Journal Entries

In this comprehensive guide, we will delve into the intricacies of QuickBooks journal entries and explore the process of deleting them. As a QuickBooks user, understanding how to manage and delete journal entries is crucial for maintaining accurate financial records and ensuring the integrity of your bookkeeping. How to Delete Journal Entries In QuickBooks.

Read moreThis article explains the difference between adjusting entries and correcting entries in accounting. Learn how to identify and record these entries to ensure accurate financial records.

Read moreThis article explains the difference between adjusting entries and closing entries in accounting. Learn how these two types of entries are used to ensure accurate financial records and how they affect the balance sheet.

Read moreLearn the basics of accounting for the sale of land, including the different types of land sales, the accounting entries required, and the tax implications.

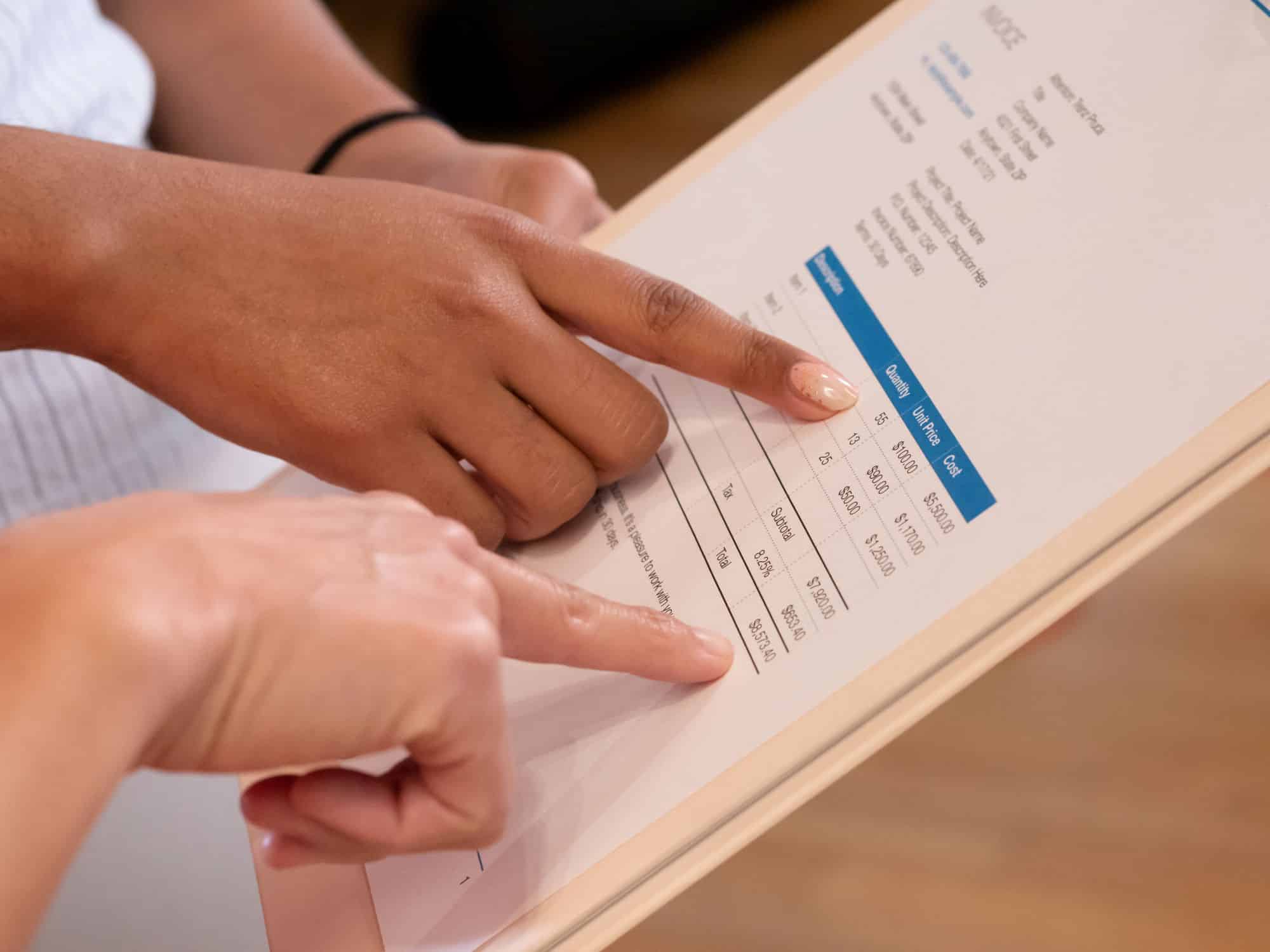

Read moreLearn how to post to the general ledger with this comprehensive guide. Understand the basics of accounting and the importance of the general ledger in the accounting process. “

Read moreDiscover the key responsibilities of an accounting manager and gain insights into their role in financial management, budgeting, reporting, and team leadership.

