What Should a CFO Know About Financial Risk Assessment?

Are you a CFO looking to mitigate financial risks in your organization? In today’s complex and ever-changing business landscape, it is crucial for CFOs to have a thorough understanding of financial risk assessment. This article will provide valuable insights and strategies to help you navigate potential risks and safeguard your company’s financial health. What should a CFO know about financial risk assessment?

What is Financial Risk Assessment?

Financial risk assessment is the process of evaluating potential financial risks faced by a company. It involves identifying, analyzing, and prioritizing risks that could impact the organization’s financial stability and profitability.

This assessment helps Chief Financial Officers (CFOs) make informed decisions and develop strategies to mitigate or manage these risks effectively. By understanding the potential risks, CFOs can take appropriate actions to protect the company’s financial health and ensure long-term success.

Financial risk assessment considers factors such as:

- Market volatility

- Credit risk

- Liquidity risk

- Operational risk

- Regulatory compliance

to provide a comprehensive picture of the company’s overall risk exposure.

What are the Types of Financial Risks?

Financial risk assessment involves identifying and evaluating potential risks that can impact a company’s financial stability. There are several types of financial risks that CFOs should be aware of, including:

- Credit risk

- Market risk

- Liquidity risk

- Operational risk

- Reputational risk

These risks can lead to financial loss or damage to a company’s reputation, which can affect its overall financial performance. It is crucial for CFOs to have a thorough understanding of these risks in order to effectively manage and mitigate them.

Why is Financial Risk Assessment Important for CFOs?

Financial risk assessment is crucial for CFOs as it allows them to make well-informed decisions, mitigate potential risks, and maintain the financial stability of the organization. By conducting thorough assessments, CFOs can identify and analyze a variety of financial risks, including market volatility, credit risks, and operational uncertainties. This enables them to develop effective risk management strategies, allocate resources efficiently, and safeguard the company’s assets and investments.

Additionally, financial risk assessment helps CFOs ensure regulatory compliance, boost stakeholder confidence, and ultimately drive long-term profitability and growth for the organization.

How Does Financial Risk Assessment Impact Business Decisions?

Financial risk assessment plays a crucial role in shaping business decisions, as it helps companies identify and mitigate potential risks. Here are the steps involved in how financial risk assessment impacts business decisions:

- Identifying potential risks: Assessing various financial risks, such as credit risk, market risk, and operational risk.

- Analyzing and evaluating risks: Examining the likelihood and potential impact of each risk on the business.

- Developing risk mitigation strategies: Creating plans and strategies to minimize or eliminate identified risks.

- Implementing and monitoring risk management plan: Executing the strategies and monitoring their effectiveness.

Financial risk assessment enables businesses to make informed decisions by providing insights into potential threats, assisting in risk management, and improving overall financial performance. CFOs should prioritize financial risk assessment to build trust with stakeholders and ensure long-term stability and success.

What are the Steps Involved in Financial Risk Assessment?

As a CFO, it is crucial to have a comprehensive understanding of financial risk assessment. This process involves identifying potential risks, analyzing and evaluating their potential impact, and developing strategies to mitigate these risks.

In this section, we will discuss the four key steps involved in financial risk assessment. By following these steps, CFOs can proactively manage and monitor potential risks in their organization’s financial operations.

1. Identify Potential Risks

Identifying potential risks is a crucial step in financial risk assessment. It involves carefully analyzing and evaluating various factors that could potentially impact the financial stability of a company. To effectively identify potential risks, CFOs can follow these steps:

- Conduct a comprehensive review of the company’s financial statements, including balance sheets, income statements, and cash flow statements to identify potential risks.

- Assess market conditions and trends that may affect the company’s financial performance and evaluate potential risks.

- Analyze industry-specific risks, such as regulatory changes, competition, and technological advancements, to identify potential risks.

- Evaluate internal processes and operations to identify any vulnerabilities or weaknesses that could pose potential risks.

- Consider external factors, such as economic fluctuations, interest rate changes, and political events, to identify potential risks.

Fact: According to a survey conducted by Deloitte, 85% of CFOs believe that identifying potential risks is essential for effective financial planning and decision-making.

