What Should a CFO Know About Corporate Governance Best Practices?

As a Chief Financial Officer, you have a crucial role in ensuring the success and sustainability of your company. Understanding and implementing corporate governance best practices is essential for effective decision making and mitigating potential risks. In this article, we will explore the key elements of corporate governance and why it is crucial for CFOs like you to have a solid grasp of it. Are you ready to elevate your knowledge on corporate governance? What should a CFO know about corporate governance best practices?

What is Corporate Governance?

Corporate governance is the system of rules, practices, and processes that govern the direction and control of a company. This includes the relationships between shareholders, the board of directors, management, and other stakeholders.

The main goal of corporate governance is to promote transparency, accountability, and ethical behavior within an organization. It also provides a framework for decision-making, risk management, and financial performance.

Key components of corporate governance include:

- Clearly defined roles and responsibilities

- Effective communication

- Protection of shareholders’ rights

By implementing best practices in corporate governance, CFOs can enhance the company’s reputation, foster trust with stakeholders, and promote sustainable long-term growth.

What are the Roles and Responsibilities of a CFO in Corporate Governance?

As a CFO, it is vital to understand the importance of corporate governance and your role within it. This section will delve into the specific responsibilities and duties that a CFO holds in maintaining effective corporate governance practices.

We will discuss the crucial role of ensuring compliance with laws and regulations, providing financial oversight, managing risk, and maintaining transparency and accountability within the organization. By understanding these essential tasks, a CFO can effectively contribute to the success and sustainability of the company.

1. Ensuring Compliance with Laws and Regulations

Ensuring compliance with laws and regulations is a crucial aspect of corporate governance for CFOs. They must take proactive steps to stay updated on relevant laws and regulations and avoid legal issues.

- Educate themselves on relevant laws and regulations to stay updated.

- Implement policies and procedures throughout the organization to ensure compliance.

- Regularly monitor and assess compliance with laws and regulations.

- Establish internal controls to detect and prevent violations.

By diligently ensuring compliance, CFOs contribute to a culture of integrity and minimize legal and reputational risks for the company.

2. Providing Financial Oversight

When it comes to corporate governance, providing financial oversight is a crucial role for CFOs. To effectively fulfill this responsibility, CFOs can follow these steps:

- Establishing financial controls and procedures to ensure accurate and reliable financial reporting.

- Monitoring financial performance and analyzing key financial metrics.

- Reviewing financial statements and reports to identify any potential risks or issues.

- Collaborating with internal and external auditors to ensure compliance and identify areas for improvement.

Implementing these steps helps CFOs ensure the financial health and integrity of the organization. In fact, studies have shown that companies with strong financial oversight practices enjoy better financial performance, increased investor confidence, and improved decision-making.

3. Managing Risk

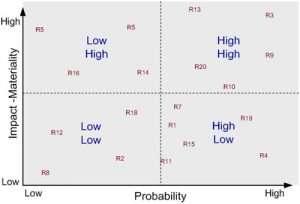

List risks, and then plot them according to impact and likelihood

Managing risk is an essential component of corporate governance that must be prioritized by CFOs. To effectively manage risk, here are the steps they can take:

- Identify Risks: Conduct a thorough assessment to identify potential risks that could impact the organization.

- Establish Risk Appetite: Clearly define the organization’s tolerance for risk and set boundaries.

- Develop Risk Mitigation Strategies: Implement processes and controls to mitigate the identified risks.

- Monitor and Evaluate: Regularly monitor and evaluate the effectiveness of the risk management strategies.

A CFO successfully implemented robust risk management practices, including regular risk assessments and proactive mitigation strategies. As a result, the company was able to navigate a financial crisis successfully and minimize potential losses. Their diligent approach to managing risk helped maintain stability and protect shareholder value.

4. Maintaining Transparency and Accountability

Maintaining transparency and accountability is crucial for effective corporate governance. As key figures in their organizations, CFOs play a vital role in upholding these principles. Here are the steps they can take:

- Establishing clear communication channels and policies to ensure transparency throughout the organization.

