Petty Cash Accounting Journal Template Word

The Petty Cash Accounting Journal Template Word is a comprehensive tool designed to help businesses keep track of their petty cash transactions. This template is perfect for small businesses, non-profit organizations, and other entities that need to manage their petty cash expenses efficiently.

The Petty Cash Accounting Journal Template Word is easy to use and customizable. It comes with pre-built categories for common petty cash expenses such as office supplies, travel expenses, and entertainment expenses. Users can also add their own categories to suit their specific needs.

The template includes a detailed log for each petty cash transaction, including the date, amount, payee, and purpose of the expense. It also includes a running balance for each category, making it easy to track expenses and ensure that petty cash funds are being used appropriately.

The Petty Cash Accounting Journal Template Word is available for download in Microsoft Word format, making it easy to edit and customize. It is also compatible with both Windows and Mac operating systems.

Using the Petty Cash Accounting Journal Template Word can help businesses save time and money by streamlining their petty cash management processes. It can also help businesses ensure that their petty cash funds are being used appropriately and in accordance with company policies.

Overall, the Petty Cash Accounting Journal Template Word is an essential tool for any business that needs to manage their petty cash expenses efficiently and effectively.

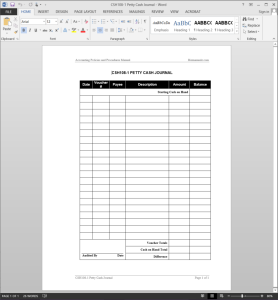

Petty Cash Accounting Journal Template

The Petty Cash Accounting Journal Template, the cash box, and all petty cash transactions should be maintained by the Cashier. The petty cash fund will be set up in the amount of $100.00 for authorized out-of-pocket expenses and advances for minor business expenses.

When an employee requests a petty cash draw, the Cashier will record the following in the CSH108-1 PETTY CASH JOURNAL:

- The date of disbursement;

- Voucher number (see Note below);

- Name of the payee (employee) receiving the advance;

- Reason or description for the draw/disbursement; and

- Amount withdrawn.

NOTE: If there is no voucher, the Cashier must write a unique, identifying number on the receipt or record the transaction on a slip of paper.

By the end of the following business day, the employee should turn in all receipts and any change to the Cashier. The Cashier completes a petty cash voucher and attaches to it any receipts. The Cashier should submit the current CSH108-1 PETTY CASH JOURNAL paperwork, with itemized descriptions of expenses and/or receipts, to the Controller

The Controller should audit the paperwork submitted by the Cashier and resolve any discrepancies. When there are no discrepancies, the Controller will approve the Petty Cash Journal Template and the check request for replenishment. The Controller should issue a check in the amount of the reimbursement to the Cashier, who is responsible for cashing the reimbursement check at the company’s bank in order to replenish the cash box.

Petty Cash Accounting Journal Template Details

Petty Cash Accounting Journal Template Details

Pages: 01

Words: 26

Format: Microsoft Word 2013 (.docx)

Language: English

Manual: Accounting Manuals Template

Category: Cash

Procedure: Petty Cash Procedure CSH108

Type: Journal

Reviews

There are no reviews yet.