How Do You Use a Balanced Scorecard?

Must all segments of your business operate effectively for your business to be truly successful? Some businesses survive in spite of poor performance in some segment(s), which is actually being carried by the performance of another segment. In other words, when one segment is not productive, other segments must be even more productive to compensate for it. If this is the case, then you could use a balanced scorecard to achieve strategic alignment.

The Balanced Scorecard (BSC)

While this condition certainly exists in many businesses, it is far from ideal. When all segments in your business are not functioning, well, it leaves your business vulnerable. When sales fall or production quality drops, can your business survive if it does not have a solid structure with sound business metrics and best practices?

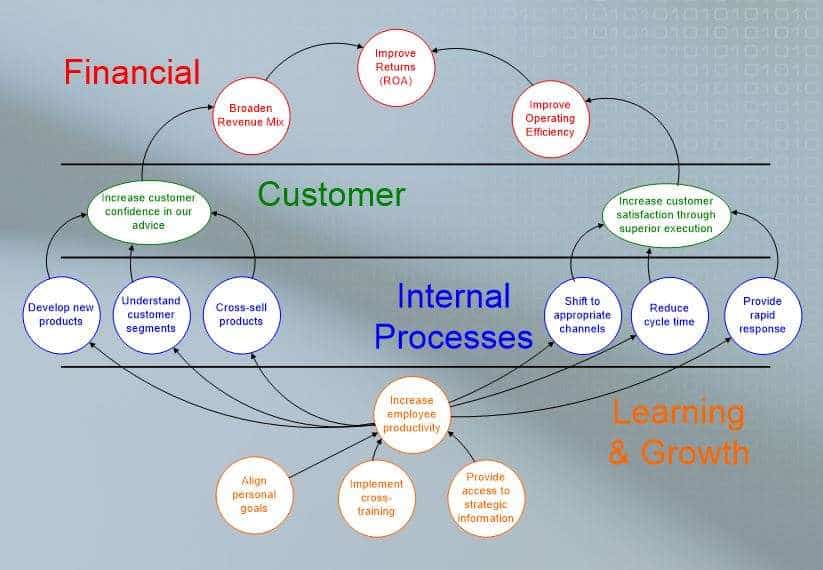

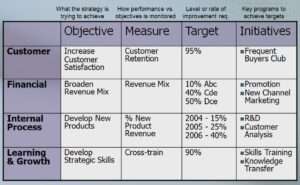

In their important work The Balanced Scorecard, Kaplan and Norton discuss using strategy maps and the importance of at least four business segments that require focus in some balanced way.

Note: The idea of balance should not be taken too literally — it is not about having perfect balance in all areas of business. Some areas may take priority. The point is that to be successful a business needs to pay attention to, and work to improve in, all key business areas.

BSC Four Segments

The four BSC segments presented for a balanced scorecard make up the framework that includes developing a set of metrics about your business that are “balanced” in some way. This is the basic idea used when developing any business performance scorecard or dashboard.

These four segments are :

- Financial Measures

- Internal Processes

- The Customer

- Learning & Growth

This should be viewed as a minimal list; your organization might identify other areas that require attention in a balanced way. While financial operations are important, they should not be the exclusive focus of management, no matter how large or small the business.

Financial Balance

Success in the financial areas (Financial Measures) alone, as typically measured by profits, cannot translate into overall success if the business does not have good products that are delivered in a timely way (Internal Processes) that satisfy customers (The Customers) and the employees are not growing (Learning & Growth) as the business grows.

If you are interested in more information, you will find a lot of downloadable Balanced Scorecard materials, including strategy implementation and performance management from 2GC Active Management, which collects data on Balanced Scorecard usage.

Finance and Balanced Scorecards

That Finance is listed as one of the pillars needed for business success in the Balanced Scorecard does indicates its importance in the overarching view of what is required for businesses to be successful. Surprisingly, however, studies show a large number of medium and small businesses do not proactively manage financial processes, financial performance objectives, or are struggling to develop their financial strategy and conduct financial analysis.

If you are one of these business owners, you need to take a look at building a financial policies and procedures manual. Producing your own finance manual will help you incorporate best practices and a systematic approach to finance, cash flow, and even raising capital when you need it.

The Importance of Financial Policies and Procedures

Public companies pay a lot of attention to financial results because they are required to — by the SEC, shareholders, their Board of Directors, and hopefully by management too. Yet, many small and medium sized businesses often times fail to pay attention to their overall financial processes and structures. Maybe it’s because the same oversight and shareholder pressure just isn’t there.

Importance of Cash Flow

If you run a business, you know that cash flow is the lifeblood of your business. So you would think that having a financial policies and procedures balance would be more common than it is. Yet, operational concerns get more attention when it comes to writing policy and procedure manuals. The goal should be to strike some kind of balance between paying attention to financial matters and the other aspects of your business such as operations.

That is why Bizmanualz has written a financial policies and procedures manual to assist you with achieving a financial policies and procedures balance. This balance with be between the key aspects of your financial operations including: regulatory compliance, improving performance (through well-defined processes) and implementing best practices into operational areas like Raising Capital and Treasury Management.

Financial Process Procedures

The finance manual describes, in procedure form, best practice activities needed to manage financial processes to achieve regulatory compliance and improve financial performance. Each financial procedure is guided by a stated finance policy, and an accompanying purpose of the procedure. Each procedure also comes with financial forms that are typically used to collect information and data as part of executing the procedure.

The policies, procedures, and associated forms can be easily edited in Microsoft Word allowing you to customize all procedures and forms to meet your individual organization’s needs, or use them as finance templates to create additional company procedures important to your financial operations.

Download Free Policies and Procedures Samples to see for yourself how easy it can be to develop your own policy and procedure manual.

[…] Bizmanualz. 3 March 2019. How to Achieve Alignment Through Clear Strategies and Tactics. Retrieved from: https://www.bizmanualz.com/strengthen-your-financials/how-to-use-a-balanced-scorecard.html […]