- Implementing robust financial reporting systems to provide accurate and timely information to stakeholders.

- Engaging in regular and open dialogue with the board of directors and other key stakeholders to address concerns and maintain accountability.

- Adhering to ethical standards and promoting a culture of integrity and honesty within the organization.

By following these steps, CFOs can contribute to the overall transparency and accountability of the organization, promoting trust and confidence among stakeholders.

What are the Best Practices for Corporate Governance?

Corporate governance is a crucial aspect of running a successful and ethical business. In this section, we will discuss the best practices for corporate governance that every Chief Financial Officer (CFO) should be aware of. These practices ensure transparency, accountability, and effective decision-making within a company.

We will delve into the importance of separating the roles of Board Chair and CEO, having independent board members, conducting regular board evaluations, and implementing clear communication and disclosure policies. Each of these practices plays a vital role in promoting good corporate governance and maintaining the trust of stakeholders.

1. Separation of Board Chair and CEO Roles

The separation of board chair and CEO roles is a crucial best practice in corporate governance. To effectively implement this practice, follow these steps:

- Conduct a thorough review of the company’s governance structure and assess the current roles and responsibilities of the board chair and CEO.

- Engage in open and transparent discussions with stakeholders, including board members, shareholders, and executives, to gain support for the separation.

- Update the company’s bylaws or governance policies to formally establish the separation of roles.

- Recruit a qualified independent board chair who can provide unbiased leadership and oversight.

- Clearly define the respective duties and responsibilities of the board chair and CEO, ensuring that there is no overlap or conflict of interest.

- Establish regular communication channels between the board chair, CEO, and board members to ensure effective collaboration and decision-making.

- Regularly evaluate and review the effectiveness of the separation of roles, making necessary adjustments as needed.

In the early 2000s, many companies faced governance failures, leading to increased scrutiny and the adoption of best practices. The separation of board chair and CEO roles emerged as a crucial reform to enhance accountability, transparency, and independent oversight in corporate decision-making. This practice has since become widely recognized and implemented by companies worldwide.

2. Independent Board Members

Independent board members play a vital role in corporate governance. With their diverse perspectives, objectivity, and accountability, they contribute to the decision-making process. Their main duty is to protect the interests of both shareholders and stakeholders.

By providing independent oversight, they ensure that management acts in the best interest of the company. Moreover, independent board members promote transparency, ethical conduct, and compliance with laws and regulations. They serve as a safeguard against conflicts of interest and encourage responsible corporate behavior.

To improve corporate governance, companies should aim to have a majority of independent board members, ensuring a variety of skills, expertise, and backgrounds. Their active involvement strengthens corporate governance practices and fosters trust with investors and the public.

3. Regular Board Evaluations

Regular board evaluations are a crucial aspect of effective corporate governance. They play a key role in ensuring that the board is operating at its best and fulfilling its duties. Here are the steps involved in conducting regular board evaluations:

- Establish evaluation criteria: Clearly define the criteria and objectives for the evaluation process, such as assessing board performance, individual director effectiveness, and adherence to governance principles.

- Collect feedback: Gather input from all board members through surveys or interviews to gain a comprehensive perspective on board performance.

- Analyze results: Review the feedback and identify areas of strength and areas for improvement. Look for patterns or common themes to guide future actions.

- Develop action plans: Based on the evaluation results, create action plans to address any identified weaknesses or gaps. Assign responsibilities and set deadlines for implementing necessary changes.

Pro-tip: Regular board evaluations should be seen as an ongoing process of improvement rather than a one-time event. By conducting periodic evaluations, the board can enhance its effectiveness and contribute to the overall success of the organization.

4. Clear Communication and Disclosure Policies

Clear communication and disclosure policies are essential for effective corporate governance. To successfully implement these policies, CFOs should follow these steps:

- Establish guidelines: Develop a comprehensive policy that clearly outlines the expectations for communication and disclosure within the organization.

- Train employees: Conduct training sessions to educate employees on the importance of clear communication and disclosure, ensuring they understand their responsibilities.

- Implement reporting systems: Set up reporting mechanisms that allow employees to raise concerns and report any potential misconduct.

