What is The Difference Between Implicit and Explicit Costs?

The concept of implicit and explicit costs is a must-know in accounting. For business operations, the difference between these two types of costs can significantly impact financial decisions. What is the difference between implicit and explicit costs?

Implicit Costs vs. Explicit Costs

Implicit costs refer to the opportunity cost of using resources in a certain way. On the other hand, explicit costs are direct expenses that can be easily identified and calculated.

Implicit costs are not written in the accounting books. They don’t involve actual cash outflows. They represent the potential benefits lost by selecting one course of action instead of another.

For example, if a company decides to use their own building instead of renting office space, the implicit cost would be the rental income that could have been earned from leasing out that space.

Explicit costs are tangible and measurable expenses due to a business activity. These costs appear on financial statements and include expenses such as rent, wages, raw materials, and utilities. Explicit costs are easily identifiable since they involve actual cash payments or an obligation to pay in the future.

Knowledge of implicit and explicit costs is essential for accurate financial reporting and decision-making. Analyzing explicit costs is important, but it’s also necessary to consider implicit costs when evaluating different alternatives. By taking into account both types of costs, businesses can make informed choices that maximize their resources and improve their financial performance.

Pro Tip: To measure overall cost effectiveness or profitability of a project, it’s vital to consider both implicit and explicit costs. Not doing so may lead to incorrect conclusions or bad decisions.

Definition of implicit and explicit costs

Implicit and explicit costs are two key accounting concepts. Implicit costs refer to the next best alternative not taken. This is an opportunity cost, without actual payment. For example, if a company chooses to use their own building instead of renting it out, the implicit cost is the rental income lost.

Explicit costs are tangible and measurable expenses. These involve actual cash outflows and are easy to account for. Examples include wages, rent, utility bills, and raw materials.

Both must be considered when evaluating business profitability or making financial decisions. Explicit costs are more straightforward, but implicit costs factor in what could have been gained by choosing otherwise.

Let’s look at a small bakery. Two options: expand or keep current location. Expanding involves higher rent, equipment, and more staff. Explicit costs are increased rent, equipment, and employee salaries. Implicit costs include the personal time sacrificed to manage the larger operation. This time could have been spent on other activities. So, implicit costs still affect the decision-making process, even without direct monetary transactions.

Explanation of implicit costs

Implicit costs are not recorded in accounting books, yet still impact a business’s profitability. Unlike explicit costs, which are easily measurable, implicit costs are intangible and hard to quantify.

For example, a small business owner investing personal savings into the business instead of a high-interest savings account. The interest that could have been earned is an implicit cost and represents the opportunity to make income from an alternative investment.

Implicit costs can also be the time spent by business owners or employees on a project instead of pursuing other activities. The value of this time would be an implicit cost as it stands for foregone earnings that could have been earned elsewhere.

It is essential to note that even though implicit costs may not be on financial statements, they still affect a business’s financial performance. Ignoring these hidden costs can lead to faulty decisions and suboptimal resource allocation.

A study at Stanford University showed businesses often underestimate implicit costs and focus mainly on explicit costs when making decisions. This highlights the need for businesses to consider both explicit and implicit costs when looking at profitability and making strategic decisions.

Explanation of explicit costs

Explicit costs are expenses that a business spends, and can be identified and measured. These costs include payments for raw materials, wages, rent, utilities, advertising, and other operational costs. Explicit costs are different from implicit costs – they are actual monetary outflows that affect a company’s income.

Explicit costs are linked with production or acquisition activities. For instance, a manufacturing company buying raw materials would have an explicit cost. Additionally, a service-based business paying salaries to its employees is also considered an explicit cost.

Explicit costs can be easily seen and calculated. Since they involve real money, businesses can precisely track the amount spent. By analyzing explicit costs over time, companies can find ways to reduce or optimize expenses for improved financial performance.

To manage explicit costs, businesses can negotiate contracts with suppliers or service providers. This can help lower the cost of raw materials or services, without compromising on quality.

Businesses can also incorporate technology solutions or process improvements to reduce labor and transportation costs. Companies can also adjust prices based on market trends and customer demand, to cover costs and generate profits.

By effectively managing explicit costs, businesses can optimize operations and increase profitability in a competitive market.

Implicit and Explicit costs Differences

Implicit and explicit costs are two distinct ideas in accounting. Implicit costs refer to opportunity costs that arise from using resources for a certain purpose instead of their best alternative. Explicit costs are tangible expenses incurred during business operations.

