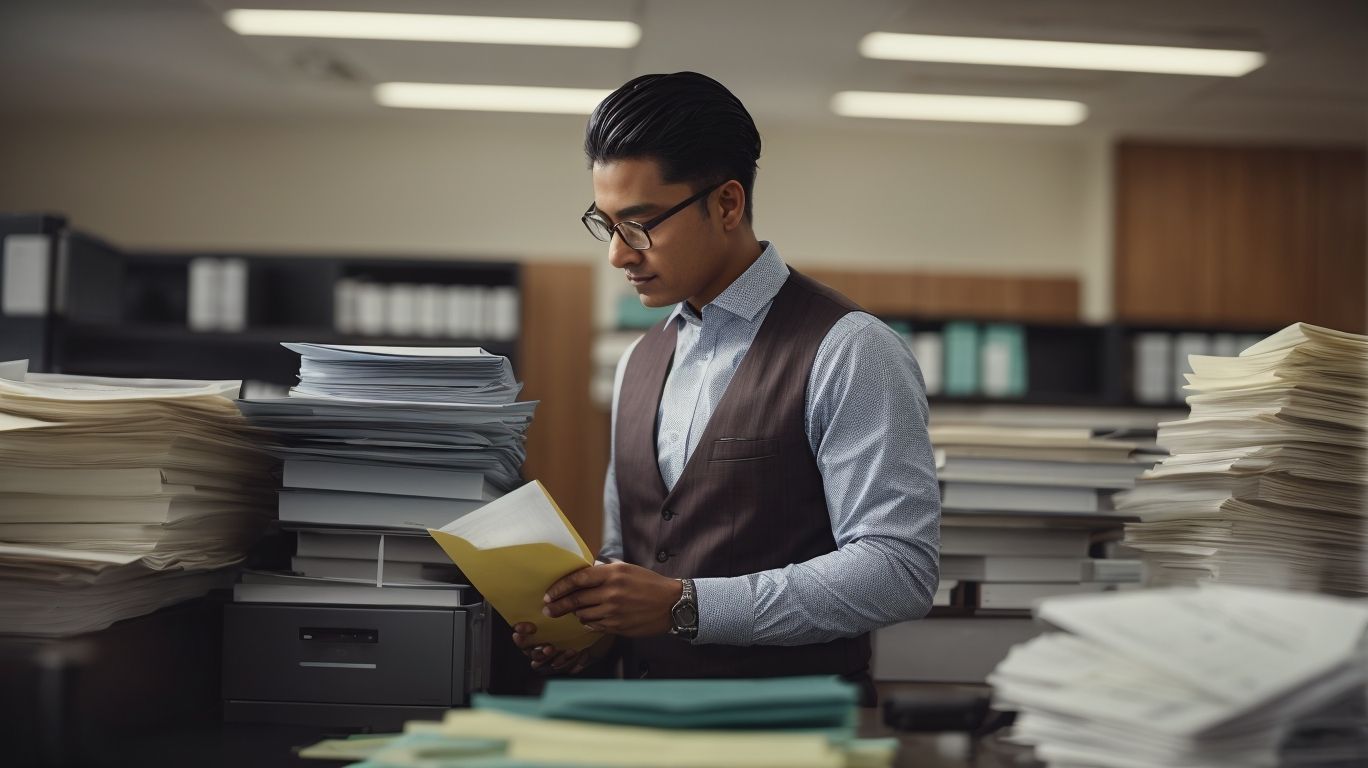

What Does an Accounting Clerk Do?

Are you curious about the daily responsibilities of an accounting clerk? Do you want to know more about this often overlooked but crucial role in a company? Accounting clerks play a vital role in keeping a business running smoothly, and understanding their role can be beneficial for both employees and employers. Discover the ins and outs of an accounting clerk’s job in this informative article. What Does an Accounting Clerk Do?

What Is An Accounting Clerk?

An accounting clerk is a vital member of a finance team within an organization. Their role is crucial in maintaining accurate financial records, processing invoices, and conducting reconciliations. Accounting clerks are responsible for ensuring the completeness and accuracy of financial transactions, assisting with budgeting and financial reporting, and supporting the overall financial operations of the company. They often utilize accounting software and spreadsheets to efficiently perform their tasks.

Pro-tip: To excel as an accounting clerk, attention to detail, strong organizational skills, and proficiency in accounting software are essential.

What Are The Responsibilities Of An Accounting Clerk?

As an integral member of an accounting team, an accounting clerk has a variety of important responsibilities. These tasks require a high level of attention to detail and organization, as they involve the accurate recording and management of financial information. In this section, we will delve into the core responsibilities of an accounting clerk, including maintaining financial records, processing invoices and payments, reconciling bank statements, and assisting with budget preparation. Each of these tasks plays a crucial role in ensuring the financial stability and success of a company.

