How to Avoid Missed Billings

In today’s fast-paced world, missed billings can be a huge problem. Consequences can range from delayed payments to bad relationships with clients or suppliers. Here, we’ll explore strategies to help with this. How to avoid missed billings.

Avoiding Missed Billings

To avoid missed billings, maintain a system for tracking invoices. Use software or spreadsheets to keep records of all outstanding bills, due dates and payment statuses. By updating regularly, you can stay on top of financial obligations and reduce the risk of missing any.

Set clear terms and conditions for services or products. Clearly communicate your payment expectations to clients. Include billing cycles, late fees and consequences for non-payment. This manages expectations and ensures timely payments.

Send out invoices promptly. Delayed invoicing increases the chances of missed billings. Prompt invoicing shows professionalism and urges clients to pay.

Finally, use automated reminders for overdue bills. These can be sent via email or text message. Automated reminders save time and reduce the number of missed billings.

Understanding the Importance of Avoiding Missed Billings

Missed billings can seriously harm businesses. Not only do they lead to money losses, but they also damage the company’s reputation and credibility. It’s essential for organizations to understand the importance of avoiding missed billings. They must ensure smooth operations and customer satisfaction.

Implementing an efficient billing system is a great way to avoid missed billings. This system should track all transactions accurately and quickly generate invoices. Companies can reduce the chances of overlooking billing details with a streamlined process.

Communication between different departments is also important. Miscommunication or not communicating at all can lead to missed billings. Clear guidelines should be set to make sure all involved in the billing process are aware of their role and responsibilities.

Reconciling accounts regularly is vital in preventing missed billings. By analyzing financial records regularly, discrepancies or errors can be spotted early and fixed quickly. This practice helps maintain accuracy in billing processes, thus reducing the risk of missing payments.

Missed billings have caused huge losses for businesses in the past. For example, a telecom company suffered a big loss due to missed billings from their outdated billing software. They had to invest heavily in upgrading their systems and recovering from the financial hit.

To sum up, avoiding missed billings is essential for businesses’ financial stability and reputation. Efficient billing systems, effective communication, and regular monitoring are key strategies companies should adopt. Historical experiences can offer valuable insight into the severe consequences of ignoring this important business aspect.

Identifying Common Reasons for Missed Billings

Missing billings can be a huge problem for businesses, causing financial losses and customer dissatisfaction. Recognizing the typical causes of these missed billings is vital to stop such occurrences.

- Wrong data entry: One of the main causes of missed billings is human error when putting in data. This can include mistakes in typing customer details or billing info.

- Inadequate record-keeping: Poor record-keeping practices can also cause missed billings. When important info is not stored or noted properly, it’s hard to track and bill customers accurately.

- No communication: Missed billings can happen when there is no communication between departments in an organization. For example, if sales reps don’t tell the billing department about new orders, invoices may not be created.

It’s important to note that recognizing typical causes for missed billings goes beyond these three points. Each business could have exclusive factors leading to this problem. In some cases, tricky pricing structures or a high number of transactions can make it harder to detect missed billings.

To dodge missed billings, some advice can be followed:

- Use a double-check system: Having multiple people review and confirm billing details can help spot any mistakes or omissions before invoices are sent.

- Invest in powerful record-keeping software: Utilizing advanced software systems that create invoices automatically and store comprehensive records can reduce the chances of missing billings drastically.

- Set up cross-departmental communication channels: Making sure there are clear lines of communication between different departments involved in the billing process ensures that all info is shared promptly and correctly.

By following these tips, businesses can minimize the occurrences of missed billings and keep billing processes efficient. Effective communication, precise data entry, and meticulous record-keeping are essential elements in avoiding financial issues and guaranteeing customer satisfaction.

Tips for Avoiding Missed Billings

Invoices are essential to any business; missing billings can cause financial issues. To prevent that, here are five tips:

- Keep a detailed record of all transactions & payments. This way, you won’t miss any bills.

- Set automated reminders for billing deadlines. That way, you will get alerts in good time and won’t miss any due dates.

- Check customer accounts often to identify overdue invoices. Send gentle reminders to those who didn’t pay yet.

- Use invoicing software that tracks billable hours & expenses. This streamlines the process and decreases the chance of missing billable items.

- Talk to clients about payment terms and expectations. This way, both sides understand the deal.

Remember to do audits of your billing system too. They can help spot mistakes that may lead to missed billings.

A report by ABC News says businesses lose millions of dollars annually due to missed invoices.

Case Studies of Successful Billing Avoidance Strategies

Various businesses have implemented successful billing avoidance strategies, resulting in improved financial outcomes. These strategies involve proactive monitoring, effective communication, and streamlined invoicing.

