How to Convert Accrual Basis to Cash Basis Accounting

Cash basis accounting records financial transactions when they are paid or received in cash. It’s simpler and easier to understand than accrual basis accounting. Let’s explore how to convert from accrual to cash basis. How to convert accrual basis to cash basis accounting.

Converting Accrual Basis to Cash Basis Accounting

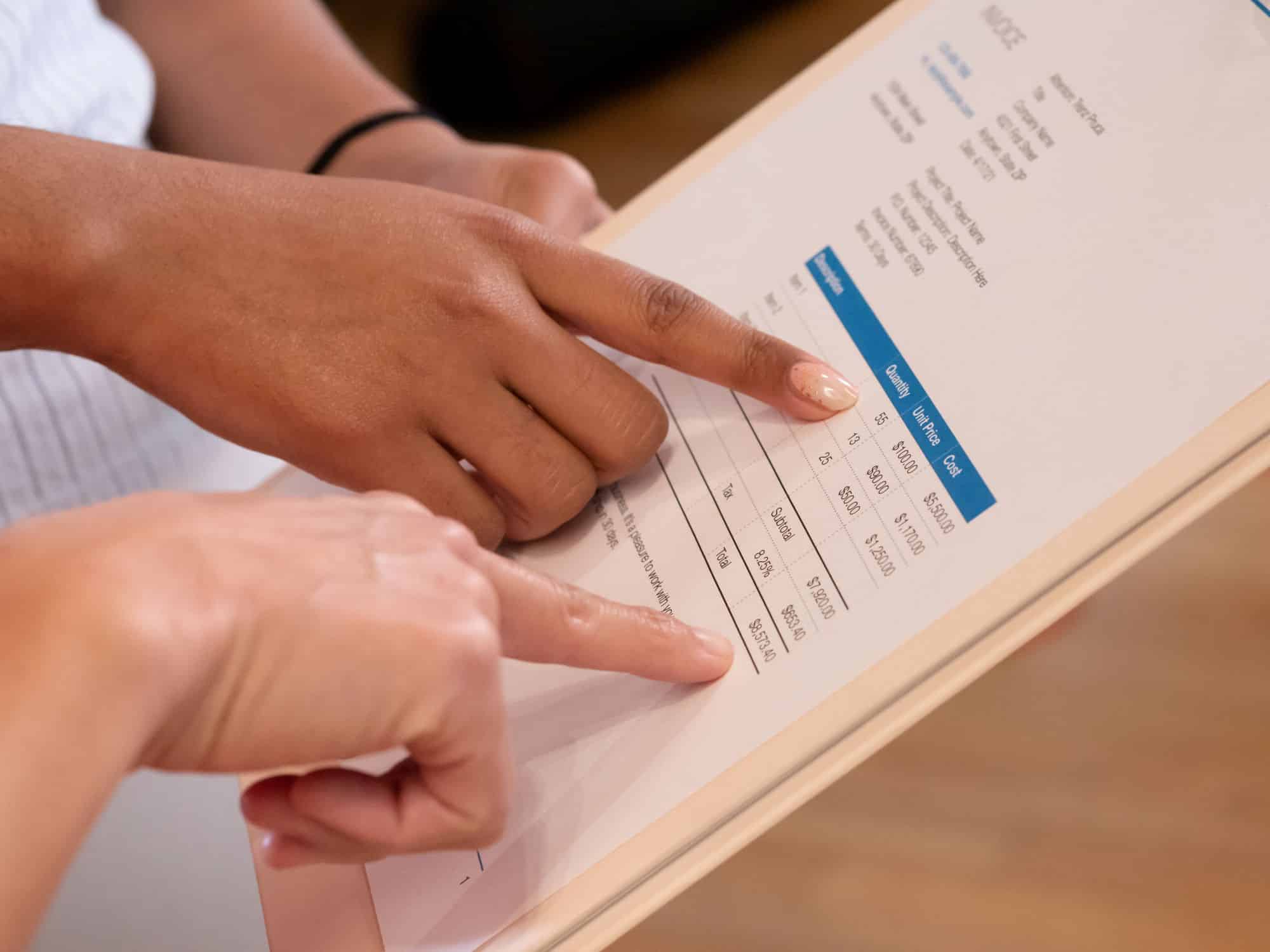

To begin, identify all outstanding accounts receivable an Convert Accrual Basis to Cash Basis Accounts payable. This includes invoices issued but not paid, and bills received but not paid. Then, adjust the revenue and expenses in the financial statements.

In accrual basis, revenue is recognized when earned, and expenses when incurred. Whereas, in cash basis, revenue is only recognized when received, and expenses when paid.

It’s important to remember that this conversion could change the financial statements significantly. This could affect key financial ratios and performance indicators used for decision-making.

