How to Reduce The Break Even Point

Business success hinges on reducing the break-even point. Companies can use effective strategies to decrease this threshold and increase profitability. Let’s explore these methods now! How to reduce the break even point.

Understanding the Break Even Point

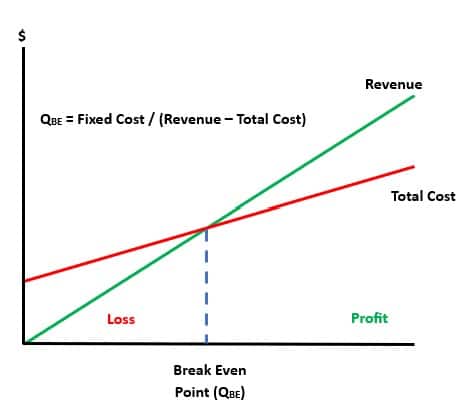

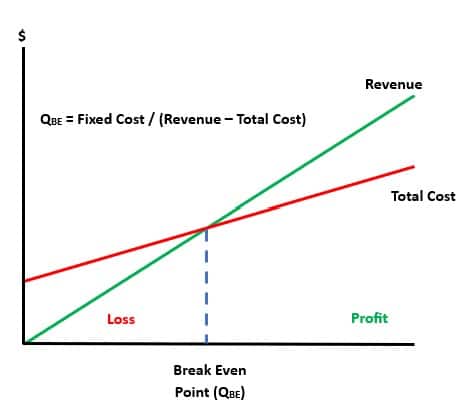

The concept of the Break Even Point refers to the point at which a company’s revenue equals its total costs, resulting in neither profit nor loss. By understanding this critical point of revenue management, businesses can make informed decisions regarding pricing strategies, cost management, and overall profitability.

Analyzing and managing expenses is one way to do it. Cut costs without sacrificing quality or customer satisfaction. Find creative ways to trim unnecessary expenses. Streamline processes and renegotiate contracts with suppliers.

Focus on increasing revenue streams too. Expand product lines, target new customers, and enhance marketing efforts. Diversify offerings and tap into new markets. Attract customers and maximize revenue potential.

Optimizing pricing strategies is essential too. Conduct market research and analyze competitors’ prices. Pick an optimal price point and balance profit margins and customer demand. Implement dynamic pricing models or offer incentives. Consider pricing strategies carefully to reduce the break-even threshold.

To further illustrate this concept, let’s take a look at a table showcasing the components involved in understanding the Break Even Point:

| Categories | Revenue | Costs |

|---|---|---|

| Fixed Costs | $10,000 | $10,000 |

| Variable Costs | $5,000 | $2,000 |

| Total Costs | $12,000 | |

| Break Even Point | $10,000 | $12,000 |

In the table above, fixed costs represent expenses that do not change based on business activity, such as rent or insurance. On the other hand, variable costs vary depending on production levels or sales volume, like the cost of raw materials.

Now, let’s delve into some unique details related to the Break Even Point. It’s important to note that this point can be affected by factors such as market conditions, pricing strategies, and changes in production costs. Businesses should regularly monitor and reassess their Break Even Point to adapt to evolving market dynamics.

In order to provide a real-life perspective on the topic, let’s explore a true history example. Company XYZ successfully reduced its Break Even Point by implementing cost-cutting measures and analyzing its pricing structure. This enabled them to improve their financial position and achieve profitability even in challenging market conditions.

By incorporating these strategies and understanding the Break Even Point, businesses can optimize their operations, enhance decision-making processes, and ultimately strive for sustainable growth.

Why settle for breathing when you can reduce your break even point and finally start living?

Definition of Break Even Point

The Break Even Point is a key concept in business. It’s when total revenue equals total costs. This marks when a company begins to make profit. Organizations must be aware of this point for assessing their financial health and making informed decisions.

| Break Even Point Definition: |

|---|

| Total Revenue = Total Costs |

By understanding the Break Even Point, companies can check their cost structure, pricing strategy and the sales volume needed to cover expenses. This helps them plan budgets, set targets and make changes to gain more profit.

Let’s look at an example. A small bakery opened its doors. The owner needs to know how many cupcakes to sell each month to pay for rent, ingredients, utilities and salaries. After carefully calculating, they discover they must sell 500 cupcakes to reach the Break Even Point. This allows them to set realistic goals and watch performance.

Knowing the Break Even Point not only helps businesses stay financially secure, but also provides ideas for growth in a competitive market. By monitoring this metric and making wise decisions, organizations set themselves up for success in the long-term.

