Streamline Your HR Payroll Tax Management with Our Calendar Template

Managing HR payroll taxes can be a daunting task, especially when you have to keep track of multiple deadlines and filing requirements. Our HR Payroll Tax Calendar Template Word product is designed to simplify this process and help you stay on top of your tax obligations.

Our template is easy to use and customizable to fit your specific needs. It includes all the important dates and deadlines for federal and state payroll taxes, as well as reminders for quarterly and annual filings. With our template, you can easily keep track of when taxes are due, when to file forms, and when to make payments.

Our HR Payroll Tax Calendar Template Word product is perfect for small businesses, HR departments, and payroll professionals who want to streamline their tax management process. It is also ideal for those who want to avoid costly penalties and interest charges for missed or late tax payments.

Our template is available for immediate download and can be easily edited and customized to fit your specific needs. It is compatible with Microsoft Word and can be used on both Windows and Mac computers.

Don’t let HR payroll taxes become a headache for your business. Streamline your tax management process with our HR Payroll Tax Calendar Template Word product and stay on top of your tax obligations.

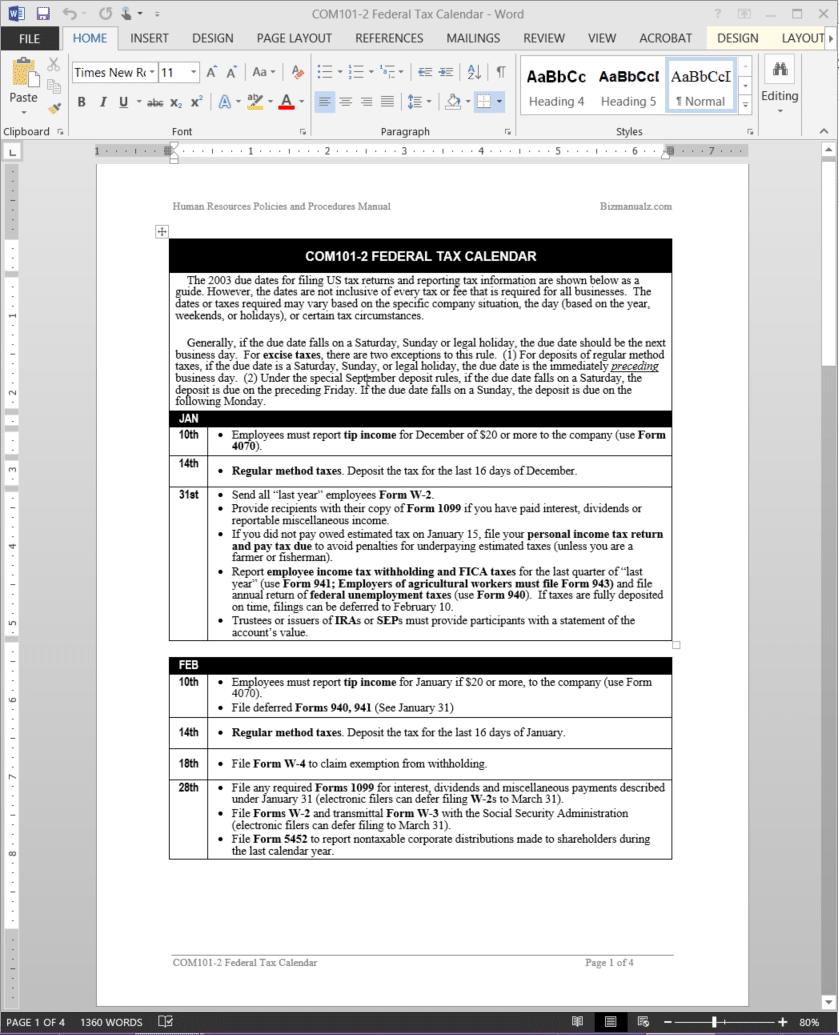

Federal Tax Calendar Template

The Federal Tax Calendar Template is an example of when tax payments are due. The dates on COM101-2 FEDERAL TAX CALENDAR are not inclusive of every tax or fee that is required for all businesses. The dates or taxes required may vary based on the specific company situation, the day (based on the year, weekends, or holidays), or certain tax circumstances. The Treasury Department and or the Internal Revenue Service (IRS) collect all monies due the Federal Government.

Technically, withholding amounts deducted from a paycheck are considered the government’s money and the business owner is temporarily holding the money, in deposit, until it can be transferred to the government. Any failure to pay in a timely fashion is considered a serious matter by the IRS and will not be ignored. The IRS will impose a penalty for failing to pay the required withholding amounts. In addition, interest will be charged until the amount is paid. Both interest and penalties imposed by the IRS can add up significantly.

Federal Tax Calendar Template Details

Federal Tax Calendar Template Details

Pages: 04

Words: 1360

Format: Microsoft Word 2013 (.docx)

Language: English

Manual: Human Resources

Category: Hiring

Procedure: Payroll Procedure COM101

Type: Guide

Related Documents

Reviews

There are no reviews yet.