Streamline Your Property Tax Assessments with Our Procedure Template Word Product

Are you tired of the tedious and time-consuming process of property tax assessments? Our Property Tax Assessments Procedure Template Word product is here to help. This comprehensive template provides a step-by-step guide to streamline your property tax assessments and ensure accuracy and compliance.

Our template includes detailed instructions on how to gather and analyze property data, calculate property values, and complete necessary forms and documentation. With our easy-to-follow procedures, you can save time and reduce errors in your property tax assessments.

Our Property Tax Assessments Procedure Template Word product is customizable to fit your specific needs. You can easily modify the template to reflect your organization’s unique processes and requirements. This flexibility ensures that you can use our template to improve your property tax assessments, regardless of your organization’s size or industry.

Our template is also designed to help you stay compliant with local and state regulations. We provide guidance on how to ensure that your property tax assessments meet all necessary legal requirements, reducing the risk of penalties or fines.

Investing in our Property Tax Assessments Procedure Template Word product can save you time, reduce errors, and improve compliance. With our comprehensive guide, you can streamline your property tax assessments and focus on other important aspects of your business. Order now and start improving your property tax assessment process today!

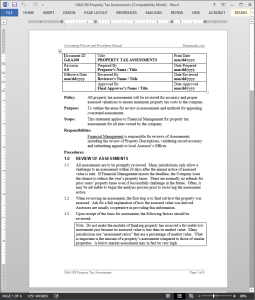

Property Tax Assessments Procedure

The Property Tax Assessments Procedure outlines the areas for review in assessments. The Property Tax Assessments Procedure also explains how perform a property tax assessment appeal.

Customize and apply this property tax assessments policy in your finance department for property tax assessments for all sites owned by your company. (4 pages, 1235 words)

Property Tax Assessments Responsibilities:

Financial Management is responsible for reviews of assessments including the review of Property Descriptions, validating record accuracy and submitting appeals to local Assessor’s Offices.

Property Tax Assessments Procedure Activities

Property Tax Assessments Procedure Activities

- Review of Assessments

- Property Tax Assessment Appeal

Reviews

There are no reviews yet.