What is a Risk Matrix?

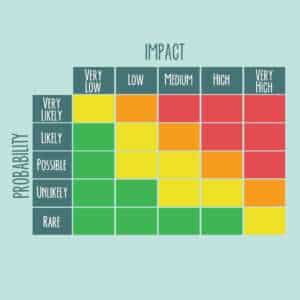

A Risk Matrix is a crucial tool for project managers in risk management. It helps businesses assess and prioritize potential risks based on their likelihood and impact. You can place risks on a grid, with the horizontal axis showing the probability of an event happening and the vertical axis showing the possible effect it could have.

The Risk Matrix has a unique feature – you can assign colors or labels to each risk category. For instance, high-risk events could be labeled as “critical” and low-risk events could be labeled as “negligible”. This makes it easier to understand and communicate the severity of each risk.

As an example, Company XYZ used a Risk Matrix to assess possible cyber threats. It revealed that an out-of-date software system was both likely and damaging to their data security. So, they allocated resources to update their software and prevent any data breaches.

What is a Risk Matrix?

To better understand what a risk matrix is, dive into its definition and purpose. Discover how it can become a valuable tool for risk management. Delve into the importance and benefits of utilizing a risk matrix in decision-making processes.

Definition and Purpose of a Risk Matrix

A risk matrix is a useful tool to assess risks in an organized way. It shows the likely consequences and chance of various risks, aiding organizations to prioritize their risk management tasks. Each risk is put into a certain spot in the matrix, based on the impact and likelihood.

The matrix is divided into sections, each representing a different level of risk severity. The size, colour, or shading of each section could be different. Risks with high-severity and high-likelihood are the top priority, whereas those with low-severity and low-likelihood may be accepted or need little intervention.

The purpose of using a risk matrix is to give an orderly approach to risk assessment, helping organizations assign resources correctly. By mapping out risks and their potential impacts, decision-makers can make wise choices about how to manage them. This lets organizations ensure their risk tolerance and actions for managing risks are aligned.

In reality, many organizations have used the risk matrix to tackle different issues. One example is an international construction firm that had to manage a complex project in an area prone to earthquakes. The risk matrix was used to spot potential dangers due to earthquakes and prioritize measures to reduce their impact.

This risk matrix was their guide in allocating resources towards engineering solutions to decrease structural weaknesses and setting up quick evacuation systems during seismic events. In the end, it safeguarded workers and allowed the project to carry on.

The advantage of the risk matrix is that it turns complex data into visuals, assisting decision-making. As organizations face changing risks, the risk matrix is a key tool in their toolbox, making it easier to make proactive choices for growth. It’s like having a crystal ball that shows the chance of a project failing – without the psychic hotline charges!

Importance and Benefits of Using a Risk Matrix

A risk matrix is a tool used to assess and manage risks in various industries. It shows potential risks, their likelihood, and impact. This helps stakeholders make informed decisions and prioritize actions.

Benefits of using a risk matrix include:

- Better risk assessment – look at probability and severity.

- Decision-making is improved – prioritize actions.

- Communication is clearer – common framework.

- Proactive risk management – plan in advance.

Regular updates and reevaluation of the risk matrix are key. This ensures organizations stay ahead of risks.

As an example, in 2011, the US East Coast was hit by Hurricane Irene. Emergency managers used a risk matrix to prepare. They mapped out scenarios based on wind speed, storm surge, and population density. This enabled them to accurately determine evacuation zones and allocate resources. Millions of people were safely evacuated, with minimal loss of life and property damage. The use of a risk matrix was essential to managing this crisis.

Creating a risk matrix is like finding the right balance between predicting the worst and being optimistic.

How to Create a Risk Matrix

To create a risk matrix, start with identifying and defining the risks. Then, determine the likelihood and consequences of each risk. Next, assign risk levels based on this assessment. Finally, develop a risk matrix grid to visually represent the different risk levels.

