cash flow

Inventory costs can be a major expense for businesses, but there are ways to reduce them. This article will provide tips on how to reduce inventory costs, including analyzing inventory levels, using technology to track inventory, and negotiating with suppliers. Learn how to save money on inventory costs and keep your business running smoothly. Discover the best strategies for reducing inventory costs and get the most out of your inventory budget.

Read moreAre you looking for ways to write off inventory? Writing off inventory is a common accounting practice used to reduce the value of inventory that is no longer usable or has become obsolete. This article will provide an overview of the process of writing off inventory, including the different types of write-offs, the accounting implications, and the best practices for managing inventory write-offs. We will also discuss the potential tax implications of writing off inventory and how to ensure compliance with applicable laws.

Read moreCash flow and free cash flow are two important financial metrics used to measure the financial health of a business. Cash flow is the total amount of money coming in and out of a business, while free cash flow is the amount of cash available to the business after all expenses and investments have been paid. The difference between cash flow and free cash flow is that free cash flow is the amount of money that is available to the business to use for growth and expansion.

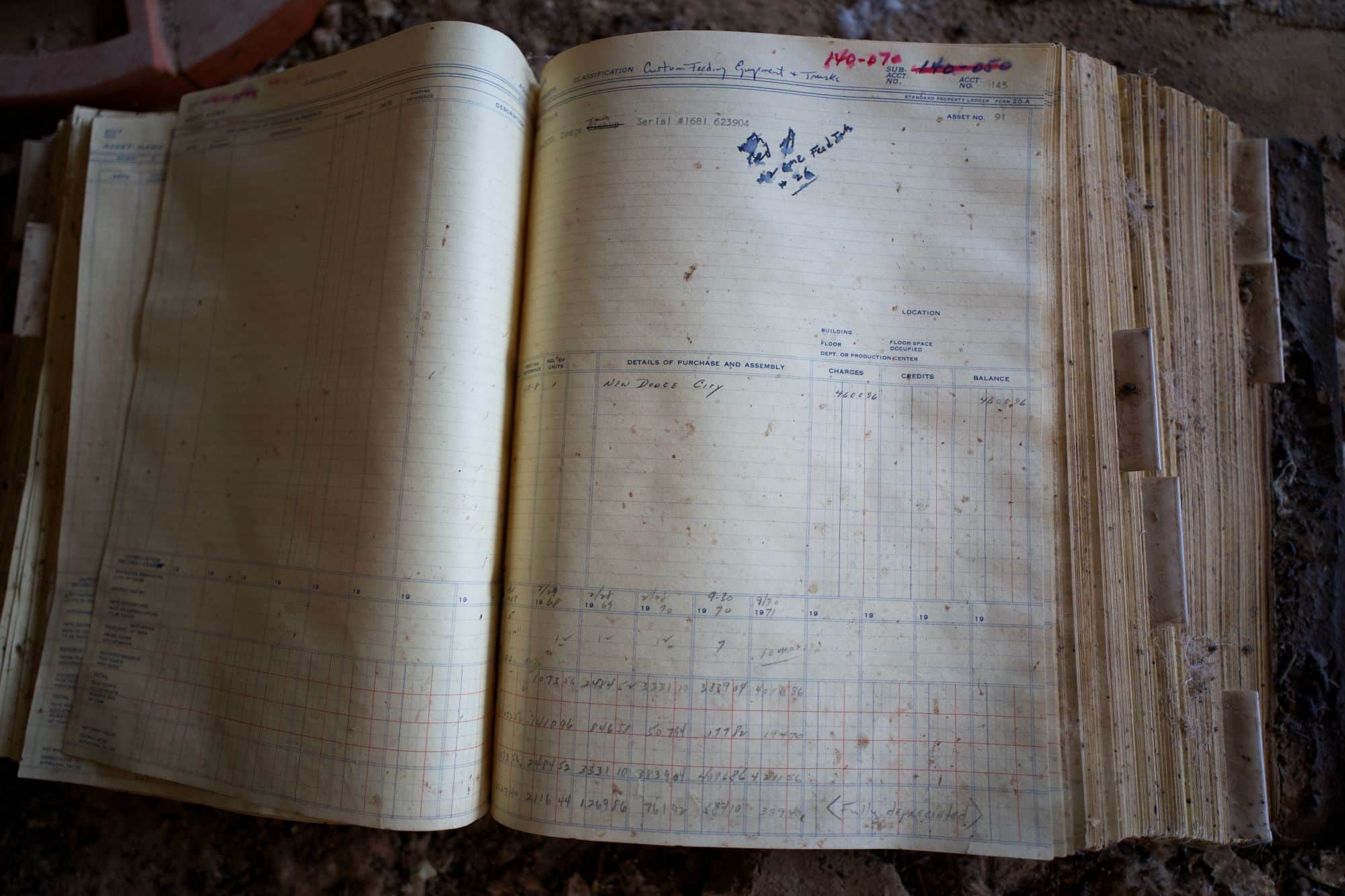

Read moreReconciling the general ledger is an important part of any business’s financial management. It ensures that all financial transactions are accurately recorded and reported. This article will provide an overview of the process of reconciling the general ledger, including the steps involved, the benefits of doing so, and the potential risks associated with it.

Read moreFinancial analysis is an important tool for investors and business owners alike. It can help identify potential risks and opportunities in a company’s financial performance. However, it is important to be aware of red flags that may indicate a company is in financial trouble. This article will discuss the common red flags in financial analysis, such as declining sales, increasing debt, and decreasing profits.

Read moreRecording an advance to an employee is a great way to ensure that they have the funds they need to cover expenses. It is important to understand the process and the implications of recording an advance to an employee. This article will provide an overview of the process, including the steps to take, the implications of recording an advance, and the best practices for managing advances.

Read moreAccounts Receivable is an important asset for any business. It is the money owed to a company by its customers for goods or services that have been delivered or used, but not yet paid for. Accounts Receivable is considered an asset because it is money that is owed to the company and can be collected in the future. It is also considered a form of revenue because it is money that has been earned but not yet received.

Read moreIs Depreciation a Direct Cost or Indirect Cost? Depreciation is an accounting concept that is used to spread the cost of an asset over its useful life. It is a non-cash expense that is used to reduce the value of an asset on the balance sheet.

Read moreErrors in financial statements, inaccurate assets and liabilities, and difficulty monitoring cash flow could arise when transactions aren’t recorded accurately. This also allows businesses to keep and eye on their income and expenses, giving them and accurate reflection of their financial standing.

Read more