How to Reconcile The General Ledger

Reconciling the general ledger is very important in financial management. This includes comparing and adjusting recorded financial data with external sources. This ensures accuracy and consistency, giving an accurate view of the company’s finances. How to reconcile the general ledger.

Definition: Explaining what the general ledger is and its role in accounting

The general ledger is an essential part of accounting. It is the central recording system for all financial activities in a business. The ledger keeps track of and organizes all accounts and their balances. This provides a clear view of the company’s financial standing. Keeping up-to-date entries in the general ledger helps guarantee the accuracy of financial statements and assists in making informed decisions.

Importance of the General Ledger

The general ledger is important for financial reporting. It shows all monetary transactions, allowing decision-makers to judge performance and make informed choices. Additionally, it detects errors or discrepancies during data entry or processing.

Reconciliation also helps prevent fraud. It checks and verifies records against independent sources. This helps to spot unusual activities and irregularities that may indicate fraud. It safeguards company assets and ensures compliance.

Historical examples show the importance of reconciling the general ledger. In 2001, the Enron scandal showed how executives used improper accounting practices to manipulate statements. They deceived investors and concealed debts, which eventually led to bankruptcy.

Purpose of the General Ledger

The main purpose of the general ledger is to keep a log of each transaction taking place in a business. This includes revenue and expenditure transactions, as well as any adjustments such as accruals or depreciation. Recording the transactions in this way simplifies the retrieval and analysis of financial information.

The general ledger also plays an important part in preparing financial statements. The balances in the various accounts are used to create these statements, including income statements, balance sheets, and cash flow statements. These statements offer great insights into a company’s profitability, liquidity, and overall financial situation.

To make sure the general ledger is reconciled, it is necessary to document and classify all transactions properly. This involves looking at bank statements, invoices, receipts, and other documents to make sure they match the entries in the ledger. If there are any differences or mistakes, they must be identified and fixed immediately to keep accurate financial records.

Pro Tip: Regularly comparing bank statements and the general ledger can help catch potential errors or fraudulent activity early. This allows for quick resolution before they get out of hand.

Why reconcile the general ledger: Highlighting the benefits of reconciling the general ledger

Reconciling the general ledger is essential for businesses. It guarantees precise financial reporting and discovers discrepancies. This process offers many advantages, such as pinpointing mistakes or fraud, enhancing cash flow management, facilitating audit activities, and improving decision-making based on dependable data.

- Detecting Errors or Fraud: Reconciliation exposes differences between the general ledger and subsidiary accounts, which can signify errors or fraudulent activities. Swift detection helps tackle these problems rapidly.

- Improving Cash Flow Management: By reconciling the general ledger with bank statements, businesses can spot disparities in balances, outstanding checks, or deposits. This boosts cash flow management and reduces the risk of overdrafts.

- Facilitating Audit Procedures: Reconciled general ledgers streamline the auditing process by supplying exact financial records. This saves time and resources during audits and keeps transparency between companies and auditors.

- Enhancing Decision-Making: A reconciled general ledger provides reliable financial data for decision-making. Managers can rely on precise information to assess profitability, manage expenses efficiently, and make informed business decisions.

Plus, reconciling the general ledger encourages cleaner financial statements. It ascertains that all transactions are accurately recorded and classified. Companies can avoid reporting errors or misstatements that could influence their credibility.

On the same note, consider a small business owner named Sarah who regularly reconciles her company’s general ledger every month. One day, while assessing her bank statement reconciliation, she spots an unanticipated discrepancy in a vendor payment. After thorough inquiry, Sarah finds that a duplicate payment was made because of an input mistake by her accounts payable clerk. Thanks to her dedication to reconciliation, Sarah captures this mistake in time and rectifies it before any major damage happens to her business.

Reconciling the general ledger is essential for any organization aiming for accurate financial reporting, fraud prevention, improved cash flow management, smoother audits, and informed decision-making. It is a beneficial practice that ensures financial stability and fosters business growth.

Steps to reconcile the general ledger

Concrete Steps

Reconciling the general ledger is essential for accurate financial records. Match and compare the ledger with other accounts to make sure it’s correct. Follow four steps to reconcile the ledger:

- Check Transactions: Look at bank statements, invoices, receipts, and journal entries. Make sure all transactions are in the ledger.

- Compare Balances: Match the ledger with bank accounts, accounts receivable, and accounts payable. Check for errors or differences.

- Investigate: If discrepancies are found, investigate them. Trace back transactions connected to the discrepancies and fix any mistakes.

- Make Adjustments: Once discrepancies are solved, adjust the ledger accordingly. This could mean posting adjusting journal entries or correcting misclassified transactions.

