How Can Companies Avoid Unnecessary Business Expenses?

Part of being a responsible small business owner is anticipating major expenses and doing your best to avoid them. How can a business avoid unnecessary expenses?

How to Avoid Major Unwanted Business Expenses

In some cases, it comes down to preparedness – certain things like repair costs, fees, and fines can be avoided with great success if you’re careful. And while you can’t think about every possible issue that might come up, there are some significant areas that you should know to tread carefully in. This mainly involves legal matters, insurance policies, and the unexpected costs of running specific internal departments.

Never Do Any Legal Work Yourself

This should go without saying, yet you can still find a surprisingly large number of cases where business owners have buried their companies by choosing to handle some legal matters on their own. Don’t be fooled by the various sites promising to guide you through these things for a lower price than a lawyer consultation. They might work sometimes, but it only takes one mistake to find yourself in a lot of trouble. Always go through a qualified attorney for anything involving legal issues, and once your company is large enough to support it, hire someone permanently.

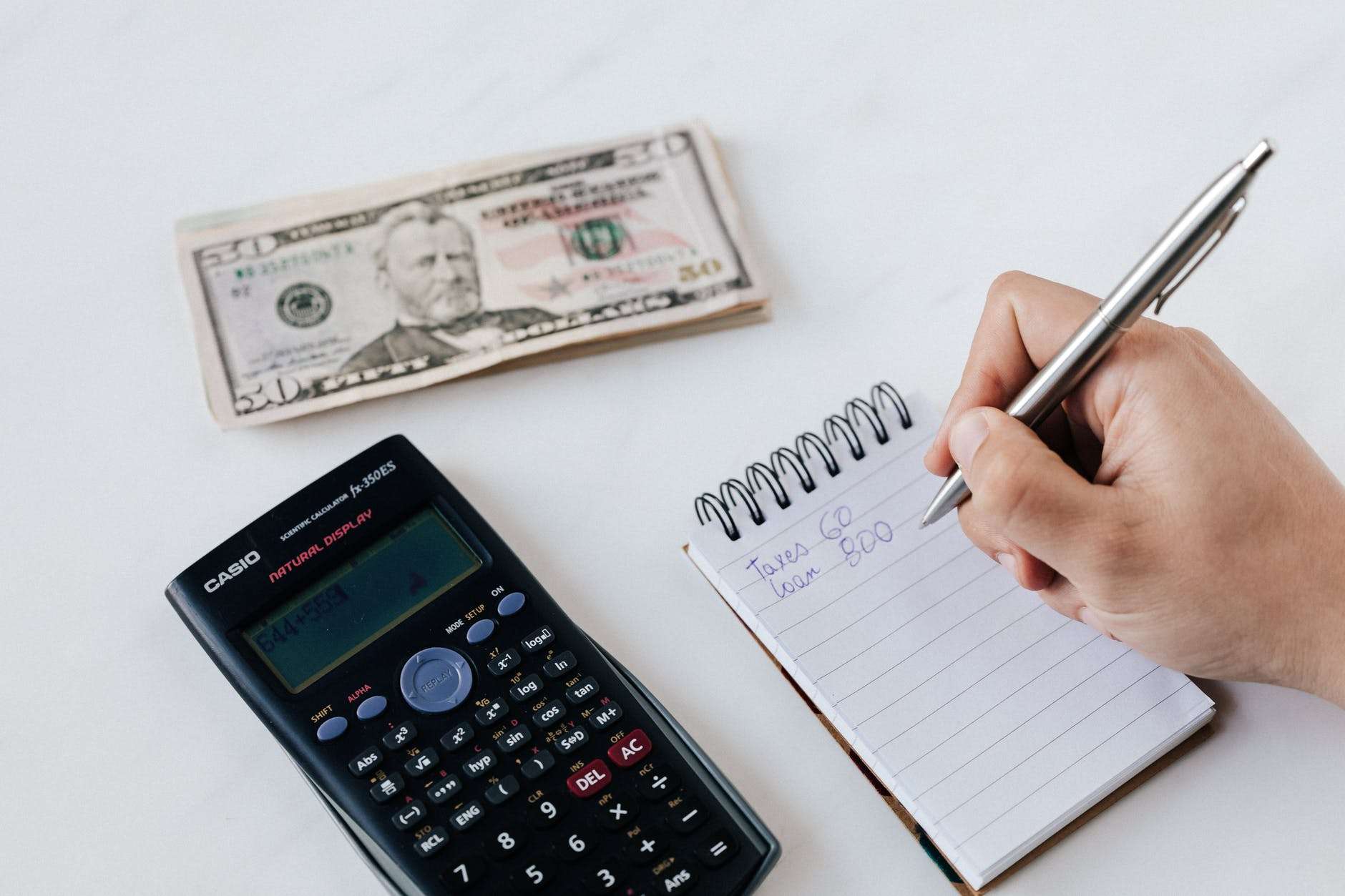

Keep Business and Personal Finances Separate

Because a startup business might accumulate a number of legal and financial responsibilities, it is critical to maintain your corporate identity separate from your personal identity. Combining personal and corporate finances is one of the quickest ways for a business owner to lose his or her firm. To get out of debt, you can use a money management service or research debt snowball vs debt avalanche. You don’t want the business obligation to add to your debt because of bad money management or merging business and personal expenses in the first place.

Get Insurance for Everything That Matters

Insurance is a complicated field, especially if your company operates in certain more delicate areas. But it’s something you can’t afford to ignore, and you don’t want to do it without the proper assistance. A reliable insurance company can guide you through the process of obtaining business insurance for your assets, and they will also provide you with additional tips for specific matters related to your business. This is not optional – working with a top business insurance company such as The Hartford is crucial for keeping all your fronts covered for your business insurance.

Avoid the Exploding Cost of Internal Departments with Outsourcing

Last but not least, don’t try to do everything in-house. This might seem tempting at first when your company is still small, and you don’t need to allocate too many resources in any single department. But if your business takes off, the burden of having an in-house IT or customer support department is going to grow exponentially. Few companies can support that on their own resources, which is why it’s important to consider outsourcing as early as possible. This will give you the additional benefit of scaling up your operations more efficiently, as you won’t have to worry about so many specific aspects that will grow in cost.

Avoid Unnecessary Business Expenses

As you build a successful business, you’ll come across more situations where a small initial investment can spare you a lot of expenses down the road. It’s essential to note those developments because they’re part of your growth as a leader. Of course, not all of those might be relevant in your future operations, but it’s still a good idea to build up some general sense of running a company and keeping its operations tight on all fronts. With time, you may even be able to handle some of those issues on your own without external help and be able to avoid unnecessary business expenses!

Leave a Reply