Understanding the Operating Cycle in Accounting

In the realm of accounting, it is imperative to grasp the intricacies of the operating cycle. This article aims to equip you with the knowledge to understand and navigate this fundamental aspect of financial management. Join us as we explore the essence of the operating cycle, unravel the various stages involved, and delve into its implications for financial performance and decision-making. Through this exploration, you will gain insights into the significance of the operating cycle within the accounting field and its broader implications for businesses of all sizes. Understanding the operating cycle in accounting.

Definition of Operating Cycle

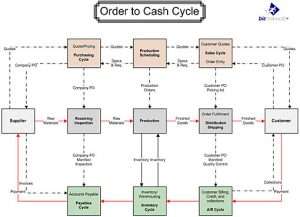

The operating cycle is a financial metric that measures the time it takes for a company to turn its investments in inventory, accounts receivable, and accounts payable into cash. By refining your comprehension of the operating cycle, you will gain a deeper understanding of how businesses operate, track their financial transactions, and ultimately achieve their goals.

It represents the entire process from purchasing raw materials to selling finished goods and collecting payment. By analyzing the operating cycle, businesses can gain insights into their efficiency, cash flow management, and overall financial health.

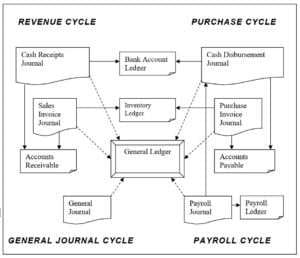

Components of the Operating Cycle

The operating cycle consists of three key components: the inventory conversion period, the accounts receivable collection period, and the accounts payable payment period. Each component represents a different stage in the business’s operations and has a distinct impact on the length of the operating cycle.

Inventory Conversion Period

The inventory conversion period refers to the time it takes for a company to convert its raw materials into finished goods ready for sale. This period includes activities such as purchasing, production, and storage. During this time, inventory is held by the business, tying up its capital and potentially incurring costs such as storage fees or natural depreciation.

Accounts Receivable Collection Period

The accounts receivable collection period measures the average time it takes for a company to collect payment from its customers after a sale is made. This period reflects the efficiency of the company’s credit and collection policies. A longer collection period may indicate issues such as ineffective credit management or difficulties in collecting outstanding balances, which can negatively impact cash flow.

Accounts Payable Payment Period

On the other side of the operating cycle, the accounts payable payment period represents the average time it takes for a company to pay its suppliers for the goods and services it has purchased. This period reflects the company’s ability to manage its payables and negotiate favorable terms with its suppliers. A longer payment period can provide short-term financing advantages, but it may also strain supplier relationships or lead to missed payment deadlines.

Inventory Conversion Period

Definition

The inventory conversion period is the duration between when a company acquires raw materials and when the finished goods are ready for sale. It encompasses the entire manufacturing or production process, including sourcing materials, converting them into finished products, and keeping them in stock until they are sold. Essentially, it measures how long the company’s capital is tied up in inventory before it can be converted into cash through sales.

Calculating the Inventory Conversion Period

To calculate the inventory conversion period, the following formula can be used:

Inventory Conversion Period = Average Inventory / Cost of Goods Sold * 365

The average inventory is calculated by adding the beginning inventory and ending inventory together and dividing by two. The cost of goods sold represents the total cost of producing the goods sold during a specific period, excluding any non-production expenses.

Example

Suppose a company has an average inventory of $500,000 and a cost of goods sold of $2,000,000. Using the formula mentioned earlier, the inventory conversion period would be calculated as follows:

Inventory Conversion Period = $500,000 / $2,000,000 * 365 = 91.25 days

This means that, on average, it takes approximately 91.25 days for the company to convert its inventory into cash through sales.

Accounts Receivable Collection Period

Definition

The accounts receivable collection period represents the average number of days it takes for a company to collect payment from its customers after a sale has been made. It provides insights into the effectiveness of a company’s credit and collection policies, as well as its ability to manage outstanding receivables.

A shorter collection period indicates efficient credit management, whereas a longer period may highlight issues such as delayed payment collection or ineffective credit assessment.

Calculating the Accounts Receivable Collection Period

To calculate the accounts receivable collection period, the following formula can be used:

Accounts Receivable Collection Period = (Accounts Receivable / Net Credit Sales) * 365

Accounts receivable refers to the total amount of money owed to the company by its customers, while net credit sales represent the total sales made on credit during a specific period minus any sales returns or allowances.

Example

Let’s assume a company has accounts receivable of $300,000 and net credit sales of $1,200,000. Applying the formula mentioned earlier, the accounts receivable collection period would be calculated as follows:

Accounts Receivable Collection Period = ($300,000 / $1,200,000) * 365 = 91.25 days

This means that, on average, it takes around 91.25 days for the company to collect payment from its customers.

Accounts Payable Payment Period

Definition

The accounts payable payment period indicates the average number of days it takes for a company to pay its suppliers for the goods and services it has purchased on credit.

It represents the company’s ability to manage its payables effectively and reflects the payment terms negotiated with its suppliers.

A longer payment period can provide a short-term financing advantage but may strain relationships with suppliers or affect the company’s reputation if payment deadlines are not met.

