What are Core Accounting Processes?

Are you struggling to understand the basics of accounting? With the increasing complexity of modern businesses, it’s crucial to have a solid understanding of core accounting processes. In this article, we’ll unravel the mystery and simplify the key concepts for you, addressing any potential concerns or confusion you may have. What are Core Accounting Processes?

What Are the Main Accounting Processes?

When it comes to managing a company’s financial records and transactions, there are several key accounting processes that play a crucial role. These processes are essential for maintaining accurate and organized financial data, as well as making informed decisions about the company’s finances. In this section, we will discuss the main accounting processes, including bookkeeping, accounts payable, accounts receivable, financial reporting, budgeting and forecasting, payroll, and tax preparation. Each process serves a specific purpose and contributes to the overall financial management of a business.

1. Bookkeeping

Bookkeeping is an integral part of core accounting processes. It involves recording financial transactions, maintaining accurate records, and organizing financial data. Here are the steps involved in bookkeeping:

- Collect and organize financial documents, such as receipts and invoices.

- Record transactions in the general ledger, including debits and credits.

- Reconcile bank statements with the recorded transactions to ensure accuracy.

- Prepare financial statements, such as the balance sheet and income statement.

- Generate reports for management or external stakeholders.

The origins of bookkeeping can be traced back to ancient civilizations, such as Mesopotamia and Egypt, where scribes were responsible for recording financial transactions. Over time, the practice evolved, and double-entry bookkeeping was developed in the 15th century by Italian mathematician Luca Pacioli, laying the foundation for modern accounting. Today, bookkeeping remains a crucial process for businesses, ensuring accurate financial records and facilitating decision-making.

2. Accounts Payable

Accounts payable is a critical aspect of accounting that involves handling and settling a company’s unpaid debts. Here are the key steps involved in the accounts payable process:

- Receive invoices from vendors

- Verify the accuracy and legitimacy of the invoice

- Record the invoice in the accounting system

- Match the invoice with purchase orders and receiving documents

- Obtain approval for payment

- Prepare payment for the vendor

- Issue payment to the vendor

- Record the payment in the accounting system

- Reconcile vendor statements and resolve any discrepancies

By following these steps, businesses can effectively manage their outstanding debts, maintain strong relationships with vendors, and ensure precise financial records.

3. Accounts Receivable

Accounts Receivable is an essential core accounting process that involves managing and tracking the money owed to a business by its customers. Here are the steps involved in the accounts receivable process:

- Generate and send invoices to customers for products or services rendered.

- Monitor and track outstanding invoices to ensure timely payment.

- Follow up with customers on overdue payments through phone calls, emails, or reminder letters.

- Record and reconcile incoming payments with the corresponding invoices.

- Update the accounts receivable ledger to maintain accurate and up-to-date financial records.

- Resolve any discrepancies or disputes with customers regarding invoices or payments.

To improve accounts receivable processes, businesses can consider implementing the following suggestions:

- Offer flexible payment options to customers, such as online payment portals or installment plans.

- Implement credit checks and establish credit limits for customers to minimize the risk of non-payment.

- Regularly review and update credit and collection policies to adapt to changing market conditions.

- Utilize accounting software or automation tools to streamline the invoicing and payment tracking process.

- Provide training and support to staff members responsible for managing accounts receivable to ensure efficient management of customer accounts.

4. Financial Reporting

Financial reporting is a vital aspect of accounting that involves the preparation and presentation of financial statements to stakeholders. These reports play a crucial role in providing important information about a company’s financial performance, position, and cash flows. Accurate and transparent financial reporting is essential for ensuring accountability and aiding stakeholders in making well-informed decisions.

This process includes various activities such as:

- Recording transactions

- Reconciling accounts

- Generating financial statements like the balance sheet, income statement, and cash flow statement

Compliance with accounting standards and regulations is also a critical component of financial reporting. It is crucial for businesses to establish robust financial reporting processes in order to maintain transparency, gain the trust of investors, and make sound financial decisions.

5. Budgeting and Forecasting

Budgeting and forecasting are essential elements of core accounting processes that are crucial for businesses to effectively plan and manage their finances. Here are the main steps involved:

- Establish financial goals: Determine the objectives and targets that the budgeting and forecasting processes aim to achieve.

- Collect data: Gather relevant financial information, including historical data, market trends, and internal projections.

- Analyze and project: Analyze the data to identify patterns, trends, and potential risks. Use this analysis to create realistic financial projections.