2. Analyze and Evaluate Risks

Analyzing and evaluating risks is a critical process in financial risk assessment. It involves carefully considering the potential impact and likelihood of various risks to determine their significance. This step helps identify vulnerabilities and prioritize risk management efforts.

The steps involved in analyzing and evaluating risks are as follows:

- Identify the risks: Identify potential risks that could affect the organization’s financial stability.

- Quantify the risks: Assess the potential impact of each risk on the organization’s financial performance.

- Evaluate the risks: Consider the likelihood of each risk occurring and the organization’s risk tolerance.

- Rank the risks: Prioritize risks based on their potential impact and likelihood.

- Develop risk mitigation strategies: Formulate plans to minimize or eliminate identified risks.

- Monitor and review: Continuously monitor the effectiveness of risk mitigation strategies and adapt them as needed.

The 2008 financial crisis was a prime example of the consequences of failing to properly analyze and evaluate risks associated with mortgage-backed securities. This resulted in significant losses and triggered a global economic downturn. This crisis highlighted the importance of thorough risk analysis and evaluation, emphasizing the need for CFOs to prioritize this step in financial risk assessment.

3. Develop Risk Mitigation Strategies

Developing risk mitigation strategies is a crucial step in financial risk assessment for CFOs. It involves identifying potential risks, analyzing and evaluating them, and implementing strategies to minimize their impact. Here are the steps involved:

- Identify potential risks: Identify all possible risks that may pose a threat to the financial stability of the organization.

- Analyze and evaluate risks: Assess the likelihood and potential impact of each risk to prioritize them.

- Develop risk mitigation strategies: Create effective strategies, such as diversification of investments or implementing internal controls, to minimize the impact of identified risks.

- Implement and monitor risk management plan: Execute the mitigation strategies and continuously monitor their effectiveness.

Fact: A study found that companies that actively manage risks achieve higher financial performance compared to those that do not prioritize risk mitigation strategies.

4. Implement and Monitor Risk Management Plan

Implementing and monitoring a risk management plan is a crucial step in financial risk assessment for CFOs. This involves several important steps:

- Establishing clear roles and responsibilities for implementing and monitoring the risk management plan.

- Developing a detailed action plan outlining specific tasks and timelines for risk management activities.

- Allocating resources and ensuring that sufficient budget is allocated for risk management.

- Creating a communication plan to involve all stakeholders in the implementation and monitoring process.

- Regularly monitoring and reviewing the effectiveness of risk mitigation strategies.

- Updating the risk management plan as needed based on emerging risks or changes in the business environment.

By effectively implementing and monitoring the risk management plan, CFOs can proactively identify and address potential risks, safeguard the financial stability of the organization, and make informed decisions to improve overall financial performance.

What Tools and Methods are Used in Financial Risk Assessment?

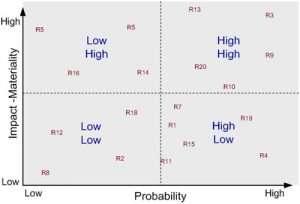

List risks, and then plot them according to impact and likelihood

As a Chief Financial Officer, understanding and managing financial risk is a crucial aspect of your role. In order to make informed decisions, it is important to be familiar with the tools and methods used in financial risk assessment.

In this section, we will discuss the various approaches to financial risk assessment, including quantitative and qualitative analysis, as well as scenario analysis and stress testing. By the end, you will have a better understanding of how these methods can help identify and mitigate potential financial risks for your company.

1. Quantitative Analysis

Quantitative analysis is a vital step in assessing financial risk. It involves utilizing numerical data to evaluate and measure potential risks. This analysis provides CFOs with unbiased insights into the financial stability and health of their organization.

The following are the steps involved in conducting quantitative analysis:

- Gather relevant financial data, such as historical financial statements and market data.

- Apply statistical techniques to analyze the data, including calculating ratios, trends, and correlations.

- Utilize financial models to forecast potential outcomes and evaluate the impact of various scenarios.

- Quantify risks by assigning probabilities and estimating potential financial losses.

- Identify key risk indicators to monitor and track ongoing risks.