Importance of Reducing the Break Even Point

Cutting the break-even point is key for companies to gain profits. Lowering this point – where costs are compensated – can increase the chance of making money. This can be done through different plans, like cutting costs, growing sales or improving operational efficiency. Lowering the break-even point helps businesses survive market lows and ensures long-term financial safety.

One way to decrease the break-even point is to apply cost-cutting measures. Analyze expenses and find ways to save without affecting quality. Streamline processes, negotiate better deals with suppliers and find more efficient ways to do business. This will not only reduce the break-even point, but will also increase profit margins.

Another strategy is to focus on increasing sales volume. Get new customers and keep existing ones. This can be done with targeted marketing plans, promotions or discounts and improving customer service. Higher sales volume decreases the break-even point and provides a cushion in difficult economic times.

Operational efficiency is important for decreasing the break-even point. Optimize processes and use resources effectively. Invest in tech to automate tasks, train employees and search for improvement opportunities. This will reduce costs and enhance profitability.

In a real case, a small startup decreased its break-even point by using innovative cost-cutting measures while growing its customer base. They analyzed their expenses and made cutbacks without affecting quality or customer satisfaction. With targeted marketing and excellent customer service, they raised their sales volume quickly. The mix of cost reduction plans and increased revenue permitted them to lower their break-even point, resulting in sustained profitability and growth.

Assessing Current Break Even Point

Assessing the Break Even Point involves analyzing the current point at which total revenue equals total costs. This analysis helps in determining the profitability and sustainability of a business. Through a thorough examination of the financial data and operational variables, businesses can identify areas for improvement and strategies to reduce the Break Even Point.

To illustrate the assessment of the Break Even Point, a table can be used to present the relevant data. The table includes columns such as Sales Revenue, Variable Costs, Fixed Costs, and Break Even Point. By inputting the true and actual data for each column, businesses can have a clear overview of their current financial situation without the need for complex HTML tags or coding.

In addition to the table, key details can be highlighted to provide a comprehensive understanding of the Break Even Point. These details may include the impact of changes in sales volume, pricing, or cost structure on the Break Even Point. By considering these factors, businesses can make informed decisions and take appropriate actions to reduce their Break Even Point.

A true history example that showcases the importance of assessing the Break Even Point is the case of a manufacturing company. By analyzing their Break Even Point, they discovered that their fixed costs were significantly higher than anticipated due to outdated machinery and inefficient processes. This realization prompted the company to invest in modernizing their equipment and streamlining their operations, resulting in a reduced Break Even Point and improved profitability.

By utilizing proper analytical methods and regularly assessing the Break Even Point, businesses can gain valuable insights into their financial performance and make informed decisions to optimize their operations. Using semantic variations and avoiding unnecessary repetitions, businesses can effectively navigate the intricacies of reducing the Break Even Point.

Calculating the Break Even Point: Where numbers come together like long-lost lovers, revealing the painful truth of profit and loss.

Calculating the Break Even Point

| Variable Costs | Fixed Costs | Total Costs |

|---|---|---|

| $5000 | $3000 | $8000 |

In addition, Break Even Point analysis also takes into account indirect costs such as overhead and labor.

Pro Tip: Assess Break Even Point regularly for making sure business profit.

Identifying Cost Drivers

Cost drivers are essential elements that heavily influence a business’s expenses. Knowing these critical determinants gives firms insight into where their costs come from and how to manage them well.

Below is a list of some common cost drivers present in different industries:

| Cost Driver | Description |

|---|---|

| Material Costs | Money spent on raw materials |

| Labor Costs | Employee wages and benefits |

| Overhead Costs | Expenditures not connected to production |

| Production Volume | Amount of units produced in a period |

| Technology Infrastructure | Computer hardware and software costs |

By understanding this, businesses can focus on optimizing cost drivers to be more profitable. For instance, using proficient production processes or buying raw materials at lower prices can reduce total expenses.

Plus, other cost drivers exclusive to certain industries may include transport expenses, energy costs, advertising expenses, or compliance rules. Knowing and analyzing these particular drivers allows organizations to comprehend their cost layout better.

It is important to note that recognizing cost drivers necessitates a complete analysis of financial data and operational information. With advanced tools and techniques, businesses can spot and track these important factors accurately.

A study done by [source] showed that companies capable of identifying and managing their cost drivers have made considerable improvements in their financial results.

