What Should a CFO Know About Working Capital Management?

Are you a CFO struggling to manage your company’s working capital? You’re not alone. In today’s fast-paced business world, understanding and effectively managing working capital is crucial for success. This article will provide valuable insights and tips on how CFOs can optimize their working capital management to maximize profits and ensure financial stability. What should a CFO know about working capital management?

What is Working Capital Management?

Working capital management is the practice of managing a company’s short-term assets and liabilities to ensure its operational efficiency. This involves optimizing cash flow, inventory management, and accounts receivable and payable.

An effective CFO can ensure that the company has sufficient liquidity to meet its daily operational requirements, such as paying suppliers, managing payroll, and funding ongoing projects. Ultimately, the goal of working capital management is to maintain financial stability and support growth by finding the optimal balance between cash inflows and outflows.

Why is Working Capital Management Important for a CFO?

Effective working capital management is crucial for CFOs as it directly impacts a company’s financial health. It ensures adequate liquidity, allowing the CFO to meet short-term obligations and capitalize on growth opportunities. By optimizing cash, inventory, and receivables, a CFO can minimize the risk of cash flow issues and improve profitability.

Furthermore, working capital management enables CFOs to evaluate operational efficiency, identify areas for enhancement, and make well-informed decisions regarding financing, investment, and risk management. In summary, implementing effective working capital management practices is vital for a CFO’s success in maximizing shareholder value.

What is the Role of a CFO in Working Capital Management?

The role of a CFO in working capital management is crucial for maintaining the financial health of a company. CFOs play a critical role in overseeing the management of current assets and liabilities to ensure smooth cash flow and liquidity. They closely monitor and analyze cash flow, optimize inventory management, negotiate payment terms with suppliers, and implement effective invoicing processes.

Through maintaining sufficient cash reserves, regularly reviewing and adjusting working capital strategies, utilizing technology and automation, and collaborating with other departments, CFOs can effectively manage working capital and mitigate potential risks such as cash flow problems, inadequate liquidity, and missed growth opportunities. It is essential for a company’s overall financial stability and success to have a strong working capital management strategy in place.

What are the Components of Working Capital?

As a CFO, understanding the various aspects of working capital management is crucial for making informed financial decisions. One key component of working capital is the balance between current assets and current liabilities.

In this section, we will examine the different elements of working capital and how they contribute to the overall financial health of a company. We will specifically discuss the importance of current assets and current liabilities, and how they impact a company’s liquidity and ability to meet short-term financial obligations.

1. Current Assets

Current assets are a crucial aspect of working capital and must be properly managed by a CFO. These assets include cash, accounts receivable, inventory, and short-term investments. To ensure the company’s liquidity and operational efficiency, here are some steps that a CFO can take to effectively manage current assets:

- Regularly monitor cash flow to ensure that there is enough funds available.

- Implement efficient processes for accounts receivable to minimize outstanding payments.

- Optimize inventory management by forecasting demand and avoiding excess stock.

- Diversify short-term investments to maximize returns while maintaining liquidity.

By following these steps, CFOs can maintain a healthy level of current assets, which will ultimately improve overall working capital management.

2. Current Liabilities

Current liabilities are a vital aspect of working capital as they consist of short-term debts or obligations that a company must settle within a year. These can include accounts payable, accrued expenses, and short-term loans.

Efficient management of current liabilities is crucial for a CFO as it directly affects the company’s cash flow and liquidity. To optimize working capital management, a CFO should prioritize negotiating favorable payment terms with suppliers, closely monitoring and analyzing cash flow, and implementing efficient invoicing processes.

Neglecting to manage current liabilities can result in cash flow issues, insufficient liquidity, and missed opportunities for growth. To enhance working capital management, CFOs should maintain sufficient cash reserves, regularly review and adjust strategies, utilize technology and automation, and collaborate with other departments.

How Can a CFO Improve Working Capital Management?

As a Chief Financial Officer (CFO), understanding the importance of working capital management is crucial for the success of a company. In this section, we will discuss how a CFO can improve working capital management for their organization.

By carefully monitoring and analyzing cash flow, optimizing inventory management, negotiating payment terms with suppliers, and implementing efficient invoicing processes, a CFO can effectively manage the company’s working capital and improve its financial health. Let’s dive into each of these strategies and understand how they can be implemented for maximum impact.

1. Monitor and Analyze Cash Flow

CFOs understand the importance of monitoring and analyzing cash flow in order to effectively manage working capital. This practice allows for better financial planning, early detection of potential issues, and maximizing profitability. To effectively monitor and analyze cash flow, it is recommended to:

- Regularly review financial statements to track cash inflows and outflows.

- Analyze cash flow patterns to identify trends and areas for improvement.

- Implement cash flow forecasting to anticipate future cash needs.

