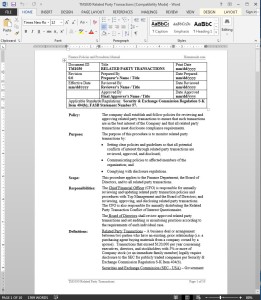

Related Party Transactions Procedure

Related Party Transactions Procedure

The Related Party Transactions Procedure ensures that such transactions are in the best interest of the company and in compliance with disclosure requirements. The procedure sets guidelines to avoid potential conflicts of interest and to communicate policies to affected members of the organization. It applies to the Finance Department, Board of Directors, and to all employee with the potential for related party transactions. (10 pages, 1803 words)

Related Party Transactions Responsibilities:

The CFO (Chief Financial Officer) is responsible for annually reviewing and updating related party transaction policies and procedures with Top Management and the Board of Directors; and reviewing, approving, and disclosing related party transactions. The CFO is also responsible for annually distributing the Related Party Transaction Conflict of Interest Questionnaire.

The Board of Directors should review approved related party transactions and set auditing or monitoring practices according to the requirements of each individual case.

Related Party Transactions Definitions:

Related Party Transactions – A business deal or arrangement between two parties who have an existing, prior relationship (i.e. a purchasing agent buying materials from a company owned by a spouse). Transactions that exceed $120,000 per year concerning executives, directors, and stockholders with 5% or more of company stock (or an immediate family member) legally require disclosure to the SEC for publicly traded companies per Security & Exchange Commission Regulation S-K Item 404(b).

Securities and Exchange Commission (SEC – USA) – Government commission created by the Securities Exchange Act of 1934 to regulate securities markets and protect investors.

Related Party Transactions Procedure Activities

Related Party Transactions Procedure Activities

- Related Party Transactions Plan

- Related Party Transactions

- Related Party Transactions Review

- Improving Related Party Transactions

Related Party Transactions Procedure References

- Securities and Exchange Act of 1934

- SEC General Regulation S-K (17 CFR 229, USA)

- FASB Statement of Financial Accounting Standards No. 57, “Related Party Disclosures“

- FASB Statement on Auditing Standards No. 6, Related Party Transactions

Related Party Transactions Procedure Forms

- Related Party Transaction Policy and Conflict of Interest Questionnaire Form

- Related Party Transaction Questionnaire Log Form

Reviews

There are no reviews yet.