What are Risk Management Frameworks?

Prominent Risk Management Frameworks

Several widely recognized risk management frameworks exist, each with its unique characteristics. Here we introduce ISO 31000, COSO ERM, NIST RMF, FAIR, PRINCE2, and PMI-RMP.

- ISO 31000: Risk Management Standard

- Overview: ISO 31000 is an international standard that provides principles and guidelines for effective risk management. It emphasizes the integration of risk management into an organization’s governance, management, and processes.

- Key Components:

- Principles: Establishing a risk management policy, integrating risk management into organizational governance, and continually improving the risk management framework.

- Framework: Creating a structured and comprehensive framework that aligns with the organization’s objectives and context.

- Process: Implementing a systematic process for risk management, including risk identification, assessment, treatment, monitoring, and communication.

- COSO Enterprise Risk Management (ERM) Framework

- Overview: Developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), the COSO ERM Framework is widely used to enhance an organization’s ability to manage uncertainty.

- Key Components:

- Governance and Culture: Establishing a governance structure and a risk-aware culture.

- Strategy and Objective-Setting: Aligning risk appetite with strategy and setting objectives that consider potential risk.

- Performance: Evaluating the risk management capability and performance of the organization.

- Review and Revision: Ongoing assessment and adjustment of the risk management process.

- NIST Risk Management Framework (RMF)

- Overview: Developed by the National Institute of Standards and Technology (NIST), the RMF is a structured process that integrates information security and risk management activities into the system development life cycle.

- Key Components:

- Prepare: Establishing the context and priorities for risk management.

- Categorize: Identifying and classifying information systems and the information processed, stored, and transmitted by those systems.

- Select: Identifying and choosing appropriate security controls.

- Implement: Putting the selected security controls into practice.

- Assess: Evaluating the effectiveness of the security controls.

- Authorize: Granting management approval to operate the system.

- Monitor: Continuously monitoring security controls and the security state of the information system.

- FAIR (Factor Analysis of Information Risk)

- Overview: FAIR is a risk management framework that provides a quantitative model for understanding, analyzing, and measuring information risk.

- Key Components:

- Risk Factors: Identifying and defining risk factors, including threat events, vulnerabilities, and potential impacts.

- Analysis: Quantitatively assessing risk by estimating the frequency and magnitude of risk events.

- Treatment: Developing risk treatment plans based on the analysis.

- Communication: Effectively communicating risk information to stakeholders.

- PRINCE2 Risk Management

- Overview: PRINCE2 (Projects IN Controlled Environments) is a project management framework that includes a risk management component. It focuses on managing risks within the context of project management.

- Key Components:

- Risk Management Strategy: Developing an overall approach to risk management for the project.

- Risk Register: Identifying, assessing, and documenting risks.

- Risk Response Planning: Developing strategies to address identified risks.

- Risk Communication: Communicating risk information to relevant stakeholders.

- PMI Risk Management Framework (PMI-RMP)

- Overview: Developed by the Project Management Institute (PMI), the PMI-RMP framework is designed for project risk management.

- Key Components:

- Risk Management Planning: Defining how risk management will be conducted in the project.

- Risk Identification: Identifying potential risks that could affect the project.

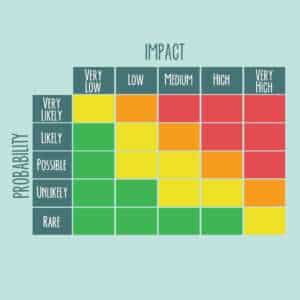

- Qualitative Risk Analysis: Assessing the likelihood and impact of identified risks.

- Quantitative Risk Analysis: Numerically analyzing the effect of identified risks on project objectives.

- Risk Response Planning: Developing strategies to enhance opportunities and reduce threats.

Risk Management Framework Comparison

While there are several risk management frameworks, each with its unique characteristics and areas of focus, a comparison can be made based on common elements and key components. Let’s compare the ISO 31000, COSO Enterprise Risk Management (ERM) Framework, NIST Risk Management Framework (RMF), FAIR (Factor Analysis of Information Risk), PRINCE2 Risk Management, and PMI Risk Management Framework (PMI-RMP).

Scope of Risk Management

ISO 31000: Broad applicability across various industries and organizational contexts.

COSO ERM: Emphasizes enterprise-wide risk management, focusing on strategic objectives.

NIST RMF: Primarily designed for information security risk management within federal agencies.

