revenue

Financial analysis is an important tool for investors and business owners alike. It can help identify potential risks and opportunities in a company’s financial performance. However, it is important to be aware of red flags that may indicate a company is in financial trouble. This article will discuss the common red flags in financial analysis, such as declining sales, increasing debt, and decreasing profits.

Read moreAccounts Receivable is an important asset for any business. It is the money owed to a company by its customers for goods or services that have been delivered or used, but not yet paid for. Accounts Receivable is considered an asset because it is money that is owed to the company and can be collected in the future. It is also considered a form of revenue because it is money that has been earned but not yet received.

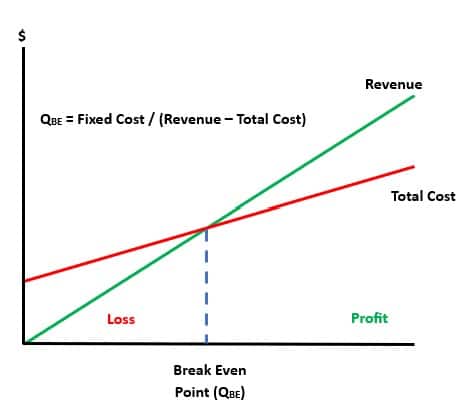

Read moreAre you looking for ways to reduce your break even point? This article will provide you with strategies to help you reduce your break even point and maximize your profits.

Read moreAccounting principles are guidelines for accuracy, consistency, and transparency in financial statements. These rules create a structure for recording, analyzing, and understanding financial data. What are the 3 basic accounting principles?

Read moreGeneral accounting is the process of noting, analyzing, an summarizing financial transactions for a company or organization. It involves keeping track of earnings an expenses, making financial statements, an following accounting rules an regulations. Professionals in general accounting must keep exact records of all financial activities in a business.

Read moreIn the world of accounting and finance, there are various metrics and rules that help evaluate the financial health and growth potential of companies. One such metric, gaining prominence in recent years, is the “Rule of 40.” Initially popularized in the software-as-a-service (SaaS) industry, the Rule of 40 provides a valuable framework for assessing the […]

Read moreClosing entries in accounting are the ultimate financial puzzle! They summarize revenue and expense accounts, so accuracy is guaranteed and the accounts are ready for the next cycle. This important step resets all temporary accounts to zero. These include revenue, expenses, gains, and losses. Their balances are transferred to permanent accounts such as retained earnings. […]

Read moreThe role of a Chief Financial Officer (CFO) is and essential one. CFOs use their expertise in financial management and strategic planning to drive growth and secure the financial health of a company. They oversee budgeting, forecasting, and financial reporting. Also, they manage cash flow, make investment decisions, and strategize to optimize profitability. Through data […]

Read moreUS accounting rules and standards are essential for financial accuracy and consistency. These professional rules of accounting tell companies how to record, present, and reveal financial information. They give businesses a reliable way to report their finances and help them make good decisions. What are commonly followed US accounting rules and standards?

Read more