By conducting quantitative analysis, CFOs can make informed decisions based on data, develop effective risk mitigation strategies, and improve overall financial performance.

2. Qualitative Analysis

Qualitative analysis is a crucial aspect of financial risk assessment. It involves evaluating risks that cannot be easily measured or quantified, such as reputation risk or regulatory risk. Here are the steps involved in conducting qualitative analysis:

- Identify qualitative risks: Identify potential risks that cannot be easily quantified, such as changes in regulations or shifts in consumer preferences.

- Assess impact: Evaluate the potential impact of these risks on the company’s financial stability and performance.

- Analyze likelihood: Determine the likelihood of these risks occurring and the probability of them having a significant impact.

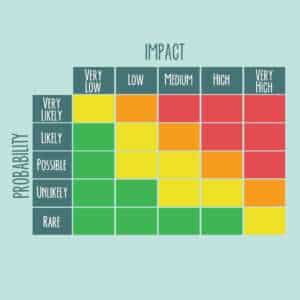

- Assign qualitative ratings: Assign qualitative ratings to each risk based on the severity of its impact and the likelihood of occurrence.

- Risk prioritization: Prioritize the risks based on their ratings to focus on the most critical ones.

Conducting qualitative analysis allows CFOs to gain a deeper understanding of potential risks and their impact, enabling them to make informed decisions and develop effective risk mitigation strategies.

3. Scenario Analysis

Scenario analysis is a crucial step in financial risk assessment that involves evaluating potential outcomes based on different hypothetical scenarios. This allows CFOs to assess how various risks could impact their organization’s financial stability. In scenario analysis, CFOs perform the following steps:

- Identify relevant scenarios: CFOs identify and define potential scenarios that could impact the organization’s financial performance, including conducting a thorough Scenario Analysis.

- Gather data: They collect relevant data and information to determine the probability and potential impact of each scenario.

- Analyze scenarios: CFOs analyze each scenario to understand how it could affect the organization’s financial position, cash flow, profitability, and other key metrics.

- Evaluate outcomes: They evaluate the potential outcomes of each scenario and assess the level of risk associated with each one.

- Develop contingency plans: Based on the analysis, CFOs develop contingency plans and strategies to mitigate the risks identified in the scenarios, including conducting a thorough Scenario Analysis.

By conducting thorough scenario analysis, CFOs can proactively identify and address potential risks, ensuring the organization’s financial stability and successful decision-making.

4. Stress Testing

Stress testing is a vital step in evaluating financial risk for CFOs, allowing them to assess their organization’s ability to withstand adverse scenarios. This process involves subjecting the financial system to extreme conditions to determine its resilience to shocks. Here are the steps involved in stress testing:

- Identify relevant stress scenarios, such as economic downturns or market crashes.

- Gather data and perform simulations to assess the impact of these scenarios on the organization’s financial health.

- Analyze the results, identifying vulnerabilities and areas that require improvement.

- Develop strategies to mitigate the identified risks, such as adjusting investment portfolios or improving risk management protocols.

- Implement the risk mitigation strategies and closely monitor their effectiveness over time.

Effective stress testing provides CFOs with the necessary information to proactively manage risks and ensure the financial stability of their organization.

What are the Benefits of Financial Risk Assessment for CFOs?

As a CFO, understanding and managing financial risk is crucial for the success of your organization. One effective tool for this is financial risk assessment. In this section, we will discuss the benefits that financial risk assessment can offer for CFOs.

This includes identifying potential threats to financial stability, making informed business decisions, improving overall financial performance, and building trust with stakeholders. Let’s delve into each of these benefits and understand how they can impact your role as a CFO.

1. Identifies Potential Threats to Financial Stability

Identifying potential threats to financial stability is a crucial aspect of financial risk assessment for CFOs. This process helps them anticipate and mitigate risks that could impact the organization’s financial health.

The following steps are involved in identifying potential threats to financial stability:

- Conduct a comprehensive analysis of the organization’s financial statements and performance indicators.

- Review industry trends and external factors that could potentially impact the organization’s financial stability.

- Identify potential risks such as market volatility, regulatory changes, economic downturns, or cybersecurity threats.

- Assess the likelihood and potential impact of each identified risk on the organization’s financial stability.