1. Maintaining Financial Records

Maintaining accurate financial records is a crucial responsibility of an accounting clerk. This process involves the following steps:

- Organize and file financial documents, such as invoices, receipts, and bank statements, in a systematic manner.

- Record financial transactions carefully and precisely in accounting software or ledger books.

- Prepare and update financial reports, including balance sheets and income statements, with accuracy and completeness.

- Conduct regular audits and reconciliations to identify any discrepancies and resolve them promptly.

- Ensure compliance with accounting regulations and company policies to maintain the integrity of financial records.

To effectively maintain financial records, accounting clerks should possess excellent attention to detail, strong organizational skills, and proficiency in mathematical abilities. They should also have good time management abilities to meet deadlines. Pursuing relevant education, gaining experience in accounting or a related field, and obtaining certification can enhance career prospects. Remember, maintaining accurate financial records is essential for the success of any organization.

2. Processing Invoices and Payments

Processing invoices and payments is a crucial responsibility of an accounting clerk. This task involves several steps to ensure accurate and timely financial transactions. Here is a list of steps involved in the process:

- Receive invoices from vendors or suppliers.

- Review invoices for accuracy, matching them to purchase orders and contracts.

- Enter invoice details into the accounting system.

- Verify invoice amounts and calculations.

- Prepare payment schedules based on due dates and payment terms.

- Obtain proper authorization for payment.

- Generate and issue checks, electronic transfers, or other payment methods.

- Record payments in the accounting system and update vendor accounts.

- Reconcile payments made with vendor statements to ensure accuracy.

- Resolve any discrepancies or issues with invoices or payments.

By following these steps, accounting clerks ensure that invoices and payments are processed efficiently and accurately, maintaining the financial records of the organization.

3. Reconciling Bank Statements

Reconciling bank statements, as an accounting clerk, involves following a structured process to ensure accuracy and identify any discrepancies. Here are the steps to reconcile bank statements:

- Compare the ending balance on the bank statement with the balance in the company’s records.

- Identify any outstanding checks or deposits in transit that have not yet cleared the bank.

- Check for any bank errors or fees that require adjustment.

- Review any previously made bank reconciliation adjustments from past periods.

- Record any necessary adjustments to the company’s records to match the bank statement.

- Double-check that the adjusted balance in the company’s records matches the ending balance on the bank statement.

- Prepare a bank reconciliation report documenting the process and any discrepancies found.

4. Assisting with Budget Preparation

Assisting with budget preparation is an important responsibility of an accounting clerk. Here are the steps involved in this process:

- Gather Financial Data: Collect financial information from various departments and sources.

- Analyze Expenses: Review expenses from previous periods to identify trends and patterns.

- Create Budget Templates: Develop templates or spreadsheets to organize and track budget data.

- Estimate Revenues: Work with managers to forecast revenues based on historical data and market trends.

- Allocate Funds: Allocate funds to different departments or projects based on their needs and priorities.

- Monitor Budget Performance: Continuously monitor actual expenses and revenues against the budget to identify any variances.

- Provide Reports: Prepare reports and presentations to communicate budget information to management and stakeholders.

- Suggest Adjustments: Collaborate with managers to recommend adjustments to the budget based on changing circumstances.

What Skills Are Required For An Accounting Clerk?

As an integral part of any accounting team, an accounting clerk must possess a specific set of skills to effectively carry out their duties. These skills not only ensure accuracy and efficiency in their work, but also contribute to the overall success of the financial operations.

In this section, we will discuss the key skills required for an accounting clerk, including attention to detail, organizational skills, mathematical abilities, and time management. Each of these skills plays a crucial role in the daily tasks and responsibilities of an accounting clerk.

1. Attention to Detail

Having a keen attention to detail is an essential skill for an accounting clerk as it guarantees precision and eliminates errors. Here are steps to improve this skill:

- Double-check: Thoroughly review all data, calculations, and entries to identify any potential mistakes or inconsistencies.

- Follow procedures: Adhere to established protocols and guidelines to ensure consistency and accuracy in all tasks.

- Organize: Maintain a systematic approach to organizing and categorizing financial documents and records for easy retrieval.

- Verify information: Confirm the accuracy of data by comparing it with supporting documents and cross-referencing to ensure accuracy.

2. Organizational Skills

Organizational skills are crucial for an accounting clerk to effectively manage tasks and ensure efficiency in financial operations. Here are the steps to develop and improve organizational skills:

- Prioritize tasks: Identify urgent and important tasks and create a to-do list or use a task management system.

- Create a filing system: Arrange documents, invoices, and financial records in a logical and easily accessible manner.

- Maintain a clean workspace: Keep your desk free of clutter and organized, promoting concentration and productivity.