- Promptly address any cash flow gaps or inconsistencies.

Fact: According to a survey, 82% of businesses that fail do so because of poor cash flow management.

2. Optimize Inventory Management

Optimizing inventory management is critical for efficient working capital management. Here are some steps to follow:

- Conduct regular inventory audits to identify excess or obsolete stock.

- Implement an optimized inventory system to reduce holding costs and minimize stockouts.

- Analyze historical sales data to accurately forecast demand and avoid overstocking.

- Establish strong relationships with suppliers to ensure timely deliveries and negotiate favorable terms.

- Utilize inventory management software to track stock levels, automate reordering, and streamline processes.

3. Negotiate Payment Terms with Suppliers

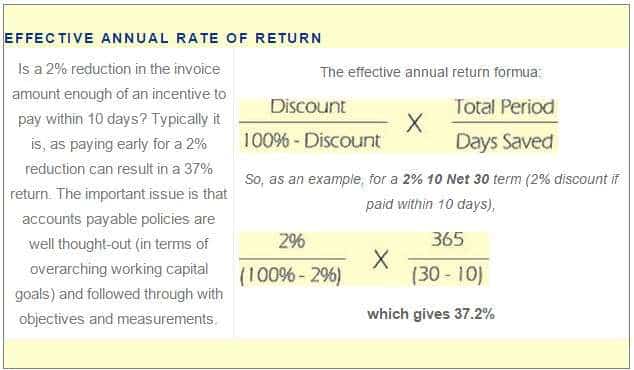

Negotiating payment terms with suppliers is a crucial aspect of working capital management for CFOs. By optimizing these terms, CFOs can improve cash flow and enhance the financial stability of the company. Here are some steps to effectively negotiate payment terms:

- Analyze supplier relationships and identify opportunities for negotiation.

- Establish open lines of communication with suppliers to discuss payment terms.

- Offer incentives for early payment, such as discounts or extended contracts.

- Explore alternative payment options, like installment plans or trade credit.

- Negotiate longer payment terms to improve cash flow and manage working capital efficiently.

- Regularly review and update payment terms based on the company’s financial performance and supplier relationships.

4. Implement Efficient Invoicing Processes

Implementing efficient invoicing processes is crucial for effective working capital management. Follow these steps to optimize your invoicing procedures and improve cash flow:

- Automate invoice generation to minimize errors and save time.

- Send invoices promptly to ensure timely payment.

- Provide clear and accurate information on invoices to avoid confusion and payment delays.

- Establish efficient processes for invoice approval and payment collection.

By implementing streamlined invoicing processes, a company was able to reduce payment delays and improve cash flow. With automated systems and clear communication, they experienced faster invoice processing and increased customer satisfaction.

What are the Risks of Poor Working Capital Management?

Working capital management is a crucial aspect of financial management for any company, and it is the responsibility of the CFO to oversee this area. However, poor working capital management can lead to significant risks for a company’s financial health. In this section, we will discuss the potential risks that come with inadequate working capital management.

These include cash flow problems, inadequate liquidity, and missed growth opportunities. By understanding these risks, CFOs can take proactive measures to mitigate them and ensure the financial stability of their company.

1. Cash Flow Problems

Cash flow issues can greatly impact a company’s financial stability and sustainability. To address such problems, CFOs can take the following steps:

- Analyze cash flow: Continuously monitor and analyze cash flow to identify potential issues and areas for improvement.

- Manage expenses: Exercise control and reduce unnecessary expenses to enhance cash flow.

- Accelerate revenue collection: Implement efficient invoicing processes and follow up with clients to ensure prompt payments.

- Optimize inventory management: Minimize inventory levels and negotiate favorable payment terms with suppliers to free up cash.

- Secure financing: Explore options such as lines of credit or loans to bridge any cash flow gaps.

Company XYZ faced cash flow problems due to slow-paying clients. However, by implementing stricter payment terms, improving invoicing processes, and proactively following up on outstanding invoices, the CFO successfully improved cash flow and stabilized the company’s financial situation.

2. Inadequate Liquidity

Inadequate liquidity refers to a situation where a company does not have enough cash or easily convertible assets to meet its short-term financial obligations. This can result in difficulties in paying suppliers, employees, or other operational expenses, potentially damaging the company’s reputation and ability to function effectively.

CFOs have a crucial role in managing liquidity by closely monitoring cash flow, optimizing working capital components, and implementing efficient invoicing processes. To improve liquidity, CFOs should:

- Maintain sufficient cash reserves

- Regularly review and adjust working capital strategies

- Leverage technology for better cash management

- Collaborate with other departments to streamline processes

3. Missed Growth Opportunities

Missed growth opportunities can have significant consequences for a company’s success and profitability. To avoid these missed opportunities, CFOs should take the following steps:

- Regularly analyze market trends and identify potential growth areas.

