Understanding Modified Accrual Accounting

As a form of accounting widely used in the public sector, modified accrual accounting is an approach that allows for the tracking and recording of government funds effectively. Unlike other accounting methods, modified accrual accounting operates on a basis that recognizes revenues only when they are available and measurable, and expenses only when they have been incurred.

Basics of Modified Accrual Accounting

Modified accrual accounting is a method of accounting that is commonly used by government entities to track their financial information. It is a cash and accrual system that combines elements of both accounting methods, allowing the government to accurately record and track revenues and expenditures in a manner that is consistent with generally accepted accounting principles.

Definition and Purpose

The purpose of modified accrual accounting is to provide a clear and accurate picture of the financial status of a government entity at a given point in time. This method is particularly useful for governments because it allows them to track their financial activity in a way that is consistent with the unique nature of government operations.

Government entities often have complex revenue streams, including taxes, grants, and fees, which can make it difficult to accurately record and track financial activity. Modified accrual accounting provides a framework for tracking these revenue streams and ensuring that they are properly accounted for.

Key Principles

The key principle of modified accrual accounting is the recognition of financial activity when it occurs. This means that revenues are only recognized when they can be measured and available for use, and expenses are only recorded when they have been incurred and indicate an outflow of assets. This method allows for a clear and accurate record of the government’s financial status at a particular point in time.

Another key principle of modified accrual accounting is the concept of fund accounting. Governments often have multiple funds, each with its own revenue streams and expenses. Modified accrual accounting allows for the tracking of each fund separately, providing a more detailed picture of the government’s financial activity.

Modified Accrual vs. Accrual Accounting

Modified accrual accounting differs from accrual accounting in that it is a hybrid of the cash basis and the accrual basis of accounting. While both methods use the accrual principle, accrual accounting recognizes revenues and expenses when they are earned or incurred, even if the cash has not yet been received or paid out. Modified accrual accounting, on the other hand, focuses more on the inflows and outflows of cash to conduct financial reporting as it is more relevant.

Another key difference between modified accrual and accrual accounting is the treatment of long-term assets and liabilities. Accrual accounting recognizes these items on the balance sheet, while modified accrual accounting does not. This is because the focus of modified accrual accounting is on the short-term financial activity of the government, rather than its long-term financial position.

Modified accrual accounting is a valuable tool for government entities to track their financial activity and ensure that it is properly recorded and reported. By combining elements of both cash and accrual accounting, modified accrual accounting provides a framework for tracking government revenue streams and expenses in a way that is consistent with generally accepted accounting principles.

Components of Modified Accrual Accounting

Modified accrual accounting is a method of accounting used by government entities to record financial transactions. This method of accounting is different from traditional accrual accounting in that it recognizes revenues and expenditures when they have become available and measurable. Here are some of the key components of modified accrual accounting:

Revenues

Revenues are a critical component of modified accrual accounting. They are recognized only when they meet certain criteria, making them available and measurable. This can include taxes, fines, grants, and donations, among others. It is important to note that revenues can be recorded when the government is legally entitled to the funds, with the exception of interest, which is recorded after it has been earned.

For example, if a government receives a grant from a private foundation, it cannot recognize the revenue until it meets the criteria for availability and measurability. This may include meeting certain performance requirements or providing specific documentation to the foundation. Once the criteria are met, the revenue can be recognized in the government’s financial statements.

Expenditures

Expenditures are another critical component of modified accrual accounting. They are recorded when they have been incurred, indicating an outflow of assets that were previously recognized as an expense. The government would need to deem that the expenditure is necessary and authorized in the budget. Examples include salaries, equipment purchases and rentals, and utilities.

For example, if a government hires a new employee, the salary for that employee cannot be recognized as an expenditure until the employee has actually started working. Once the employee has started working and the salary has been paid, the expenditure can be recorded in the government’s financial statements.

Fund Balances

Fund balances refer to the difference between the revenues and expenditures for a particular government fund. These balances represent the financial resources that are available for future use and can be classified as unassigned (general fund), restricted (grant fund), or committed (sinking fund).

For example, if a government has a general fund with a balance of $100,000, this means that there are $100,000 in financial resources available for future use. The government may choose to use these resources for a variety of purposes, such as funding a new program or investing in infrastructure.