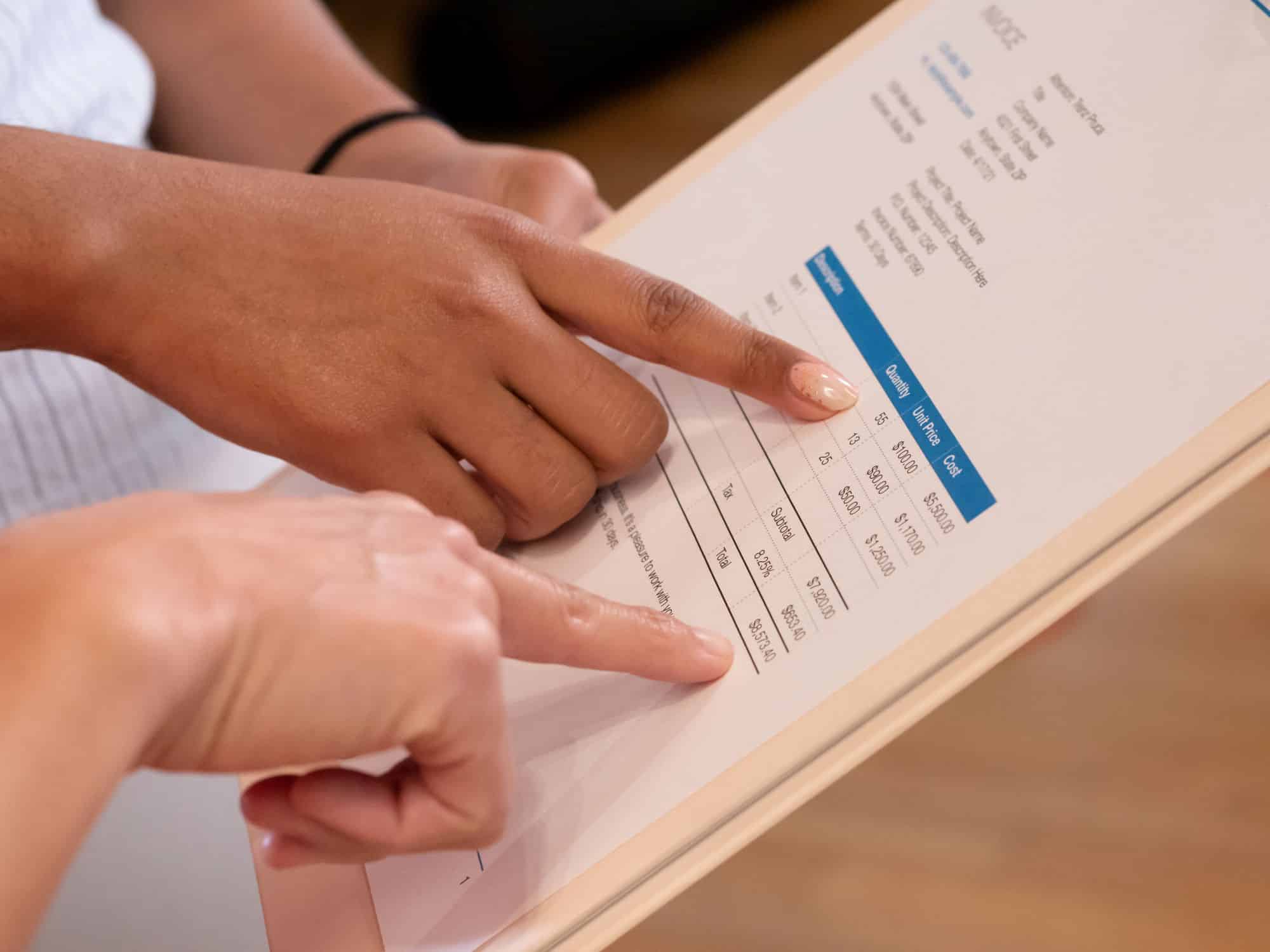

Let’s look at these strategies in action! Here are some case studies and their data:

| Case Study | Business Type | Strategy Implemented | Outcome |

|---|---|---|---|

| Case 1 | Retail | Proactive monitoring | Reduced missed billings by 50% |

| Case 2 | Healthcare | Enhanced communication channels | Improved payment accuracy by 80% |

| Case 3 | IT Services | Streamlined invoicing processes | Decreased billing errors by 75% |

We can see that through proactive monitoring, the retail business in Case 1 reduced missed billings. The healthcare industry in Case 2 saw improved payment accuracy with enhanced communication channels. and in Case 3, the IT services company decreased billing errors by streamlining their invoicing processes.

Tip: Automating billing systems will further increase efficiency and reduce manual errors.

These case studies show us that tailored strategies can help businesses across different industries minimize missed billings and optimize financial outcomes. By learning from these success stories, businesses can implement similar approaches to achieve positive results.

Missed Billings

To avoid missed billings, there are strategies to be done. Here are some steps to follow:

- Double-check all invoices and payments. This can help spot errors.

- Build trust with clients by regularly updating them on their account status.

- Invest in tech solutions that automate billing processes.

- Training staff on billing procedures can help ensure accuracy.

Here’s an example of how not having organized processes led to missed billings and financial strain. Stricter billing procedures and software solutions helped the company avoid similar issues in the future.

Frequently Asked Questions

Q: How can I avoid missed billings?

Q: How can I avoid missed billings?

A: Here are some tips to avoid missed billings:

1. Set up payment reminders: Utilize calendar alerts or mobile apps to remind you of upcoming bill due dates.

2. Sign up for automatic payments: Enable automatic deductions from your bank account or credit card to ensure timely payments.

3. Create a budget: Track your expenses to better manage your finances and avoid forgetting about bills.

4. Keep a bill payment schedule: Maintain a record of all your bills and their due dates to stay organized.

5. Opt for electronic billing: Receive bills via email to reduce the chances of missed physical mail.

6. Monitor your bank account: Regularly check your bank statements to ensure all bills have been properly paid.

Leave a Reply