accounting policy

Learn how to convert from accrual basis to cash basis accounting with this easy-to-follow guide. Understand the differences between the two methods and the advantages of each to make the best decision for your business. “

Read moreLearn how to reconcile accounts receivable and ensure accuracy in your accounting records. Get tips and advice on the best practices for successful account reconciliation. “

Read moreThe current ratio and quick ratio are two of the most important financial ratios used to measure a company’s liquidity. They are both used to assess a company’s ability to pay its short-term obligations. The current ratio measures a company’s current assets against its current liabilities, while the quick ratio measures a company’s liquid assets against its current liabilities. Knowing the difference between the current ratio and quick ratio can help investors make more informed decisions when evaluating a company’s financial health.

Read moreGain a comprehensive understanding of revenue reporting with our article “When Revenues Are Reported: An Overview.” Learn about the different methods of revenue recognition and how they impact financial statements.

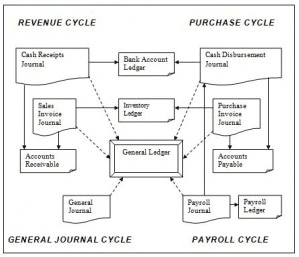

Read moreThe compilation and presentation of financial statements are governed by a set of rules known as Generally Accepted Accounting Principles (GAAP) in the accounting industry. Although firms are not obligated by law to adopt GAAP, the subject of whether accounting policies should do so frequently arises. Must Accounting Policies Follow GAAP?

Read moreLearn how to write effective accounting policies with our comprehensive guide.

Read more