What Accounting Methods Are Common?

Accounting methods are the account rules a company uses to maintain its financial transactions, such as accrual accounting. GAAP and IFRS pronouncements constitute the universal principles companies use to keep the “books”. What accounting methods are common?

Types of Accounting Methods

Accounting methods consist of the accounting rules your company follows. The types of accounting methods and accounting standards are typically defined within your accounting manual, a key component of your accounting system. Your accounting policies and procedures manual defines your policies, procedures, and internal controls for Sarbanes Oxley and other compliance needs. There are two main accounting methods: accrual and cash.

Accrual Method Defined

The first of the main accounting methods used in making accounting systems work is the accrual method. It’s defined as the method of keeping accrual accounts like inventory, accounts receivable, and accounts payable. The expenses incurred and income earned for a given period are recorded, although such expenses and income may not have been actually paid or received in cash. Hence, the financial statements show revenues and expenses, even before any such revenues or expenses are paid.

The accrual method is the more acceptable and the more widely used because it correctly matches the earning process to the activity. In other words, revenue is recorded when services or goods are rendered or shipped, regardless of when paid.

Cash Method Defined

The other of the main accounting methods is the cash method. This is familiar to most individuals since personal income tax returns are filed on the cash basis. As the name implies, revenues and expenses are only recorded when the consideration paid actually changes hands. This could be months after the actual event occurred.

The other of the main accounting methods is the cash method. This is familiar to most individuals since personal income tax returns are filed on the cash basis. As the name implies, revenues and expenses are only recorded when the consideration paid actually changes hands. This could be months after the actual event occurred.

Many small business owners prefer the cash basis due to its simplicity and ease of understanding. At the end of any given period, the recorded net income will agree more closely to the change in the business’s cash balance. However, when requesting financing from any bank or agency, business owners are generally asked to furnish financial statements, prepared on the accrual basis.

Clearly any “stakeholders” want to see the true effect on the financial statements of activities, as the cash cycle occurs, as opposed to when they are paid. Many small businesses (under $1,000,000 in sales) that do not carry inventory may use the cash basis method for filing business tax returns, even if the business keeps its books on the accrual basis. In a growing business, income taxes can be deferred for a year for revenues recorded from increases in accounts receivables.

Percentage of Completion Method Defined

The percentage of completion method is a variant of the one of the accounting methods, the accrual method. It’s used for businesses with long term contracts, primarily construction contractors. Instead of valuing revenues based on services invoiced, contractors will adjust the revenue billed to agree with the estimated percentage of the total contract that has been completed to date.

Accounting Reporting Standards

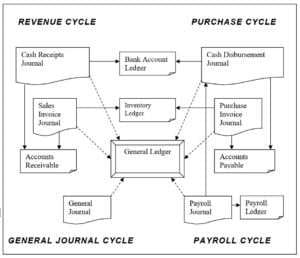

Many transactions resulting from the operation of the various accounting cycles are entered routinely through the accounting system without much concern about reporting standards. However, other transactions can be handled in different ways depending on a person’s judgment over the facts and circumstances.

For example, if a business decides to lease an expensive piece of machinery, how should it record lease payments? Perhaps they should be simply charged to lease expense. Do you have a lease policy procedure? Your accounting policies should clearly state how to record leases.

However, maybe the terms of the lease imply an obligation and the payments represent a pay-off of that obligation. In that case, a portion of the payment should be applied to the debt and the other portion charged to interest expense.

The resulting financial statements would look different in those two cases. The usefulness of financial statements would be severely limited if their presentation was based solely upon the preparer’s judgment. Consequently, certain standards must be agreed upon and followed.

GAAP – Generally Accepted Accounting Principles

There was no commonly agreed upon standardization over accounting practices for past accounting systems until after the great depression of 1933. In response to the vast sums lost by investors in the stock market crash, the Securities and Exchange Commission (SEC) was established and given authority to set accounting standards for publicly held corporations.

In an effort to stave off further government regulation, the accounting profession, organized under the American Institute of Certified Public Accountants (AICPA), issued its first auditing standards in 1939. This began its attempt at self-regulation, though the AICPA continues to work with the SEC and defers to the SEC on regulatory reporting requirements for publicly held companies.

