What are the Best Practices for a Finance Policy Procedure Manual?

In today’s dynamic business environment, it is vital to have a well-structured finance policy procedure manual that aligns with the organization’s objectives. This article will provide insights into the importance, key components, and development of a finance policy procedure manual, along with best practices for its implementation. What are the Best Practices for a Finance Policy Procedure Manual?

Understanding the Importance of a Finance Policy Procedure Manual

An organization’s finance policy procedure manual plays a critical role in establishing and maintaining effective financial management practices. It sets out the rules, guidelines, and limitations for handling financial transactions and ensures compliance with internal and external regulations.

The manual provides a consistent framework for decision-making, enabling employees to handle financial matters with confidence and efficiency. In addition, a well-structured manual can safeguard the organization’s assets and reputation, reduce the risk of fraud, and enhance overall financial performance.

The Role of a Finance Policy Procedure Manual in an Organization

A finance policy procedure manual defines the roles and responsibilities of various stakeholders in financial management. It outlines the procedures for managing and reporting financial transactions, ensuring transparency and accountability. Furthermore, the manual acts as a tool for risk management by identifying areas of vulnerability and establishing appropriate controls to mitigate them. By having a clear and concise finance policy procedure manual in place, an organization can achieve consistent financial results that align with its objectives.

For example, a finance policy procedure manual can outline the process for approving expenses, including the types of expenses that are reimbursable and the documentation required to support the expense. This can help prevent employees from submitting fraudulent expense reports and ensure that expenses are aligned with the organization’s budget and goals.

Another example is the manual’s guidance on managing cash flow. The manual can outline the procedures for collecting payments from customers, managing accounts payable, and investing excess cash. This can help ensure that the organization has sufficient cash on hand to meet its financial obligations and take advantage of opportunities for growth.

Benefits of Having a Well-Structured Finance Policy Procedure Manual

A well-written and organized finance policy procedure manual has several benefits for an organization. Firstly, it provides a clear understanding of the financial policies and procedures, which can help mitigate risks associated with financial transactions. Secondly, it sets out guidelines for budgeting and forecasting, enabling the organization to plan and manage its financial resources effectively.

The manual can also provide guidance on financial reporting, including the format and content of financial statements, and the procedures for preparing and reviewing them. This can help ensure that financial information is accurate, complete, and timely, which is essential for making informed business decisions.

Thirdly, a finance policy procedure manual can improve communication and coordination among finance department staff, leading to better decision-making and efficient operations. By providing a common framework for financial management, employees can work together more effectively, share information, and collaborate on projects.

Finally, a well-structured finance policy procedure manual ensures compliance with regulations and standards, minimizing legal and reputational risks. It can outline the procedures for complying with tax laws, accounting standards, and other regulations that govern financial transactions. This can help prevent fines, penalties, and other legal consequences that can result from non-compliance.

In conclusion, a finance policy procedure manual is an essential tool for any organization that wants to establish and maintain effective financial management practices. By providing clear guidance and establishing consistent procedures, the manual can help reduce risks, improve financial performance, and ensure compliance with regulations and standards.

