How Do You Keep Business and Personal Finances Separate?

6 Easy Ways to Keep Your Business and Personal Finances Separate

A business can build up a series of legal and financial liabilities so it is important to keep your business identity separate from your personal identity. Use these handy tips to keep your business and personal finances separate, avoiding the liability problem altogether.

1. Establish a Separate Business Entity

Every business should do this whether you are launching an eCommerce business or something else, establishing a separate legal entity for your business, such as an S Corp, C Corp, or LLC, should be at the top of your to-do list. Which type of legal entity depends on the nature of your business, but if you are unsure, a legal expert can steer you in the right direction. Beyond that, you will also need to visit the IRS’s website and apply for an Employer Identification Number (EIN) so you have a separate legal identity with the IRS too.

2. Open a Business Bank Account

If you really want to keep your finances separate, one of the best things you can do is open up a business checking account, as well as at least one line of credit. This will help you to understand your business cash flow needs also. You don’t want to mix your business and personal expenses together in checking or credit account. A business credit card is a great way to build your business credit scores, which can be helpful should you ever need to apply for a small business loan.

3. Give Yourself a Salary

Keeping your personal spending separate is hard to do when you’re paying for everything from one account. As your own boss, you should be setting up standard payroll policies and paying yourself a salary and not a draw from cash flow. Transferring your paycheck to your personal account allows you to keep all of your personal expenses together and help to keep things straight with the IRS.

4. Separate and Keep Receipts

Every purchase we make comes with a receipt. Something you can do that will help you keep business and personal accounts separate is keeping your receipts organized. For digital receipts, you can set up folders on your phone or computer. To organize your physical receipts, you can get folders or a pair of boxes you can use to keep things separate. The best solution is to use Quicken or QuickBooks to organize your business accounting and bookkeeping.

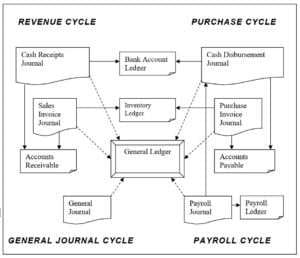

5. Understand Personal vs. Business Expenses

Understanding how accounting systems work can be helpful here. It should be pretty obvious which expenses are business-related and which ones are strictly personal, but when you’re using your personal items for business-related tasks, you should count this as a business expense.

Whether you’re using your personal phone to consult with customers, driving your personal vehicle to meetings, or you have a home office, keeping track of these expenses is a smart move because you’ll be able to write off some or all of these expenses when tax season rolls around.

Keeping daily, weekly or monthly notes of personals items used for business is important when the end of the year rolls around and your accountant asks you for the total and if you have records to back it up. It will be much harder to remember if you don’t keep good notes.

6. Educate other Business Members

Now that you are up to date on the difference between business and personal expenses, it is time to ensure your partners and employees are training as well. If you are the only one involved that is actively separating their personal expenses from business expenses, it won’t really make a difference. If everyone is informed and involved, keeping everyone’s personal expenses separate will be simple.

Keeping Business and Personal Finances Separate

Mixing personal and corporate funds is one of the quickest ways for business owners to lose their company. You can use a money management service or look into debt snowball vs debt avalanche to get yourself out of debt. You don’t want the business liability to add to your debt as a result of poor money management or combining business and personal costs in the first place.

Leave a Reply