Step 1: Identify and Define the Risks

Identifying and defining risks is the first crucial step in creating a risk matrix. Gaining a comprehensive understanding of potential threats and challenges enables you to develop strategies to mitigate their impact and ensure success. Follow these steps to effectively identify and define risks:

- Analyze project/organization – assess goals, objectives, stakeholders, resources, and timelines. Identify vulnerabilities and areas where risks are likely.

- Brainstorm possible risks – engage with team members, stakeholders, or experts. Encourage open communication.

- Categorize the risks – classify financial, operational, technical, legal, or reputational. Prioritize your efforts.

Continuously monitor and update your risk register as new risks emerge or existing ones evolve. Regularly review and reassess your risk matrix. Take charge today by incorporating this process into your project planning. Your future success depends on it!

Step 2: Determine the Likelihood and Consequences of Each Risk

Determining Likelihood and Consequences of Risks is key to creating a risk matrix. Analyzing both lets you gain insights into potential impact and probability. Here’s a 3-step guide:

- Identify likelihood: Analyze factors that contribute to risk. Use historical data, expert opinions & existing controls/mitigations. Assign qualitative/quantitative rating for probability/frequency.

- Evaluate consequences: Assess potential impact if a risk occurs. Identify tangible/intangible consequences (e.g. financial losses, reputational damage, operational disruptions, safety hazards). Assign qualitative/quantitative rating for severity/magnitude.

- Combine likelihood & consequences: Create a matrix. Plot each risk point in it based on ratings. Visual representation helps prioritize risks.

Also, consider context-specific details (e.g. industry trends, regulatory requirements, organizational objectives, stakeholder expectations). These shape your understanding & guide decision-making.

A real-life example: In 2010, an automotive company underestimated both likelihood (caused by inconsistent manufacturing processes) & severe consequences (including legal implications). Failed assessment led to major financial repercussions, damaged brand reputation, legal battles & bankruptcy.

By assessing likelihood & consequences, you can anticipate & manage risks. Protecting your business with the right measures!

If risk levels had a competition, I’d be the champion – I always ace it when it comes to evading lawsuits!

Step 3: Assigning Risk Levels

Risk levels are a must for constructing a risk matrix. By assessing and classifying potential risks, you can prioritize them and take action. This step helps you understand the chances and effect of each risk, so you can make wise decisions.

Four steps to assign risk levels:

- Step 1: Name the risks. Look into all risks that may come up during your project or decision-making.

- Step 2: Analyze the chances of each risk happening. Estimate the probability of each risk event, with data and expertise.

- Step 3: Gauge the impact of each risk. Decide what consequences could come with each risk.

- Step 4: Rank risks based on their likelihood and impact. Appoint categories, such as low, medium, and high severity levels.

Remember to consider all factors when assigning the right risk levels, including historical data, expert opinions, and project-specific elements.

Take action to manage risks properly. Ignoring or misjudging risk levels could lead to bad outcomes for your project or organization ‚Äì don’t slack on this important step!

In short, by assigning accurate risk levels through a logical method, you can discover potential threats and make smart decisions to protect your projects from surprises. Begin evaluating and categorizing risk levels now! Conquer risk by forming a matrix grid – the name of the game is Risk, after all.

Step 4: Developing a Risk Matrix Grid

Developing a Risk Matrix Grid is like playing chess with your fears. It involves creating a visual representation based on the likelihood and impact of each risk. Here’s a 5-step guide to help you create an effective Risk Matrix Grid:

- Determine the criteria – Define the factors used to assess the likelihood and impact, e.g. probability, severity, or frequency.

- Assign ratings – Use a numerical rating system, such as a 1-5 scale, with 1 being low and 5 high.

- Create the matrix – Construct a grid with two axes representing the likelihood and impact ratings.

- Plot risks – Place each identified risk on the matrix according to its ratings.