Between then and 1959 the AICPA issued 51 authoritative pronouncements known as Accounting Research Bulletins (ARB) that formed the basis of what became known as generally accepted accounting principles (GAAP). From 1959 to 1973 the Accounting Principles Board (APB) issued 31 additional standards.

In 1973 a new full-time independent body, separate from the AICPA was created, called the Financial Accounting Standards Board (FASB). This board has issued over 147 Statements of Standards by the end of 2002. These standards, along with official interpretations, Accounting Research Bulletins (ARB), previously issued pronouncements, SEC rulings, industry guides, and other exposure drafts make up the current basket of generally accepted accounting principles.

The Matching Principle

Woven through all of the GAAP pronouncements are several universal principles. One is the concept of matching. Accrual and percentage of completion methods represent attempts to more properly match the financial statement presentation to the actual transactions that have occurred.

This represents the difference between finance, accounting and bookkeeping. Revenues are matched to services performed and product sold, and expenses are matched to activities that have incurred expenses. This is why accrual based reporting conforms to GAAP and cash based reporting does not. The matching principle is a keystone of generally accepted accounting practice.

Conformity

Conformity is another widely used concept in accounting. The method of implementing percentage of completion, for example, should be the same for all companies. Only by practicing conformity will there be comparability. Investors, lenders and business owners, could not properly evaluate the success of a particular business as compared to the rest of its industry, if all businesses used different methods for recording transactions. Conformity is another fundamental principle in GAAP.

Valuation

A common consensus in GAAP reporting is the agreement that financial statements are valued on an historical basis. This is an important concept that provides for consistent conformity. As an example, real estate is valued at its original cost, not what it might be worth on an appraised value.

Accounting board pronouncements have continued to modify this principle to make financial reports even more conservative than historical basis, by requiring a downward adjustment, if the potential selling value has fallen below the original cost.

An example is inventory, when obsolescence reduces its value below its original cost. Another example is the yearly devaluing of fixed assets through depreciation. Each year the original cost of a building or equipment is lowered by writing off a portion of its expected life and expensing it to depreciation. Other assets like accounts receivable are reviewed and written down to their expected realizable value by charging off any amount deemed uncollectible to bad debt expense.

The overall attempt is to present financial statements on the most conservative basis possible. The objective is to ensure that the net worth recorded on a company’s financial statements is never more than the true value of a company, based upon the lower of historical cost or the expected realized selling price of its assets minus its liabilities.

Events in the early years of the 2000’s have shown how important this objective is. In spite of all the GAAP pronouncements in place, “creative accounting” techniques that push the gray areas of accounting valuation issues have resulted in significant, previously undisclosed impairments to the financial statements of companies like Tyco, Enron, and WorldCom.

Inventory Valuation

Inventory valuation is a specially treated area that deserves specific mention. Your inventory is always valued at the lower or cost or market (realizable value, net of selling costs). However, cost can be determined in three different ways.

First In – First Out (FIFO) values the cost of inventory based on the principle that the first item purchased is the first item to be sold. Visually, this method mimics a store owner’s method of stocking shelves by putting its most recent purchases at the back of the shelf, so that the older product is sold first. Hence, the value of the amount of inventory on hand, always represents the cost of the very latest purchases. In a true FIFO valuation, each purchase is tracked as a separate layer with its own cost. Sales are also tracked and taken from one or more specific layers.

A variant on the FIFO method is the Average Cost FIFO method, which eliminates the need to keep track of separate purchasing layers. The cost of each new purchase is added to the “pool” which changes the overall cost of the “pool”. Sales are then taken from this single “pool”, leaving a value of the inventory on hand that closely resembles, but not necessarily equals, the value of inventory on a true FIFO method.

A final method of valuation is based on Last In – First Out (LIFO). This is the opposite of FIFO: the last items purchased are deemed to be the first items sold. This means that the ending inventory value is comprised of the very first items purchased. This value could be lower than the FIFO value, particularly in inflationary times.

One might ask how two opposing methods of valuation could both be allowed under GAAP, particularly, when this would seem to violate the important principle of conformity. This is one of many good examples of the challenge to create a consensus of opinion when there are several options, which have equal justification and support. Accounting principles are not static laws handed down from the mountaintop, hence the term, “generally accepted.”