Investopedia points out that accrual basis accounting gives a more accurate financial picture over a period of time. However, cash basis may be better for small businesses or those with simple transactions due to its simplicity.

Understanding Accrual Basis Accounting

Accrual basis accounting refers to a method of recording financial transactions in the books at the time they are incurred, regardless of when the cash is actually received or paid. It provides a more accurate picture of a company’s financial health by recognizing revenue and expenses when they occur, rather than when the cash is exchanged.

This method is widely used by businesses to comply with the Generally Accepted Accounting Principles (GAAP) and provides a more comprehensive view of a company’s financial activities.

By recognizing revenue and expenses on an accrual basis, businesses can better match revenues with the expenses incurred to generate them, resulting in more accurate financial statements and reports. Additionally, accrual basis accounting allows for the inclusion of accounts receivable and payable, providing a clearer representation of a company’s cash flow.

In summary, accrual basis accounting offers a more accurate and informative way of recording financial transactions, ensuring that a company’s financial statements reflect its true financial position.

Accrual basis accounting: Making money appear out of thin air, just like a magician with a limitless supply of rabbits in his hat.

Explanation of accrual basis accounting and its benefits

Accrual basis accounting is a way to record financial transactions. Revenues and expenses are noted when earned or incurred, regardless of when cash is received or paid. This offers a more precise look at a company’s financial status and performance than cash basis accounting.

By following accrual basis accounting principles, businesses can link revenues and expenses. This helps stakeholders like investors, lenders, and management make informed decisions based on a company’s real profitability.

Accrual basis accounting has a unique benefit. It allows businesses to track and measure income and expenses over time. This helps recognize trends, analyze performance, and predict future outcomes. For example, recognizing revenue when a sale is made instead of when payment is received, helps businesses understand sales cycles, customer behaviors, and pricing strategies.

Another advantage of accrual basis accounting is that it assists with industry regulations. Many industries require companies to use this method for reporting. By following these standards, businesses show transparency and credibility to stakeholders.

To make the most of accrual basis accounting, businesses should keep accurate records of accounts receivable and accounts payable. This ensures that all transactions are properly recorded in the right period.

Plus, regular reconciliations between accrual accounts and cash accounts should take place. This looks for any discrepancies or errors in the recording process and keeps financial statements accurate.

Also, businesses should set up solid internal controls to prevent or find fraudulent activities related to accruals. This includes dividing duties, regular audits, and comprehensive reviews of financial documents.

Examples of transactions recorded under accrual basis accounting

Accrual basis accounting is a common practice used by businesses to keep track of financial transactions. It shows a more comprehensive and precise picture of a company’s financial situation. This method recognizes revenues when they are earned and expenses when they are incurred, not when the cash is received or paid out.

Examples of transactions that would be recorded using accrual basis accounting are: sale of goods, purchase of supplies, accrued salaries, and depreciation. These transactions illustrate how this method records revenues and expenses properly, providing an accurate representation of a company’s profitability.

Furthermore, accounts receivable and accounts payable are two key elements of accrual basis accounting. Accounts receivable refers to the money owed to a business by customers. Whereas, accounts payable means the money owed by a business to suppliers or vendors. These two factors must be carefully monitored and documented under this method.

Interestingly, the concept of accrual basis accounting dates back to the Renaissance period in Italy. Merchants needed a way to accurately record their transactions, leading to the development of this method. Since then, it has become a part of modern-day accounting around the world.

In conclusion, understanding examples of transactions recorded under accrual basis accounting is beneficial for businesses. By using this method, businesses can make informed decisions based on their real financial position.

Understanding Cash Basis Accounting

Cash Basis Accounting is a method of bookkeeping where revenues and expenses are recognized only when payment is received or made, respectively. This accounting method differs from Accrual Basis Accounting, which recognizes revenues and expenses when they are earned or incurred, regardless of when cash is received or paid.

In Cash Basis Accounting, cash flow is the primary focus, making it a simpler and more straightforward method for small businesses or individuals. Unlike Accrual Basis Accounting, it does not consider accounts receivable or accounts payable. By using Cash Basis Accounting, businesses can have a clearer understanding of their immediate cash flow and financial position.

Cash basis accounting: where cash is king and accruals are the court jesters, but be careful not to let the laughter distract you from the potential pitfalls.

Explanation of cash basis accounting and its advantages and disadvantages

Cash basis accounting is a way of recording transactions based on real cash inflows and outflows. Businesses must consider the advantages and disadvantages when selecting their accounting method.

Advantages:

- Easy to understand: Cash basis accounting is direct, making it simpler for small businesses without professional accountants to manage their books.

- Reveals true cash available: By noting only cash transactions, this method provides an accurate view of the company’s present liquidity.