- Monitor compliance: Regularly review and assess compliance with the communication and disclosure policies to identify areas for improvement.

Fact: According to a study by EY, companies with strong clear communication and disclosure policies have a 40% higher return on equity compared to those without such policies.

How Can a CFO Implement Corporate Governance Best Practices?

As a CFO, understanding and implementing corporate governance best practices is crucial for the success and sustainability of a company. In this section, we will discuss how a CFO can effectively implement these practices within their organization.

From educating themselves on corporate governance principles to closely working with the board of directors, establishing strong internal controls, and monitoring compliance and risk management, we will explore the key steps that a CFO must take to ensure good corporate governance practices are in place.

1. Educate Themselves on Corporate Governance Principles

To enhance their knowledge of corporate governance principles, CFOs can take the following steps:

- Read and study relevant literature, such as books, articles, and research papers, to educate themselves on corporate governance.

- Attend conferences, seminars, and workshops focused on corporate governance to gain insights from industry experts.

- Join professional organizations and networks that offer resources and opportunities for learning about corporate governance.

- Participate in online courses and webinars that provide training on best practices for corporate governance.

Pro-tip: Developing a strong understanding of corporate governance principles is crucial for CFOs to effectively contribute to the governance framework of their organization. Continuously learning and staying up-to-date with evolving governance practices can enhance their decision-making, risk management, and financial oversight abilities.

2. Work Closely with the Board of Directors

A CFO plays a crucial role in corporate governance by closely collaborating with the board of directors. To effectively work with the board, a CFO should:

- Establish open lines of communication and build strong relationships with board members.

- Regularly report financial performance, risk management, and compliance issues to the board.

- Collaborate with the board to develop and implement effective financial strategies and policies.

- Provide insights and guidance on financial matters, offering expertise in decision-making processes.

By working closely with the board of directors, a CFO can contribute to the successful implementation of corporate governance best practices and ensure transparency, accountability, and sound financial management within the organization. It is essential for a CFO to work closely with the board of directors in order to effectively fulfill their role in corporate governance.

3. Establish Strong Internal Controls and Processes

Establishing strong internal controls and processes is crucial for effective corporate governance. Here are some steps to follow:

- Identify key areas of risk: Conduct a thorough assessment to identify potential risks and vulnerabilities.

- Design control mechanisms: Develop robust policies, procedures, and guidelines to mitigate identified risks.

- Implement controls: Ensure that the designed controls are effectively implemented throughout the organization.

- Monitor and evaluate: Continuously monitor and evaluate the effectiveness of controls to identify any gaps or weaknesses.

- Regular internal audits: Conduct periodic internal audits to validate the efficiency and compliance of established controls.

By establishing strong internal controls and processes, CFOs can enhance transparency, mitigate risks, and ensure compliance, thereby safeguarding the organization’s interests and fostering trust among stakeholders.

4. Monitor and Report on Compliance and Risk Management

To effectively monitor and report on compliance and risk management in corporate governance, CFOs can follow these steps:

- Establish a comprehensive compliance program to ensure adherence to laws, regulations, and internal policies.

- Implement a risk management framework that identifies, assesses, and mitigates potential risks.

- Develop key performance indicators (KPIs) and metrics to monitor compliance and risk-related activities.

- Regularly review and analyze data to identify any compliance gaps or emerging risks.

- Prepare accurate and timely reports on compliance and risk management for the board of directors and senior management, focusing on the 4. Monitor and Report on Compliance and Risk Management.

- Collaborate with internal audit and legal teams to address any compliance issues or violations.

- Stay updated on industry best practices and regulatory changes to ensure the effectiveness of compliance and risk management efforts.

- Engage in continuous improvement by conducting regular assessments and implementing corrective actions.

By implementing these steps, CFOs can contribute to maintaining a robust compliance and risk management system in the organization.

What are the Benefits of Implementing Corporate Governance Best Practices?

As a Chief Financial Officer, understanding and implementing corporate governance best practices is crucial for the success of your company. But what are the benefits of incorporating these practices into your business strategy?