- Prioritize risks based on their severity and the organization’s ability to manage and mitigate them.

By following these steps, CFOs can gain a clear understanding of potential threats to financial stability and develop strategies to effectively address them.

2. Helps in Making Informed Business Decisions

Financial risk assessment plays a crucial role in aiding CFOs to make well-informed business decisions. By carefully evaluating potential risks, such as market volatility or credit default, CFOs can anticipate and mitigate potential financial challenges. This assessment is essential in helping CFOs assess the potential impact of different scenarios and make data-driven decisions to safeguard the financial stability of the organization.

By taking into account the risks and rewards associated with various options, CFOs can make informed choices that align with the company’s goals and enhance overall financial performance. Ultimately, financial risk assessment ensures that CFOs have the necessary information to make strategic decisions that support the long-term success of the business.

3. Improves Overall Financial Performance

Implementing financial risk assessment can significantly enhance overall financial performance by:

- Identifying potential risks to financial stability

- Aiding in making informed business decisions

- Improving overall financial performance by identifying and addressing potential risks

- Building trust with stakeholders

For example, a multinational corporation conducted a thorough financial risk assessment and discovered that their heavy reliance on a single supplier posed a significant risk. By diversifying their supplier base, they not only mitigated the risk of disruptions but also negotiated better terms, leading to improved financial performance and increased shareholder confidence.

4. Builds Trust with Stakeholders

Building trust with stakeholders is a crucial aspect of financial risk assessment for CFOs. By implementing effective risk management strategies and maintaining transparency, CFOs can foster trust among stakeholders. Here are the steps to build trust with stakeholders:

- Open Communication: Regularly communicate with stakeholders to provide updates on risk assessment efforts and address any concerns or questions.

- Risk Disclosure: Clearly disclose potential risks to stakeholders, including the likelihood and potential impact of each risk.

- Compliance: Ensure compliance with regulatory requirements and ethical standards, demonstrating a commitment to responsible financial management.

- Risk Mitigation: Implement measures to mitigate identified risks, showcasing proactive and responsible risk management practices.

- Performance Monitoring: Continuously monitor and evaluate the effectiveness of risk management strategies, providing evidence of proactive risk management.

A well-known example of building trust with stakeholders is the response of Johnson & Johnson during the Tylenol poisoning crisis in 1982. By immediately recalling the product, showing transparency, and taking responsibility, Johnson & Johnson built trust with stakeholders, leading to a swift recovery and long-term success.

Frequently Asked Questions

What is financial risk assessment and why is it important for CFOs to know about it?

Financial risk assessment is the process of identifying, analyzing, and evaluating potential financial risks that a company may face. It is important for CFOs to know about it because it helps them make informed decisions and mitigate potential risks that could negatively impact the company’s financial health.

What are the key elements of financial risk assessment?

The key elements of financial risk assessment include identifying potential risks, assessing the likelihood and impact of those risks, and determining the appropriate risk management strategies to minimize or mitigate them.

How does financial risk assessment help CFOs in making strategic decisions?

Financial risk assessment provides CFOs with a comprehensive understanding of the potential risks facing the company, allowing them to make informed decisions and develop effective strategies to manage and mitigate those risks. It also helps them allocate resources and prioritize investments to ensure the company’s financial stability.

What are the common types of financial risks that CFOs should be aware of?

Some common types of financial risks include credit risk, market risk, liquidity risk, operational risk, and legal and regulatory risk. It is important for CFOs to have a thorough understanding of these risks and their potential impact on the company’s financial performance.

How often should a CFO conduct a financial risk assessment?

The frequency of financial risk assessment may vary depending on the company’s size, industry, and risk exposure. However, it is recommended for CFOs to conduct a comprehensive risk assessment at least once a year, and more frequently if there are significant changes in the company’s operations or market conditions.

What are some best practices for CFOs to effectively manage financial risks?

Some best practices for CFOs to effectively manage financial risks include regularly monitoring and evaluating risks, developing a risk management plan, diversifying investments, maintaining adequate cash reserves, and regularly communicating with stakeholders about the company’s risk exposure and management strategies.

Leave a Reply