- No need to monitor accounts receivable or payable: With cash basis accounting, there’s no need to keep tabs on unpaid invoices or unpaid bills, streamlining bookkeeping.

- May provide tax benefits: In some cases, businesses may be able to defer taxable income by using the cash basis technique.

Disadvantages:

- Does not show the real financial position: Cash basis accounting neglects to seize all income and expenses incurred in a period, which can lead to inaccurate financial statements.

- Cannot accurately decide profitability: Since it notes only cash transactions, this method does not include future liabilities or revenue streams when assessing overall performance.

- Inability to stick with Generally Accepted Accounting Principles (GAAP): Several regulatory bodies require businesses to obey GAAP guidelines, which often means using accrual basis accounting instead of the cash basis.

- Limited analysis capacities: Without precise records and accrual info, analyzing business performance over time becomes difficult.

Also, it’s essential to be aware that while cash basis accounting can be fitting for small businesses with simple operations and reporting needs, it may not be suitable for bigger companies that require more comprehensive financial reporting.

Examples of transactions recorded under cash basis accounting

Cash basis accounting is a system that pays attention to cash flow in a business. It’s commonly used by small businesses and people who don’t have complex finance.

For instance:

- Transaction: Sale of goods. Date: April 10, 2022. Cash Inflow: $1,000. Cash Outflow: -.

- Transaction: Purchase of office supplies. Date: May 5, 2022. Cash Inflow: -. Cash Outflow: $200.

Also, Payment received from customer, which makes a great gift. Citing convenience and features. Participating in soccer matches, to ask for and value your opinion and knowledge. User-friendly interfaces with affordances.

Converting from Accrual Basis to Cash Basis Accounting

Converting from Accrual Basis to Cash Basis Accounting is a crucial step for businesses looking to streamline their financial reporting. This process involves transitioning from recording transactions when they occur (accrual basis) to tracking them when cash is received or paid (cash basis).

To better understand the conversion, here are five key points to consider:

- Identify revenue and expenses: Start by categorizing revenue and expenses based on whether they have already been recognized or not. Revenue that has been earned but not received and expenses that have been incurred but not yet paid fall under accrual basis, while cash received and paid fall under cash basis accounting.

- Adjust accounts receivable and accounts payable: Accrual basis accounting recognizes revenue and expenses even if cash has not been exchanged. To convert to cash basis, adjust the accounts receivable and accounts payable balances to reflect only the transactions that have resulted in cash inflows and outflows.

- Revise inventory values: Under accrual basis, inventory is recorded at cost, regardless of when it was purchased. However, under cash basis, inventory should be valued at the actual cash outlay. Adjust the value of inventory accordingly to reflect the cash basis.

- Update prepaid expenses and deferred revenue: Prepaid expenses and deferred revenue are commonly recorded under accrual basis accounting. In the conversion process, adjust these accounts to reflect the actual cash flows rather than the timing of when they were recognized.

- Prepare financial statements: Once the necessary adjustments have been made, prepare the financial statements based on the cash basis accounting. This includes updating the income statement, balance sheet, and statement of cash flows to reflect the transition from accrual to cash basis.

It is worth noting that this conversion process may vary depending on the specific accounting policies and practices of each business. Therefore, seeking professional guidance or consulting an accountant with expertise in this area is highly recommended.

In terms of unique details, it is important to consider the impact of the conversion on tax reporting. Depending on the jurisdiction, the tax authorities may require businesses to continue using accrual basis accounting for tax purposes, even if they switch to cash basis accounting for internal reporting. It is crucial to consult with tax professionals to ensure compliance with applicable tax regulations.

A true history related to this topic revolves around the implementation of the Sarbanes-Oxley Act (SOX) in the United States in 2002. This legislation aimed to improve corporate governance and financial reporting practices.

SOX introduced more stringent regulations and required public companies to adhere to accrual basis accounting for their financial statements. It reinforced the importance of accurately capturing transactions and maintaining transparent financial records.

Converting to cash basis accounting: because who needs those pesky financial complexities when you can just focus on securing the bag?

Reasons for converting

Converting from accrual to cash basis accounting is a popular option for businesses. It offers numerous advantages, such as:

- Improved cash management

- Simpler financial reporting

- Clearer visibility of available funds

- Easier budgeting

The straightforward nature of cash transactions also reduces the risk of accounting errors and helps businesses stay compliant with tax regulations. Furthermore, stakeholders find cash basis financial reports easier to understand. All these factors contribute to increased efficiency and effective decision-making.

It is important to evaluate your unique circumstances before making any changes. Professional advice from accountants or financial experts can be beneficial.

Fun Fact: 24% of small businesses in the US use cash basis accounting for its simplicity and practicality.

Step-by-step guide on converting from accrual basis to cash basis accounting

Converting from accrual to cash basis accounting can be complex. But, with the right steps, it can be done smoothly! Here’s a guide to help you.

