What is a W-9 Form and Why would a business request one?

It’s a good practice to get a W-9 form whenever you engage an independent contractor. When you request a W-9 form, you are indicating to freelancers that you plan to keep your business dealings formal. What is a W9 Form and Why would a business request one?

What’s a W-9 Form and When Does Your Business Need to Request One?

Most of us agree that filing our taxes is more complicated than it needs to be. There are so many forms, acronyms, and processes we have to keep track of and complete, especially as business owners. One of these forms is the W-9, which is essential if you hire freelancers.

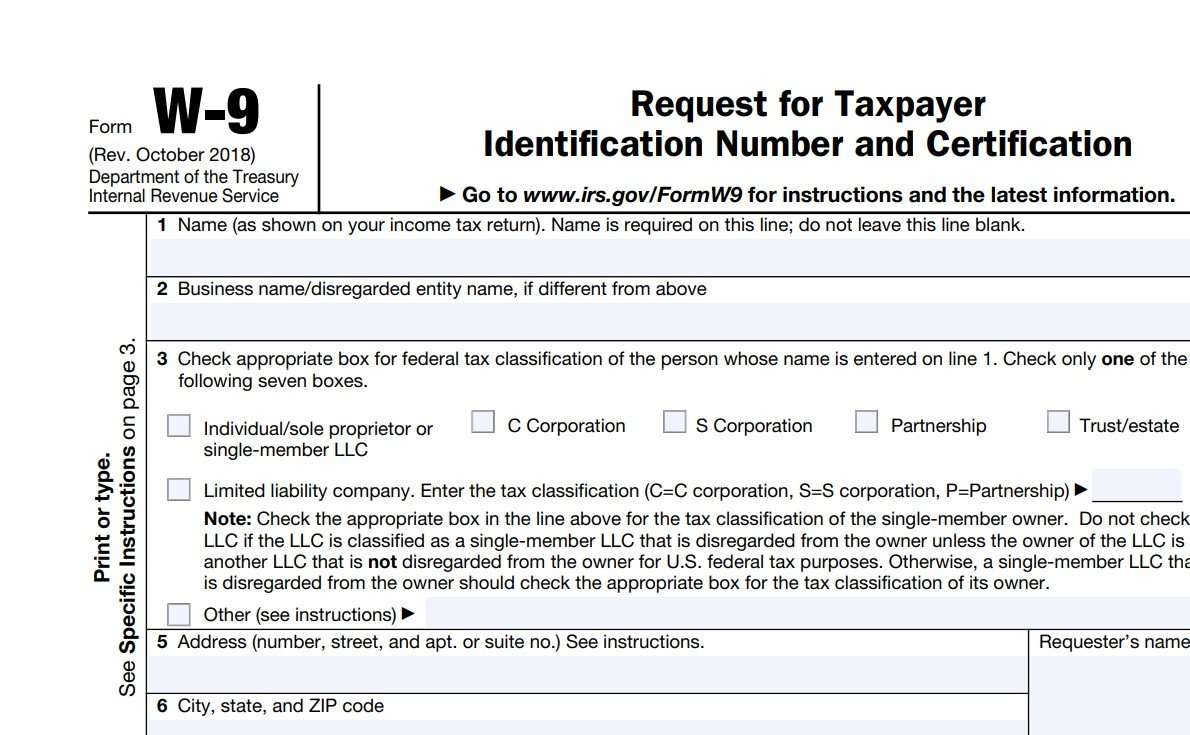

What is a W-9 Form?

A W-9 form, also known as the “Request for Taxpayer Information” form, is an IRS document issued to individuals to obtain their tax identification number (TIN) and mailing address. The IRS uses the W-9 form to collect taxpayer information.

Whether you use a W-9 generator or get the document off the IRS website, you do not need to submit these forms to the IRS. Instead, your company will keep this document on file so it can be used to fill out other informational tax forms, such as the 1099-NEC for freelancers.

When Should Your Business Request a W-9?

There are four circumstances when a company might collect a W-9 form from an individual. The most common include hiring a contractor, but there are 3 other reasons to ask for one.

1. Hiring a Contractor or Freelancer

If you have to collect information about an independent contractor, self-employed individual, or freelancer, you have to use a W-9 form. By law, independent contractors can’t start working for you until you’re provided with a complete W-9, which can be sent back and forth electronically.

2. Opening a New Account at the Bank

If you operate as a bank, you may ask your customers for a W-9 to submit tax information to the IRS. However, banks will typically only ask for a W-9 if the new customer has earned interest on their investments. Otherwise, they’ll ask for a customer’s personal information on another form.

3. Canceled Debt as Taxable Income

If a person has a loan with a lender and the lender cancels the debt, either due to bankruptcy or some other means, that canceled debt is considered taxable income. To provide this information to the IRS, the person who had the loan will fill out a W-9 form and deliver it to the lender.

4. A Request From an Investment Firm

Investment firms, like banks, may have to submit a W-9 form if the client needs to provide details about gains or dividends earned to the IRS. Form W-9 will also track income paid to the client through capital gains, royalties, and rents, which are also considered investment income.

What’s the Difference Between a W-9, W-4, and 1099-NEC?

The W-9 and W-4 are used by businesses that regularly hire employees or freelancers, but what’s the difference between the two? When would you need to fill out a 1099-NEC?

W-9 Form vs. W-4 Form

The W-9 form and W-4 look almost identical. In fact, taxpayers who fill out both documents will need to include their name, contact information, and social security number. Businesses will then put their business contact information and Employer Identification Number somewhere on the form.

The biggest difference between both forms is who they’re intended for. A W-9 form is used for independent contractors or people, entities, or businesses who will be paid by a company. A W-4 is used for company employees and includes extra sections pertaining to deductions.

1099-NEC Form

Employers who hire independent contractors must also submit a 1099-NEC to the IRS and said contractor provided they were paid at least $600 within the tax year. If you paid a contractor less than $600, you don’t have to submit a 1099-NEC, but you should put this amount on your taxes.

Freelancers who should receive a 1099-NEC aren’t required to send a copy to the IRS, even if their client doesn’t submit it. Employers must submit all 1099-NEC forms by the end of January.

When in Doubt, Request a W-9 Form

Whenever you hire an independent contractor, it’s a good idea to request a W-9 form every single time, even if you don’t plan on using their services in the future. When you request a W-9 form, you’re showing freelancers that you intend to keep your business dealing official.

There’s nothing more terrifying than paying illegal vendors who could be committing tax evasion, money laundering, or worse. The W-9 can protect you from shady dealings and help you with employment law compliance.

Leave a Reply