check

How to Write Off Outstanding Checks

August 19, 2023 -

Improve Accounting

Writing off outstanding checks is a common accounting practice used to remove checks from the books that have not been cashed or are unlikely to be cashed. This process is used to ensure that the company’s financial statements accurately reflect the current financial position. It is important to understand the process of writing off outstanding checks and the implications it has on the company’s financial statements.

Read more

What Are Cash Cycle Procedures?

November 7, 2021 -

Solve Business Problems, Tighten Accounting Controls

Control over cash receipts and disbursement are a vital element of the company’s internal accounting controls. What Cash Cycle Procedures should you use?

Read more

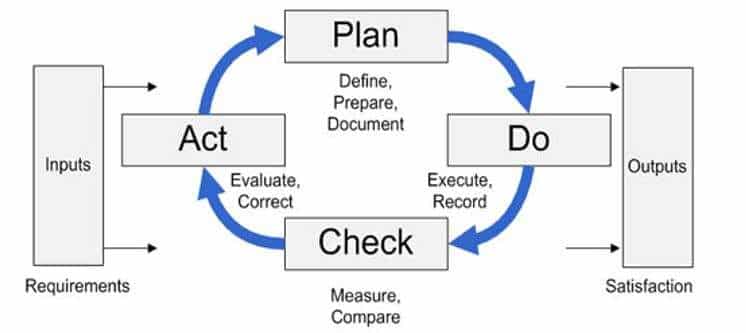

What Is Plan Do Check Act (PDCA)?

September 18, 2021 -

Analyzing Business Data, Improve Quality

PDCA sounds easy, doesn’t it? Just plan your work, and work your plan.

Read moreGet to Know Us

About

Bizmanualz

Our

Customers

Our

Contributors

Featured

Products

Business

Manual Products

FREE

Policies and Procedures

Privacy

Policy

FAQs

Risk

Free Guarantee

Process

Improvement

Contact

Us

Top Business Blog Posts

What

is a Procedure?

What

are Policies and Procedures SOPs?

What

is the Purpose of a Procedure Manual?

What

is the Difference Between Policies and Procedures?

How

to Create a Standard Operating Procedure

What

are the Top 10 Core Business Processes?

Are

Procedures the Same as Work Instructions?

What

Business Policies Does Every Company Need?

How

to Start Writing Policies and Procedures

Business Procedures

Accounting

Manuals Template

Finance

Procedures

HR

Procedures

IT

Policies and Procedures Templates

Sales

Marketing Procedures

Quality

Assurance Policy Statement and Procedures

Medical

Office Procedures

Employee

Handbook Manual

Aerospace

Procedures

Food

Safety Procedures

Security

& Disaster Plans

Production

Procedures

Procedure

Writing Guide