How to Reconcile a Bank Statement

Ever felt confused by your bank statement? You’re not alone. Reconciling a bank statement is key. It helps keep track of finances and make sure everything is accurate. Let’s learn the art of reconciliation. How to reconcile a bank statement.

Reconciling Bank Statements

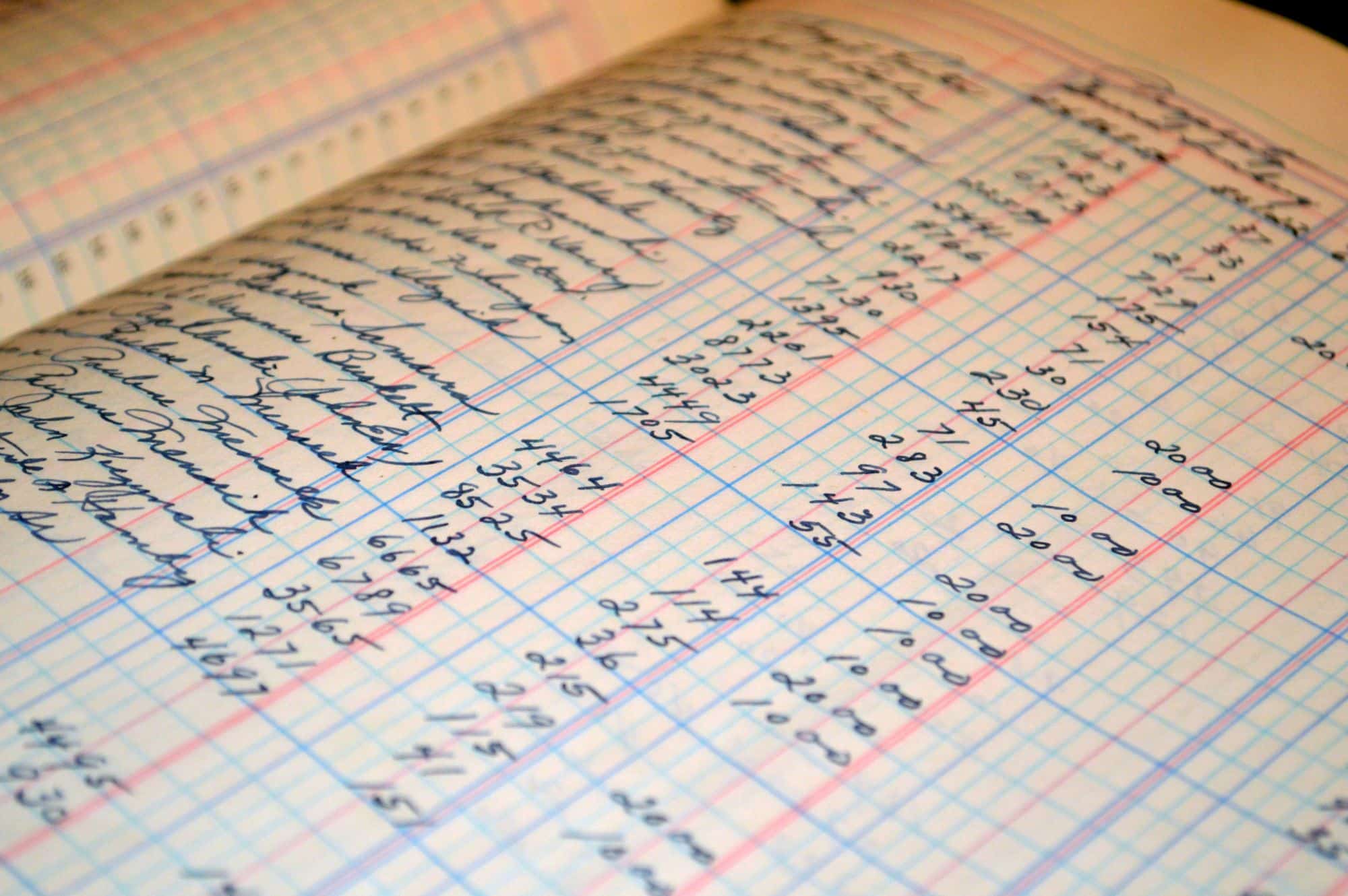

Bank statements record financial transactions in a given period. They include deposits, withdrawals, checks cleared, service charges and interest earned. Reconciling means comparing the record with your own records.

When reconciling, check each transaction on the statement. Cross-reference it with your checkbooks, deposit slips, and receipts. Note any discrepancies and investigate further.