FAIR: Primarily used for information and cybersecurity risk analysis.

PRINCE2 Risk Management: Project-specific risk management within a structured project management environment.

PMI-RMP: Specifically designed for project risk management within the context of project management.

Approach to Risk

ISO 31000: Principles-based approach emphasizing integration into organizational processes.

COSO ERM: Emphasizes integrating risk management with strategy-setting and performance management.

NIST RMF: Integrates risk management with the system development life cycle and information security.

FAIR: Quantitative risk analysis approach, focusing on factors influencing risk.

PRINCE2 Risk Management: Embedded within a project management methodology, focusing on project-specific risks.

PMI-RMP: Integrates risk management into the project management life cycle, from planning to closure.

Risk Categories

ISO 31000: Broadly covers various types of risks, including strategic, operational, financial, and compliance.

COSO ERM: Aligns risk categories with the organization’s objectives, covering internal and external factors.

NIST RMF: Primarily addresses information security risks but can be adapted to broader contexts.

FAIR: Primarily focused on information and cybersecurity risk factors.

PRINCE2 Risk Management: Tailored to project-specific risks.

PMI-RMP: Focuses on project risks, including schedule, cost, quality, and other project-specific risks.

Quantitative vs. Qualitative Analysis

ISO 31000: Supports both qualitative and quantitative risk assessment methods.

COSO ERM: Primarily qualitative, with a focus on understanding and managing risk’s impact.

NIST RMF: Can incorporate both qualitative and quantitative risk analysis methods.

FAIR: Emphasizes quantitative risk analysis.

PRINCE2 Risk Management: Often employs qualitative risk analysis.

PMI-RMP: Both qualitative and quantitative risk analysis methods can be applied.

Integration with Governance

ISO 31000: Emphasizes integrating risk management into overall governance and decision-making.

COSO ERM: Aligns risk management with governance and business strategy.

NIST RMF: Integrates with overall governance and security management.

FAIR: Integrates risk analysis with overall risk governance.

PRINCE2 Risk Management: Integrated into the broader PRINCE2 project management framework.

PMI-RMP: Integrated into the PMBOK (Project Management Body of Knowledge) Guide and project management practices.

Specific Industry Focus

ISO 31000: Applicable across various industries.

COSO ERM: Suitable for all industries, with a focus on broader enterprise risks.

NIST RMF: Initially designed for U.S. federal agencies but adaptable to various industries.

FAIR: Often used in information security and technology-related industries.

PRINCE2 Risk Management: Primarily used in project management across different industries.

PMI-RMP: Used in project management across different industries.

Global Recognition

ISO 31000: Internationally recognized standard.

COSO ERM: Widely recognized and used globally.

NIST RMF: Primarily used in the United States but has gained international attention.

FAIR: Recognized in the information security and risk management communities.

PRINCE2 Risk Management: Widely recognized in project management globally.

PMI-RMP: Widely recognized in project management globally.

Documentation and Reporting

ISO 31000: Emphasizes communication and reporting of risk information.

COSO ERM: Requires documentation of risk management processes and reporting to stakeholders.

NIST RMF: Emphasizes documentation of security controls and risk assessments.

FAIR: Provides a framework for documenting and communicating risk analysis results.

PRINCE2 Risk Management: Requires documentation of risks and risk responses.

PMI-RMP: Emphasizes communication of risk information and documentation of risk management activities.

Continuous Improvement

ISO 31000: Emphasizes continual improvement of the risk management framework.

COSO ERM: Encourages ongoing assessment and improvement of risk management practices.

NIST RMF: Built on a continuous monitoring and improvement cycle.

FAIR: Supports ongoing refinement of risk analysis processes.

PRINCE2 Risk Management: Allows for continuous improvement in project risk management.

PMI-RMP: Promotes ongoing risk management throughout the project life cycle.

In summary, these risk management frameworks serve different purposes and cater to specific contexts. Organizations may choose a framework based on their industry, objectives, and the nature of risks they face. Often, organizations may also integrate elements from multiple frameworks to create a customized risk management approach that suits their unique needs.

Risk Management Frameworks

These frameworks provide a systematic and structured approach to managing risks across different organizational contexts and industries. Organizations often tailor these frameworks to meet their specific needs, considering factors such as size, industry, and risk appetite. Effective risk management is an ongoing process that involves continuous assessment, adaptation, and improvement based on changes in the internal and external environment.

Leave a Reply