Calculating the Accounts Payable Payment Period

To calculate the accounts payable payment period, the following formula can be utilized:

Accounts Payable Payment Period = (Accounts Payable / Cost of Goods Sold) * 365

Accounts payable refers to the total amount of money owed by the company to its suppliers, while the cost of goods sold represents the total cost of producing the goods sold during a specific period, excluding non-production expenses.

Example

Assuming a company has accounts payable of $200,000 and a cost of goods sold of $1,500,000, the accounts payable payment period can be calculated as follows:

Accounts Payable Payment Period = ($200,000 / $1,500,000) * 365 = 48.67 days

This means that, on average, it takes approximately 48.67 days for the company to pay its suppliers for the goods and services it has purchased.

Operating Cycle Calculation

Formula

The operating cycle can be calculated by summing up the inventory conversion period and the accounts receivable collection period and subtracting the accounts payable payment period. The formula for calculating the operating cycle is as follows:

Operating Cycle = Inventory Conversion Period + Accounts Receivable Collection Period – Accounts Payable Payment Period

Example

Consider a company with an inventory conversion period of 91.25 days, an accounts receivable collection period of 91.25 days, and an accounts payable payment period of 48.67 days. Calculating the operating cycle using the formula mentioned earlier would be done as follows:

Operating Cycle = 91.25 + 91.25 – 48.67 = 133.83 days

This means that, on average, it takes approximately 133.83 days for the company to complete its operating cycle.

Significance of the Operating Cycle

The operating cycle plays a crucial role in analyzing a company’s efficiency and financial performance. By understanding the duration it takes for the company to convert its investments into cash, businesses can identify areas for improvement and measure their effectiveness in managing the cash conversion process.

A longer operating cycle may indicate potential issues, such as excessive working capital, inefficient inventory management, slow payment collection, or delayed payment to suppliers. On the other hand, a shorter operating cycle suggests efficient operations, optimized cash flow, and timely turnover of investments.

Measuring Efficiency

Shorter Operating Cycles

Shorter operating cycles are generally desirable as they indicate higher efficiency and stronger financial performance. A shorter operating cycle means that a company can quickly convert its investments into cash, allowing for increased liquidity and the ability to reinvest in the business or distribute profits to shareholders.

Companies with shorter operating cycles typically experience reduced working capital needs and improved cash flow management. They can also react more swiftly to changes in customer demands, market conditions, and technological advancements, enhancing their competitiveness and overall business agility.

Industry Benchmark

To assess the efficiency of a company’s operating cycle, it is essential to compare it against industry benchmarks and peer averages. Different industries have varying operating cycle lengths due to differences in business models, supply chains, and customer behaviors.

Benchmarking against competitors or industry standards helps businesses identify potential areas for improvement and determine whether they are operating within acceptable ranges or lagging behind.

Evaluating Cash Flow Management

Positive Cash Flow vs. Negative Cash Flow

The operating cycle is closely linked to a company’s cash flow management. Positive cash flow refers to the inflow of cash exceeding the outflow, indicating that a business generates more cash from its operations than it spends.

A positive cash flow is generally considered favorable as it provides liquidity, enables investment in growth opportunities, and allows the servicing of debt obligations.

Conversely, negative cash flow indicates that a company is spending more cash than it is generating from its operations. This may be due to factors such as slow sales, excessive inventory levels, ineffective credit management, or cost overruns.

Negative cash flow can strain a company’s financial resources, limit its growth potential, and lead to difficulties in meeting obligations.

Working Capital Needs

The operating cycle is instrumental in determining a company’s working capital requirements. Working capital refers to the funds needed to cover day-to-day operational expenses, such as rent, salaries, and raw material purchases. By analyzing the operating cycle, businesses can gauge their working capital needs and make informed decisions about inventory management, credit policies, and pricing strategies.

A longer operating cycle usually necessitates higher levels of working capital to support ongoing operations. It may require additional financing or credit facilities to ensure the business can cover expenses during the cash conversion period. Understanding the working capital requirements associated with the operating cycle is crucial for maintaining financial stability and avoiding liquidity challenges.

Managing the Operating Cycle in Accounting

Effective management of the operating cycle is essential for companies to optimize cash flow, improve efficiency, and enhance overall financial performance. There are several strategies that businesses can employ to manage and minimize the duration of the operating cycle:

- Inventory Management: Implementing just-in-time (JIT) inventory systems, analyzing demand patterns, optimizing supply chain processes, and minimizing excess inventory levels.

- Credit and Collection Policies: Setting clear credit terms, conducting credit checks on customers, promptly invoicing customers, and actively monitoring and collecting outstanding receivables.

- Supplier Relationships: Negotiating favorable payment terms with suppliers, exploring early payment discounts, and maintaining strong relationships to ensure a reliable supply of goods and services.

- Technology and Automation: Leveraging technology solutions, such as enterprise resource planning (ERP) systems, inventory management software, and electronic payment systems, to streamline operations, reduce processing times, and enhance accuracy.

- Cash Flow Forecasting: Regularly forecasting cash flows, monitoring cash conversion cycles, and utilizing financial tools to assess the impact of changes in operations or external factors on cash flow.

By implementing these strategies, businesses can effectively manage their operating cycles, improve cash flow management, and achieve greater financial stability and growth. The operating cycle serves as a valuable tool for businesses to assess their financial health, identify operational inefficiencies, and make informed decisions for long-term success.

Leave a Reply