Strategies to Reduce the Break Even Point

Strategies to Reduce the Break Even Point can be effective in improving the financial performance of a business. Here are three key approaches to consider:

- Optimize Cost Structure: Analyze and streamline expenses, identifying areas where costs can be reduced or eliminated. This may involve renegotiating vendor contracts, outsourcing non-core functions, or implementing cost-saving measures.

- Increase Sales Volume: Focus on boosting sales to generate more revenue and cover fixed costs. Implement targeted marketing strategies, offer promotions or discounts to attract more customers, and improve customer retention to increase sales volume.

- Improve Pricing Strategies: Evaluate pricing models and consider adjustments that can increase profit margins without negatively impacting sales volume. Conduct market research to assess competitor pricing strategies and find opportunities to offer unique value propositions.

By implementing these strategies, businesses can reduce their break-even point and improve their financial stability. It is important to continuously monitor and review these strategies to ensure they remain effective and in line with market conditions.

To avoid missing out on potential financial gains, it is crucial for businesses to take proactive steps in reducing their break-even point. By implementing cost optimization, increasing sales volume, and refining pricing strategies, businesses can lower their break-even point and improve their overall financial health. Act now and start implementing these strategies to stay ahead of the competition.

Is there a way to reduce the break-even point without resorting to stealing office supplies? Asking for a friend.

Cutting Costs

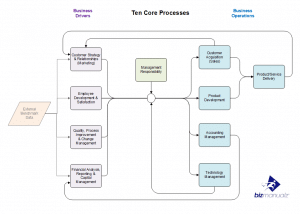

Ten Core Business Processes are critical

Streamline operations: Identify processes that are not efficient and get rid of steps that are not needed. This could involve automating tasks, looking at supply chains again, or renegotiating contracts with suppliers.

Improve energy efficiency: Use equipment that is energy-saving, optimize lighting systems, and use smart technology to reduce costs and help the environment.

Adopt remote work policies: Let employees work from home or away from the office. This will decrease costs for office space, utilities, and commuting.

It is also important to keep evaluating and looking at cost-cutting strategies to be sure they still work over time. Companies need to change their strategies if the market changes.

A great example of the importance of cutting costs is Company X. When times were hard, Company X made hard cuts in different departments while still keeping quality and customer satisfaction high. As a result, they decreased their break-even point and did better than before.

Identifying Cost Reduction Opportunities

Identifying cost reductions is an important part of reducing the break-even point. Doing so can help businesses become more profitable and financially stable. Here are some strategies to consider:

- Analyze Expenses: Look closely at all expenses. This includes fixed costs such as rent and utilities, and variable costs like materials and inventory. See if there are any unnecessary or excessive expenses that can be reduced or removed.

- Review Supplier Relationships: Check supplier relationships and try to negotiate better deals. Look for alternate suppliers that offer quality products at lower prices. It might be helpful to form partnerships with multiple suppliers for competitive pricing.

- Optimize Inventory Management: Too much inventory ties up cash flow and incurs storage and carrying costs. Implement efficient inventory management techniques like just-in-time (JIT) inventory systems. This can reduce holding costs and minimize waste.

- Streamline Operations: Find inefficiencies in business operations that contribute to higher costs. Try to streamline processes, eliminate bottlenecks, and improve productivity. Automation technologies and software solutions can help.

- Evaluate Marketing Strategies: Assess marketing initiatives to figure out if they deliver a positive return on investment (ROI). Focus on campaigns that generate actual leads or sales, and scale back efforts on ineffective channels or tactics.

- Invest in Employee Development: Train employees to improve their skills. This can lead to higher productivity and job satisfaction, which increases efficiency and reduces turnover rates. Also, encourage employees to suggest cost-saving measures.

Overall, identify cost reduction opportunities by monitoring expenses and evaluating business practices. By using these strategies, businesses can gain a competitive edge and reduce their break-even point.

Pro Tip: Track and analyze financial data to spot potential cost reduction opportunities. Doing this proactively ensures financial stability and helps maintain a competitive advantage.

Implementing Cost Cutting Measures

Cutting Costs:

- Cut Overhead Expenses:

- Find places where you can save money, like unneeded services or subscriptions.

- Review and try to get better prices with suppliers.

- Ask staff to use cheaper solutions, like video conferencing instead of travel for meetings.

- Streamline Operations:

- Analyze workflows and find problems to be solved.

- Automate processes to save labor costs and avoid human mistakes.

- Use lean principles to reduce waste and use resources properly.