We will explore four key benefits that come with implementing corporate governance best practices: improved financial performance, enhanced reputation and investor confidence, better decision making and risk management, and increased accountability and transparency. These benefits not only lead to a more successful and sustainable business, but also strengthen the overall economy.

1. Improved Financial Performance

Implementing best practices in corporate governance can have a positive impact on a company’s financial performance. Here are some steps that a CFO can take to achieve this goal:

- Evaluate the current financial processes and identify areas that could benefit from improvement.

- Implement strong financial controls to minimize errors and prevent fraud.

- Develop a robust financial reporting framework to ensure the accuracy and timeliness of information.

- Establish clear financial goals and regularly monitor performance against them.

- Ensure compliance with financial regulations and ethical standards.

- Implement effective risk management strategies to mitigate financial risks.

- Invest in technology and tools to streamline financial operations and increase efficiency.

- Collaborate with other departments to align financial goals with the overall business objectives.

By following these steps, a CFO can contribute to the company’s improved financial performance and enhance its long-term success.

2. Enhanced Reputation and Investor Confidence

Implementing best practices in corporate governance has many benefits, including enhanced reputation and increased investor confidence. Companies that demonstrate strong governance not only build trust with investors, stakeholders, and the public, but also attract more investors and improve their financial performance.

Investor confidence is crucial for obtaining capital and maintaining a healthy stock price. By prioritizing transparency, accountability, and rigorous risk management, CFOs can play a significant role in building a strong reputation and instilling confidence in investors. In fact, studies have shown that companies with strong corporate governance practices tend to outperform their peers in terms of stock performance and overall financial results.

3. Better Decision Making and Risk Management

Effective corporate governance relies heavily on making informed decisions and effectively managing risks. To achieve this, CFOs can take the following steps:

- Develop a comprehensive risk management framework to identify, assess, and mitigate potential risks.

- Implement strong internal controls and processes to ensure accurate financial reporting and compliance with laws and regulations.

- Establish a robust decision-making process that involves evaluating all relevant information, considering different perspectives, and conducting thorough analysis.

- Promote a culture of transparency and accountability within the organization, encouraging open communication and ethical behavior.

4. Increased Accountability and Transparency

Effective corporate governance requires a focus on increased accountability and transparency. By implementing best practices in these areas, CFOs can ensure that the organization operates with integrity and openness. This includes establishing robust internal controls, regularly monitoring compliance and risk management, and reporting transparently to stakeholders.

The benefits of prioritizing accountability and transparency include:

- Improved financial performance

- Enhanced reputation and investor confidence

- Better decision-making and risk management

In fact, research has shown that companies with strong governance practices tend to outperform their peers financially. Emphasizing these values not only fosters trust, but also contributes to the long-term success of the organization.

Fun Fact: Companies with high ESG ratings have been found to outperform their peers in terms of stock market performance.

Frequently Asked Questions

What should a CFO Know about Corporate Governance Best Practices?

As a CFO, it is important to have a thorough understanding of corporate governance best practices to ensure the financial stability and success of the company. Here are some key things to know:

What is corporate governance?

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It sets the framework for how a company is managed, how decisions are made, and how accountability is enforced.

Why is understanding corporate governance important for a CFO?

As a CFO, you are responsible for managing the company’s finances and ensuring the company’s financial health. Understanding corporate governance best practices helps you to fulfill this role effectively and make informed decisions that align with the company’s goals and values.

What are some common corporate governance best practices?

Some common corporate governance best practices include having a diverse and independent board of directors, clear and transparent financial reporting, effective risk management, and ethical behavior from all levels of the company.

How can a CFO promote good corporate governance within the company?

As a CFO, you can promote good corporate governance by setting a strong example through your own actions and decisions, ensuring compliance with regulatory requirements, and actively participating in board meetings and discussions.

What are the consequences of poor corporate governance?

Poor corporate governance can lead to financial instability, loss of investor trust, legal issues, and damage to the company’s reputation. It can also result in financial fraud and other unethical practices, which can have serious consequences for the company and its stakeholders.

Leave a Reply