businesses can maximize their chances of success. Don’t miss out on using this powerful tool!

Factors to Consider in Break Even Sales Calculation

Calculating break-even sales involves several factors. They are crucial in working out when revenue equals expenses. By understanding them, businesses can predict and decide better about their financial condition.

To understand these factors better, let’s look at the table below:

| Factor | Description |

|---|---|

| Fixed Costs | Expenses that don’t vary with production volume |

| Variable Costs | Expenses that change with production volume |

| Selling Price per Unit | The price at which a product is sold/unit |

| Contribution Margin | Shows how much each unit contributes to profit |

Fixed costs are expenses that stay the same no matter the production level. Examples include rent, utilities, and insurance. Variable costs, on the other hand, are linked to the production volume; materials, labor, and packaging.

The selling price per unit is a key factor in break-even sales calculation as it impacts competition and profit margins. Also, by knowing the contribution margin for each unit sold, businesses can see how much each sale helps to cover fixed costs and generate profit.

It’s also important to consider other elements, such as market demand and competition. These external factors affect pricing strategies and overall sales performance. By analyzing market trends and consumer behavior, companies can make wiser decisions about their break-even point.

Forbes1 issued a report about the significance of accurate break-even analysis in working out business viability.

Calculate Break Even Sales

Analyzing break-even sales is a must for businesses. It’s when revenue matches expenses. Several factors affect the calculation, such as fixed and variable costs. To calculate break-even sales, identify fixed and variable costs per unit. Fixed costs are expenses that stay the same no matter the number of products or services produced. Variable costs change with production volume.

The contribution margin is the portion of each sale that covers fixed costs and generates profit. Calculate it by subtracting variable costs from the selling price. To determine break-even point in units, divide total fixed costs by the contribution margin per unit. This shows how many units need to be sold to cover expenses without a loss.

An example is Sony’s PlayStation 3 launch in 2006. High manufacturing and marketing expenses made it hard for Sony to reach break-even sales. But through adjustments, cost reductions, and increased demand, they eventually surpassed the break-even point and made profits.

This example shows how important break-even analysis is for businesses. It helps make informed decisions and achieve profitability.

Additional Resources and Tools for Break Even Sales Calculation

Need assistance to calculate break-even sales? Resources and tools can make it easier and more accurate. Here is a table of helpful resources:

| Tool/Resource | Description |

|---|---|

| Break-Even Calculator | Use this online tool to input fixed costs, variable costs, and selling price. It’ll tell you how many units you need to sell to break even. |

| Financial Statements | Analyze sales performance using profit and loss statements, balance sheets, and cash flow statements. Identify areas for improvement. |

| Cost-Volume-Profit Analysis | See how changes in sales volume affect profitability. Also gives insights into pricing strategies and cost management. |

| Industry Benchmarks | Compare your business’s performance to industry averages. Research associations or consult industry reports for accurate benchmarks. |

Remember to consider market conditions, competition, and consumer behavior when calculating break-even sales. Analyzing these will give you an overall understanding of the factors affecting your break-even point.

Get these resources now. The right tools and information will help you make wise decisions that lead to profitability and success.

References

It’s essential to have an understanding of the complexities of calculating break-even sales accurately. To gain a better understanding of this important concept, two sources provide comprehensive info on formulas, metrics, and factors affecting the break-even point calculation: Entrepreneur.com and Investopedia.com.

To make the most of these sources and enhance your business strategies, here are some tips:

- Do market research. Knowing your target market’s demand and competition will help you predict sales volumes more accurately.

- Cut expenses. Identify areas where you can reduce costs without sacrificing quality. This will reduce the costs needed to reach break-even sales.

- Set pricing strategies. Analyze your pricing strategy and consider factors such as production costs, market demand, and competitor pricing. Adjusting prices accordingly will get you to break-even quicker.

By following these tips, you can optimize your break-even sales calculations and make informed decisions to improve your business’s financial wellbeing. Utilizing knowledge from reliable sources and taking proactive measures can have a great effect on achieving break-even sales.

Frequently Asked Questions

Q: What is break-even sales?

Q: What is break-even sales?

A: Break-even sales refer to the point at which a company generates enough revenue to cover all its expenses and neither incurs a profit nor a loss.

Q: How to calculate break-even sales?

A: Break-even sales can be calculated by dividing the total fixed costs by the contribution margin per unit. The contribution margin per unit is obtained by subtracting the variable costs per unit from the selling price per unit.

Q: What are fixed costs?

A: Fixed costs are the expenses that remain constant regardless of the level of production or sales. They include rent, salaries, insurance, and utilities.

Q: What are variable costs?

A: Variable costs are expenses that change in direct proportion to the level of production or sales. Examples of variable costs include raw materials, direct labor, and packaging costs.

Q: Why is break-even analysis important?

A: Break-even analysis helps businesses determine the minimum amount of sales they need to cover costs and make informed decisions about pricing, production levels, and profitability.

Q: Can break-even sales change over time?

A: Yes, break-even sales can change over time due to various factors such as changes in fixed costs, variable costs, selling price, and market conditions. Regular monitoring and analysis are necessary to adjust the break-even point accordingly.

Leave a Reply