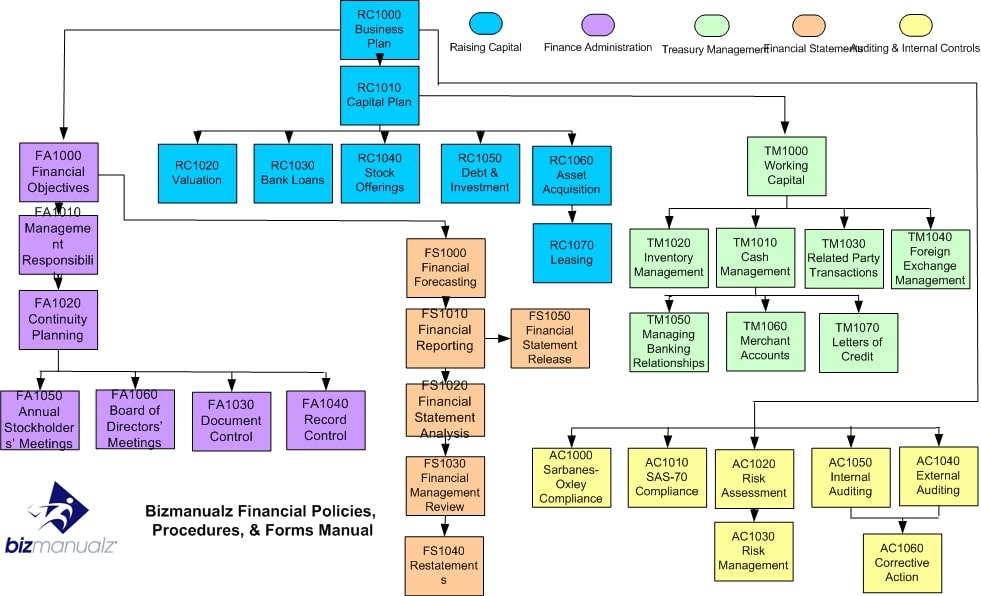

Key Components of a Finance Policy Procedure Manual

A finance policy procedure manual is a crucial document that outlines the financial policies and procedures of an organization. It serves as a reference guide for employees and ensures consistency in financial practices. There are a few key components of a finance policy procedure manual that should be included.

Financial Policies and Procedures

The financial procedures section of the finance policy procedure manual includes guidelines for handling transactions such as purchasing, payments, and reimbursements. It outlines the authorization process for financial transactions, specifying who has the authority to approve transactions and under what conditions. Furthermore, this section details the methods to record and report financial transactions to maintain records that comply with both internal and external standards.

Internal Controls and Risk Management

The internal controls and risk management section of the finance policy procedure manual establishes adequate control frameworks for financial operations. It also outlines measures that should be taken to mitigate known financial risks associated with transactions. This section sets out procedures for identifying, monitoring, and reporting risk along with action plans to address any identified risks or gaps.

Financial Reporting and Analysis

The financial reporting and analysis section of the finance policy procedure manual provides guidance on preparing financial statements, management reports, and other financial documents that are needed to support decision-making, budgeting, and planning. This section specifies the frequency and format of financial reports and indicates who should receive them. It also outlines the tools and techniques used to formulate financial analysis, including ratio analysis, cash flow analysis, and financial trend analysis.

Budgeting and Forecasting

The budgeting and forecasting section of the finance policy procedure manual outlines procedures and methodologies used to prepare and manage the annual budget. The procedures should specify the budgeting model, budgetary guidelines, and timing of the budget cycle. This section provides details concerning the budget approval process, the assumptions made in producing the budget, and the process for tracking and reporting variances. Furthermore, the budget manual should contain procedures for reviewing and approving capital expenditures, taking into account their impact on the organization’s strategic and operational objectives.

Cash Management and Banking

The cash management and banking section of the finance policy procedure manual outlines control measures in place to manage cash and investments. It explains the process of cash flow forecasting and how liquidity risks are managed. The procedures should detail cash management strategies, including investment guidelines, borrowing framework and rules around bank account setup. Additionally, this section should specify approval thresholds for opening or closing bank accounts.

Procurement and Purchasing

The procurement and purchasing section of the finance policy procedure manual outlines the process for procuring goods or services. This section should specify who is authorized to make purchases, along with the approval process and conditions for quotes and bids. It should also detail the procurement process to be followed in case of emergency buying or outside the standard purchasing cycle. An organization should follow the procurement and purchasing procedure as per its specific needs and preferences.

Payroll and Employee Benefits

The payroll and employee benefits section of the finance policy procedure manual outlines the procedures for managing employee compensation, taxes, and benefits. It should detail the payroll schedule, reporting requirements, and payroll processing procedures. Additionally, it should provide guidelines for benefit entitlements and accounting treatments. Ensuring compliance with payroll and employee benefits regulation are important to protect an organization’s reputation and minimize tax exposure.