In this case, there is current justification and support for either method. In deference to conformity, GAAP provides that financial statements valuing inventory on LIFO are to include a footnote reference, which discloses the valuation difference between LIFO and FIFO. This is one of many compromises that provide conformity over different methods of valuation.

Materiality

A final important concept in all of GAAP is materiality. Surprisingly, coming from a group of professionals known for their penchant for chasing down pennies, every pronouncement contains a materiality clause that allows for non-compliance in any area, if the effect on the financial statement presentation is clearly immaterial. In other words, if the effect is minimal or does not represent a significant change in the financial position of the account then it might be considered immaterial.

Basic Accounting Ledger Accounts

Your accounting ledger accounts make up your financial statements that include your balance sheet and income statement.

Balance sheet

Contains accounts whose value is determined at a specific point in time.

Assets – accounts with value that you own

- Cash – the amount on hand or in the bank at a specific point in time

- Accounts Receivable – how much people owe you

- Inventory – the value of business merchandise for sale

- Fixed Assets – the value of property and equipment

Liabilities – accounts with value that you owe to others

- Accounts Payable – how much you owe others for unpaid purchases

- Debt – how much you owe others for money borrowed

- Other Liabilities – services or money owed to others

Equity – accounts with paid in capital or earned from profits.

- Contributed Capital – money invested in business by ownership

- Distributions – dividends and other types of money paid out to ownership

- Capital Stock – money invested in exchange for company ownership

- Retained Earnings – earnings retained in business from net profits

Income Statement

This statement contains accounts whose value is determined over a period of time (e.g., day, week).

Income: total sales and income recorded over a period time

Expenses: total purchases and other expenses recorded over a period of time

Basic Accounting Formula

“I found the Bizmanualz Accounting Policies and Procedures manual to be an efficient way to build my new organization’s accounting manual in a short time. Adapting the specific policies and procedures to our needs was quite simple, and I saved a great deal of valuable time better spent elsewhere.” Bob Dodd, CPA, Controller Global Development Network

All transactions are posted to one or more of these accounts. As discussed earlier, every posted transaction must balance. That is, debits must equal credits. Furthermore, the result of every posting, if done correctly, will never put the Basic Accounting Formula out of balance. Asset accounts will always equal the total of all liability and owner equity accounts. If this formula is ever out of balance, the cause will always be an incorrect transaction posting where debits don’t equal credits.

Accounting Assets

Assets include those accounts, which give value to the company: cash, accounts receivable, inventory, property, etc. Liabilities are those accounts which reduce the company’s value: accounts payable, debt, and other liabilities. If total assets are greater than liabilities, then this net value (that is, the total of all assets minus liabilities) represents the true value of the business, otherwise known as its Equity. Hence, the Basic Accounting Formula can be expressed and equally understood in these two ways:

Assets = Liabilities + Equity

or

Equity = Assets – Liabilities

If the company’s assets are less than its liabilities, then it will necessarily show a negative equity. This makes intuitive sense to anyone following the demise of a business in bankruptcy. When a business owes more than it has in value, the resulting negative equity is an obvious warning sign.

Accounting Equity

The equity accounts include owner’s contributions, distributions, and retained earnings. Retained earnings operate in a manner unique to all other accounts. It contains the net effect of postings to all income and expense accounts. It is truly the one account, which links the balance sheet accounts (assets, liabilities and owner’s equity) with the income and expense accounts.

Understanding the importance of retained earnings, the Basic Accounting Equation could be expanded thus:

ASSETS = LIABILITIES + (Investor and owner contributions, and distributions + Retained Earnings)

OR

ASSETS = LIABILITIES + (OWNER’S EQUITY ACCOUNTS + INCOME – EXPENSE)

Common Accounting Methods

When a transaction, like writing a check or paying a bill, is executed in an accounting program, the accounting software is designed to take this transaction event and create the proper and necessary debit and credit entries to record the effects of the transaction in the appropriate journals and general ledger accounts. Now that you know a little more about accounting methods, your CFO accounting policies and procedures should help you achieve more accounting control.

Leave a Reply