- Utilize digital tools: Take advantage of accounting software, spreadsheets, and digital calendars to streamline processes and track deadlines.

- Develop time management techniques: Set deadlines, allocate time for each task, and avoid procrastination.

- Communicate effectively: Maintain clear and concise communication with team members, clients, and superiors to ensure smooth collaboration.

By following these steps, an accounting clerk can improve their organizational skills and contribute to the efficient functioning of the accounting department.

3. Mathematical Skills

Mathematical skills are crucial for an accounting clerk. Here are the steps to effectively develop and utilize these skills:

- Gain a solid understanding of basic arithmetic, including addition, subtraction, multiplication, and division.

- Familiarize yourself with financial calculations such as percentages, interest, and depreciation.

- Become proficient in spreadsheet software like Excel to perform complex calculations and generate financial reports.

- Practice analyzing and interpreting numerical data to identify trends and make informed decisions.

Pro-tip: Stay updated with the latest accounting software and tools to streamline mathematical calculations, saving time and increasing accuracy.

What Education and Training Is Needed To Become An Accounting Clerk?

The role of an accounting clerk is a crucial one in any organization, as they are responsible for maintaining financial records and ensuring accuracy in financial transactions. So, what education and training is required to become an accounting clerk?

In this section, we will discuss the various paths one can take to become an accounting clerk, including obtaining a high school diploma or equivalent, pursuing an associate’s degree in accounting or a related field, and gaining on-the-job training. By the end, you will have a better understanding of the skills and knowledge needed to excel in this role.

1. High School Diploma or Equivalent

Obtaining a high school diploma or its equivalent is the first step towards becoming an accounting clerk. Here are the steps to follow:

- Research the educational requirements for becoming an accounting clerk through local job listings or career guides.

- Enroll in a high school program or obtain a General Education Development (GED) certificate to meet the necessary qualifications.

- Consider taking relevant courses in math, business, and accounting to enhance your knowledge and skills in the field.

- Participate in extracurricular activities, such as joining math or business clubs, to showcase your interest in the field.

- Seek guidance from school counselors or career advisors for information on post-secondary options, such as community colleges or vocational schools, that can help you achieve your goals.

- Explore financial aid options or scholarships that can assist in funding your education.

- Prepare necessary documents, such as transcripts and test scores, for college applications.

2. Associate’s Degree in Accounting or Related Field

Earning an associate’s degree in accounting or a related field is an important step towards becoming an accounting clerk.

- Research programs: Look for accredited institutions offering associate’s degrees in accounting or other related fields.

- Admission requirements: Meet the prerequisites, such as a high school diploma or equivalent.

- Curriculum: Enroll in courses covering fundamental accounting principles, financial analysis, bookkeeping, and business math.

- Gain practical experience: Seek internships or part-time jobs in accounting departments to apply classroom knowledge.

- Networking: Attend industry events and join professional organizations to connect with professionals and gain insights.

- Continuing education: Stay updated with industry trends and advancements through seminars, workshops, and certification programs.

3. On-the-Job Training

On-the-job training is a crucial step in becoming an accounting clerk. It provides practical experience and helps develop essential skills. Here are the steps involved in on-the-job training for accounting clerks:

- Shadowing: New hires observe experienced accountants to understand daily tasks and processes.

- Hands-on tasks: Trainees gradually take on more responsibilities, such as entering financial data, reconciling accounts, and processing invoices.

- Supervision: Supervisors guide and review trainees’ work, providing feedback and addressing any questions or concerns.

- Real-world scenarios: Trainees gain exposure to different accounting scenarios, such as handling discrepancies or assisting with audits.

- Continued learning: Trainees can attend workshops or seminars to enhance their knowledge and skills in specific areas of accounting.

On-the-job training, also known as 3. On-the-Job Training, allows individuals to apply theoretical knowledge in a practical setting, fostering confidence and competence in their role as accounting clerks.

What Is The Career Outlook and Salary for Accounting Clerks?

Now that we have a solid understanding of the responsibilities and daily tasks of an accounting clerk, let’s take a closer look at the career outlook and salary for this profession. In this section, we will discuss the job growth and demand for accounting clerks, as well as the average salary for this position. By the end, you will have a better understanding of the potential future for those pursuing a career as an accounting clerk.

1. Job Growth

The job growth for accounting clerks is expected to be positive in the coming years. To pursue a career in this field, consider the following steps:

- Earn a high school diploma or equivalent.

- Obtain an associate’s degree in accounting or a related field.

- Gain on-the-job training to develop practical skills.

To enhance your prospects, it is advisable to:

- Seek internships or entry-level positions in accounting or a relevant field.

- Stay updated with industry trends and technological advancements.

- Consider obtaining certification or licensure to demonstrate your expertise and commitment.