Tax Compliance and Planning

The tax compliance and planning section of the finance policy procedure manual provides guidance on tax-related matters. It details procedures for tax preparation and reporting, including registering for tax, the filing process and specific taxation requirements of the business. Additionally, this section should outline the tax implications of financial transactions to be undertaken and how best to manage them for competitive gains for the organization.

Furthermore, it should provide guidance on tax planning, incorporating tax-optimizing strategies into the organization’s broader financial planning and forecasting processes. Understanding how to address tax issues can provide a critical competitive advantage to optimize the organization’s financial position.

Developing and Implementing a Finance Policy Procedure Manual

Developing and implementing a finance policy and procedure manual is a process that begins with assessing your current financial practices and then regularly reviewing and updating the manual.

Assessing Your Organization’s Current Financial Practices

The first step in developing a finance policy procedure manual is to assess your organization’s current financial practices. You can conduct a gap analysis between current practices and industry best practices to identify areas requiring upgrades. This step will lead to an understanding of specific requirements for the manual tailored to the organizations’ financial practices, which will have a direct impact on its effectiveness and usefulness.

Establishing a Finance Policy Procedure Manual Development Team

One of the critical steps in developing a finance policy procedure manual is assembling a team tasked with drafting the manual. The team should comprise individuals from across different departments, having a clear understanding of the organization’s financial operations, and be familiar with relevant regulations. The team should also have a designated lead to oversee the project and ensure that everyone’s contributions are filtered into the manual. The inclusion of team members from a broad spectrum of departments and roles provides a better overview of the organization’s practices leading to a stronger manual that best takes into account the needs of everyone involved.

Defining the Scope and Objectives of the Manual

The process of developing a finance policy procedure manual should include a clearly defined scope and objective based on an organization’s needs and preferences. This step ensures everyone participating in the manual’s creation is aligned, and expectations for the final product are understood. Determining the scope of the manual involves compiling a list of the financial policies and procedures the manual should contain, considering the organization’s objectives and its financial strategy.

Writing and Organizing the Manual

The finance policy procedure manual should be well-organized and easy to navigate. It should be presented in a clear and concise manner, using proper terminology and regulatory references, where applicable. The manual should be written in easy, plain English where possible to make it even more accessible to every operational staff. It should be structured in a way to make information easy to find and follow. Additionally, every section should include checklists or forms required for the process, making it easy for all staff to follow and abide by the manual.

Training Staff on the New Finance Policy Procedure Manual

After the finance policy procedure manual’s completion, it is imperative to train staff on the new manual. It is crucial that everyone involved in financial processes reads and understands the manual before it is adopted, ensuring compliance and consistency in financial practices. The manual should be presented in an easy-to-follow, user-friendly manner to maintain staff engagement. It is advisable to involve the finance manual team in each staff training session to ensure any issues identified are dealt with immediately, building a good understanding of staff requirements and perception of the finished good.

Regularly Reviewing and Updating the Manual

Lastly, the finance policy procedure manual should be reviewed regularly. Industry advancements and internal process changes may dictate that any necessary updates be considered to remain aligned. Furthermore, the manual should be reviewed and reapproved by the management to ensure it is still valid and applicable. This step is essential to keep the manual relevant, accurate, and effective.

Finance Policy Procedure Manual Best Practices

Having a well-structured finance policy procedure manual is a critical component of effective financial management and risk mitigation for any organization. This manual’s development should be made following an inclusive approach involving all necessary stakeholders, which will result in robust guidelines that details all significant financial policies and practices for the organization.

To ensure the policy’s effectiveness, management should thoroughly review the policy and ensure regular updates are implemented. Carrying out these best practices will result in numerous long-term advantages, such as better decision-making, enhanced staff confidence, transparency, and accountability in financial operations, which will all translate into the organization’s growth and development.

As a practicing CPA I have had the privilege of working with several small businesses. Your article addressing the need for having a well written financial policy and procedure manual exposes why many of these organizations are unable to properly embark on a sustainable financial journey. After a time, these businesses just have to close their doors.

From an education standpoint I gather that more effort has to be made to get businesses of all sizes to adopt the framework you have laid out.

Your article is inspiring to say the least.