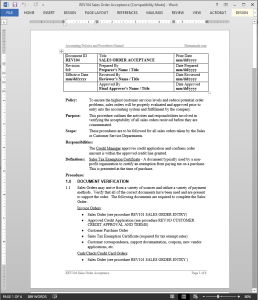

Sales Order Acceptance Procedure

Sales Order Acceptance Procedure

The Sales Order Acceptance Procedure outlines the activities and responsibilities involved in verifying that all sales orders received by your company are acceptable before they are completed.

The Sales Order Acceptance Procedure implements a process to evaluate and approve all sales orders before they are entered into the accounting system—thus reducing potential problems and ensuring the highest level of customer service.

The sales order confirmation policy should be followed for all sales orders taken by your company’s sales or customer service departments. (6 pages, 1055 words)

Sales Order Acceptance Responsibilities:

The Credit Manager approves credit application and confirms order amount is within the approved credit line granted.

Sales Order Acceptance Definitions:

Sales Tax Exemption Certificate – A document typically used by a non-profit organization to certify an exemption from paying tax on a purchase. This is presented at the time of purchase.

Sales Order Acceptance Procedure Activities

Sales Order Acceptance Procedure Activities

- Order Document Verification

- Telephone Order Confirmation

- Sales Order Acceptance

Reviews

There are no reviews yet.