Sarah is a great example of the importance of reconciling. She found unauthorized charges in her business’s statement. Thanks to her reconciling, she identified them and took action.

Reconciling plays a role in financial security and stability. You can catch errors and prevent hardships or fraud. Whether personal or business, make time to reconcile statements regularly. It’ll keep you informed and give peace of mind.

Understanding the Importance of Reconciling a Bank Statement

Reconciling a bank statement is vital for keeping your finances on track. It means comparing your records to the bank’s records. Each transaction, such as deposits, withdrawals, and fees must be checked. This can show up any errors or dodgy activities.

It also helps you monitor your budget, so you don’t overspend. Plus, it’s useful for spotting potential fraud. Cross-check transactions with your own records to detect any discrepancies.

The Bank of America states, “Regularly reconciling your bank statements is key for finding mistakes and suspicious activity.” So, take the time to do it!

Gathering the Necessary Documents and Information

In order to reconcile a bank statement, it is important to gather all the necessary documents and information. This can be done by following a simple 5-step guide:

- Collect all bank statements and receipts related to the accounts in question. This includes both physical copies and electronic versions.

- Organize the documents chronologically, ensuring that each transaction is accounted for. This will help to identify any discrepancies or errors.

- Verify the accuracy of the information by cross-referencing bank statements with receipts and other documentation. This will help to ensure that all transactions are correctly recorded.

- Compare the recorded transactions with the bank statement to identify any missing or incorrect entries. This step is crucial for detecting errors or fraudulent activities.

- Compile a comprehensive list of all the gathered documents and information, including any discrepancy and its corresponding action plan. This will serve as a reference for further investigation or resolution.

It is important to note that during the process of gathering the necessary documents and information, attention to detail is paramount. By carefully examining and comparing the records, any discrepancies or errors can be promptly addressed and resolved. This ensures the accuracy of the bank statement and helps maintain the integrity of financial records.

Additionally, it is recommended to keep a backup of all the gathered documents and information, either in physical or electronic form. This serves as extra protection against potential loss or damage.

By following these steps and suggestions, the process of reconciling a bank statement becomes more efficient and effective. It helps to maintain accurate financial records and provides a clear overview of the account’s transactions.

Bank statements: The closest thing to a horror movie that involves numbers and deducts your happiness instead of your soul.

Bank Statements

| Date | Description | Amount |

|---|---|---|

| 01/01/2022 | Salary | $2,000 |

| 02/01/2022 | Rent Payment | -$900 |

| 05/01/2022 | Grocery Shopping | -$100 |

| 10/01/2022 | Credit Card Payment | -$200 |

| 15/01/2022 | ATM Withdrawal | -$50 |

Bank statements also include:

- starting & ending balance

- interest earned/charged

- service fees deducted

- electronic fund transfers

Providing complete bank statements is essential. This helps you avoid delays or rejections. Organizing bank statements is necessary. Review them regularly to detect errors & unauthorized transactions. Do this to protect yourself and keep accurate records. Gather all documents promptly for efficient decision-making & financial standing!

Supporting Documents (checks, deposit slips, etc.)

Supporting documents are key when gathering information. Checks, deposit slips, receipts, invoices, statements and pay stubs are all examples. They are proof of financial transactions and often needed by banks, institutions and gov agencies.

It is vital that these documents are accurate, complete and organized. Errors or omissions can cause delays. Unique requirements and extra paperwork may be required too. For example, for a mortgage application, employment and tax returns may be needed.

Keeping track of financial transactions dates back centuries. Ancient merchants used written receipts as evidence and records for the future.

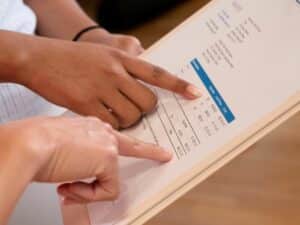

Reviewing the Bank Statement

Reviewing the Bank Statement is an essential step in reconciling finances. By thoroughly examining the Bank Statement, individuals can identify any discrepancies, errors, or unauthorized charges.

Analyzing transactions, comparing them with records, and highlighting discrepancies aids in detecting and rectifying discrepancies promptly to ensure accurate financial records.

| Column 1 | Column 2 | Column 3 |

| Data 1 | Data 2 | Data 3 |

| Data 4 | Data 5 | Data 6 |

It is crucial to pay attention to unique details during the bank statement review process. This includes examining any unusual or unexpected transactions, ensuring proper categorization of expenses, and identifying potential fraudulent activities. Vigilance in reviewing the bank statement minimizes errors and strengthens financial management practices.