- Analyze and prioritize – Determine the significance of each risk by noting its position on the Matrix. High likelihood-high impact quadrant risks should be top priority.

By regularly reviewing and updating the risk matrix based on changing circumstances or new information, organizations can improve their risk management process. The risk matrix provides an at-a-glance overview of potential risks, allowing them to allocate resources more effectively and manage potential risks proactively.

How to Use a Risk Matrix

To effectively utilize a risk matrix, grasp the concept of risk assessment, address high-risk areas, and create risk mitigation plans. Interpret the risk matrix to understand its implications, identify and prioritize high-risk areas, and develop strategies to minimize potential risks. Each sub-section offers valuable insights into applying the risk matrix successfully.

Interpreting the Risk Matrix

Evaluating the risk matrix is key for accurate decision-making. It gives a visual representation of the risks and their potential effects. To interpret the matrix, consider both the likelihood and severity of each risk. The likelihood is the chance of an event occurring, and the severity is the consequences if it does happen.

Organizations should assign specific actions or controls to each level of risk identified in the matrix. This guarantees preventative actions are taken to reduce the impact of high-risk events. The risk matrix also guides organizations in implementing appropriate risk management strategies.

Risk matrices are popular across industries as a practical tool for risk assessment and management. Its organized approach helps organizations detect, analyze, and react appropriately to threats and opportunities. By using a risk matrix, businesses can improve their decision-making and protect their interests in a complicated business environment.

Identifying High-Risk Areas

To find high-risk areas, it’s important to collect data on possible threats and weaknesses in the organization’s surroundings. Analyzing past incidents and doing risk assessments can show which areas usually have higher levels of risk – like certain places, tools, processes, or people. This helps organizations focus on preventive measures and use resources better.

It’s also useful to keep up with industry trends. Keeping up with regulations and best practices makes sure organizations are proactive with risk management. Staying informed about risks specific to their field can be done by reading, joining conferences, and networking. Recognizing trends quickly lets them make quick adjustments or make new strategies.

Regulatory guidelines are also helpful for finding high-risk areas. Following industry standards gives organizations a base for risk assessment. It shows commitment to safety and earns trust from stakeholders. It’s important to review and update internal policies and procedures with new regulations to have a strong risk management system.

Don’t let complacency put your organization at risk! Start assessing your high-risk areas and take action. The consequences of not paying attention to these areas are too severe to ignore. Take action and gain confidence in your ability to manage risks, protecting your organization’s reputation and earnings.

Developing Risk Mitigation Strategies

Risk mitigation strategies are essential for any project or business. Start by recognizing risks, internal and external. Then, evaluate their likelihood and consequences. Prioritize your efforts to address the most significant risks first. Create strategies to prevent their occurrence or have contingency plans if they happen.

For an example: a construction project had the risk of adverse weather conditions delaying it. The team monitored forecasts, made alternative plans, and increased staff when good weather hit. As a result, delays were minimized and the project was completed on time.

So, now you know the basics of risk assessment. Ready to go to the dark side? Check out these examples of a risk matrix!

Examples of Risk Matrix

To gain insights into examples of risk matrix, delve into how risk matrices are used in various scenarios. Explore Example 1: Risk Matrix for Project Management and Example 2: Risk Matrix for Financial Planning. Each sub-section unravels the specific application of risk matrices in these respective fields.

Example 1: Risk Matrix for Project Management

Project managers utilize risk matrices to assess and prioritize potential risks in their projects. It’s a visual tool to determine the severity of each risk, based on its likelihood of occurrence and potential impact. By categorizing risks into different levels, project managers can allocate resources effectively and take actions to mitigate or manage these risks.

To create the matrix, start by recognizing various risks that could affect the project. These risks could include budget constraints, schedule delays, resource limitations, technical complexities, or external dependencies. Each risk should be evaluated based on its probability and potential effect on the project’s objectives.

