Streamline Your Fixed Asset Capitalization and Depreciation Process with Our Procedure Template

Managing fixed assets can be a daunting task, especially when it comes to capitalization and depreciation. However, with our Fixed Asset Capitalization Depreciation Procedure Template, you can streamline the process and ensure accuracy and compliance.

Our template is designed to help you establish a clear and concise procedure for capitalizing and depreciating fixed assets. It includes step-by-step instructions, forms, and checklists to guide you through the process and ensure that all necessary information is captured.

With our template, you can:

- Establish a consistent and standardized process for capitalizing and depreciating fixed assets

- Ensure compliance with accounting standards and regulations

- Reduce errors and inaccuracies in your fixed asset records

- Improve efficiency and save time

Our Fixed Asset Capitalization Depreciation Procedure Template is fully customizable to meet the specific needs of your organization. You can easily modify the template to reflect your unique processes and requirements.

Don’t let the complexities of fixed asset management overwhelm you. With our template, you can simplify the process and ensure accuracy and compliance. Order now and start streamlining your fixed asset capitalization and depreciation process today!

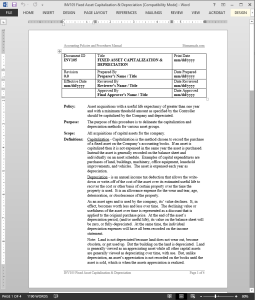

Fixed Asset Capitalization Depreciation Procedure

The Fixed Asset Capitalization Depreciation Procedure describes how to delineate capitalization and depreciation methods for various asset groups.

This Fixed Asset Capitalization Depreciation Procedure applies to all acquisitions with more than a one-year useful life expectancy and a minimum threshold amount as specified by the controller. (4 pages, 1232 words)

Fixed Asset Capitalization Depreciation Definitions:

Capitalization – Capitalization is the method chosen to record the purchase of a fixed asset on the company’s accounting books. If an asset is capitalized then it is not expensed in the same year the asset is purchased. Instead the asset is generally recorded on the balance sheet and individually on an asset schedule. Examples of capital expenditures are purchases of land, buildings, machinery, office equipment, leasehold improvements, and vehicles. The asset is expensed each year as depreciation.

Depreciation – is an annual income tax deduction that allows the write-down or write-off of the cost of the asset over its estimated useful life to recover the cost or other basis of certain property over the time the property is used. It is an allowance expense for the wear and tear, age, deterioration, or obsolescence of the property.

As an asset ages and is used by the company, its’ value declines. It, in effect, becomes worth less and less over time. The declining value or usefulness of the asset over time is represented as a discount that is applied to the original purchase price. At the end of the asset’s depreciation period, (and/or useful life), its value on the balance sheet will be zero, or fully-depreciated. At the same time, the individual depreciation expenses will have all been recorded on the income statement.

Cost basis – The total amount paid for the asset, in cash or kind, is considered the “cost-basis.” This should include all charges relating to the purchase, such as the purchase price, freight charges, and installation, if applicable. The cost basis is not the market value or list price of the asset. It is the total amount invested in the purchase or the total amount paid.

Fixed Asset Capitalization Depreciation Procedure Activities

Fixed Asset Capitalization Depreciation Procedure Activities

- Assets Capitalization

- Assets Depreciation

Fixed Asset Capitalization Depreciation Procedure References

- IRS Publication 964 “How to Depreciate Property”

Reviews

There are no reviews yet.