Reconcile the ledger throughout the year. This helps to identify and fix errors quickly. Reconciling regularly leads to accurate financial reporting and increases transparency.

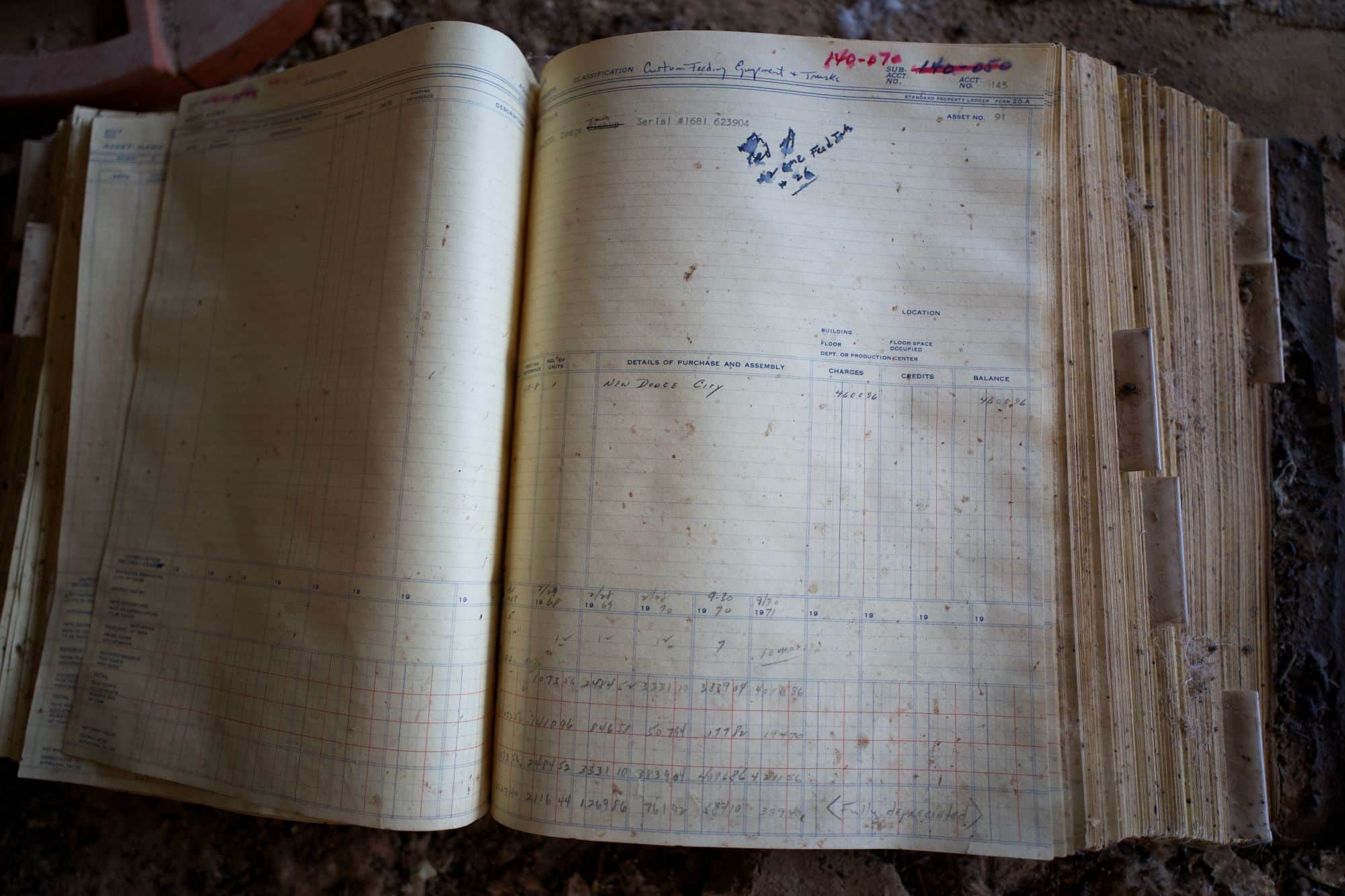

True Story: In olden times, reconciliation was done by hand. Accountants compared ledger entries with physical documents to ensure accuracy. This process was long and needed extreme attention to detail.

Tips and best practices for effective reconciliation

To successfully reconcile, follow these tips and best practices. Here are 3 key points to remember:

- Good record-keeping: Accurate records are essential for a successful reconciliation process. Document all transactions, adjustments, and corrections accurately. Make sure they are well-organized and easily accessible.

