Streamline Your HR Payroll Procedures with Bizmanualz

Are you tired of spending countless hours managing your company’s HR payroll procedures? Look no further than Bizmanualz’s HR Payroll Procedure Word product. Our comprehensive guide provides step-by-step instructions for managing payroll, from calculating employee wages to filing taxes.

Our HR Payroll Procedure Word product includes customizable templates and forms to help you streamline your payroll process. With our easy-to-use guide, you can ensure that your payroll procedures are accurate and compliant with federal and state regulations.

Our product covers a wide range of topics, including:

- Employee classification and compensation

- Timekeeping and attendance tracking

- Payroll processing and distribution

- Tax filing and reporting

- Recordkeeping and documentation

Our HR Payroll Procedure Word product is perfect for small and medium-sized businesses looking to improve their payroll procedures. With our guide, you can save time and reduce errors, allowing you to focus on growing your business.

At Bizmanualz, we pride ourselves on providing high-quality, customizable products that meet the needs of our customers. Our HR Payroll Procedure Word product is no exception. With our guide, you can ensure that your payroll procedures are efficient, accurate, and compliant with all regulations.

Order your copy of our HR Payroll Procedure Word product today and start streamlining your payroll procedures!

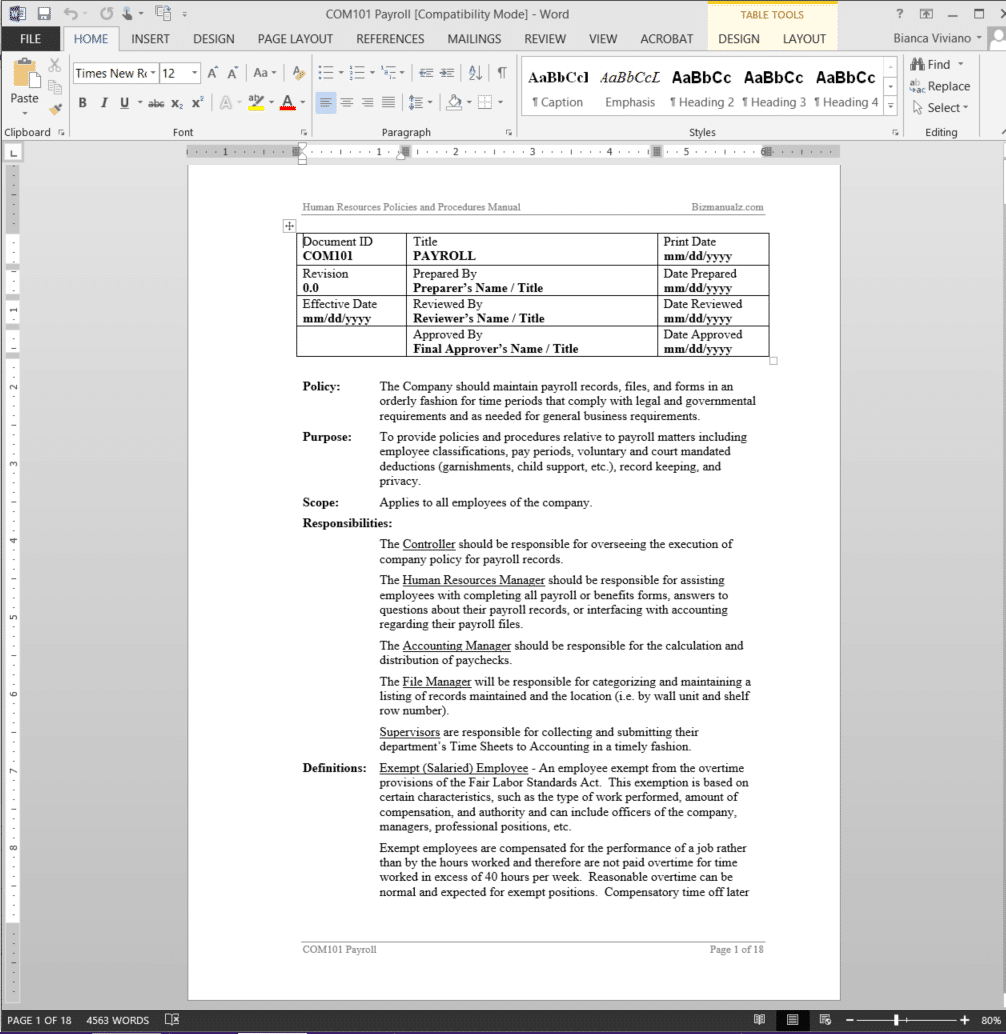

Payroll Procedure

The Payroll Procedure provide guidelines relative to payroll matters including employee classifications, pay periods, voluntary and court mandated deductions (garnishments, child support, etc.) record keeping and privacy.

The Payroll Procedure applies to all employees of your company. (18 pages, 4626 words)

Payroll Responsibilities:

The Controller should be responsible for overseeing the execution of company policy for payroll records.

The Human Resources Manager should be responsible for assisting employees with completing all payroll or benefits forms, answers to questions about their payroll records, or interfacing with accounting regarding their payroll files.

The Accounting Manager should be responsible for the calculation and distribution of paychecks.

The File Manager will be responsible for categorizing and maintaining a listing of records maintained and the location (i.e. by wall unit and shelf row number).

Supervisors are responsible for collecting and submitting their department’s Time Sheets to Accounting in a timely fashion.

Payroll Procedure Activities

- Payroll Records

- Timesheets

- Payroll Deductions

- Payroll Adjustments

- Paychecks

- Vacation Pay

Payroll Procedure References

- Fair Labor Standards Act (FLSA)

- Equal Pay Act

- Family and Medical Leave Act (FMLA)

- IRS Revenue Procedure 98-25 Records Retention

- Federal Insurance Contribution Act (FICA)

- Federal Unemployment Act (FUTA)

Payroll Procedure Forms

- Bi-weekly Time Sheet Form

- Federal Income Tax Calendar Form

- Electronic Funds Transfer Authorization Form

Reviews

There are no reviews yet.