IRS

Learn about the importance of Form 8379 in filing taxes. Understand how it helps protect your share of the refund and navigate complex filing situations.

Read moreUnderstand the purpose of Form 6781: Learn about tax reporting for Forex and securities contracts. Discover the purpose, requirements, and penalties associated with this crucial document. Gain insights to ensure compliance with tax regulations. Read more now.

Read moreAre you looking for information about 1035 Exchanges? Learn more about 1035 Exchanges and how they can help you save on taxes and maximize your retirement savings. Get the facts and make an informed decision about your financial future.

Read moreDo you record in ledger or journal first? It’s a crucial topic that must be explored for effective financial transaction recording. Traditionally, businesses would start with the journal then transfer to the ledger. But modern tech and accounting practices allow for direct input into specialized software or spreadsheets. Do you record in ledger or journal […]

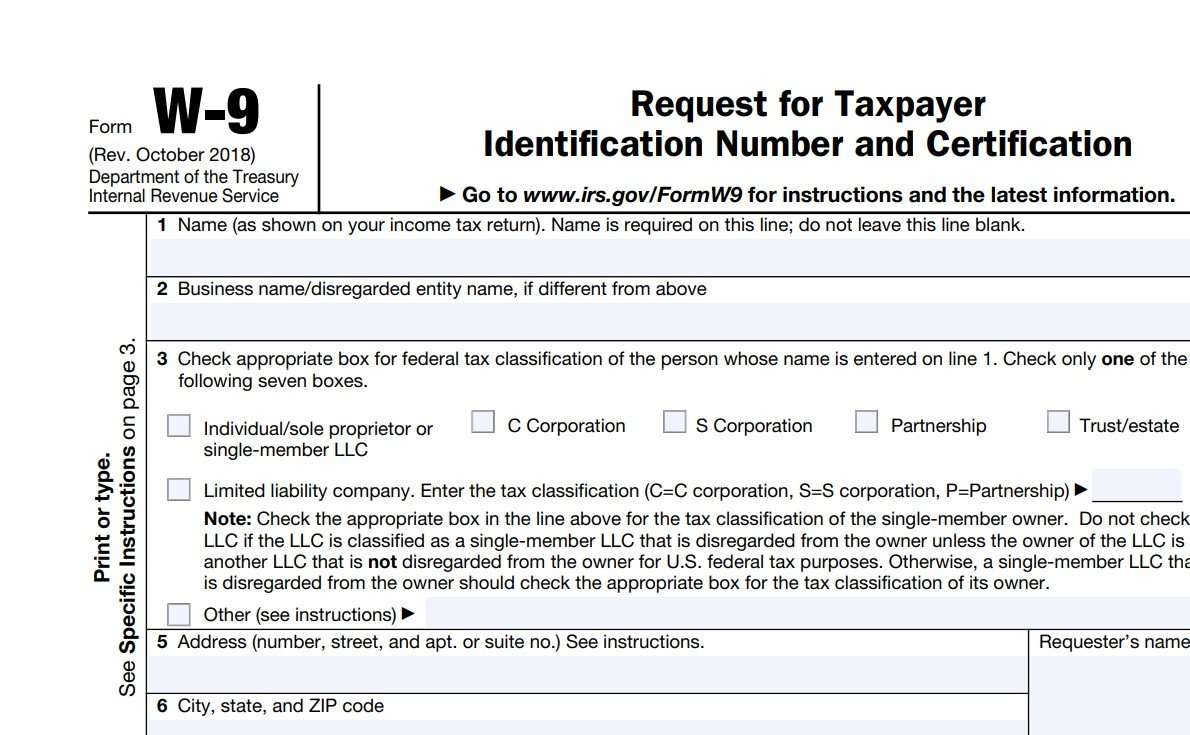

Read moreIt’s a good practice to get a W-9 form whenever you engage an independent contractor. When you request a W-9 form, you are indicating to freelancers that you plan to keep your business dealings formal. What is a W9 Form and Why would a business request one?

Read moreOne of the biggest financial mistakes that put businesses at risk is by mingling their personal and business finances. As a business owner, you don’t want to open yourself to liability or fall further into debt due to poor money management by letting your business and personal expenses mix. How do you keep business and […]

Read moreNot only is tax preparation exceedingly time consuming — it’s confusing and frustrating. Sound familiar? Are any of your company policies and procedures frustrating and confusing?

Read more