Overall, modified accrual accounting is a critical tool for government entities to manage their finances and ensure that they are making informed decisions about how to allocate their resources. By following the principles of modified accrual accounting, governments can maintain a clear and accurate picture of their financial health and make strategic decisions about how to use their resources to best serve their constituents.

Implementing Modified Accrual Accounting

Modified accrual accounting is a popular accounting method used by governments and non-profit organizations. It is a method of accounting that recognizes revenue and expenses when they are earned or incurred, rather than when they are received or paid. This method of accounting is beneficial for governments because it provides a more accurate picture of their financial health and performance.

Setting Up the Chart of Accounts

The chart of accounts is a key component of the implementation process for modified accrual accounting. It allows the government to organize financial data and report on its expenses, revenues, and assets. The government must ensure that the chart of accounts aligns with accounting standards to ensure accurate and consistent reporting.

The chart of accounts typically includes a list of all the accounts used by the government, such as cash, investments, accounts payable, and accounts receivable. Each account is assigned a unique code or number for easy identification and tracking. The chart of accounts may also include sub-accounts, which provide more detail on specific transactions.

It is important to note that the chart of accounts may need to be updated periodically to reflect changes in the government’s operations or accounting standards.

Recording Transactions

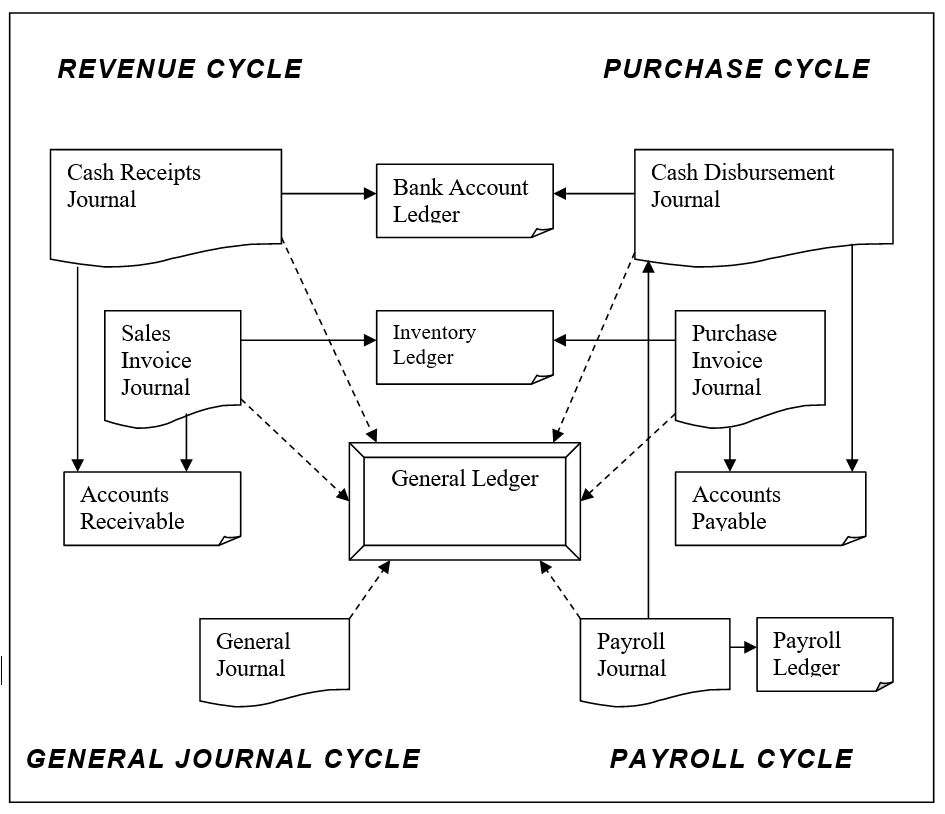

Once the chart of accounts has been developed, the government can begin recording transactions. This involves identifying the accounts that are affected by the transaction and recording the relevant data in the appropriate cost accounting ledgers or journals.

For example, if the government receives payment for a service provided, the transaction would be recorded in the revenue account. If the government pays for a service, the transaction would be recorded in the expense account. It is important to ensure that transactions are recorded accurately and in a timely manner to provide an accurate picture of the government’s financial health.

