Streamline Your Financial Restatements with Our Procedure Template Word Product

Financial restatements can be a daunting task for any organization. It involves revising previously issued financial statements to correct errors or omissions. This process can be time-consuming and costly, especially if you don’t have a clear procedure in place. That’s where our Financial Restatements Procedure Template Word product comes in.

Our template is designed to help you streamline the financial restatement process. It provides a step-by-step guide on how to identify errors, assess their impact, and make the necessary corrections. The template also includes a checklist of documents and information needed to complete the restatement process.

With our Financial Restatements Procedure Template Word product, you can:

- Ensure compliance with accounting standards and regulations

- Reduce the risk of errors and omissions in financial statements

- Save time and money by having a clear procedure in place

- Improve transparency and accuracy in financial reporting

Our template is easy to customize to fit your organization’s specific needs. It comes in a Microsoft Word format, making it easy to edit and share with your team. You can also use it as a training tool for new employees or as a reference guide for existing ones.

Don’t let financial restatements be a headache for your organization. Streamline the process with our Financial Restatements Procedure Template Word product today.

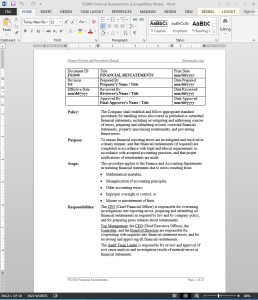

Financial Restatements Procedure

The Financial Restatements Procedure ensures financial reporting errors are investigated and resolved in a timely manner, and that financial restatements are completed in accordance with ethical and legal requirements and accepted accounting practices. The procedure applies to mathematical mistakes, misapplication of accounting principles, improper oversight or control, misuse or misstatement of facts. (10 pages, 1986 words)

Financial Restatements Responsibilities:

The CFO (Chief Financial Officer) is responsible for overseeing investigations into reporting errors, preparing and submitting all financial restatements as required by law and by company policy, and for preparing press releases about restatements.

Top Management, the CEO (Chief Executive Officer), the Controller, and the Board of Directors are responsible for cooperating with inquiries into financial statement errors, and for reviewing and approving all financial restatements.

The Audit Team Leader is responsible for review and approval of root cause analysis and investigation results of material errors in financial statements.

Financial Restatements Definitions:

Auditor – A qualified accountant who inspects the accounting records and practices of a business or other organization.

Audit Team – Body formed by a company’s Board of Directors to oversee internal and external audit operations. Sarbanes-Oxley (USA) requires that publicly traded companies form an Audit Team from the Board of Directors.

Financial Statements – Statements that give an overall picture of business operations and of financial condition.

Financial Restatement – When a company, either voluntarily or prompted by regulators or auditors, revises previous financial statements.

Form 10-Q/A – Form 10-Q is the form and instructions used for submitting quarterly financial reports to the SEC. “Q/A” is used when submitting a financial report that amends a previously submitted 10-Q.

Financial Restatements Procedure Activities

Financial Restatements Procedure Activities

- Financial Restatement Plan

- Financial Restatements

- Reviewing the Financial Restatement Process

- Improving the Financial Restatement Process

Financial Restatements References

- Securities and Exchange Act of 1934(USA)

- SEC General Rules and Regulations(12B CFR 240)

- SEC Accounting Regulation S-X (17 CFR 210)

- SEC General Regulation S-K (17 CFR 229)

- SEC General Rules for Electronic Filing Regulation S-T (17 CFR 232)

- Sarbanes-Oxley Act of 2002 (USA)

- SEC Regulation 14A Solicitation of Proxies (14A CFR 240)

Financial Restatements Procedure Forms

Reviews

There are no reviews yet.