To facilitate a smooth bank statement review, consider implementing the following suggestions. Firstly, regularly update and maintain accurate records to ensure consistency between personal records and the bank statement.

Secondly, utilize financial management software or tools to expedite the reconciliation process, minimizing the risk of errors. Lastly, reconcile the bank statement promptly each month to identify and address discrepancies promptly, resulting in accurate financial records and enhanced financial management overall.

If comparing your bank deposits and withdrawals feels like discovering a long-lost twin who’s always short on cash, then congratulations, you’ve just entered the surreal world of reconciling a bank statement.

Comparing Deposits and Withdrawals

Reviewing a bank statement is key. Comparing deposits and withdrawals helps keep track of all finances. To easily spot any differences, a table can be used. This table shows the date, description, deposit, and withdrawal amount.

| Date | Description | Deposit | Withdrawal |

|---|

Also, unique details should be noted. These may include any extra deposits or sudden withdrawals that affect the total. Paying attention to these details gives a clear view of one’s financial status.

An example of this is when someone noticed an unapproved withdrawal while comparing deposits and withdrawals. By carefully checking their bank statement, they noticed a large cash withdrawal that they had not made. By acting quickly and reporting the issue, they were able to resolve it quickly.

Identifying Discrepancies

Check the table for key factors to look for when finding discrepancies in your bank statement.

| Factors to Look For | Actions to Take |

|---|---|

| Transaction Date | Check if the dates are accurate. |

| Transaction Amount | Compare listed amounts to your own records. |

| Payee/Description | Verify that payee/description matches. |

| ATM/Cash Withdrawals | Double-check for accuracy. |

| Service Fees | Ensure all fees and charges are accurate. |

| Online/Paper Statements | Cross-reference if using online banking. |

Also, keep an eye out for anything suspicious, don’t wait to act when it comes to discrepancies, and review statements regularly to stay on top of any potential issues. Take the steps to protect your financial well-being.

Reconciling the Bank Statement

Reconciling the Bank Statement is an essential step in financial management. It ensures that the bank’s records and an individual’s or company’s records match accurately. This process involves comparing transactions on the bank statement with those in the accounting records and resolving any discrepancies.

To guide you through the process of reconciling a bank statement, follow these 6 steps:

- Gather the necessary documents: Collect the bank statement, accounting records, and any supporting documentation for transactions that may need clarification.

- Compare transactions: Start by comparing each transaction listed on the bank statement with the corresponding entry in the accounting records. Verify that the dates, amounts, and descriptions match.

- Mark matched transactions: As you identify matching transactions, mark them as reconciled on both the bank statement and accounting records. This ensures no duplication or omission during the reconciliation process.

- Investigate discrepancies: If any discrepancies arise, analyze them thoroughly. Check for errors, such as missing or duplicate entries, and consider any outstanding checks or deposits in transit.

- Adjust the accounting records: After investigating and resolving the discrepancies, adjust the accounting records as necessary. Rectify errors and update balances to align with the bank statement.

- Finalize the reconciliation: Once all discrepancies are resolved and the accounting records reflect the bank statement accurately, finalize the reconciliation. Prepare a summary of the adjustments made and any remaining outstanding items.

In addition to these steps, it is crucial to maintain clear documentation throughout the reconciliation process. This documentation helps to track any changes made and provides an audit trail for future reference.

It is noteworthy that reconciling a bank statement regularly reduces the risk of financial errors and helps detect fraudulent activities efficiently.

A true fact: According to a study conducted by the Association for Financial Professionals, 80% of companies experienced attempted or actual payment fraud in 2020.

Bank statements and outstanding checks are like a relationship gone sour – it’s all about finding the right balance, or you’ll be feeling the overdraft heartache.

Adjusting for Outstanding Checks

Let’s make a table to show the steps for adjusting for outstanding checks:

| Check Number | Check Amount ($) | Date Issued | Date Cleared |

|---|---|---|---|

| 1234 | $500 | 10/15/2022 | – |

| 5678 | $250 | 10/18/2022 | – |

| 9101 | $1000 | 10/20/2022 | – |

We have 3 checks that haven’t been cleared yet. Making a table helps keep track of them.

We need to remember more details when adjusting for outstanding checks.

- Record dates accurately.

- Keep track of when each check clears.

Here are tips to adjust for outstanding checks:

- Keep a check register.

- Regularly update bank statements.

- Communicate with banks.

Doing this lets companies put the right info in their financial records. It’s important, no matter how big or small the company is.

Accounting for Deposits in Transit

Recording deposits in transit is vital for accurate financial reconciliation. We can make a table with columns like “Date of Deposit,” “Amount Deposited,” and “Receipt Number”. This will show if each deposit is in the bank statement or still in transit.