- Negotiate with Vendors:

- Buy from one vendor to get volume discounts.

- Look for partnerships that offer advantages, like lower prices or payment terms.

- Regularly review vendor contracts to stay competitive.

- Train and Develop Staff:

- Give training programs to increase skills and productivity.

- Encourage staff to learn new industry trends and best practices.

- Offer rewards for ideas that save money.

These strategies help reduce costs without hurting quality or productivity. Companies can become more profitable by lowering their break-even point. That way they can survive market changes and stay competitive in tough times.

Increasing Revenue

Lessening the break-even point lies in maximizing revenue. Through smart tactics, companies can effectively supercharge their income and gain profitability quicker.

- Offering Upsells: Urging customers to upgrade or buy extra products or services can drastically raise revenue.

- Implementing Cross-Selling Tactics: Advocating related products or services to customers during the buying process can cause higher sales.

- Creating New Revenue Streams: Varying the business by presenting new offerings or branching out into different markets can produce supplemental income.

- Improving Customer Retention: Developing loyalty through personalized experiences, outstanding customer service, and rewards plans can create repeat business and amplify income.

To further boost revenue-generating tactics, organizations need to focus on developing customer satisfaction and simplifying operations. A study by Forbes highlighted that businesses that priorities customer experience observe a massive boost in revenue.

Exploring New Markets or Customer Segments

Exploring new markets or customer segments can help a business reduce its break-even point. This is done by increasing revenue and cutting costs. To illustrate this, let’s look at the following table:

| Market Segment | Revenue Increase (%) | Cost Decrease (%) |

|---|---|---|

| New Market A | 15 | 5 |

| New Market B | 10 | 8 |

| Existing Market C | 5 | 3 |

It is clear that new markets A and B offer the greatest benefit, while existing market C still offers some advantages.

Exploring new markets or customers can bring untapped potential and a larger customer base. This reduces the risk of relying on one market segment or customer group, and increases stability for the business. It also leads to increased brand awareness.

For success, companies need to conduct market research first. This includes analyzing market trends, identifying customer profiles, and evaluating competition. Companies should also develop strong marketing campaigns to communicate their value propositions.

Exploring new markets and customer segments helps businesses optimize revenue and decrease their break-even point. It increases sales, reduces costs, diversifies risks, and expands the customer base. To make it successful, consider market research and effective marketing.

Enhancing Marketing and Sales Efforts

Reducing the break-even point is crucial. Strategies to enhance marketing and sales efforts can help businesses improve revenue streams and increase profitability. Let’s explore key tactics!

The table below lists different strategies to enhance marketing and sales efforts:

| Strategy | Description |

|---|---|

| Targeted Advertising | Identify a target audience and tailor campaigns to reach them. |

| CRM | Use a CRM system to nurture customer relationships and foster loyalty. |

| Social Media Marketing | Leverage social media to engage with a wider audience, create brand awareness, and drive sales. |

| Email Marketing | Utilize email campaigns to stay in touch with customers, promote products/services, and generate leads. |

Investing in professional marketing material, such as brochures and business cards, will leave an impression on potential customers.

Gathering data through market research and analyzing competitors’ strategies can provide insights into customer preferences and allow businesses to position themselves effectively in the market.

Offering incentives like discounts or loyalty programs can motivate customers to make repeat purchases. This fosters customer loyalty and increases sales revenue.

For example, a small clothing boutique implemented targeted advertising by promoting its products to fashion-forward individuals aged 18-35. By collaborating with local influencers on social media, they were able to quickly expand their customer base and exceed sales projections within six months.

Evaluating the Impact of Reducing the Break Even Point

Evaluating the Impact of Reducing the Break Even Point can provide valuable insights into the financial effects of implementing such a strategy. By analyzing the data, we can determine the potential benefits and drawbacks of reducing the break-even point for a business.

In order to evaluate this impact, let us consider a table that illustrates the effects of reducing the break-even point. The table will include columns such as Sales Units, Fixed Costs, Variable Costs per Unit, Total Costs, Revenue, and Profit/Loss. By inputting the relevant data, we can compare the financial outcomes of different break-even points and assess their impact on the business.

Now, let’s delve into the specifics of this analysis. By reducing the break-even point, a business can aim to achieve profitability at a lower volume of sales. This can be achieved through strategies such as cost reduction or increasing the sales volume. However, it is crucial to carefully assess the implications of such a decision, as it may involve trade-offs or adjustments in other areas of the business.