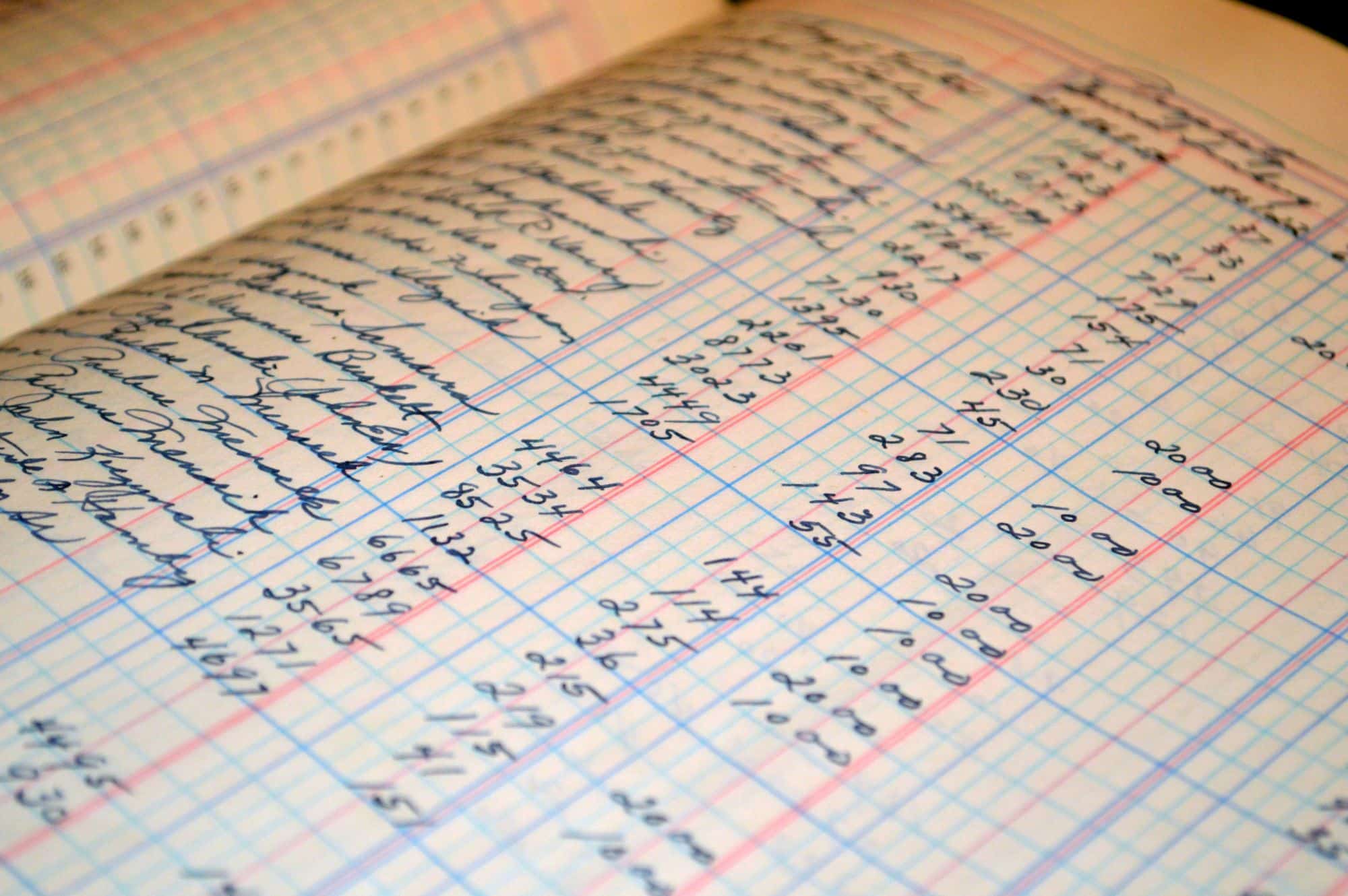

Read moreJournal entries are and essential part of accounting. They are the foundation for financial statements and show a company’s profitability and financial health. They document inflows and outflows of funds and provide and organized record of business transactions such as dates, accounts, amounts and descriptions. What are the golden rules for making journal entries?

Read more