- Review your financials: Look over your accounts and identify what’s on an accrual basis. This includes receivables, payables, and other relevant expenses and revenue.

- Analyze impacts: Figure out how this switch may affect your financial statements. Accrual records transactions when they happen, while cash does so when money is exchanged. This could lead to differences in revenue and expense recognition.

- Adjust accounts: Make necessary changes to switch to cash-based accounts. If there are outstanding receivables, for example, remove them from your books as they’re not considered cash receipts.

- Update revenue recognition: Update policies to match cash basis accounting. Under accrual, revenue is recognized when earned, not when cash is received. In contrast, cash basis only recognizes revenue when money is received.

- Reconcile discrepancies: After switching, reconcile any discrepancies between the old and the new financial statements.

- Inform stakeholders: Tell investors, employees, and creditors about the transition. Explain how this change may affect financial reporting and decision-making.

Also, consider getting professional help. Converting can be tricky for businesses with complex transactions or specialized industries. An experienced accountant or financial advisor can help you stay accurate. Plus, anticipate potential challenges such as employee training and initial confusion.

Follow this guide to convert successfully from accrual to cash basis accounting. Assess financials, adjust accounts, update revenue recognition, reconcile discrepancies, and communicate changes. Also, think about getting help and planning for potential challenges.

Tips and considerations for a successful conversion

- Understand the contrast between accrual basis and cash basis accounting.

- Scan your financial reports to locate any issues or disparities which could appear in the conversion.

- Hire a pro accountant or financial advisor who is an expert in accounting changes.

- Construct a plan that includes steps and timeline, with all involved stakeholders informed.

- Audit and compare data repeatedly while and after the transition, for accuracy and consistency in the new cash basis system.

- Remember to keep the team connected throughout the transition. By doing this, you can solve any worries or queries that may arise, to ensure a simpler transition.

- Seize this chance to enhance by utilizing tech tools that can make the conversion smoother.

Convert Accrual Basis to Cash Basis Accounting

To convert from accrual basis to cash basis accounting, it is vital to recognize unearned revenue or prepaid expenses. Adjustments should be made when cash is actually paid or received. This will give an accurate representation of the company’s financial position.

Moreover, review accounts receivable and payable. Any unlikely balances should be written off or adjusted. This will provide a better understanding of the company’s cash flow.

Another important aspect is inventory valuation. Under accrual basis, record at cost or market value, whichever is lower. But under cash basis, record at actual cost. May need to adjust inventory values.

Also, look at long-term assets and liabilities. Adjust depreciation expenses and recognize interest expenses when payment is actually made.

Furthermore, ensure compliance with applicable tax laws. Professional advice can help navigate through any complexities and guarantee accurate reporting.

Overall, converting from accrual basis to cash basis accounting requires attention and knowledge of both methods. By adjusting financial statements and reconciling differences between accruals and cash flows, businesses can see a precise representation of their financial position.

Also, management should explain the reasons for the conversion to stakeholders like investors and lenders. This will help them comprehend any changes in financial figures and avoid misinterpretation.

In short, converting from accrual basis to cash basis accounting is a difficult but necessary process. By carefully analyzing financial statements, making suitable adjustments, and seeking professional advice if needed, businesses can get an accurate representation of their financial position and comply with relevant accounting standards.

Frequently Asked Questions

Q1: What is the difference between accrual basis and cash basis accounting?

Q1: What is the difference between accrual basis and cash basis accounting?

A1: Accrual basis accounting records transactions when they occur, regardless of when cash is exchanged. Cash basis accounting, on the other hand, only records transactions when cash is received or paid.

Q2: Why would I want to convert from accrual basis to cash basis accounting?

A2: Converting to cash basis accounting can provide a clearer picture of your business’s cash flow, especially if you operate on a cash basis or need to track cash flow for tax purposes.

Q3: How do I convert accounts receivable from accrual to cash basis?

A3: To convert accounts receivable from accrual to cash basis, subtract any unpaid receivables at the beginning of the period and add any receivables that were collected during the period.

Q4: How do I convert accounts payable from accrual to cash basis?

A4: To convert accounts payable from accrual to cash basis, subtract any unpaid payables at the beginning of the period and add any payables that were paid during the period.

Q5: Are there any limitations or considerations when converting to cash basis accounting?

A5: Yes, it’s important to note that converting to cash basis accounting may not be suitable for all businesses, especially those with complex financial transactions. It’s essential to consult with a qualified accountant or financial advisor before making the switch.

Q6: Can I convert from cash basis back to accrual basis accounting?

A6: Yes, it is possible to convert from cash basis back to accrual basis accounting. However, it’s best to seek professional guidance as the process can be more complex and may require adjustments to previous financial statements.

Leave a Reply