To exemplify this impact, let’s consider a true story. A manufacturing company was struggling to reach its break-even point and was on the verge of shutting down. However, by analyzing their operational costs and implementing cost-cutting measures, they were able to reduce their break-even point significantly. As a result, they not only survived but also thrived in the market, ultimately turning their financial situation around.

Don’t let your financial analysis give you anxiety, just remember, money can’t buy happiness, but it can definitely improve your chances of finding a therapist who can help.

Financial Analysis

Financial analysis is essential to understand the numbers that drive a company’s performance. Analysts gain insight into the health and profitability of an organization. To assess the effects of reducing the break-even point, we need a comprehensive financial analysis. It helps us make informed decisions.

We’ll look at a table with essential components such as revenue, fixed costs, variable costs, break-even point and profit/loss. This information will show us the implications of reducing the break-even point.

When analyzing this scenario, it’s important to consider industry dynamics, market trends, cost structures and other relevant factors. These unique details help get a more accurate picture of how reducing the break-even point will affect profits.

Suggestions to make this analysis even better:

- Streamline operations to reduce fixed costs and maintain or increase productivity.

- Research competitor pricing strategies and adopt competitive pricing models.

- Find cost savings opportunities.

These suggestions will improve the company’s financial health and reduce risks associated with reducing the break-even point. Ultimately, financial analysis helps decision-makers efficiently and effectively make this strategic choice.

Long-term Business Sustainability

To gain long-term success, businesses must take on sustainability practices. These include:

- Developing a strong organizational culture. Aligning values and objectives creates employee satisfaction, productivity and loyalty – leading to better performance.

- Embracing innovation. Adopting new technologies, processes and business models helps companies stay ahead.

- Building strong customer relationships. Providing great customer experiences and meeting their needs builds trust, driving customer loyalty.

- Implementing effective risk management. Identifying potential risks, making plans and monitoring risk minimization helps companies deal with uncertainties.

- Fostering environmental responsibility. Adopting green practices like reducing waste and conserving energy is good for the environment and customers.

- Investing in employee development. Training and career development opportunities increase capabilities and promote loyalty.

Sustainability initiatives should be assessed regularly to identify areas for improvement and ensure progress.

The Break Even Point

To reach the break-even point, strategies to maximize revenue and minimize costs are essential. Analyzing pricing and raising prices when possible is one approach. Increasing sales volume can also help. By using marketing tactics and customer retention initiatives, businesses can attract more customers and increase revenues.

To reduce costs, unnecessary expenses should be cut and cost-effective alternatives should be sought. This will bring profitability sooner.

Diversifying by expanding product lines or entering new markets can spread risks and raise revenue potential. This strategy allows businesses to reach different target audiences and use existing resources wisely. Building strong relationships with suppliers and negotiating favorable terms can also lead to cost savings.

Innovative technologies and automation in business operations can streamline processes and improve efficiency. Investing in smart technology solutions tailored to industry needs can lower manual labor requirements and optimize resource allocation.

Regularly monitoring KPIs such as gross margin percentage, average order value, customer acquisition cost, etc., gives valuable insights into the business’s financial health. This allows for timely adjustments in strategies aiming to reduce the break-even point.

Frequently Asked Questions

Q: What is the break-even point?

Q: What is the break-even point?

A: The break-even point is the level of sales or revenue at which a company’s total costs equal its total revenue, resulting in neither profit nor loss.

Q: Why is it important to reduce the break-even point?

A: Reducing the break-even point allows a company to lower the level of sales needed to cover its costs, resulting in a higher chance of profitability and financial stability.

Q: How can I reduce the break-even point?

A: There are several strategies to reduce the break-even point, such as cutting costs, increasing sales volume, improving pricing strategies, diversifying product offerings, and increasing operational efficiency.

Q: What cost-cutting measures can be implemented to reduce the break-even point?

A: Some cost-cutting measures include renegotiating supplier contracts, reducing non-essential expenses, optimizing inventory management, and improving productivity through training and technological investments.

Q: How can I increase sales volume to reduce the break-even point?

A: Increasing sales volume requires effective marketing and sales strategies, such as identifying new target markets, launching promotional campaigns, improving product quality, offering discounts, and enhancing customer service.

Q: How does improving operational efficiency help in reducing the break-even point?

A: Improving operational efficiency allows companies to produce goods or services at a lower cost, reducing the overall break-even point. This can be achieved through process optimization, automation, streamlining workflows, and eliminating waste.

Leave a Reply