- Frequent reviews: Regular review of financial statements and reconciliations helps find any mistakes quickly. Schedule regular review periods to keep your general ledger up-to-date and accurate.

- Open communication: Communication between departments should be open. Encourage cross-team collaboration to ensure data accuracy, resolve issues quickly, and ensure everyone understands the process.

Accuracy is more important than speed when reconciling your general ledger. Double-check calculations and verify information to avoid costly mistakes that may affect decision-making later.

The importance of effective reconciliation cannot be overstated. By implementing these best practices, you can reduce errors, maintain financial transparency, and make informed business decisions confidently. Don’t wait; start using these tips today to improve your reconciliation process!

Overcoming Common General Ledger Challenges

Succeeding with general ledger reconciliations can be done! Here’s how:

- Record all transactions and entries accurately.

- Compare ledger balances with external documents/statements regularly.

- Investigate discrepancies/errors immediately.

- Create a standard process with document/review procedures.

- Use automated accounting software to simplify the process.

Stay in touch with relevant stakeholders and update them on any outstanding issues or resolutions. Address these challenges right away for accurate financial records and regulatory compliance.

Prioritize accuracy over speed when reconciling. Otherwise, errors/inaccuracies may lead to significant financial statement issues. A survey by Deloitte revealed that 67% of finance execs consider reconciliations a top priority for accurate financial statements!

The importance of regular reconciliation and its impact on financial reporting

Reconciling regularly is a must for accurate financial reporting. It guarantees all transactions are recorded accurately, minimizing errors and inconsistencies. This helps detect any fraudulent activities, keeping financial statements true. By reconciling the general ledger regularly, firms can keep their financial records visible and reliable.

Not only does regular reconciliation prevent fraud, but it also boosts decision-making. Accurate and up-to-date financial info helps managers make sound decisions about resource use and investments. This increases operational efficiency and aids business development.

Regular reconciliation not only affects financial reporting, but it also provides understanding into a company’s financial well-being. It lets businesses track cash flow, manage expenses, and locate areas to cut costs. With a clear grasp of their financial state, firms can devise effective plans to expand profitability and sustainability.

In fact, the Association of Certified Fraud Examiners (ACFE) state organizations that do regular reconciliations have lower fraud levels than those that don’t. This shows how important this practice is in keeping financial info accurate and reliable.

The significance of Accurate General Ledger Reconciliation

The importance of accurate general ledger reconciliation is key for keeping financial integrity. It makes sure all financial transactions are correctly recorded and businesses can easily understand their finances.

Reconciliation is done by comparing general ledger numbers with external records like bank statements, credit card bills, and vendor statements. This helps to find and fix errors in the accounts.

By reconciling the general ledger on a regular basis, businesses can spot and address discrepancies before they become bigger issues. It also confirms financial statements are correct and show the business’s financial performance.

Accurate general ledger reconciliation also promotes transparency. Investors, creditors, and auditors can trust the financial information given by the company. This trust is important for successful relationships and attracting potential investors or financing.

General ledger reconciliation serves as an internal control as well. It helps companies detect any unexplained changes or discrepancies in account balances. This allows them to take action to stop fraudulent activities.

In conclusion, accurate general ledger reconciliation is essential for good financial management. By frequently reconciling accounts, businesses can find areas to improve, stay compliant, and make decisions based on reliable financial data.

Frequently Asked Questions

Q: What is a general ledger reconciliation?

A: General ledger reconciliation is the process of comparing the balances in the general ledger accounts with other financial records to ensure accuracy and identify any discrepancies.

Q: Why is general ledger reconciliation important?

A: General ledger reconciliation is important as it helps ensure the accuracy of financial statements, identify errors or fraud, maintain compliance with regulations, and provide a clear audit trail.

Q: How often should general ledger reconciliation be performed?

A: General ledger reconciliation should be performed on a regular basis, ideally monthly or quarterly, to promptly identify and correct any discrepancies and ensure the accuracy of financial reports.

Q: What are the steps involved in reconciling the general ledger?

A: The steps for reconciling the general ledger typically include comparing account balances, investigating and resolving any discrepancies, documenting adjustments, and preparing a reconciliation report.

Q: What tools or software can be used to reconcile the general ledger?

A: There are various tools and software available that can assist in reconciling the general ledger, such as accounting software with built-in reconciliation features, spreadsheet programs, or specialized reconciliation software.

Q: What should I do if I encounter a discrepancy during general ledger reconciliation?

A: If you encounter a discrepancy during general ledger reconciliation, you should investigate the issue by reviewing transactions, bank statements, and supporting documents. Once the cause is identified, corrective actions can be taken, such as adjusting entries or contacting the appropriate department.

Leave a Reply