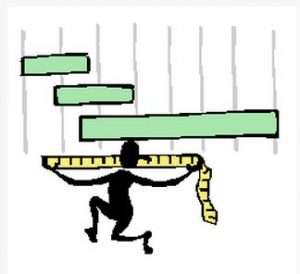

Let’s compare their features in a table:

| Implicit Costs | Explicit Costs |

|---|---|

| Not quantifiable | Quantifiable & measurable |

| From opportunity cost | From actual cash payments |

| Subjective & hard to calculate | Objective & easy to compute |

| No cash outflows | Cash outflows or payments |

| Lost wages or rent savings | Wages, utility bills, purchases |

Implicit costs have various intangible factors making them hard to calculate. These may include lost wages from entrepreneurship instead of a job, or forgone rental income using personal property for business.

Explicit costs involve actual expenses incurred by an organization. These can be identified as they involve direct financial transactions, such as wages, utility bills, or inventory purchases.

Both implicit and explicit costs play a crucial role in business decisions. While explicit costs impact financial statements, implicit costs inform entrepreneurs about the hidden value of their choices.

Importance of recognizing implicit and explicit costs

Differentiating between implicit and explicit costs is key when making financial decisions. Implicit costs are the opportunity cost of using resources, not shown in accounting statements. However, they are very important for assessing the true cost of business operations. Misunderstanding implicit costs can lead to inaccurate profit calculations.

Explicit costs, on the other hand, are easily measurable financial expenses. By acknowledging these costs, businesses can evaluate their financial situation and allocate resources adequately.

Recognizing both implicit and explicit costs helps in budgeting and resource allocation. It helps businesses identify areas where they can cut costs or invest more for better results. Also, understanding how implicit costs affect profitability helps managers prioritize and make better decisions.

Pro Tip: When assessing implicit costs, look at employee satisfaction, brand reputation, and potential future opportunities forgone. Doing this gives businesses a better view of operational expenses and allows them to make more informed decisions for long-term success.

Difference Between Implicit and Explicit Costs

Implicit and explicit costs are two accounting terms. Implicit costs refer to the cost of not using resources elsewhere, while explicit costs are the actual payments made for them.

For example, consider a business owner who wants to open a store. They invest $100,000 of their own savings, this is an explicit cost. But, they could have invested that money in stocks and earned a 5% return on investment per year. This 5% return is the implicit cost of using the money for the business.

Also, the owner quits their job to run the store full-time. The salary they could have earned from the job is another implicit cost.

Businesses can consider both implicit and explicit costs to make better decisions about resource allocation and see if an endeavor is worth pursuing.

Frequently Asked Questions

FAQs for the topic “What is the difference between implicit and explicit costs?” (Accounting definition and example)

Q: What is an implicit cost in accounting?

A: Implicit costs refer to the opportunity costs of using resources in a particular way. These costs are not reflected in monetary transactions but represent the value of the next best alternative. For example, if a business owner decides to use their own building for their business instead of renting it out, the implicit cost would be the foregone rental income.

Q: What is an explicit cost in accounting?

A: Explicit costs are direct and quantifiable expenses incurred by a business. These costs involve actual monetary outflows or payments made for resources or services used. Examples of explicit costs include rent, wages, utility bills, and raw material expenses.

Q: How are implicit costs different from explicit costs?

A: The main difference lies in how they are measured and recorded. Implicit costs are not recorded in the accounting books since they do not involve a cash outflow. On the other hand, explicit costs are recorded as actual expenses in the financial statements. Implicit costs are also subjective and based on opportunity costs, whereas explicit costs are objective and easily quantifiable.

Q: Can you provide an example to better understand the difference?

A: Sure! Let’s say you have the option of running your own business or taking a job with a monthly salary of $5,000. If you choose to run your own business, the explicit costs would be the actual expenses you incur, such as rent, wages, and utilities. The implicit cost, in this case, would be the salary you would have earned if you had taken the job instead of starting your own business.

Q: Why is it important to distinguish between implicit and explicit costs?

A: Differentiating between these costs helps in making informed business decisions. By considering both implicit and explicit costs, business owners can assess the true cost of their choices and evaluate the profitability or viability of alternative options. It also helps in accurately analyzing financial statements and performance indicators.

Q: Can implicit costs be converted into explicit costs?

A: No, implicit costs cannot be directly converted into explicit costs. Implicit costs represent the foregone opportunity, and their value is subjective and non-monetary in nature. However, by assigning a monetary value to the next best alternative, one can estimate the opportunity cost and consider it as an additional explicit cost.

Leave a Reply