- Create a budget: Develop a comprehensive budget that outlines projected income, expenses, and cash flow for a specific period.

- Monitor and adjust: Regularly track actual financial performance against the budget and make necessary adjustments to ensure alignment.

- Forecast future performance: Utilize the budgeting process to create forecasts for future periods based on changing circumstances or market conditions.

By following these steps, businesses can gain better visibility into their financial standing, make informed decisions, and achieve their financial goals.

6. Payroll

Payroll is a crucial component of core accounting processes. To ensure accurate and timely payment of employees, businesses should follow these steps:

- Collect employee time records and verify their accuracy.

- Calculate gross wages by multiplying hours worked by the applicable pay rate.

- Deduct taxes, insurance premiums, and other authorized withholdings from gross wages.

- Calculate net pay by subtracting deductions from gross wages.

- Prepare paychecks or process direct deposits for employees.

- Record payroll transactions in the accounting system.

- Submit payroll taxes and reports to the appropriate government agencies.

By following these steps, businesses can ensure accurate and compliant payroll processing.

7. Tax Preparation

Tax preparation is an essential aspect of core accounting processes. Here are the steps involved:

- Gather financial documents, including income statements, expense records, and receipts.

- Organize and categorize expenses and income.

- Calculate taxable income based on relevant tax laws and regulations.

- Complete tax forms accurately, such as the 1040 for individuals or specific business tax forms.

- Ensure compliance with tax deadlines and submit the completed forms to the appropriate tax authorities.

- Review tax returns for accuracy and address any discrepancies or errors.

- Pay any taxes owed or claim refunds.

In 1913, the 16th Amendment to the US Constitution made income tax a permanent fixture. It was introduced to fund government activities and has since evolved into a complex system with numerous regulations and annual tax filings. Today, tax preparation remains a crucial task for individuals and businesses to fulfill their tax obligations and avoid penalties.

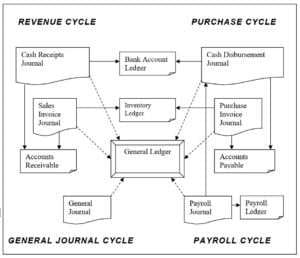

How Do These Processes Work Together?

Core accounting processes work together seamlessly to ensure accurate financial management. Here are the steps involved in how these processes collaborate:

- Recording financial transactions: All transactions, such as sales and expenses, are recorded in the general ledger.

- Classifying transactions: Transactions are categorized into appropriate accounts, such as assets, liabilities, and equity.

- Preparing financial statements: Income statements, balance sheets, and cash flow statements are generated based on the recorded and classified transactions.

- Analyzing financial data: Financial ratios and other analysis techniques are used to interpret the financial statements.

- Making informed decisions: The analysis helps stakeholders make informed decisions about the organization’s financial health and future steps.

Pro-tip: Regularly reviewing financial statements and analyzing data can provide valuable insights that drive strategic decision-making.

How Can Businesses Improve Their Core Accounting Processes?

Efficient and accurate core accounting processes are crucial for the financial health of any business. In this section, we will discuss how businesses can improve their core accounting processes through various methods. By automating processes and implementing proper controls, businesses can streamline their accounting procedures and reduce human error. Hiring experienced professionals and utilizing accounting software can also greatly enhance the effectiveness of core accounting processes. Finally, we will emphasize the importance of regularly reviewing and updating these processes to ensure they remain efficient and up-to-date.

1. Automating Processes

- Identify repetitive tasks, such as data entry or report generation.

- Research and select appropriate accounting software that aligns with the specific needs of your business.

- Implement and configure the software, ensuring smooth integration with existing systems.

- Train employees on how to effectively use the new software.

- Set up automated workflows for routine tasks, such as invoice processing or payroll calculations.

- Regularly review and update automated processes for optimal performance.

Automating processes can save time, streamline operations, and allow accounting professionals to focus on more strategic tasks.

2. Implementing Proper Controls

Implementing proper controls is crucial for ensuring the accuracy and integrity of financial information. Here are some steps to follow:

- Segregation of duties: Assign different individuals to handle different aspects of the accounting process to prevent fraud and errors.

- Authorization procedures: Implement policies and procedures for approving financial transactions to ensure they are valid and properly authorized.

- Document and record retention: Maintain proper documentation and records of all financial transactions to support the accuracy of the accounting records.