2. Average Salary

The average salary for an accounting clerk can vary depending on factors such as location, experience, and qualifications. On average, accounting clerks earn between $40,000 and $45,000 per year. However, this range can extend from $35,000 to $55,000 or more.

The industry, company size, and job responsibilities can also affect salary, with larger companies or industries with higher demands potentially offering higher pay. Additionally, those with additional certifications or advanced degrees may command higher salaries. Therefore, it is important to thoroughly research the specific industry and location to gain a more accurate understanding of the average salary for accounting clerks.

How Can Someone Become an Accounting Clerk?

Becoming an accounting clerk can be a fulfilling career path for those with a strong interest in numbers and finance. If you are considering this career, you may be wondering how to get started. In this section, we will discuss the key steps to becoming an accounting clerk, including education, experience, and optional certifications. By the end, you will have a better understanding of the requirements and qualifications needed to enter this field.

1. Gain Relevant Education and Training

To become an accounting clerk, it is crucial to gain relevant education and training. Follow these steps to achieve this:

- Obtain a high school diploma or equivalent to meet the minimum educational requirement.

- Pursue an associate’s degree in accounting or a related field to gain a deeper understanding of financial principles.

- Gain on-the-job training by interning or working in entry-level accounting positions.

Fun Fact: According to the U.S. Bureau of Labor Statistics, the employment of accounting clerks is projected to grow 4% from 2020 to 2030, which is about as fast as the average for all occupations.

2. Gain Experience in Accounting or Related Field

To acquire experience in accounting or a related field, follow these steps:

- Internship: Seek internships at accounting firms or finance departments to gain practical experience and learn industry-specific tasks.

- Part-time job: Look for part-time positions in accounting departments or financial institutions to gain hands-on experience in accounting practices.

- Volunteer: Offer your accounting skills to nonprofit organizations or community initiatives to gain practical experience and expand your network.

- Networking: Attend professional networking events, join accounting organizations, and connect with professionals in the field to learn from their experiences and gain insights.

- Professional development: Take advantage of continuing education courses, workshops, and seminars to enhance your knowledge and skills in accounting.

3. Obtain Certification or Licensure

To become an accounting clerk, obtaining certification or licensure is optional but can enhance career opportunities and credibility. Here are the steps to follow to obtain certification or licensure:

- Research: Explore different options available for certification or licensure, such as Certified Bookkeeper (CB), Certified Public Accountant (CPA), or Certified Management Accountant (CMA).

- Educational Requirements: Determine the necessary educational prerequisites for each certification or licensure, such as completing specific accounting courses or earning a degree in accounting.

- Exam Preparation: Review the content and format of the certification or licensure exam and create a study plan. Utilize study materials, practice exams, and review courses to enhance understanding and performance.

- Exam Registration: Register for the certification or licensure exam and pay the required fees. Follow all instructions regarding scheduling, locations, and required documentation.

- Exam Completion: Take the certification or licensure exam on the scheduled date and time. Follow all rules and regulations during the exam and strive to achieve a passing score.

- Continuing Education: Maintain certification or licensure by fulfilling any continuing education requirements. Stay up to date with changes in accounting practices and regulations through relevant courses, workshops, or seminars.

Accounting Clerk

Frequently Asked Questions

What Does An Accounting Clerk Do?

An accounting clerk is responsible for assisting with various financial and clerical tasks within an organization. They typically work under the supervision of an accountant or financial manager to maintain accurate and up-to-date records of financial transactions.

What are the responsibilities of an Accounting Clerk?

An accounting clerk may be responsible for entering financial data into accounting software, reconciling bank statements, creating and maintaining spreadsheets, processing invoices and payments, and preparing financial reports. They may also assist with payroll and tax preparation.

What skills are necessary for an Accounting Clerk?

An accounting clerk should have strong attention to detail, organization, and time management skills. They should also have knowledge of basic accounting principles and proficiency in relevant software and computer programs.

What education or training is required for an Accounting Clerk?

Many employers prefer candidates with a high school diploma or equivalent, but some may require an associate’s or bachelor’s degree in accounting or a related field. Accounting clerks may also receive on-the-job training or pursue certification through organizations such as the American Institute of Professional Bookkeepers.

What is the career outlook for an Accounting Clerk?

According to the Bureau of Labor Statistics, employment of accounting clerks is expected to decline slightly over the next decade. However, there will still be a need for these professionals in various industries, and those with relevant education, experience, and skills may have good job prospects.

What is the difference between an Accounting Clerk and an Accountant?

An accounting clerk typically handles basic financial tasks and supports an accountant or financial manager, while an accountant may have more advanced responsibilities and may be involved in financial planning and decision making. Additionally, an accountant may have more education and experience in the field.

Leave a Reply