Adjusting Entries

Adjusting entries ensure that financial statements are accurate. At the end of each accounting period, the government can review accounts and make any necessary adjustments to reconcile balances. Examples include depreciation expenses, prepayments, and accrued interest.

Depreciation expenses are used to account for the wear and tear on capital assets over time. Prepayments occur when the government pays for a service or asset in advance, and the expense needs to be recognized over time. Accrued interest occurs when interest on a loan or investment has been earned but not yet received.

Adjusting entries are important because they ensure that the financial statements accurately reflect the government’s financial position and performance. Without adjusting entries, the financial statements may be misleading or inaccurate.

In conclusion, implementing modified accrual accounting requires careful planning and attention to detail. Setting up the chart of accounts, recording transactions, and making adjusting entries are all important components of this accounting method. By following these steps, governments can ensure accurate and consistent reporting, which is essential for maintaining public trust and accountability.

Financial Reporting under Modified Accrual Accounting

Modified accrual accounting is a method of accounting used by governments and other public sector organizations. It is a hybrid system that combines elements of cash basis accounting and accrual basis accounting. Under modified accrual accounting, revenues are recognized when they are measurable and available, and expenditures are recognized when the related liability is incurred, except for long-term debt and capital assets.

Governmental Funds Financial Statements

The financial statements generated under modified accrual accounting fall into two main categories: governmental funds and proprietary funds. Governmental funds financial statements report the inflows and outflows of cash for the general, special revenue, debt service, capital projects, and permanent funds. These statements provide information on the short-term financial position of the government.

For example, the general fund is the primary operating fund of the government, and it accounts for the majority of the government’s activities. The special revenue fund is used to account for specific revenue sources that are restricted for a particular purpose, such as a grant or a tax. The debt service fund is used to account for the repayment of debt, while the capital projects fund is used to account for the construction of capital assets. The permanent fund is used to account for resources that are legally restricted to the extent that only earnings, and not the principal, may be used for purposes that support the government’s programs.

Governmental funds financial statements include the balance sheet, the statement of revenues, expenditures, and changes in fund balances, and the statement of cash flows. The balance sheet reports the assets, liabilities, and fund balances of the government’s funds at a particular point in time. The statement of revenues, expenditures, and changes in fund balances reports the inflows and outflows of resources and the resulting changes in fund balances for a particular fiscal period. The statement of cash flows reports the sources and uses of cash for a particular fiscal period.

Notes to Financial Statements

Notes to financial statements provide additional information relevant to the financial statements. These notes may include details regarding the accounting principles used, information regarding significant transactions, estimates, and assumptions made by management in preparing the statements. The notes to financial statements are an integral part of the financial statements and provide important information that is not otherwise apparent from the face of the financial statements.

For example, the notes to financial statements may include information about the government’s policies for recognizing revenue and expenses, the methods used to value assets and liabilities, and the types of risks that the government faces. Additionally, the notes to financial statements may provide information about the government’s pension and other postemployment benefit plans, as well as its long-term debt obligations.

Comprehensive Annual Financial Report (CAFR)

A Comprehensive Annual Financial Report (CAFR) is a comprehensive audit of the government’s financial position. It includes all of the statements and notes to financial statements, as well as an analysis of the government’s finances. The analysis provides an overview of the government’s financial condition, including its short-term and long-term financial prospects.

The CAFR is typically prepared by the government’s finance department or an independent auditor. It is an important tool for investors, analysts, and other stakeholders who are interested in understanding the government’s financial position and prospects. The CAFR may also include information about the government’s economic and demographic trends, as well as its major initiatives and accomplishments.

In conclusion, financial reporting under modified accrual accounting is an important aspect of government accounting. The governmental funds financial statements, notes to financial statements, and Comprehensive Annual Financial Report provide valuable information about the government’s financial position, operations, and prospects. These reports are essential for investors, analysts, and other stakeholders who are interested in understanding the government’s financial health and performance.

Modified Accrual Accounting

Modified accrual accounting is a valuable method of accounting for government entities. Not only does it allow for accurate tracking of revenues and expenditures but also ensures consistent reporting. With proper implementation and adherence to accounting standards, governments can efficiently manage their finances and make informed decisions.

Leave a Reply