Streamline Your Check Signing Authority with Our Procedure Template Word Product

Are you tired of the hassle and confusion that comes with managing check signing authority in your organization? Look no further than our Check Signing Authority Procedure Template Word product.

Our template provides a clear and concise process for establishing and managing check signing authority, ensuring that all necessary parties are involved and informed. With this procedure in place, you can reduce the risk of errors, fraud, and miscommunication, while also saving time and resources.

Our Check Signing Authority Procedure Template Word product includes:

- A step-by-step guide for establishing and maintaining check signing authority

- Clear roles and responsibilities for all parties involved

- Guidelines for verifying signatures and ensuring compliance with legal and regulatory requirements

- Templates for documenting and tracking check signing authority

Our template is fully customizable to meet the unique needs of your organization. Whether you’re a small business or a large corporation, our Check Signing Authority Procedure Template Word product can help you streamline your processes and improve your bottom line.

Don’t let check signing authority be a headache any longer. Invest in our Check Signing Authority Procedure Template Word product today and start enjoying the benefits of a streamlined and efficient process.

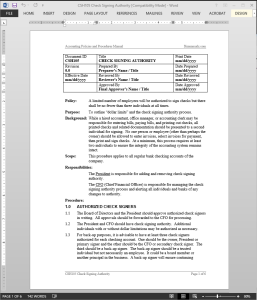

Check Signing Authority Procedure

To ensure your accounting system’s integrity, no one person or employee in your organization should enter invoices, select payment invoices, print and sign checks.

The Check Signing Authority Procedure outlines “dollar limits” and check signing authority processes to maintain your company’s maximum check safety. The Check Signing Authority Procedure applies to the president and CFO of your company. (6 pages, 712 words)

While a hired accountant, office manager, or accounting clerk may be responsible for entering bills, paying bills, and printing out checks, all printed checks and related documentation should be presented to a second individual for signing. No one person or employee (other than perhaps the owner) should be allowed to enter invoices, select invoices for payment, then print and sign checks. At a minimum, this process requires at least two individuals to ensure the integrity of the accounting system remains intact.

For back-up purposes, it is advisable to have at least three check signers authorized for each checking account. One should be the owner, President or primary signer and the other should be the CFO or secondary check signer. The third should be a back-up signer. The back-up signer should be a trusted individual but not necessarily an employee. It could be a board member or another principle in the business. A back-up signer will ensure continuing operations in case both the primary and secondary signers become incapacitated for any period of time.

Check Signing Authority Responsibilities:

The President is responsible for adding and removing check signing authority.

The CFO (Chief Financial Officer) is responsible for managing the check signing authority process and alerting all individuals and banks of any changes to authority.

Check Signing Authority Procedure Activities

Check Signing Authority Procedure Activities

- Authorized Check Signers

- Changing Check Signers

- Authority Levels

Check Signing Authority Procedure Forms

Reviews

There are no reviews yet.