Streamline Your Special Events with the Special Events Procedure Template Word

Are you tired of the chaos that comes with planning and executing special events? Look no further than the Special Events Procedure Template Word from Bizmanualz. This comprehensive template provides a step-by-step guide to ensure your special events run smoothly and efficiently.

The Special Events Procedure Template Word includes detailed procedures for event planning, budgeting, marketing, and execution. With this template, you can easily create a timeline for your event, assign tasks to team members, and track progress. The template also includes a risk management plan to help you identify and mitigate potential issues before they arise.

One of the key benefits of the Special Events Procedure Template Word is its flexibility. Whether you’re planning a small corporate event or a large-scale festival, this template can be customized to fit your specific needs. You can easily add or remove procedures, adjust timelines, and modify the risk management plan to suit your event.

In addition to streamlining your event planning process, the Special Events Procedure Template Word can also help you save time and money. By following the procedures outlined in the template, you can avoid common mistakes and ensure that your event stays within budget.

Overall, the Special Events Procedure Template Word is an essential tool for anyone involved in event planning. With its comprehensive procedures, customizable format, and cost-saving benefits, this template is sure to make your next special event a success.

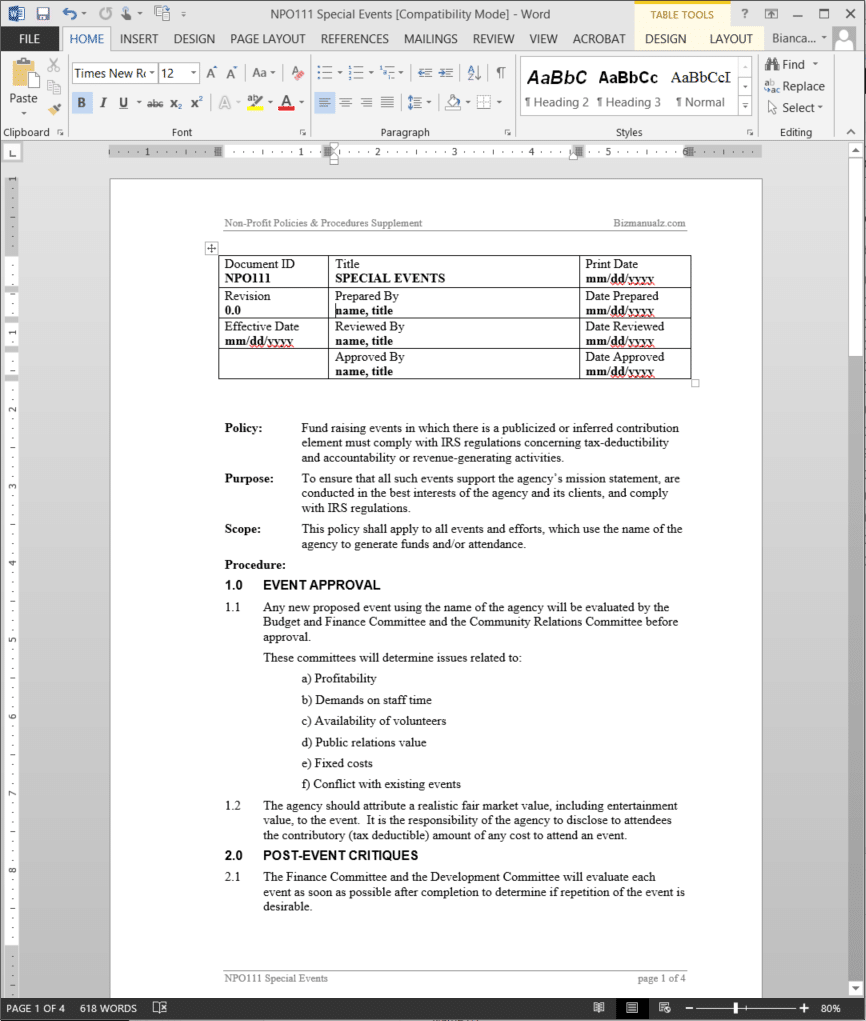

Special Events Procedure

The Special Events Procedure ensures that all such events support the agency’s mission statement, are conducted in the best interests of the non-profit agency and its clients, and comply with IRS regulations. Fund raising events in which there is a publicized or inferred contribution element must comply with IRS regulations concerning tax-deductibility and accountability or revenue-generating activities, in order to maintain a non-profit status.

The Special Events Procedure applies to all events and efforts, which use the name of the non-profit agency to generate funds and/or attendance. (4 pages, 621 words)

Special Events Procedure Activities

Special Events Procedure Activities

- Event Approval

- Post-Event Critiques

- Non-Agency Sponsored Events

Special Events Procedure Forms

Reviews

There are no reviews yet.