- Allocate resources strategically to capitalize on these missed growth opportunities.

- Develop partnerships or collaborations with other companies to expand market reach.

- Invest in research and development to innovate and create new products or services.

- Implement effective marketing and sales strategies to promote growth.

Fact: According to a study by McKinsey, companies that actively pursue growth opportunities have higher returns on investment and increased shareholder value.

What are the Best Practices for Working Capital Management?

As a Chief Financial Officer, it is crucial to have a strong understanding of working capital management in order to effectively manage a company’s financial health. In this section, we will discuss the best practices for working capital management that can help CFOs optimize their company’s liquidity and cash flow.

These practices include maintaining adequate cash reserves, regularly reviewing and adjusting working capital strategies, utilizing technology and automation, and collaborating with other departments within the company. By implementing these strategies, CFOs can ensure that their company’s working capital is effectively managed and utilized.

1. Maintain Adequate Cash Reserves

To maintain adequate cash reserves in working capital management, CFOs should follow these steps:

- Analyze historical cash flow patterns to determine the optimal level of cash reserves.

- Regularly monitor and update cash forecasts to ensure accuracy and adjust reserves accordingly.

- Implement cash management strategies like investing excess cash in short-term, low-risk instruments.

- Establish a contingency fund to mitigate unexpected financial challenges.

Pro-tip: By maintaining adequate cash reserves, CFOs can ensure liquidity, meet short-term obligations, and take advantage of growth opportunities.

2. Regularly Review and Adjust Working Capital Strategies

Regularly reviewing and adjusting working capital strategies is crucial for a CFO to ensure optimal financial performance. Here is a list of steps to follow:

- Analyze financial statements regularly to identify any inefficiencies or areas for improvement.

- Regularly review and compare cash flow projections to actual results and make necessary adjustments.

- Monitor inventory levels and turnover rates, and make necessary adjustments to prevent excess or shortage.

- Assess payment terms with suppliers and negotiate favorable terms to optimize cash flow.

- Maintain regular communication with other departments to align working capital strategies with overall business goals.

Pro-tip: Implementing a robust financial management system can provide real-time insights into working capital, enabling quick adjustments for improved efficiency.

3. Utilize Technology and Automation

Utilizing technology and automation is essential for efficient working capital management. Here are some steps to incorporate these tools:

- Implement an automated accounting system to monitor cash flow in real-time.

- Use financial management software to streamline invoice creation and payment processing.

- Utilize inventory management systems to optimize stock levels and reduce holding costs.

- Employ electronic payment methods for quicker and more effective transactions.

- Leverage data analytics to identify patterns and make informed decisions.

4. Collaborate with Other Departments

Collaborating with other departments is essential for effective working capital management. To foster collaboration, here are some steps that a CFO can take:

- Establish open communication channels with other departments to facilitate the exchange of information and ideas.

- Involve cross-functional teams in decision-making processes related to working capital management.

- Coordinate with the sales department to align revenue forecasts and inventory levels.

- Work with operations to optimize production schedules and reduce lead times.

- Collaborate with procurement to negotiate favorable payment terms with suppliers.

- Engage with finance and accounting to ensure accurate and timely financial reporting.

By collaborating with other departments, the CFO can gain a comprehensive view of the organization and make well-informed decisions to improve working capital management.

Frequently Asked Questions

What is working capital management and why is it important for a CFO to know?

Working capital management refers to the practice of managing a company’s short-term assets and liabilities in order to ensure efficient and effective use of capital. It is important for a CFO to know because it directly impacts a company’s financial health and liquidity.

What are the key components of working capital?

The key components of working capital are current assets, such as cash, inventory, and accounts receivable, and current liabilities, such as accounts payable and short-term debt. These items are essential for the day-to-day operations of a business.

How does efficient working capital management benefit a company?

Efficient working capital management can benefit a company in several ways. It can improve cash flow, minimize the risk of insolvency, and increase profitability by reducing costs associated with carrying excess inventory or having idle cash.

What are some common challenges faced by CFOs in managing working capital?

Some common challenges faced by CFOs in managing working capital include balancing the need for liquidity with the desire for high returns, predicting and managing cash flow, and maintaining good relationships with vendors and customers.

What strategies can a CFO use to effectively manage working capital?

There are several strategies that a CFO can use to effectively manage working capital, such as optimizing inventory levels, negotiating favorable payment terms with suppliers, and implementing efficient cash management practices.

How can technology assist in working capital management for a CFO?

Technology can assist in working capital management for a CFO by providing real-time data and analytics, automating routine tasks, and facilitating communication and collaboration among different departments involved in managing working capital.

Leave a Reply