Plot the risks on the grid with two axes: likelihood and impact. The likelihood axis represents the probability of a risk occurring, ranging from low to high. The impact axis represents the potential effect on the project if that risk materializes, also ranging from low to high.

By placing each risk in the corresponding cell on the grid based on its assessed likelihood and impact, project managers can easily identify which risks need immediate attention. Risks in higher-risk cells should receive priority in terms of mitigation efforts or contingency plans.

To make the Risk Matrix more effective for project management, consider:

- Updating and reassessing regularly: As projects progress, new or existing risks may change in likelihood or impact. Reevaluate and update the matrix to keep it accurate and relevant.

- Involve stakeholders: Get input from key stakeholders during the identification and evaluation of risks. This approach promotes buy-in for potential mitigation strategies.

- Focus on actionable risks: Prioritize those risks that have a realistic chance of occurring and could significantly affect the project’s success. This allows project managers to allocate resources more effectively.

By following these suggestions and employing a structured approach, project managers can make informed decisions and proactively address potential threats, increasing the likelihood of successful project outcomes. So be ready – with this Risk Matrix, even numbers can play mind games!

Example 2: Risk Matrix for Financial Planning

Constructing a risk matrix for financial planning is essential. Here are the steps to follow:

- List potential risks

- Evaluate their likelihood and impact

- Categorize them into different levels

To use the matrix effectively, you should:

- Prioritize risks

- Consider developing contingency plans

- Review and update the matrix regularly

These suggestions can help individuals safeguard their financial future in an ever-changing landscape. After all this, you’ll be an expert in risk assessment, or too scared to leave your house!

Conclusion

The Risk Matrix is a useful instrument for companies to examine and control possible risks. It enables entities to show the possibility and effect of varied risks visually. This helps them prioritize their steps and assign resources smartly.

By using a Risk Matrix, businesses can recognize high-risk zones that need immediate attention. Also, low-risk zones that may not require emergency action. This assists in making well-thought-out decisions and executing suitable risk-minimizing approaches.

Also, the Risk Matrix helps organizations communicate the potential risks to stakeholders in a clear way. By utilizing colors or numerical scales to demonstrate the varying levels of risk, it becomes simpler for all involved to apprehend the severity of each risk and take required actions accordingly.

Furthermore, the Risk Matrix can be customized in accordance with an organization’s particular needs. Distinct industries may have distinct criteria for evaluating risks. The Risk Matrix can be modified to accommodate these variations. This adaptability guarantees that businesses can provide for their special risk management needs.

It’s significant to remember that while the Risk Matrix is a beneficial tool, it should not be considered a single solution for risk management. It should be used with other risk assessment techniques and strategies to attain comprehensive risk management.

Frequently Asked Questions

Q: What is a Risk Matrix?

A: A Risk Matrix is a visual tool used to assess and prioritize risks based on their likelihood and potential impact.

Q: How does a Risk Matrix work?

A: A Risk Matrix works by plotting risks on a grid with a likelihood and impact axis. The risks are categorized into different levels of severity based on this analysis.

Q: What are the benefits of using a Risk Matrix?

A: Using a Risk Matrix provides a structured approach to risk assessment, allows for better communication and understanding of risks, and helps identify priority areas for risk mitigation.

Q: How do you determine likelihood and impact levels in a Risk Matrix?

A: Likelihood and impact levels in a Risk Matrix are determined based on historical data, expert opinions, and analysis of potential consequences. These levels can be predefined or customized to fit specific needs.

Q: Can a Risk Matrix be used in any industry or sector?

A: Yes, a Risk Matrix can be applied to any industry or sector that involves assessing and managing risks. It is commonly used in fields such as project management, healthcare, finance, and safety.

Q: How often should a Risk Matrix be updated?

A: A Risk Matrix should be regularly reviewed and updated as new information becomes available or when there are significant changes in the risk landscape. This ensures that the most current risks are considered in decision making.

Leave a Reply