Deposits in transit may include any delays between customer payment and the bank processing. So, it’s important to record these gaps to avoid discrepancies.

For instance, a client made a payment just before our accounting cycle closed. The deposit did not appear on our bank statement for weeks due to processing delays. But, by accounting for this deposit in transit, we could maintain accurate financial records and easily reconcile the bank statement.

Accounting for Bank Errors

| Error Type | Description | Correction |

|---|---|---|

| Transposition Errors | Nums in wrong order | Compare docs, recheck calcs & amend records. |

| Duplication Errors | Recorded transactions twice | Analyze entries, adjust balances & remove wrong transactions. |

| … | ||

Timing differences between the company’s records & bank statement? Delays or processing times. Reconciliation helps find & fix discrepancies fast!

For accurate accounting:

- Detailed transaction records with clear explanations.

- Compare cash balance with bank statement.

- Periodic audits to spot errors/irregularities.

By following these tips, businesses can avoid financial risks & make reliable financial decisions.

Balancing the Bank Statement

Balancing the Bank Statement:

- Gather the necessary documents: Collect your bank statement, checkbook, and any other relevant financial records.

- Compare deposits and withdrawals: Go through each transaction on your bank statement and compare them to your own records. Make note of any discrepancies.

- Verify outstanding checks: Check if any of the checks you have issued are still pending or have not been cashed yet. Deduct these amounts from your balance.

- Check for errors: Look out for any errors, such as duplicate transactions or missing entries. Rectify these mistakes to ensure accuracy.

- Adjust the balance: Make the necessary adjustments to reconcile the bank statement. This may involve adding or subtracting amounts and updating your records accordingly.

In addition, ensure that you review any unique or specific details pertaining to your bank statement reconciliation process. Take note of any specific guidelines or protocols provided by your bank.

Don’t miss out on the opportunity to maintain financial accuracy and pinpoint any discrepancies in your records. Reconciling your bank statement regularly can protect you from potential fraud or errors, ensuring your financial stability.

Calculating the ending balance may feel like solving a complicated math problem, but hey, at least numbers won’t judge you like your ex-bank statement.

Calculating the Ending Balance

Careful calculation is a must to find the ending balance. Analyzing inflows and outflows helps determine the final balance. Let’s take a look.

| Starting Balance | $5,000 |

| + Deposits | $2,500 |

| – Withdrawals | $1,000 |

| = Ending Balance* | $6,500 |

To find the end balance correctly, we must consider all money movements and adjustments. It’s important to reconcile every deposit and withdrawal for exact financial examination.

Now, let me tell you a story to emphasize the importance of balancing bank statements.

Once there was an attentive person called Alex who ran a small business. Every month, they would assess their bank statements meticulously to keep accurate financial records. One day, when Alex was going through their bank statement, they saw an odd difference.

They contacted their bank immediately to deal with the issue and realized that an incorrect fee had been put in by mistake. Because of Alex’s carefulness and their regular statement reconciliation, they could quickly solve the problem and maintain financial control in their business.

Matching the Ending Balance with the Bank Statement

Matching your bank statement’s ending balance is important to ensure accuracy. Here’s a 3-step guide to help you:

- Compare Transaction History: Carefully review the statement. Cross-check it with your own records. Ensure deposits, withdrawals, and fees match.

- Verify Outstanding Checks & Deposits: Note any pending items, subtract them from the ending balance.

- Consider Miscellaneous Factors: Account for bank errors, interest payments, service charges, and transfers.

Pro Tip: Reconciling the statement often helps spot errors and fraud quickly. It also gives transparency and financial accountability.

Final Reconciling Steps

The final reconciling steps involved in a bank statement require careful attention and precision. Here is a concise guide to help you successfully complete this process:

- Begin by comparing the ending balance on the bank statement to the ending balance in your records. Make note of any discrepancies.

- Check for any outstanding checks or deposits that have not cleared yet. Adjust your records accordingly.

- Reconcile any bank fees or interest charges that may have been applied. Ensure that your records accurately reflect these transactions.

- Verify the accuracy of any automatic payments or deposits made from your account. Make sure they match your records.

- Review any bank adjustments or corrections that may have been made. Confirm that they have been properly accounted for in your records.

- Once all the above steps have been completed, finalize the reconciliation process by updating your records to reflect the adjusted balances and ensuring everything is in order.

Remember, practice attentiveness and accuracy throughout this process to maintain the integrity of your financial records.