- Regular monitoring and review: Continuously monitor and review the accounting processes to identify any irregularities or deviations.

- Internal and external audits: Conduct regular internal audits and consider external audits to provide an independent assessment of the controls and processes.

3. Hiring Experienced Professionals

Hiring experienced professionals is crucial for efficient core accounting processes. Here are steps to consider:

- Identify the specific roles and responsibilities needed, such as bookkeepers, accountants, or financial analysts.

- Define the required qualifications and skills, such as knowledge of accounting principles, proficiency in accounting software, and attention to detail.

- Develop a comprehensive job description and job advertisement to attract qualified candidates for the role of experienced professionals.

- Utilize various recruitment methods, such as job portals, professional networks, and referrals.

- Conduct thorough interviews and assessments to evaluate candidates’ expertise and fit for the organization.

- Check references and verify qualifications to ensure candidates have relevant experience and a proven track record.

- Offer competitive compensation and benefits packages to attract and retain top talent.

- Provide training and development opportunities to enhance skills and keep professionals updated with industry changes.

4. Utilizing Accounting Software

Utilizing accounting software offers numerous advantages to businesses, streamlining financial processes and improving accuracy and efficiency. To effectively utilize accounting software, follow these steps:

- Research: Identify the accounting software that best suits your business needs, taking into consideration features such as invoicing, expense tracking, and financial reporting.

- Training: Provide thorough training to employees to ensure they can navigate and utilize the software effectively.

- Integration: Integrate the accounting software with other systems, such as payroll or inventory management, for seamless data flow.

- Customization: Customize the software to align with your business requirements, such as setting up a chart of accounts and tax codes.

- Data Migration: Transfer existing financial data to the software accurately and securely.

- Regular Updates: Stay up to date with software updates to access new features and ensure data security.

- Support: Utilize the software provider’s support resources for assistance and troubleshooting.

By following these steps, businesses can optimize their use of accounting software and improve their core accounting processes.

5. Regularly Reviewing and Updating Processes

Regularly reviewing and updating core accounting processes is crucial for maintaining accuracy and efficiency. Here are the steps to follow:

- Evaluate current processes to identify any areas that may need improvement.

- Set clear objectives for the review and update process.

- Consult with key stakeholders to gather feedback and suggestions.

- Analyze data and performance metrics to pinpoint any bottlenecks or inefficiencies.

- Make necessary changes to streamline workflows and improve productivity.

- Implement the updated processes and provide training to employees.

- Regularly monitor and evaluate the effectiveness of the updated processes.

One company consistently reviewed and updated their accounting processes, leading to the identification of a redundant step in their invoicing process. This resulted in valuable time and resources being saved, allowing for more focus on strategic initiatives and ultimately improving their bottom line.

Core Accounting Processes

A number of essential accounting procedures are vital to the management of a business’s financial records and transactions. Making wise financial decisions for the company and keeping accurate and well-organized financial data are dependent on these procedures.

Frequently Asked Questions

What are Core Accounting Processes?

The core accounting processes refer to the fundamental tasks and activities involved in managing a company’s financial records and transactions. These processes are essential for accurate and timely financial reporting and decision making.

What are some examples of Core Accounting Processes?

Some examples of core accounting processes include accounts payable, accounts receivable, general ledger management, financial reporting, budgeting, and cost management. These processes are typically carried out on a regular basis to track and record financial transactions.

Why are Core Accounting Processes important?

Core accounting processes are important because they provide a clear and accurate picture of a company’s financial health. They ensure that all financial transactions are properly recorded and tracked, which is crucial for making informed business decisions.

What skills are needed for managing Core Accounting Processes?

To effectively manage core accounting processes, one must possess strong numerical and analytical skills, attention to detail, time management abilities, and knowledge of accounting principles and software. Communication and teamwork skills are also important for collaborating with other departments and stakeholders.

How can a company streamline its Core Accounting Processes?

A company can streamline its core accounting processes by utilizing accounting software, automating routine tasks, establishing standard procedures, and regularly reviewing and updating its processes. This can improve efficiency, reduce errors, and save time and resources.

What are some challenges associated with managing Core Accounting Processes?

Some common challenges in managing core accounting processes include data entry errors, reconciling discrepancies, meeting reporting deadlines, adapting to changes in regulations, and ensuring data security. Proper training, regular monitoring, and staying updated on industry changes can help address these challenges.

Leave a Reply