In addition to the steps above, it is important to pay attention to any unusual or suspicious transactions that may appear on your bank statement. If you notice anything out of the ordinary, promptly contact your bank and report it to ensure the security of your account.

In a similar situation, a friend noticed a significant discrepancy when reconciling their bank statement. After careful investigation, it was revealed that a fraudulent transaction had occurred.

They immediately contacted their bank, who resolved the issue and provided additional security measures to prevent future occurrences. This story serves as a reminder to always be diligent when reconciling bank statements and to promptly address any discrepancies or concerns.

Documenting the reconciliation is like creating a paper trail of financial love – it may not be passionate, but it ensures your bank statements stay faithful to your records.

Documenting the Reconciliation

To keep it professional and organized, it is key to document the reconciliation. This aids accuracy in record-keeping and makes referencing simpler.

Below is a table with all relevant data to the reconciliation process. It has columns for date, transaction description, debit amount, credit amount, and balance. It gives an overview of the financial activity during the reconciliation period.

| Date | Transaction Description | Debit Amount | Credit Amount | Balance |

|---|---|---|---|---|

| 01/02/2022 | Sales Revenue | $1,000 | – | $1,000 |

| 02/02/2022 | Office Supplies | – | $50 | $950 |

| 03/02/2022 | Rent Expense | – | $500 | $450 |

| 04/02/2022 | Utilities Expense | – | $100 | $350 |

It is important to write down any discrepancies or changes made during the reconciliation process. These should be noted accurately and clearly, to provide an entire picture of the financial status. This makes sure it’s transparent and meets accounting standards.

Pro Tip: Ensure you often check and compare your documentation with documents such as bank statements or invoices. This keeps your records accurate and reduces the chances of errors or omissions that could affect future decision-making.

Taking Corrective Actions if Needed

- Identify the problem. Analyze data, conduct investigations, or seek feedback from relevant parties to find the root cause.

- Make an action plan. Outline steps to resolve the issue. Assign tasks and prioritize them for people or teams involved.

- Implement and monitor progress. Execute the plan carefully and monitor its implementation. Assess progress, make changes, and update stakeholders regularly.

To make corrective actions effective, consider these suggestions:

- Establish open communication channels. Allow team members to express their concerns and suggest solutions. This encourages collaboration and helps solve problems quickly.

- Give training and support. Train employees with necessary skills. Provide guidance and resources to help them develop and boost performance.

By following these recommendations, organizations can be proactive in tackling problems, boost productivity, and foster a culture of improvement.

Reconcile a Bank Statement

Reconciling a bank statement is a must. Comparing the transactions and your own records can help spot any errors. Pay attention to details and double-check numbers and dates.

Start by reviewing each transaction. Match them with your own records and mark off the ones that match. This will show any missing or duplicate entries. Take action when needed.

Check discrepancies found. You may need to contact the bank or look at extra paperwork to sort it out. Resolving the issues will help maintain accurate records and keep your balances up-to-date.

In addition to matching transactions, it’s important to reconcile interest. Calculate and verify rates, compounding periods, and principal amounts. Keep detailed records of your calculations to ensure accurate reconciliation.

A business owner who didn’t reconcile his statement for months got into financial trouble. He learnt his lesson and now knows that regular reconciliation is crucial to catch errors early and avoid similar situations.

Frequently Asked Questions

1. What is a bank statement reconciliation?

A bank statement reconciliation is the process of comparing the transactions recorded in your bank statement with the transactions recorded in your own accounting records to ensure they match.

2. Why is bank statement reconciliation important?

Bank statement reconciliation is important because it helps you identify any discrepancies or errors between your own records and the bank statement. It ensures that your financial records are accurate and complete.

3. How often should I reconcile my bank statement?

It is recommended to reconcile your bank statement at least once a month. Some businesses may choose to reconcile more frequently, such as weekly or even daily, depending on their volume of transactions.

4. How do I reconcile my bank statement?

To reconcile your bank statement, you need to compare each transaction recorded in your own accounting records with the corresponding transaction listed in your bank statement. Mark off each transaction that matches, and investigate any discrepancies.

5. What should I do if there are discrepancies in my bank statement?

If you identify discrepancies in your bank statement, you should carefully review both your accounting records and the bank statement to determine the cause. Common discrepancies include missing transactions, incorrect amounts, or duplicate entries. Once identified, you should make the necessary adjustments in your records.

6. Can I use software to reconcile my bank statement?

Yes, there are various accounting software programs available that can automate the bank statement reconciliation process. These programs can import your bank statement data and compare it directly with your accounting records, making the reconciliation process faster and more efficient.

Leave a Reply